We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

Simple Forex Trading Strategies That Work

For every trader, identifying a simple Forex trading strategy that works can be grueling. You have to recognize, tweak, and back-test several trading strategies to establish which one has the best chance of success and under what market conditions.

In this article, we are going to simplify that process for you. At Keenbase Trading, we understand that different types of forex traders use different strategies. Of course, a trading strategy best suited for a forex scalper cannot work for a day trader, and so forth.

However, some strategies can work for any forex trader on any timeframe. All you need to do is adjust the setting and the timeframe you trade. We’re going to show you the most straightforward trading strategies that work on any timeframe.

Both beginner and experienced traders can apply these trading strategies with ease. Note that the best forex trading strategy can help you identify the direction and magnitude of the trend.

Forex Trading Strategy 1 - Crossover of Moving Averages

For beginner traders, this is one of the most common trading strategies. If the market is moving sideways, moving averages are not the best; they work best when markets are trending. Primarily, the MA crossover only helps you visualize the current trends and identify an upcoming trend.

Therefore, this strategy can be best to determine the entry and exit points of a trade. What’s more, you won’t need to change the settings when switching between different timeframes, making it suitable for both short- and long-term forex traders. Here’s how the strategy works.

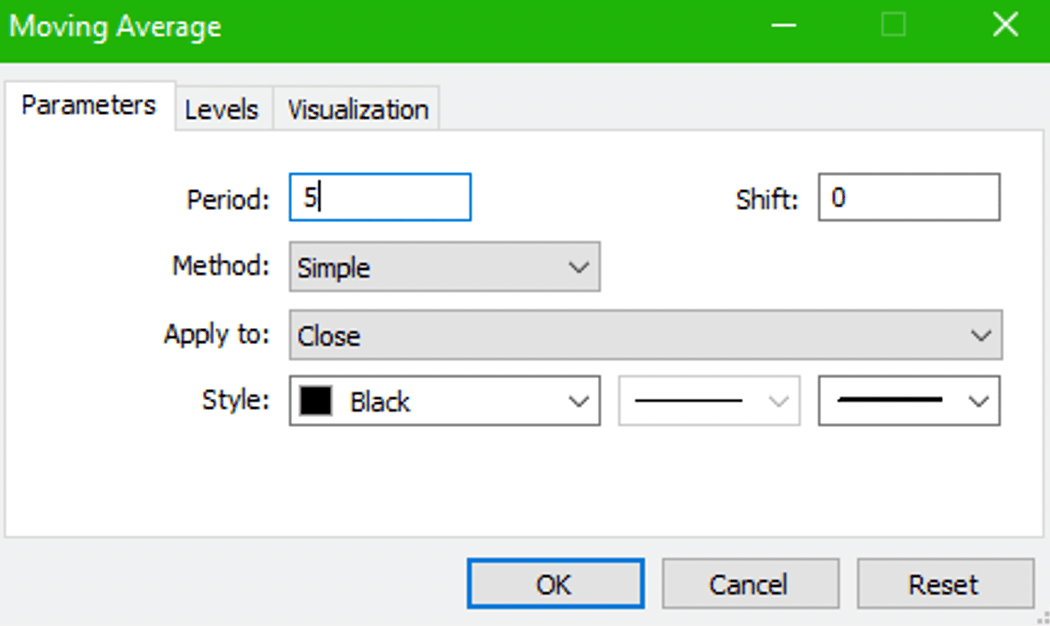

The setting for the MA is a 5-period simple moving average.

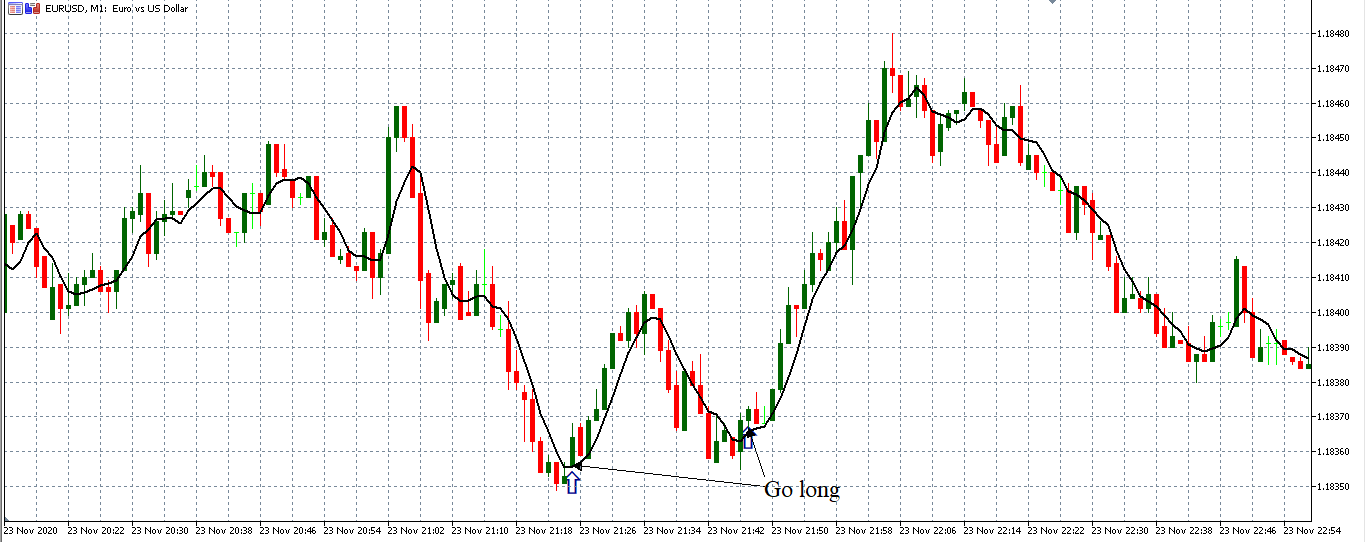

Identifying a Buy Signal with the MA crossover Forex Strategy

When the price crosses above the 5-period MA, it shows that the trend is becoming bullish. However, do not rush to open a long position yet.

A buy signal is generated when, after the price has crossed the MA, it closes above it, and the next candle opens and closes above the MA. This trading strategy is simple since you only initiate a long trade when the immediate candle after the crossover opens above the MA and closes above the MA.

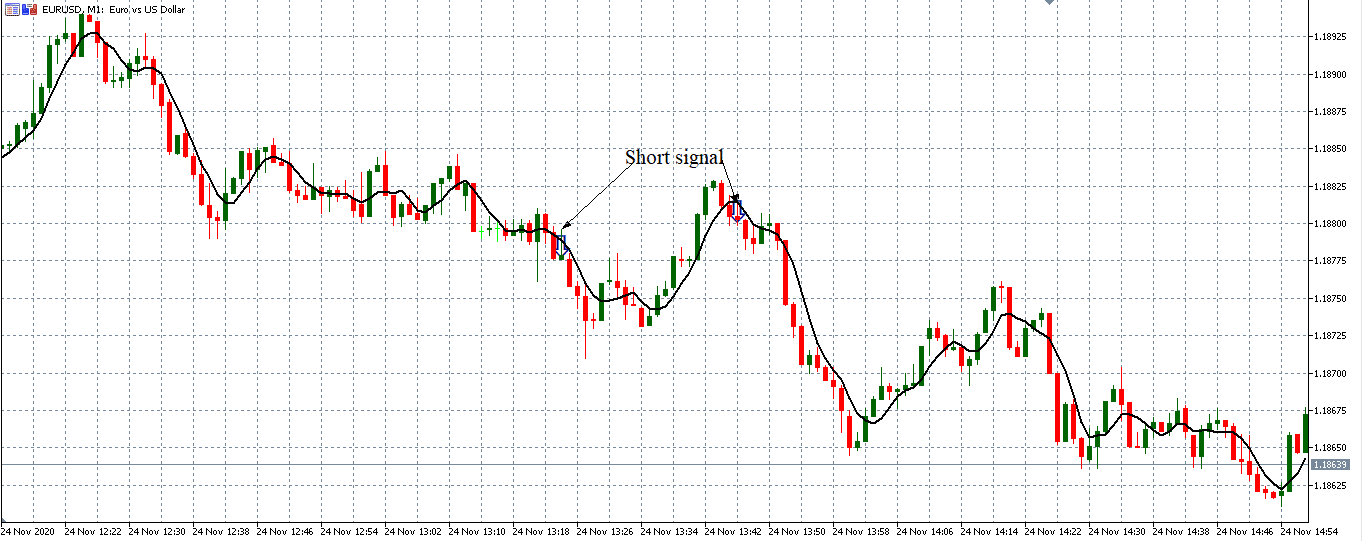

Identifying a Sell Signal using the MA Crossover Forex Strategy

A sell signal is generated in a bearish trend. The bearish trend is formed when the price crosses below a dropping MA.

After the first candle has crossed below the MA, a short-selling signal is generated when the next candle opens and closes below the 5-period MA. To avoid fake-outs, do not open a short position if the immediate candle after the crossing doesn’t open and close below the MA.

You can exit your trades when you notice a trend reversal if you are in a long trade, exit when you notice the MA switching to a downtrend similarly if you are in a short position, exit when you notice the MA switching to an uptrend.

Forex Trading Strategy 2 - Breakout Trading

Trading breakouts is a simple forex trading strategy that works best for traders who prefer not to use technical indicators since they can be lagging at times.

The breakout strategy's main idea is to establish support and resistance levels and open positions when the price breaches past these levels.

In case you find it difficult to plot the S/R levels manually, we have developed KT Support and Resistance indicator that can automatically draw the S/R levels under one second.

A support is the price level formed after a while where a downtrend seems to bounce off it. It shows the price level where a currency pair has not moved below for a specific period. i.e., it is the lowest low an asset has a trader over a period.

Resistance is a price level where a bullish trend seems to bounce off of it. A resistance level is where the price has not moved past in a specified period in a bullish trend. Therefore, it is the highest high attained by an asset over a period.

Trading the breakout strategy involves opening a long position when the price breaches the resistance level; and a short position when the support level is breached. This strategy is popular, especially when the market is volatile.

How to Establish significant Support/Resistance Levels?

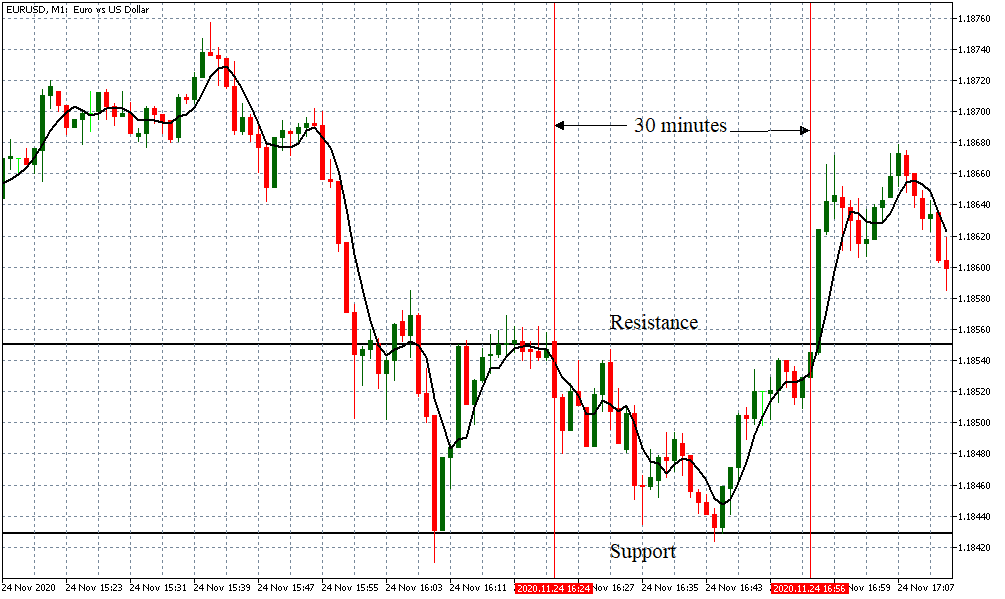

For the breakout forex strategy to work, you need to establish accurate support and resistance levels, depending on the timeframe you are trading. For example, if you are a short-term trader, your support and resistance levels can be set within intervals of 30 minutes.

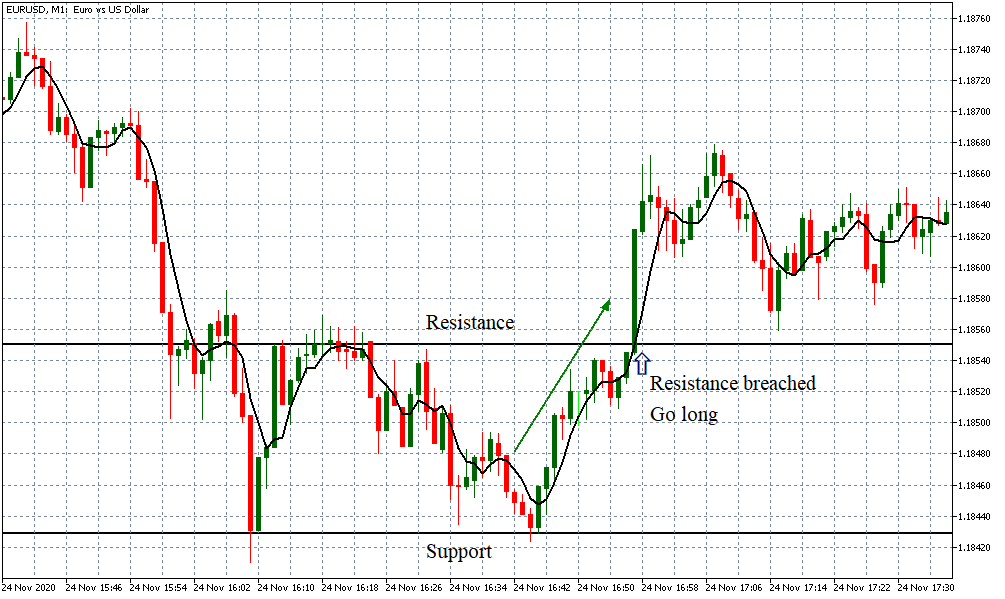

Long Trade with the Breakout

As we noted earlier, a long signal is generated when the price blast through the resistance level.

To ensure your trade accuracy, only initiate a long trade if the corresponding trend is bullish. Here’s an example.

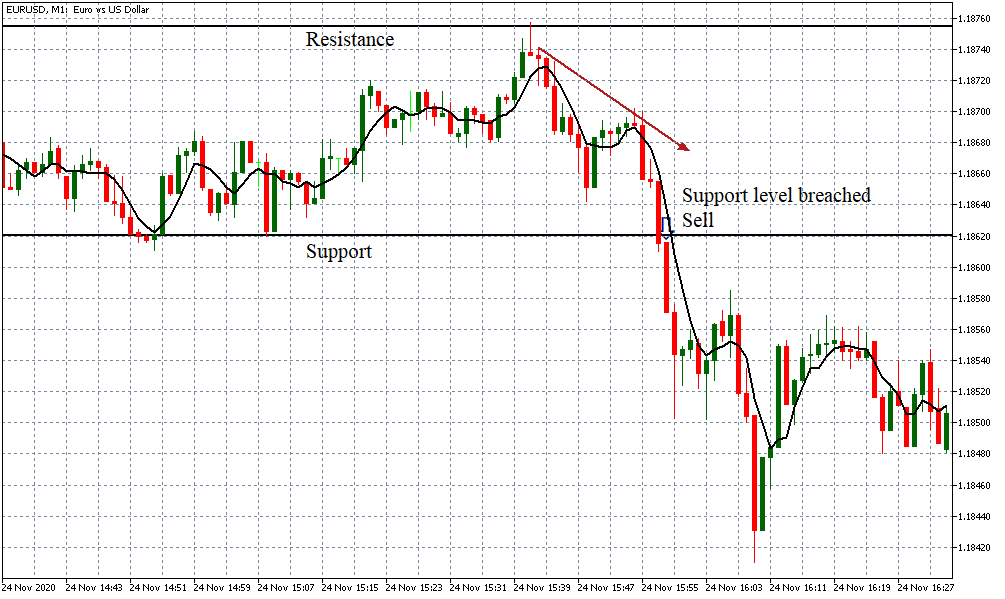

Short Trade with the Breakout

Similarly, when the price trends below the support level, a sell signal is generated. However, only initiate the short sell if the prevailing trend is bearish.

Since this strategy is popular during volatile conditions, the best way to plan an exit is by using trailing stops. Furthermore, you can also set your stop-loss levels by using prior support and resistance levels.

Forex Trading Strategy 3 - Trading the News

As a forex trading strategy, trading the news is more suited for traders who would not conduct tedious technical analyses. The sentiment of the traders primarily drives the prices in the Forex market.

This sentiment in the Forex market originates from the fundamentals of a country’s economy. Remember that the price of a currency pair shows the value of one currency relative to another. Therefore, a country’s currency can be said to be a reflection of its economic situations.

In this case, when the economic fundamentals of a country improve, it means that its currency will appreciate relative to others. Conversely, when the economic fundamentals deteriorate, its currency should be expected to depreciate in the forex market. So, how does one know when the economic fundamentals have improved or deteriorated? By using the economic calendar.

The economic calendar collates thousands of economic indicators from different sources and streams them in real-time as they are published. These economic indicators are arranged according to their release time.

Furthermore, the economic calendar categorizes the indicators depending on the magnitude of their expected impact in the forex market. Some indicators have low impacts that can be negligible, while others are high-impact indicators, resulting in extreme volatility.

When trading the news, a simple forex trading strategy would be using the high-impact news releases that give a comprehensive overview of the economy, such as the employment situation or GDP.

So, how do you go about trading the news? First, you identify the news that you want to trade and then wait for its scheduled release.

When a news release is better than the forecast, the currency concerned's value is expected to appreciate. Conversely, when the news release is lower than the estimates, the currency's value is expected to depreciate.

Trading the Non Farm Payroll (NFP)

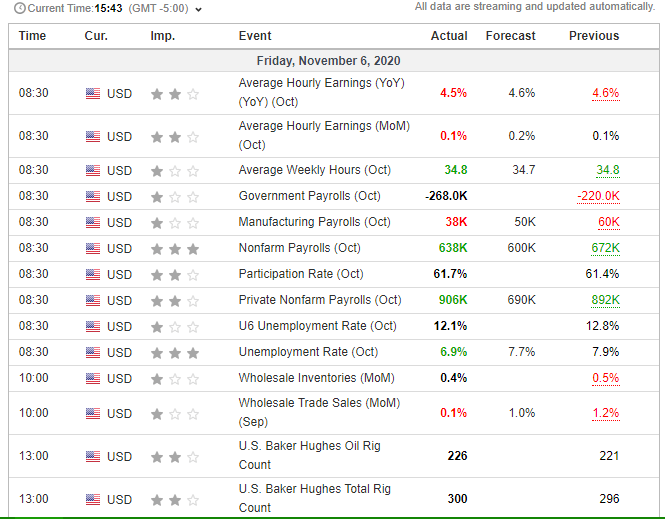

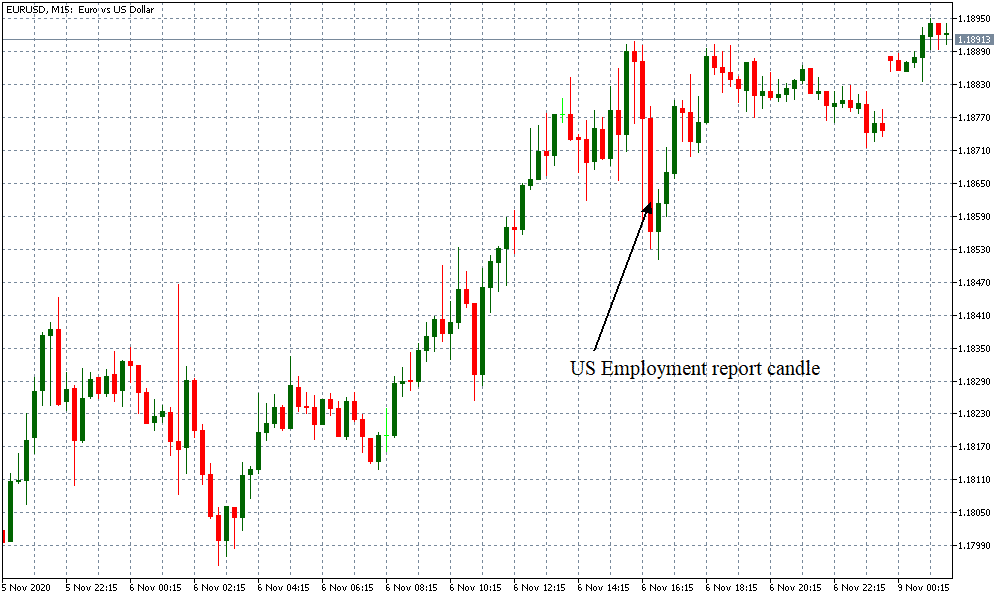

Let’s use the example seen in the screengrab above. The most recent US employment situation report was released on November 6, 2020, at 8.30 AM EST. from this release, we can see that the US unemployment rate and the Nonfarm Payrolls for October were better than forecast.

In this case, we expect that the USD will be stronger compared to other currencies.

If you were to trade the EUR/USD pair, the release of the positive US employment report news would generate a short-selling signal.

In this case, if you sold the EUR/USD pair upon the release of the news, you would have earned 20 pips in 15 minutes.

However, always familiarise yourself with the news you intend to trade and make sure you’ve done thorough research on the implications of its release.

Carry Trading - Effective Forex Trading Strategy 4

As a trading strategy, a carry trade involves selling a currency with a lower interest rate and buying one with a higher interest rate. In this case, you earn the interest rate differential between the pair. Here is this works.

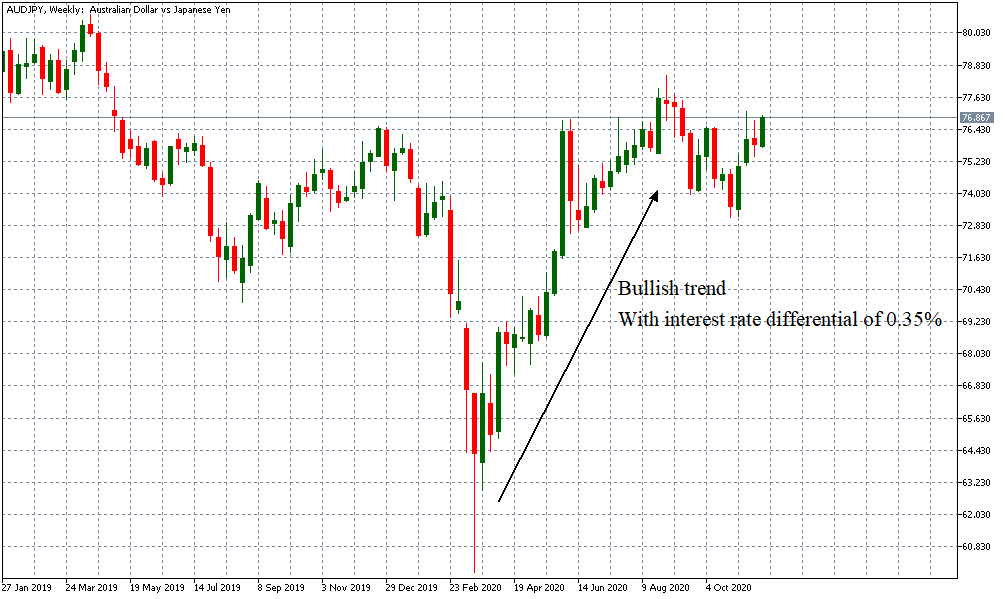

Let’s take an example of the AUD/JPY pair. In Australia, the interest rate is 0.25%, and in Japan, the interest rate is -0.1. In this case, if you buy the pair, it means you borrow and sell the JPY to buy the AUD. The interest rate differential is the base currency's interest rate minus the interest rate of the quote currency.

In this case = 0.25 – (0.1) = 0.35%

That means you’ll earn 0.35% of the total value of your position. For this trading strategy to work, two conditions need to prevail in the market:

- Firstly, the pair you trade has to be bullish in favor of the currency with the higher interest rate. That way, when you buy the pair, you can remain in the bullish position and profit from the interest rate differential for as long as possible.

- Secondly, the interest rate differential needs to be high, with no prospects of either country changing the near term's interest rates. Note that for a carry trade to work, the markets shouldn’t be highly volatile.

Conclusion

This article has reviewed simple Forex trading strategies that work for every kind of trader. These simple trading strategies can be applied by both short- and longer-term traders.

However, although we have traded using these strategies, we recommend testing them first on a demo account. Ensure that you are comfortable with them before applying them to a live account. All the best!