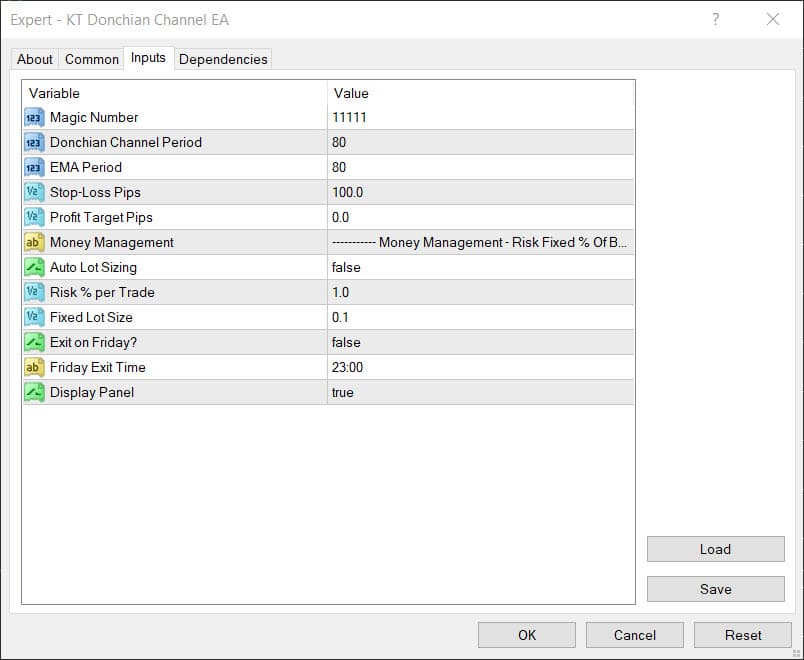

Modifying The EA Settings

KT Donchian Channel EA offers an impressive degree of customizability, allowing you to fine-tune your trading strategy based on your unique preferences and the current market conditions.

One of the key adjustable settings in the EA involves the periods used for each indicator - the Donchian Channel, Exponential Moving Average (EMA), and the Average True Range (ATR).

The period refers to the number of bars, or timeframes, used to calculate the indicator's value. For instance, a period of 20 for the Donchian Channel would mean that the upper band represents the highest price over the past 20 bars, and the lower band represents the lowest price over the same span.

In the EA's input settings, you can adjust these periods to suit your trading approach better:

Donchian Channel Period

You may opt for a shorter period if you prefer a more responsive channel that closely follows the price action. Conversely, you can choose a longer period if you favor a smoother channel that filters out minor price fluctuations.

EMA Period

Similarly, adjusting the EMA period will affect how closely it follows the price. A shorter period will make the EMA more responsive to recent price changes, while a longer period will provide a smoother and less volatile EMA line.

ATR Periods

For the ATR, you can adjust the periods for both the fast and slow ATRs. Shorter periods will make the ATR more responsive to recent volatility changes, while longer periods will provide a more stable measure of volatility.

Adjusting these periods allows you to fine-tune the EA to match your preferred trading style and risk tolerance. It allows for a more personalized trading experience and can help enhance the effectiveness of your Forex trading system.

However, it's important to remember that these settings should be adjusted carefully and ideally tested in a demo account before applying them to live trading.

Using The Donchian Channel Expert Advisor

KT Donchian Channel EA brings this convenience to the forefront, offering a robust, automated tool that navigates the volatile Forex markets with precision, utilizing the powerful Donchian Channel indicator to optimize your trading decisions.

Expert Advisor or EA is a code carefully programmed to trade the markets on your behalf. These EAs can streamline your trading journey by automating complex processes and delivering strategic insights immediately.

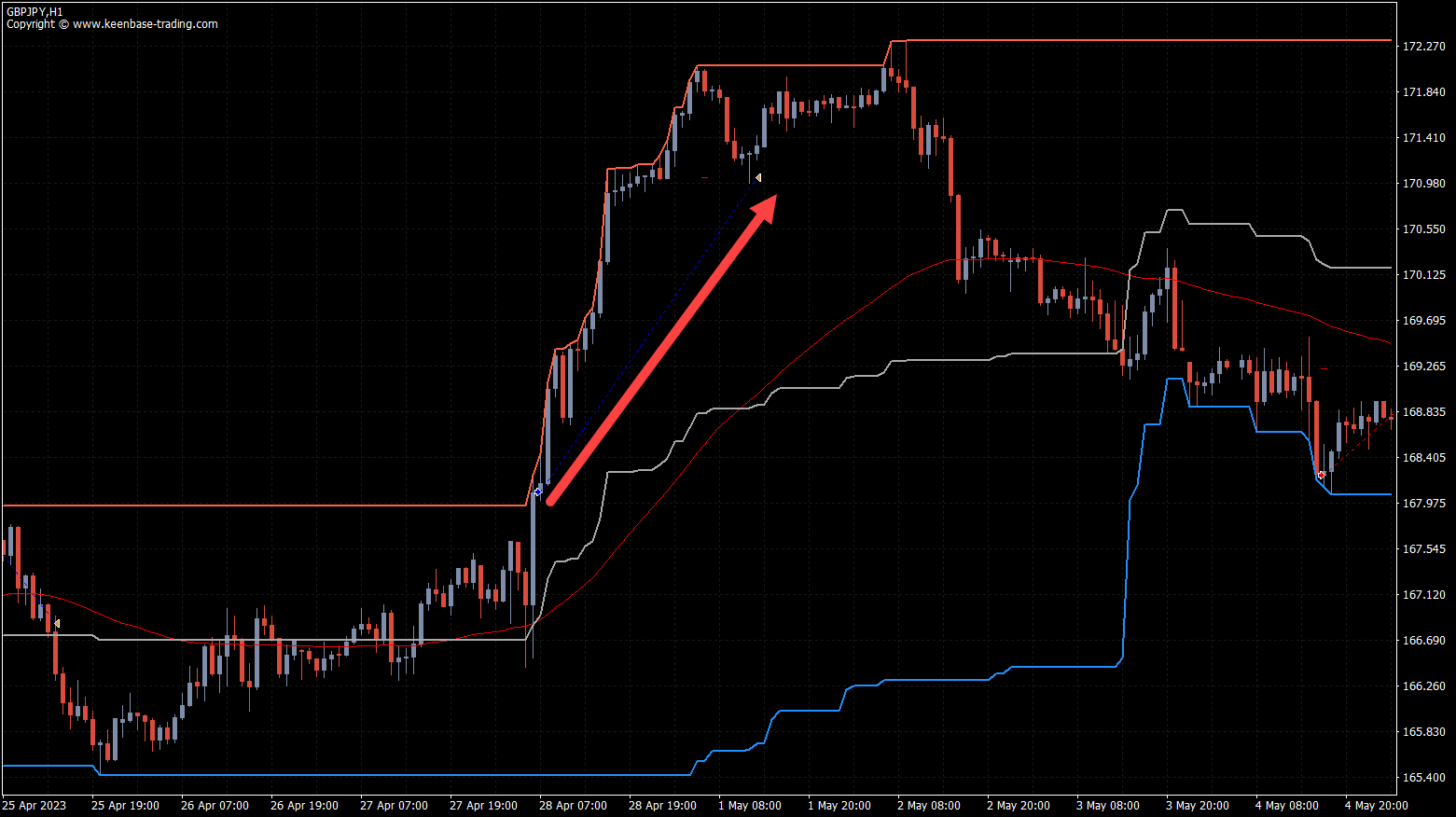

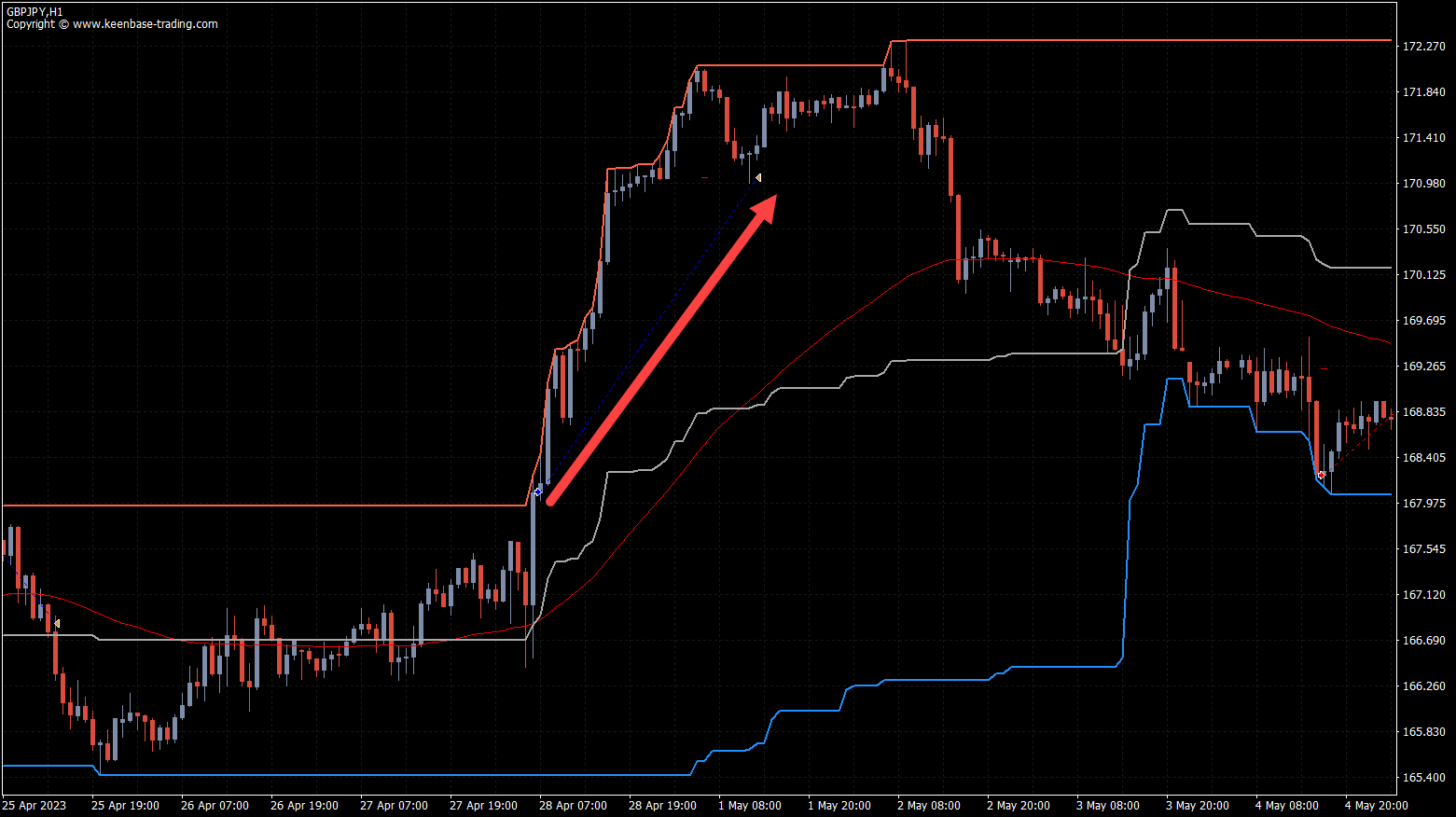

The Working of KT Donchian Channel EA

KT Donchian Channel Expert Advisor (EA) employs an entire system of data-driven strategy, taking advantage of the strong interaction between the Donchian Channel indicator, Exponential Moving Average (EMA), and Average True Range (ATR).

Buy Conditions

- The price needs to close above the upper band of the Donchian Channel. This typically indicates a bullish breakout, suggesting that the price is steadily moving upwards.

- The EMA needs to be rising. The EMA is a moving average that gives more weight to recent prices. When the EMA is increasing, it suggests that the average price over the defined period is rising, indicating a potential uptrend.

- The "fast" ATR must be above the "slow" ATR. ATR is a measure of market volatility. When the fast (shorter period) ATR is above the slow (longer period) ATR, it implies that recent volatility is higher than the average volatility over a longer period, potentially indicating an increase in bullish momentum.

Sell Conditions

- The price needs to close below the lower band of the Donchian Channel. This is seen as a bearish breakdown, suggesting the price moves downwards with strong momentum.

- The EMA should be falling. When the EMA is decreasing, it suggests that the average price over the defined period is declining, indicating a potential downtrend.

- The fast ATR should be below the slow ATR. This suggests that recent volatility is lower than the average volatility over a longer period, potentially indicating an increase in bearish momentum.

By adhering to these rules, KT Donchian Channel EA can identify optimal entry and exit points for long and short positions, automating the trading process and enhancing decision-making.

The Donchian Channel Indicator

The Donchian Channel is a technical trading indicator developed by Richard Donchian, a pioneer in trend-following systems. Donchian introduced this tool in the mid-20th century, and it quickly became a favored instrument among most traders.

The indicator comprises three lines or bands that create a channel around the price action. These three bands are as follows:

Upper Band

The upper band of the Donchian Channel marks the highest price that the asset has reached during a set number of periods.

Lower Band

The lower band represents the lowest price that the asset has hit over the same set number of periods. This band acts as a support level whose price has not fallen below during the chosen timeframe.

Middle Line

The middle line of the Donchian Channel is typically the average of the upper and lower bands.

These three lines form a channel over the last n periods that can provide valuable insights into potential overbought or oversold conditions.

The width of the channel can also offer clues about the volatility of the price action: a wider channel indicates high volatility, while a narrower channel suggests low volatility.

Using this indicator, you can also accurately gauge your stop loss and profit target levels.

Bottom Line

KT Donchian Channel EA is a valuable tool for navigating the Forex market's ever-changing tides. As we have seen, this EA is adaptable, with customizable settings for each indicator, and proficient in identifying optimal entry points for both long and short positions.

It is a testament to how automation can enhance decision-making and streamline trading.

With the proper application and mindful management, the Donchian Channel EA stands as a steadfast ally on your journey through the exciting world of Forex trading.

Trading can be a complex world to navigate. It's like walking through a bustling city without a map. But just as a good GPS makes city navigation simple and stress-free, trading indicators can guide us through the financial markets.

They help us make smarter decisions and increase our chances of success.

One such popular Forex indicator is the Donchian Channel indicator. Just as road signs alert us to upcoming turns or stops, the Donchian Channel helps point out the best spots to consider buying or selling. Think of it as your friendly neighborhood guide to the markets.