KT Supply and Demand indicator

MT4/MT5

- Description

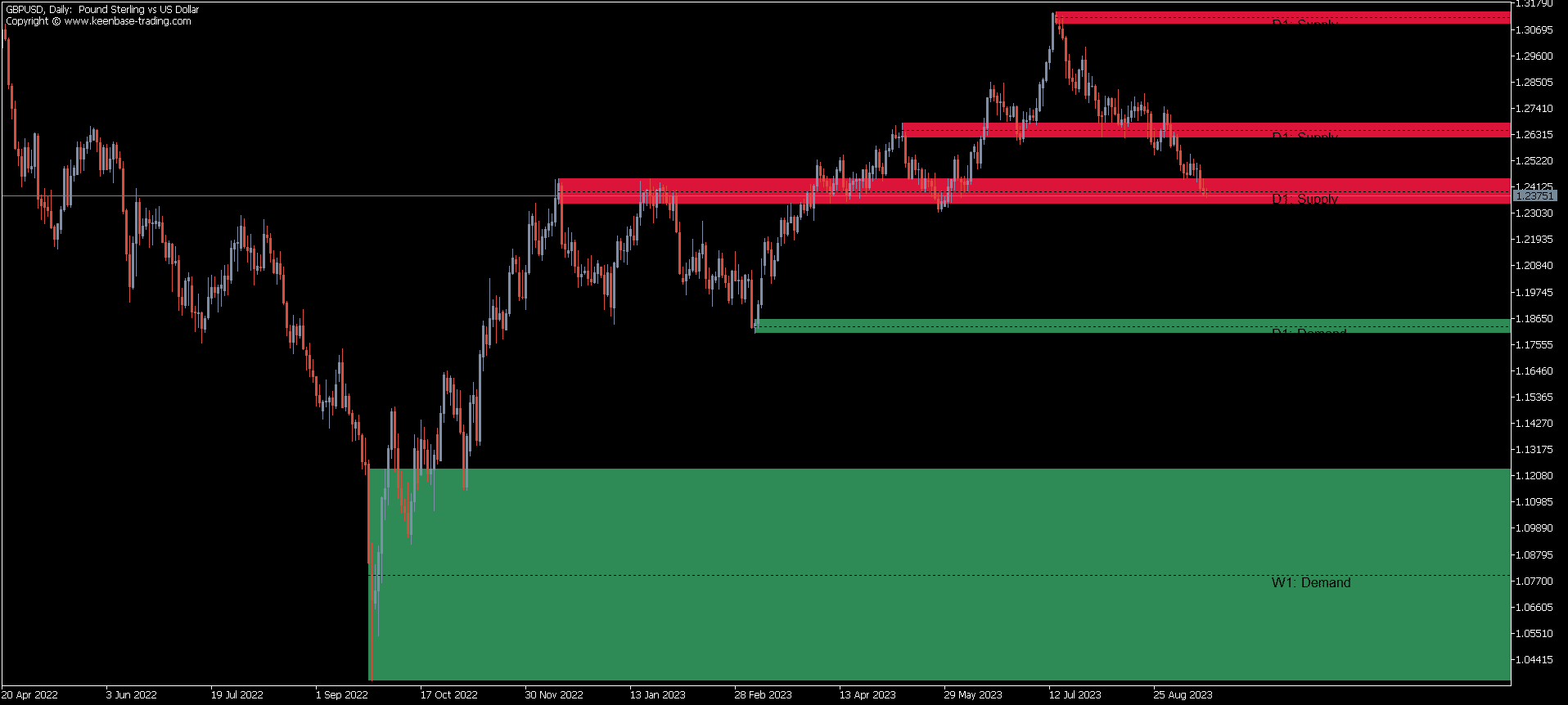

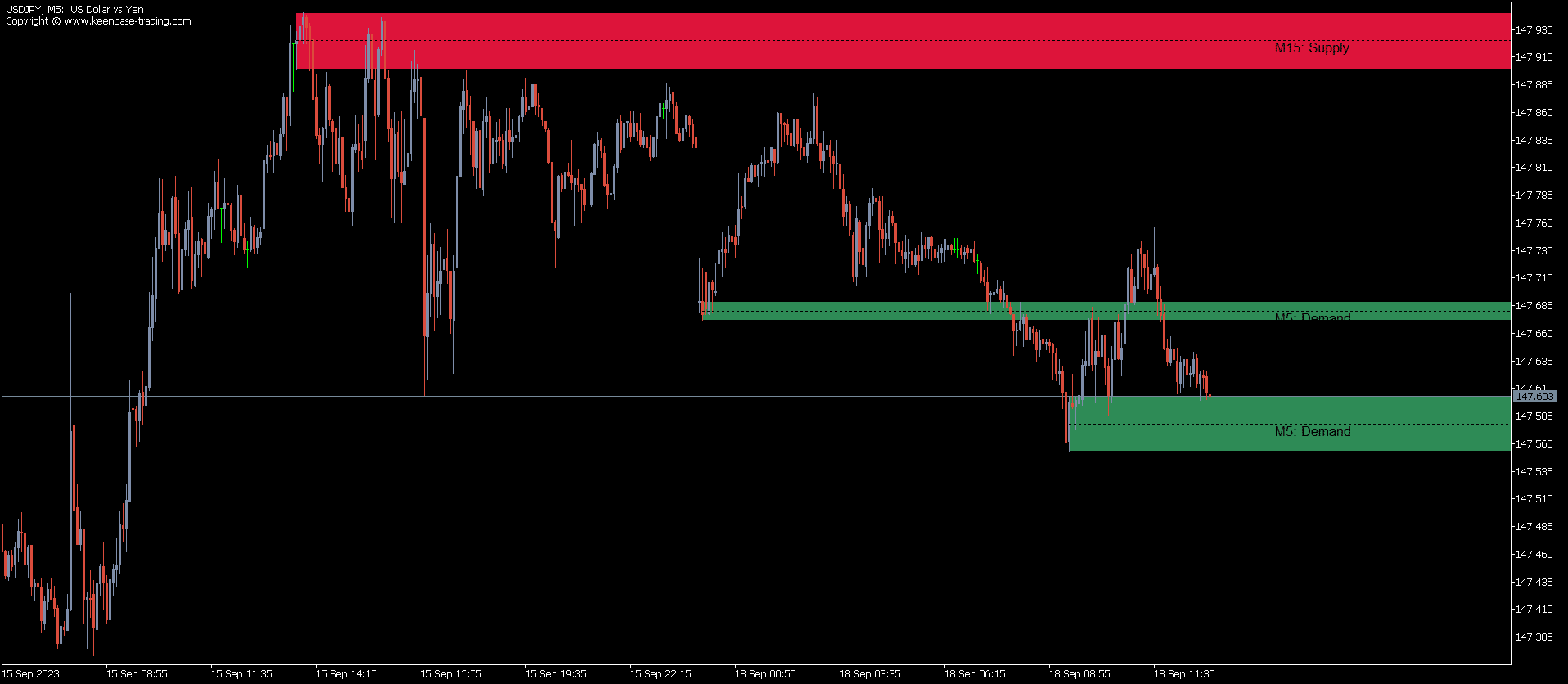

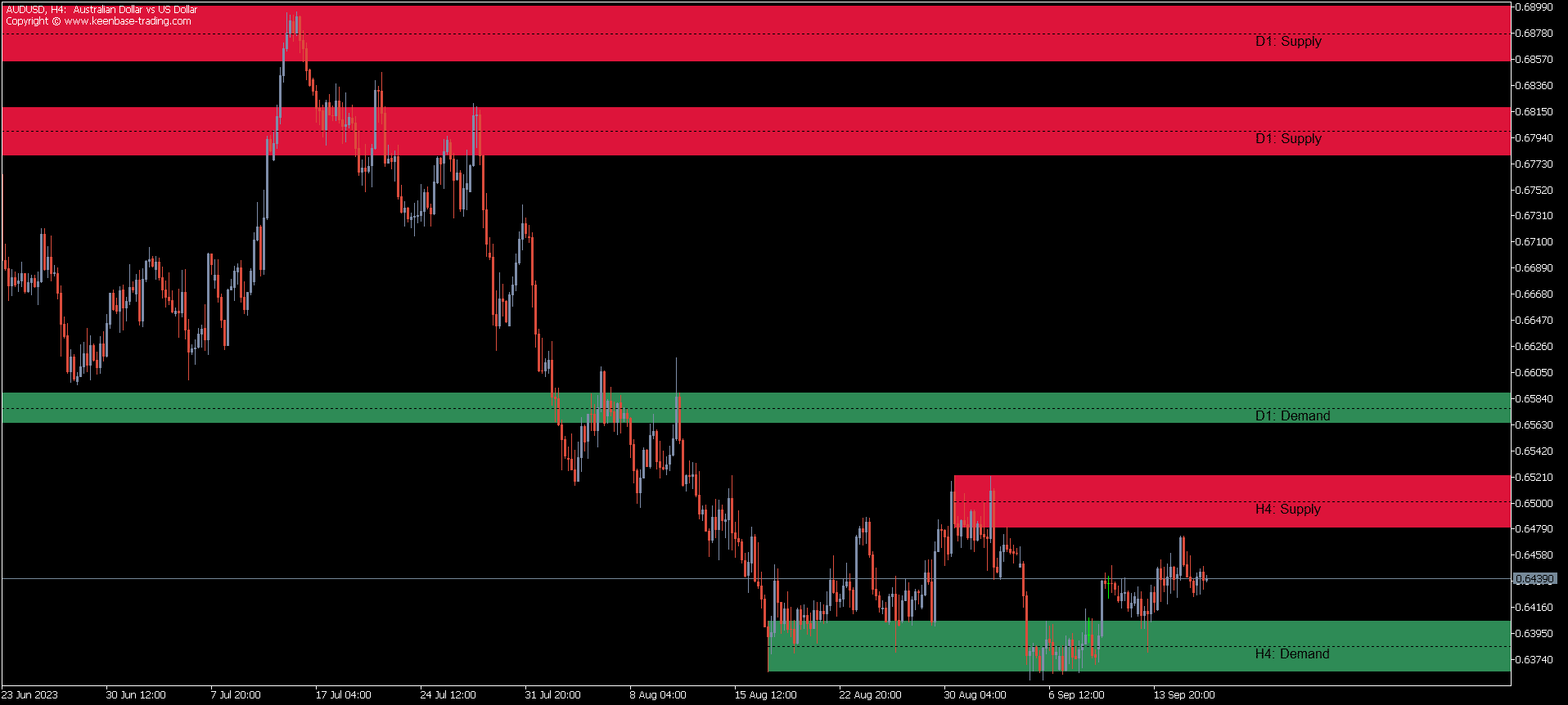

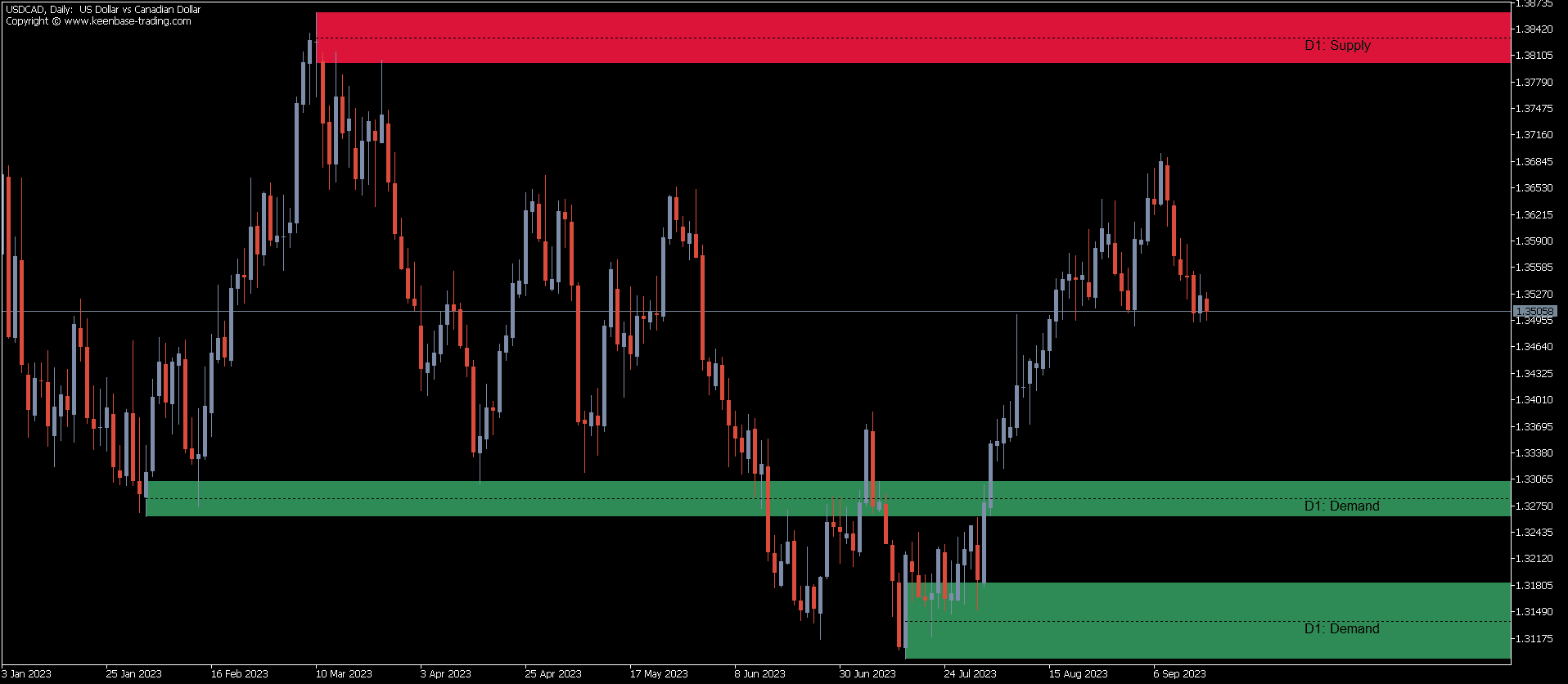

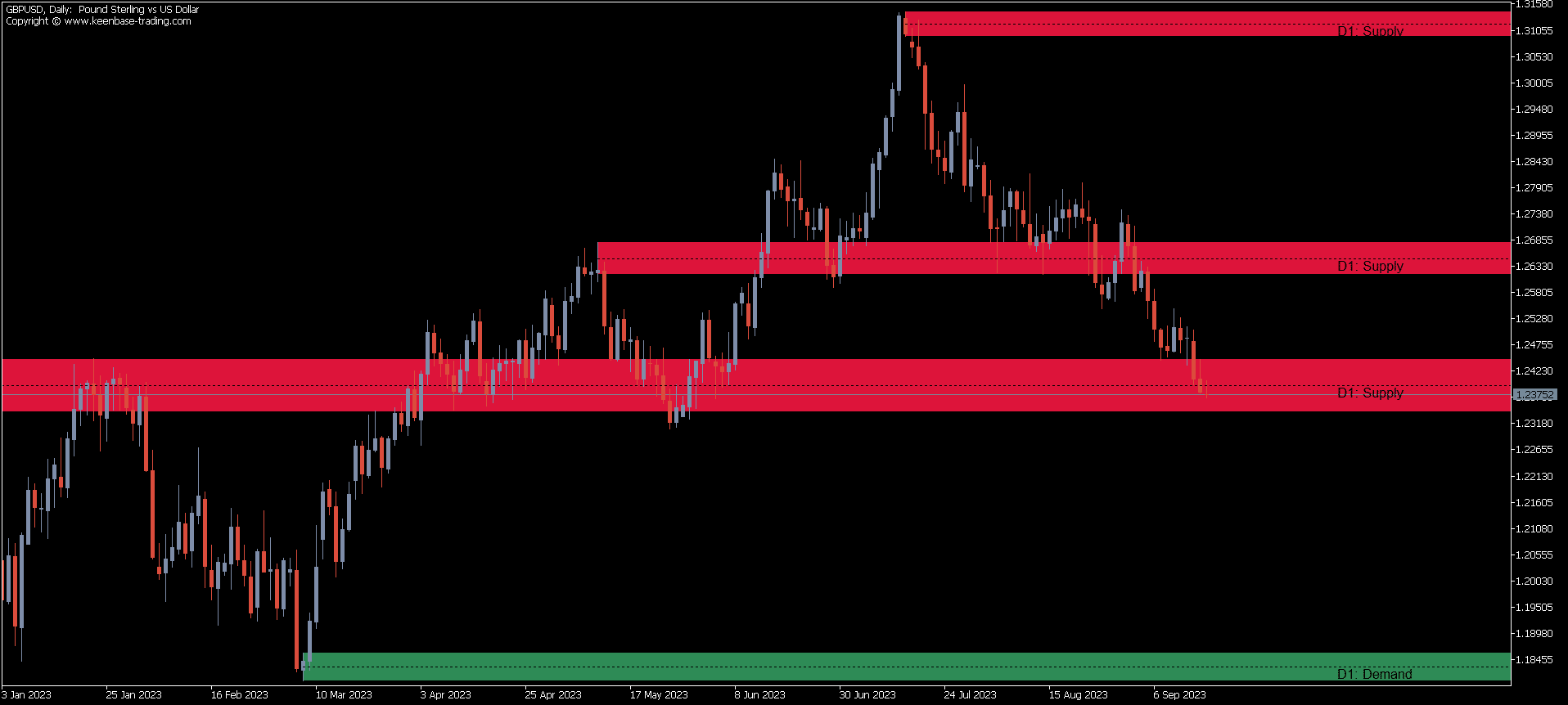

KT Supply and Demand indicator identifies and plots key supply and demand zones. It also known as a demand forex indicator, helps traders identify potential areas of significant price movement by analyzing swing points and integrating them with a multi-timeframe analysis, ensuring that only the most crucial supply-demand zones are highlighted.

This advanced method highlights the regions where prices are likely to reverse, stemming from significant supply-demand zones established by recent price movements.

Read More

Features

- 🎯 Precision Analysis: Our refined algorithm is designed to accurately pinpoint the most crucial supply and demand zones, areas often indicative of major price shifts.

- 🌐 Complete Market Insight: Showcases supply and demand zones from up to three timeframes, giving traders a thorough market view through multi-timeframe scrutiny.

- 📊 Uncluttered Visualization: Ensures your chart remains neat and interpretable by smartly avoiding any overlap of supply and demand zones, thereby reducing potential distractions.

- 🖼️ Integrated Chart Setup: The KT Supply and Demand indicator is complemented by a preset chart template that meshes perfectly with the indicator's features, enhancing your visual analysis.

- 📈 Predictive Power: Features a distinctive marking within each zone, acting as a hint for traders to foresee potential price reversals originating from these regions.

- 🎨 Adaptive Coloring: Grants the ability to fluidly alter the colors of supply and demand zones, resonating with the ongoing price movements.

- 🔧 Personalized Adjustments: Offers users a wealth of customization capabilities, from zone intensity to color choices and thickness, making sure it caters to every individual's style.

- 🔔 Active Notifications: Comes with a range of alerting mechanisms, such as on-screen prompts, mobile messages, email alerts, and auditory signals, all of which activate as the price nears a supply or demand zone.

- 📈 Demand Zone Indicator: Highlights the accuracy, alert triggers, nested zones detection, and customizable parameters of the demand zone indicator, making it invaluable for both novice and professional Forex traders in identifying support and resistance levels and improving trading strategies.

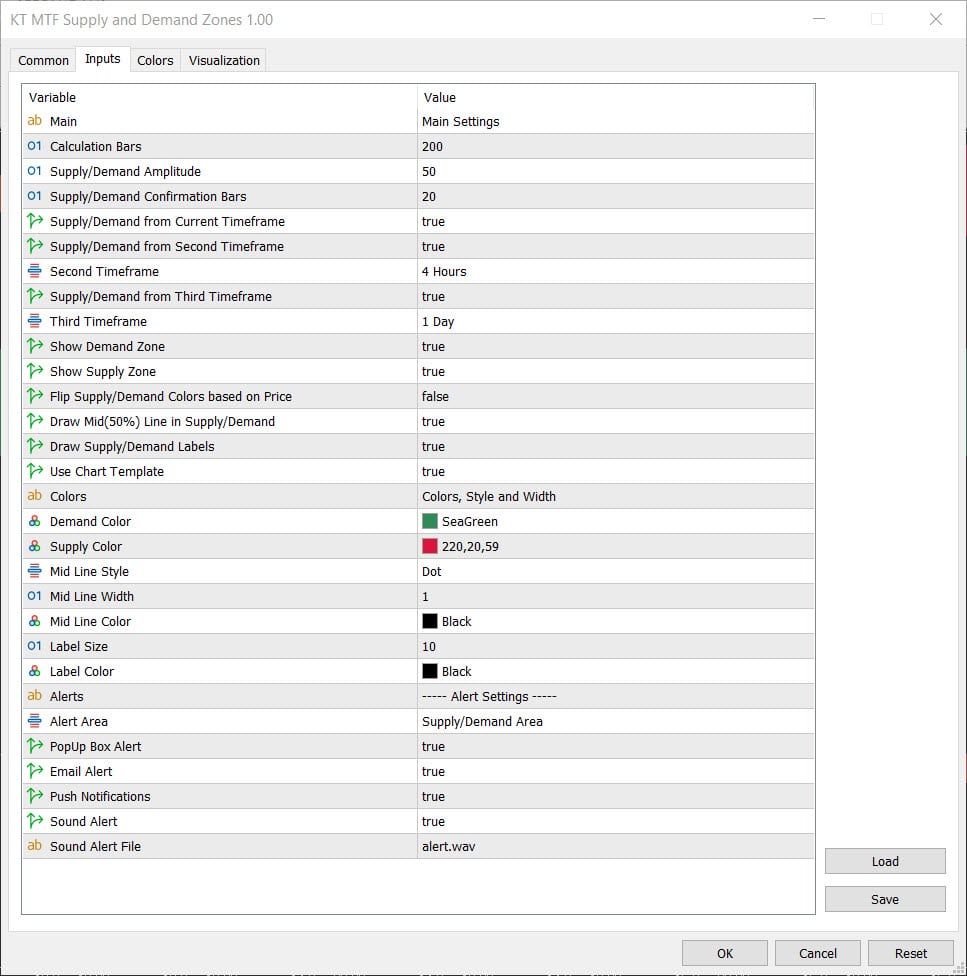

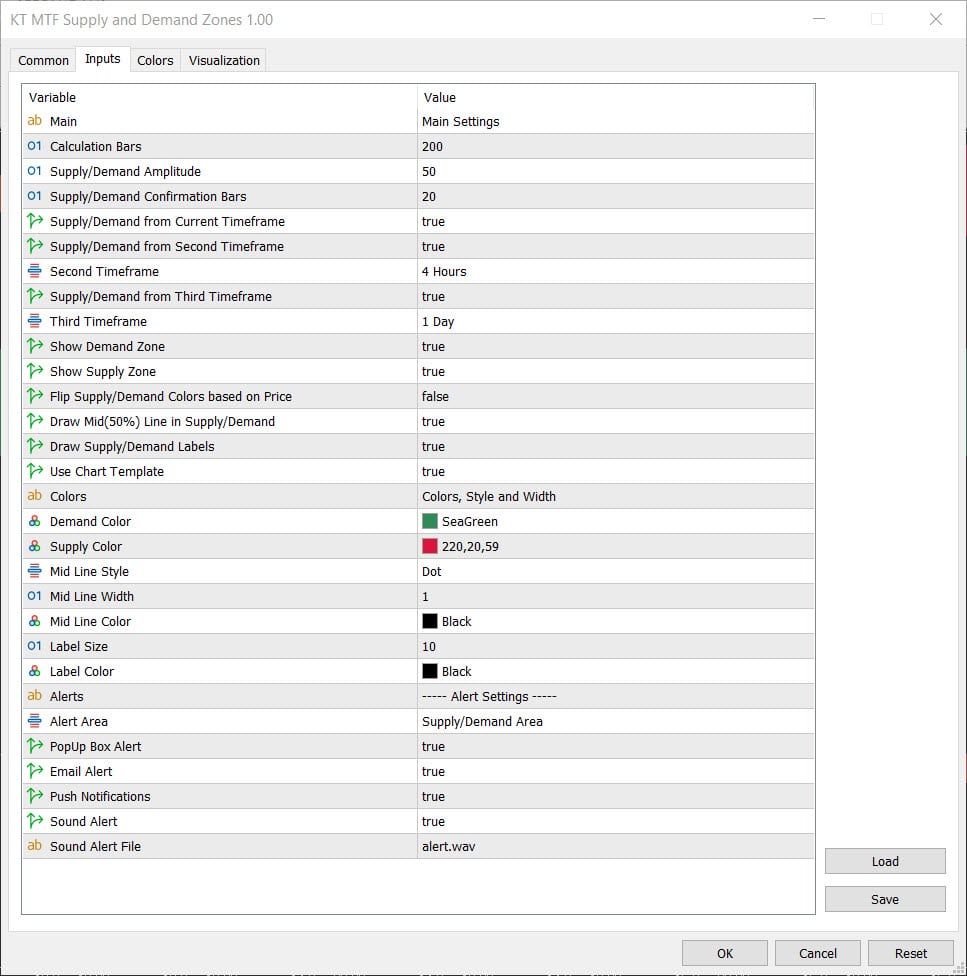

Indicator's Inputs

- Calculation Bars: Set the number of bars to spot supply and demand zones. Recent bars have a stronger effect on price actions.

- Supply/Demand Amplitude: Adjust this to pick up supply and demand zones. Bigger values give fewer but clearer zones; smaller ones give more zones.

- Supply/Demand Confirmation Bars: Choose how many bars you want for confirming a zone. More bars mean a stronger zone.

- Supply/Demand from Current Timeframe: Activate this to show the supply and demand zones from the current chart timeframe.

- Supply/Demand from Second or Third Timeframe: Use this to see zones from other timeframes you pick.

- Show Supply or Demand Zones: Decide if you want to see just supply or demand zones.

- Flip Supply/Demand Colors based on Price: When on, the colors of supply and demand zones will shift with price changes.

- Draw Mid(50%) Line in Zone: Turn this on to see a mid 50% line in each zone.

- Utilize Chart Template: Enable this function to apply a specially designed chart template that harmoniously aligns with our supply and demand indicator.

Understanding the Supply and Demand Zones

Imagine you're at a bustling local market. There's a stall selling the juiciest apples you've ever seen, but they only have a limited quantity. As more people spot these apples, they rush over, and soon there's a big crowd all wanting to buy them.

This stall represents a demand zone — a price level where buyers show a lot of interest and are eager to purchase.

A few stalls down, there's another vendor with heaps of lemons. They've got so many that they're offering discounts to anyone willing to buy in bulk. However, not many folks are interested in buying lemons today.

This stall is a supply zone — a price level where sellers are plentiful, and they're keen to offload their stock, but buyers aren't as enthusiastic.

In the world of trading, supply and demand zones work in a similar way. They are specific price areas on a chart where sellers (supply) and buyers (demand) have previously shown strong activity:

- Supply Zones: These are areas where sellers were dominant, and the price was pushed down. It's like a memory on the chart reminding traders, "Hey, we had a lot of selling going on here!"

- Demand Zones: These areas saw buyers taking control, driving prices up. It's the chart's way of saying, "Last time we were here, buyers really stepped up their game."

When prices return to these zones, traders pay close attention. A supply zone might indicate a potential resistance level where prices might struggle to rise further, while a demand zone could suggest a support level where prices might find it tough to drop below.

In essence, understanding supply and demand zones is like reading the history of a market's emotions and actions. It gives traders clues about where prices might head next based on where they've been before.

Applications of KT Supply and Demand indicator

- Spotting Key Turnaround Areas: The indicator guides traders to areas on the chart where prices might pivot due to notable supply or demand imbalances.

- Guiding Trade Entry and Exit: The clearly marked supply and demand zones can serve as reference points, bolstering the precision of traders' entry and exit decisions.

- Reinforcing Support and Resistance Identification: With its ability to spotlight critical zones, the indicator enhances traders' ability to discern support and resistance levels, guiding stop-loss placements and profit target settings.

- Elevating Risk Management: Recognizing zones with high buying or selling activity enables traders to finetune their risk parameters, from adjusting trade sizes to setting appropriate stops.

- Streamlining Trade Opportunities: By highlighting significant zones, the indicator filters out noise, letting traders concentrate on trades aligned with prominent supply or demand areas.

- Complementing Trend Strategies: Paired with trend analysis, the indicator can point out zones in sync with the dominant trend, enriching trend-based trading approaches.

- Uncovering Breakout Potential: Supply and demand zones can act as a prelude to potential breakouts, especially when there's a strong imbalance between buyers and sellers.

- Integrating with Swing Trades: Supply and demand insights can be a boon for swing traders, enhancing their ability to capitalize on short to mid-term price fluctuations.

- Optimizing Trade Timing: With timely alerts, the indicator keeps traders abreast of when prices approach a supply or demand zone, refining trade timing.

- Diving Deeper into Price Dynamics: Observing how prices behave around these zones can offer a window into market sentiment and shifts in buying and selling pressures.

How our Supply and Demand Indicator Can Elevate Your Trading Strategy

Grasping the concept of our supply and demand indicator is vital for accurately identifying key entry and exit points within trading activities.

This instruction will elucidate their importance in recognizing imbalances in the market, demonstrate methods to spot viable trading zones and offer practical advice on integrating them into your trading tactics.

Key Takeaways

- Our Supply and demand indicator helps traders to identify critical price levels known as resistance zones, indicating where significant buying or selling is expected, influencing price movement, and providing strategic entry and exit points.

- The strength of supply and demand zones can be determined by past price trends, duration of consolidation, trading volume, and the presence of an ‘Extended range candle’. These zones are crucial for reversal or trend-continuation trades and can be used with other technical tools like RSI and trendlines for enhanced precision.

- Customization of our supply and demand indicator allows traders to adapt them to their unique trading style, offering various display preferences and alert settings and the ability to tailor indicators based on timeframes and market conditions to improve trading performance.

Understanding Supply and Demand Indicators

The interaction between supply (availability) and demand significantly determines price levels in financial markets. Prices tend to increase when there is an excess of buyers over sellers. Conversely, a surplus of sellers will drive prices down. If buyers and sellers are balanced, prices remain within a specific range.

To pinpoint these critical price levels where significant transactions can occur and thus shape the market’s direction—either by propelling it upwards due to robust demand or driving it downwards when supply exceeds demand—traders utilize indicators that track supply and demand.

These indicators help traders identify potential price movements by integrating the ZigZag pattern to highlight significant price levels and market sentiment.

These areas of concentrated trading activity amongst participants in the market are referred to as resistance zones. They act as necessary support and resistance levels that traders use for the precise execution of their trading strategies based on observed price action in these zones.

Identifying Key Areas with Supply and Demand Zones

Mastering the market requires the identification of solid supply and demand zones and understanding price swings marked by significant price moves. These zones are marked by an ‘Extended range candle’ indicating significant price moves, followed by a short consolidation period.

This pattern highlights a clear imbalance between buyers and sellers, providing key levels for setting straightforward entry and exit points in trading strategies.

The strength of these zones can be gauged by the length of the trend preceding their formation and the duration of the preceding consolidation period.

Spotting these key areas where trendlines intersect with supply and demand zones can offer key trade setup opportunities, often indicating significant support or resistance levels. It’s time to explore the structure of these zones.

The Anatomy of a Supply Zone

Supply zones typically form after a price rally and are followed by a consolidation period before the price drops again. This period usually comprises a small series of candles, suggesting a tight price range.

The strength of a supply zone can be assessed by multiple factors, including:

- The size of the breakout candle.

- The trading volume during the zone’s formation.

- The presence of an Extended range candle indicates a significant breakout.

Understanding these characteristics can help traders identify potential price reversals and make informed decisions.

The Anatomy of a Demand Zone

Alternatively, a robust demand zone is typically identified by a rapid decline in price, which then levels off during consolidation before initiating an extensive upsurge. This behavior suggests that the area represents significant buying interest for the asset.

Various elements such as repeated price ‘springs’ or reversals and heightened trading volume hint at an accumulation of bullish momentum within this region.

Substantial purchase orders from financial institutions can also corroborate the power and reliability of a demand zone, signifying notable stakeholder investment and dedication to maintaining these specific pricing thresholds.

Deploying Demand Zones in Your Trading

Incorporate the demand zones into your trading strategy by deeply understanding them. These zones aid in identifying potential support regions where price has historically pivoted, providing opportunities for initiating long positions.

To delineate precise entry points, look for price reversals like bullish candlestick configurations or signals from other technical indicators suggesting oversold states.

Traders can mitigate risk by setting stop-loss orders slightly beneath a demand zone to protect against market fluctuations contrary to their expected trade trajectory.

Deploying Supply Zones in Your Trading

Like demand zones, supply zones play a significant role in trading strategies. These indicators help identify where the price of an asset is likely to stall or reverse, indicating possible overvaluation due to an excess of sellers.

Supply zones serve multiple purposes in trading:

- They serve as clear markers for short trade entries or long trade exits.

- They can be used to set strategic stop-loss orders based on historical price data.

- Traders can use alerts for zone touches or breaks to enhance decision-making.

- Additional technical indicators like RSI or MACD can be used to confirm reversals at supply zones.

The Interplay Between Supply & Demand Levels and Market Trends

Grasping the interaction between supply and demand levels with market trends is critical to successful trading. The Supply and Demand Indicator identifies significant price levels using a sophisticated algorithm that integrates the ZigZag pattern, providing a comprehensive view of potential market movements and conditions.

Supply and demand dynamics directly influence price movements in the market. When demand exceeds supply, it leads to price hikes, while supply exceeds demand and stagnant demand results in price drops.

To identify market trends and make informed trading decisions, traders should analyze the following metrics:

- Supply and demand zones.

- External factors like economic policies and market sentiment.

- Support and resistance levels.

- Trend analysis.

- The concept of ‘fresh’ zones.

Combining these zones with support and resistance levels, trend analysis, and the concept of ‘fresh’ zones can create a more complete picture of market behaviors. Visual tools like candlestick patterns and trend lines, coupled with supply and demand indicators, are instrumental in helping traders discern the overall market direction.

Crafting Trading Strategies with the Supply and Demand Indicator

KT Supply and Demand indicator hold significant sway in formulating astute trading strategies. They pinpoint prospective entry zones, favoring the inception of trends or their potential reversal, placing a premium on unexploited areas for enhanced efficacy.

Adopting either an assertive stance or a cautious one can be accommodated by these indicators, which establish concrete guidelines on when traders should enter and exit trades.

Recognizing opportunities that promise higher rewards at lower risks is possible through discerning substantial movements in price — making it imperative for traders to delve deeper into honing these tactical approaches.

Reversal Trading with Supply and Demand

Reversal trading is a strategy that involves identifying areas where potential price reversals can be anticipated.

In this context, fresh, untested supply and demand zones are more likely to succeed because these zones represent levels where significant buying or selling pressure has previously entered the market without being weakened by retests. As a part of this strategy, demand trading focuses on demand zones for potential reversals.

Specific strategies for entering reverse trades include:

- Identifying false breakouts.

- Recognizing patterns such as an spring and amateur squeeze patterns.

- Combining supply and demand zones with Fibonacci retracement levels to set highly probable trade entries and exits.

Combining Indicators for Enhanced Precision

Incorporating other technical tools with supply and demand indicators can significantly sharpen your trading strategy’s accuracy. Tools like the Relative Strength Index (RSI) validate potential entry points, improving trade decision-making.

Employing a 100-period Exponential Moving Average (EMA) in conjunction with recognizing a supply or demand zone can bolster the precision of your entry signals. Oscillators and moving averages deliver clear visual cues that assist in managing risk by indicating when markets might be overbought or oversold.

The Technical Edge: Automated Trendlines with Supply and Demand Indicator

Our automated trendline indicator offer a substantial technical advantage in the swift trading world. This tool can accurately identify and plot trend lines on charts without manual intervention, saving valuable time during technical analysis.

Automated trendlines provide visual cues about the prevailing market trends, helping traders to:

- Confirm entry and exit points using supply and demand zones.

- Combine automated trendlines and supply and demand indicators to obtain a dual-confirmation system.

- Verify the strength of supply and demand zones.

- Align supply and demand zones with the broader market trend.

This combination of tools can significantly assist traders in making informed decisions.

Customizing our Supply and Demand Indicator

Effective trading heavily relies on customization.The KT Supply and demand indicator offer a range of customization options, from visual aspects to display preferences and alert settings. This allows traders to tailor their indicators to suit their unique trading style and preferences.

Whether you want to clear the clutter by hiding all supply and demand zones on the chart or choose the number of zones displayed per timeframe, this indicator offer flexibility and control.

It can be tailored to meet your trading needs, from adjusting individual swing lengths to defining supply and demand zones to setting alerts for zone touches or breaks.

Real-Time Application: Indicator Performance on Current Timeframe vs. Higher Timeframe

Implementing real-time supply and demand zones can significantly revamp your trading strategies. It is designed to reveal zones across various timeframes, providing you with a more comprehensive analytical view.

This tools allow for independently examining up to two customizable timeframes or letting you modify specific swing lengths to delineate supply and demand areas. Utilizing these practical features is instrumental in improving your approach to trading.

It’s essential to grasp how they function over diverse periods, as this insight is vital for assessing the success rate of your market strategies.

Navigating Forex Markets with our Supply and Demand Indicator

In forex trading, indicators that track supply and demand are beneficial. They assist in pinpointing price levels where large buy or sell orders from institutional investors might be positioned, signaling potential substantial shifts in the market.

Essential Considerations for Professional Trading

Delving deeper into professional trading requires a nuanced comprehension of our supply and demand indicator beyond the elementary grasp. Elements such as market liquidity, the newness of zones, and the impact wielded by major financial institutions are vital when employing these indicators.

Employing automated trendlines can shed light on the strength and resilience of supply and demand zones. This enables traders to discern which areas have a higher probability of holding firm or breaking through.

Despite being rich data sources, one must weigh additional variables to harness their potential fully in trading strategies.

Maximizing Gains: Setting Take Profit Levels using Supply and Demand

Utilizing demand indicators to establish profit target levels could significantly enhance the potential for gains. Demand zones, identified by prior surges in price due to an overwhelming number of buyers, provide advantageous positions for setting take-profit thresholds.

Repeated reversals occurring at a consistent price point within a demand zone suggest robust interest from buyers, which assists in fine-tuning the placement of take-profit points.

It is crucial for traders to continuously evaluate and adjust their take profit settings to correspond with current market dynamics and concentrations of purchasing momentum.

The Power of Visualization: Indicator Shows for Clarity

In trading, visualization is paramount. Visual representations, such as charts and graphs, play a crucial role in helping traders analyze and interpret market data. Some key benefits of using visual representations in trading include:

- Quick identification of historical price levels where supply exceeded demand or vice versa.

- Easy comparison of different periods and market conditions.

- Clear visualization of trends and patterns.

- Enhanced understanding of market dynamics.

By utilizing visual representations effectively, traders can make more informed decisions and improve their overall trading performance.

Integrating Supply and Demand Indicator with Other Tools

Considering how our supply and demand indicator complement additional trading tools is essential. Tools that confirm trends, such as moving averages or breakout detectors, can bolster the effectiveness of these indicators.

Similarly, oscillators like the RSI and MACD help verify current market trends and identify possible points where reversals may occur.

Volume-based indicators — for instance, On-Balance-Volume and Accumulation/Distribution Line — prove vital when used with supply and demand zones to gauge market vigor and corroborate trading decisions.

Integrating these various instruments enables traders to polish their approaches and enhance their analysis of the markets.

Summary

In conclusion, our supply and demand indicator can be an invaluable tool for any trader. It helps identify key price levels, provide insights into market trends, and inform strategic trading decisions.

You can confidently navigate any financial market by understanding the anatomy of supply and demand zones, incorporating these indicators into your trading style, and integrating them with other tools.

Successful trading is about understanding the market and utilizing the right tools effectively. So, whether you’re a novice trader or an experienced professional, harness the power of our supply and demand indicator and elevate your trading strategy to new heights.

Frequently Asked Questions

Which indicator is best to combine with supply and demand?

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are useful technical indicators to confirm potential reversals at supply or demand zones.

Choose one of these indicators to identify supply and demand levels effectively.

Is there a supply and demand indicator in TradingView?

Indeed, TradingView provides an array of indicators tailored to identify supply and demand areas on charts such as the Supply and Demand Daily, Anchored Supply and Demand, and Visible Range Supply and Demand. These tools help traders pinpoint zones where supply and demand are most prevalent by using diverse techniques to mark these crucial levels.

How do you read a supply and demand indicator?

When examining a supply and demand indicator, search for chart segments with difficulty advancing or declining prices, signifying possible zones of demand or supply. These are zones where an accumulation of selling or buying pressure has led to a halt or reversal in the price movement.

What is the volume supply and demand indicator?

The volume supply and demand indicator highlights areas on a chart where the demand outstrips the supply, propelling prices higher (referred to as a demand zone) or where the supply exceeds the demand, pushing prices lower (referred to as a supply zone).

It is deployed to ascertain the equilibrium between security’s supply and its corresponding demand.

How do we find supply and demand zones manually?

To identify supply and demand zones manually, search for regions on the chart with noticeable resistance to price movement upwards or downwards. These are potential zones.

Pinpoint price levels have repeatedly seen the price reverse direction since supply and demand areas typically exhibit several reversals at identical price levels.

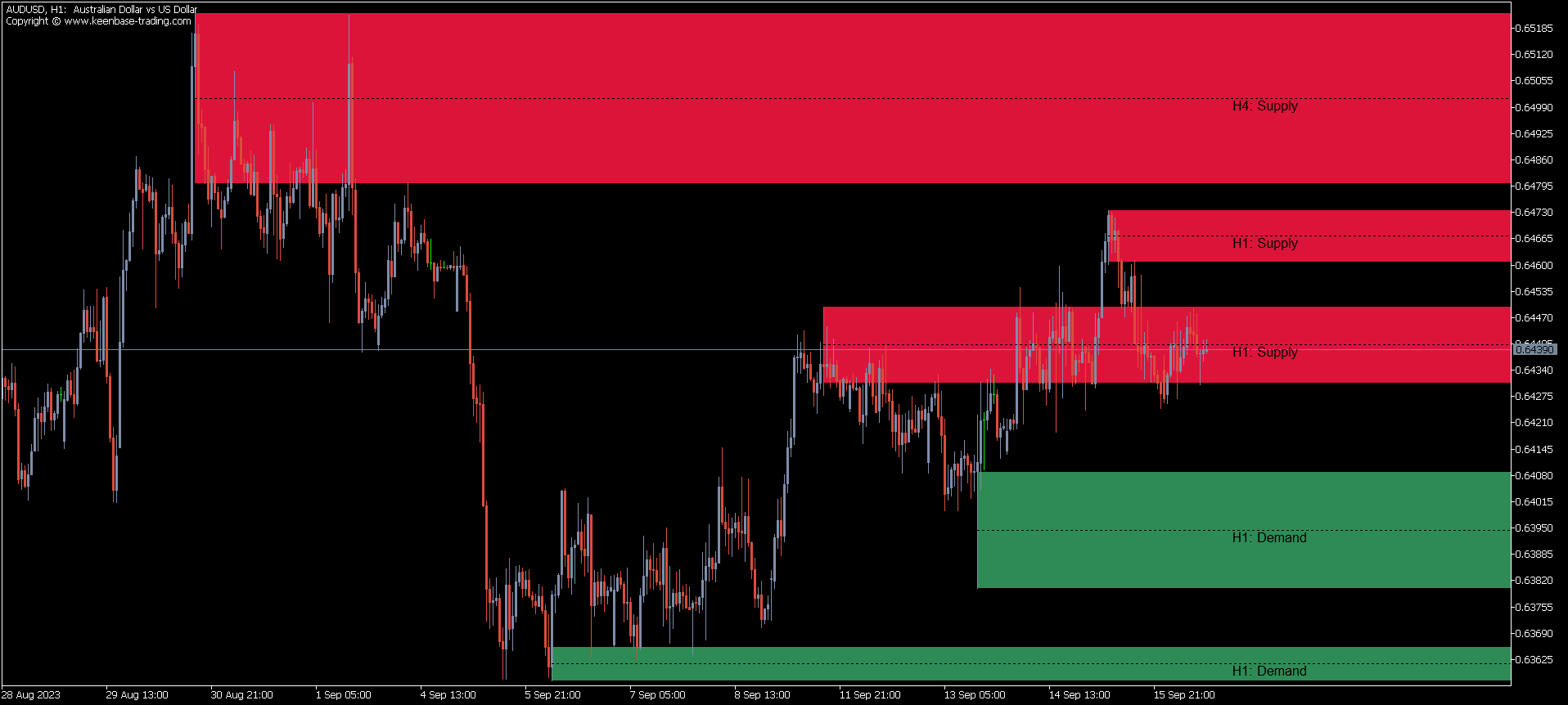

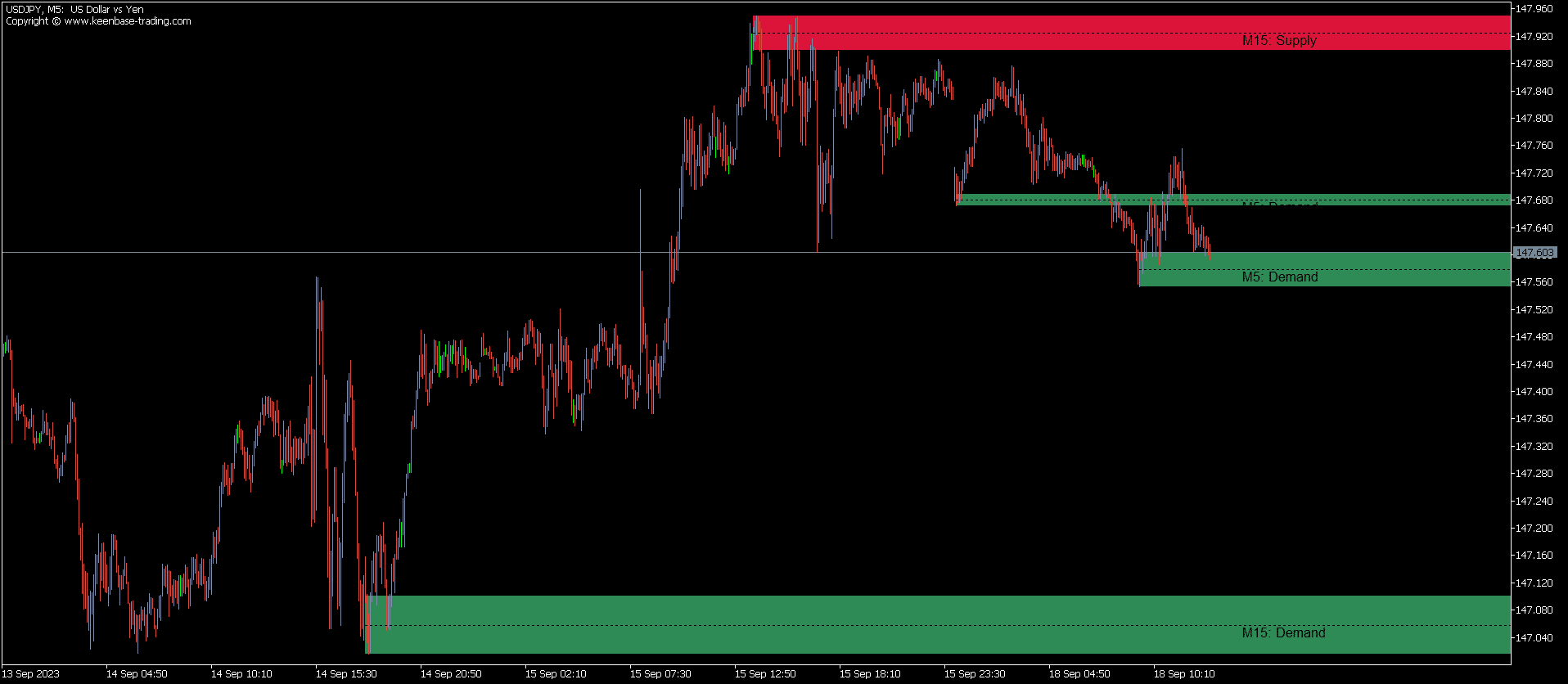

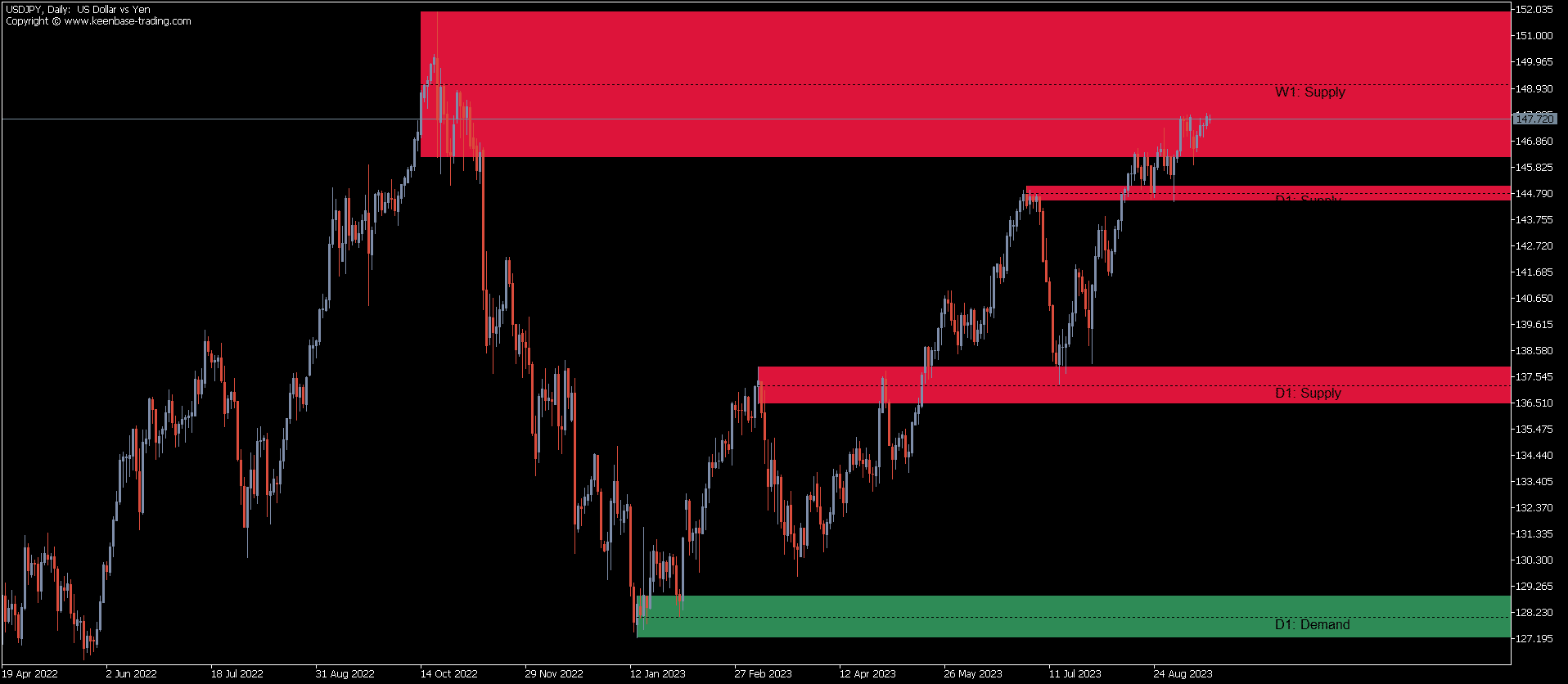

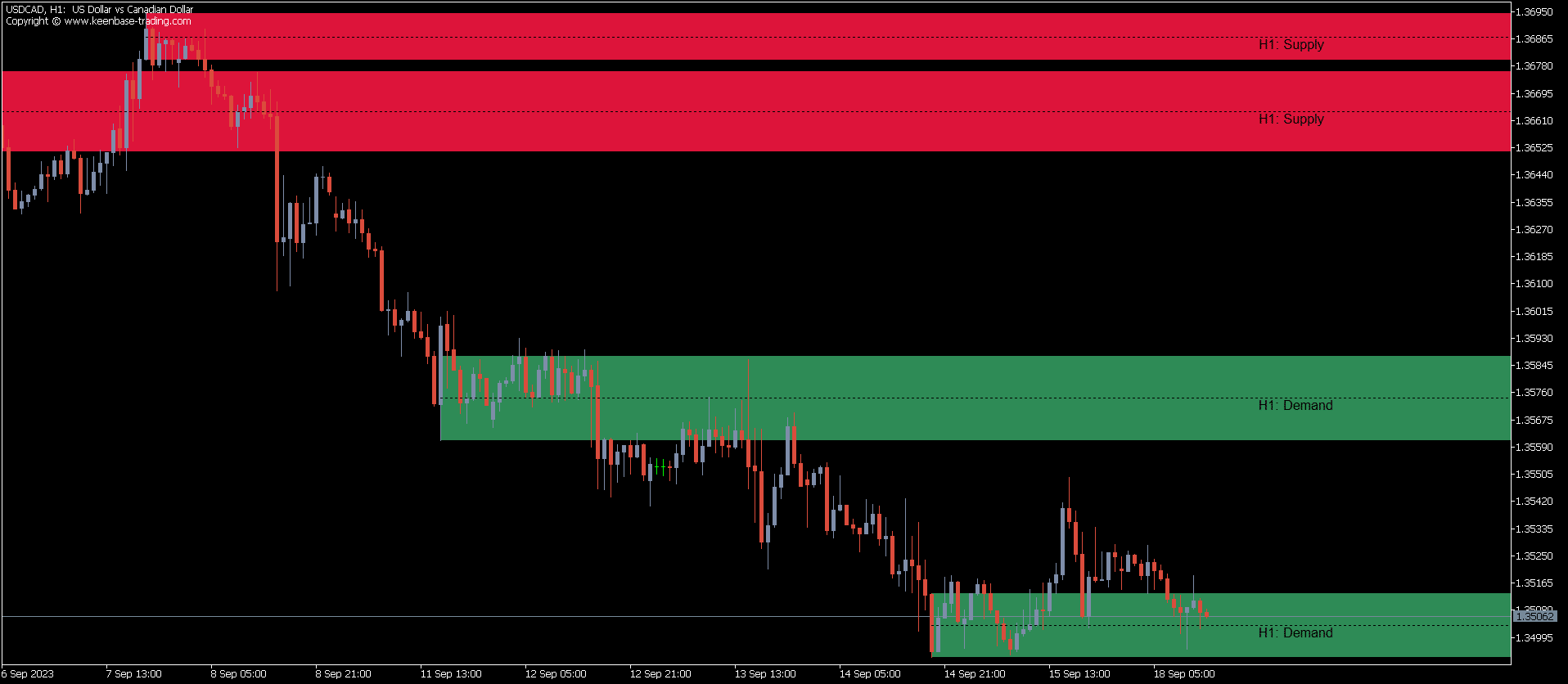

Screenshots

You Might Also Like

Help others make better choices. Please review your recent purchase.

By sharing your review, you will help others to make advised decision about what they buy from us. Thanks for contributing.