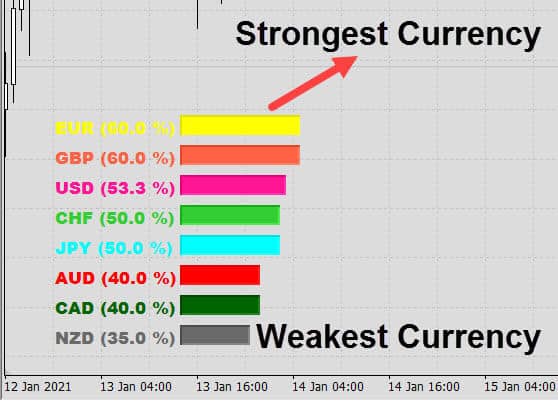

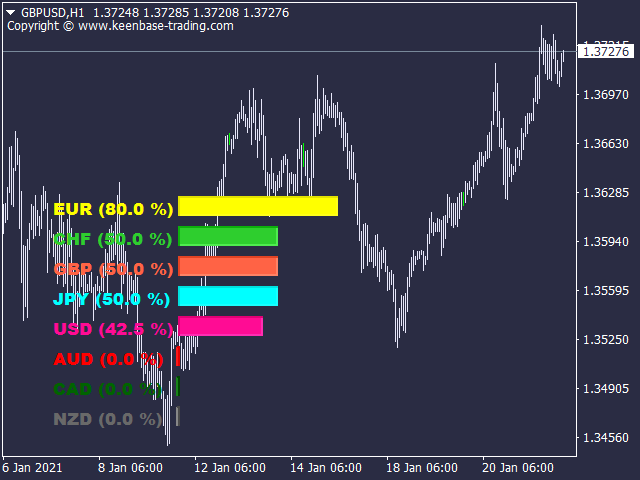

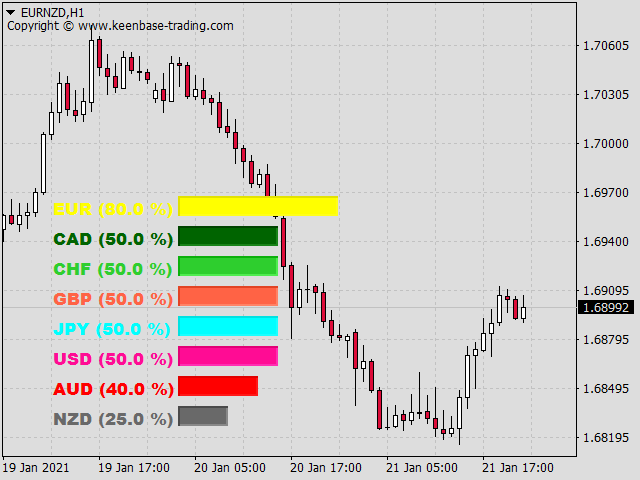

In the above picture, the currency meter shows the Euro is the strongest while New Zealand Dollar is the weakest currency. Using this information, you can plan to enter a long trade on the EURNZD pair.

It works like a compass that shows a currency's overall direction, which helps to plan the entry positions.

Currency Strength Meter Indicator MT5

More traders are moving from MT4 to MT5 as Metaquotes stopped supporting the older Metatrader 4 builds. Therefore, we suggest purchasing the MT5 version to remain future-proof.

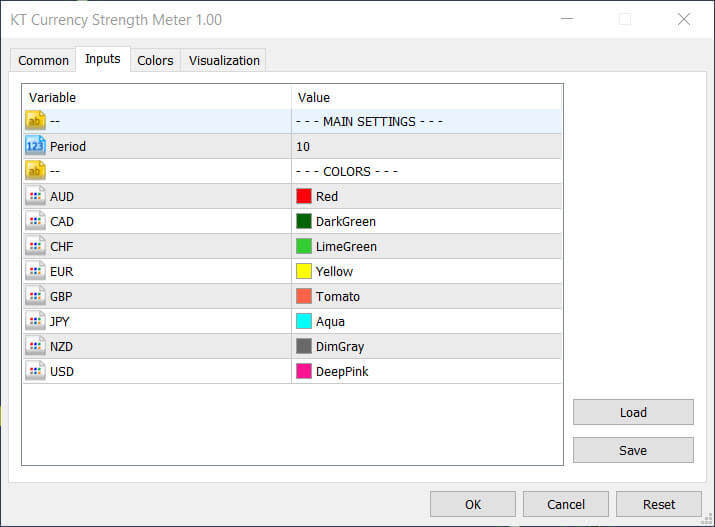

Input Parameters

- Period: Moving average period to find the strength and weakness.

- Choose a color for the Australian Dollar.

- Choose a color for the Canadian Dollar.

- Choose a color for the Swiss Franc.

- Choose a color for Euro.

- Choose a color for Great Britain Pound.

- Choose a color for the Japanese Yen.

- Choose a color for New Zealand Dollar.

- Choose a color of US Dollar.

Pro Tip

- Some free currency strength meters are available on the internet, but they are buggy and don't work as expected.

- We suggest not using it on smaller time frames as anything below 15 minutes to avoid being trapped by noisy data.

- Avoid relying too much on high-impact news, as the fundamental always comes first before the technical analysis.

- Using it as a confirmation instead of the primary signal generation is best.

- To combine the correlation analysis with a strength meter, we suggest getting our premium Currency Strength indicator MT5.

Limitations

- Most of the time, it works as a short-term strength meter which can change often. For the same reason, We suggest using it on higher time-frames like 1-Hour and above.

- While it works great in combination with other indicators, using it as a standalone in a trading strategy is limited.

- Based on moving averages, there could be a lag between the new strength and weakness identification.

How does the Currency Strength Meter Works?

Using a weighted moving average, the currency strength meter measures the net percentage change in a currency price. It then compares it against US Dollars to find the strength and weaknesses of each currency separately.

As its a time-frame dependent, the strength and weakness data is updated at the close of each bar.