We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

Forex Trading vs eStock Trading - Which One is Better?

While there might be a few similarities between the Forex market and the stock market, stock trading and Forex trading are entirely different.

In this article, we’ll explore the differences between Forex Trading vs Stock Trading. We’ll also look at how the events in the stock market impact the Forex market.

The Relationship Between Forex Trading and Stock Trading

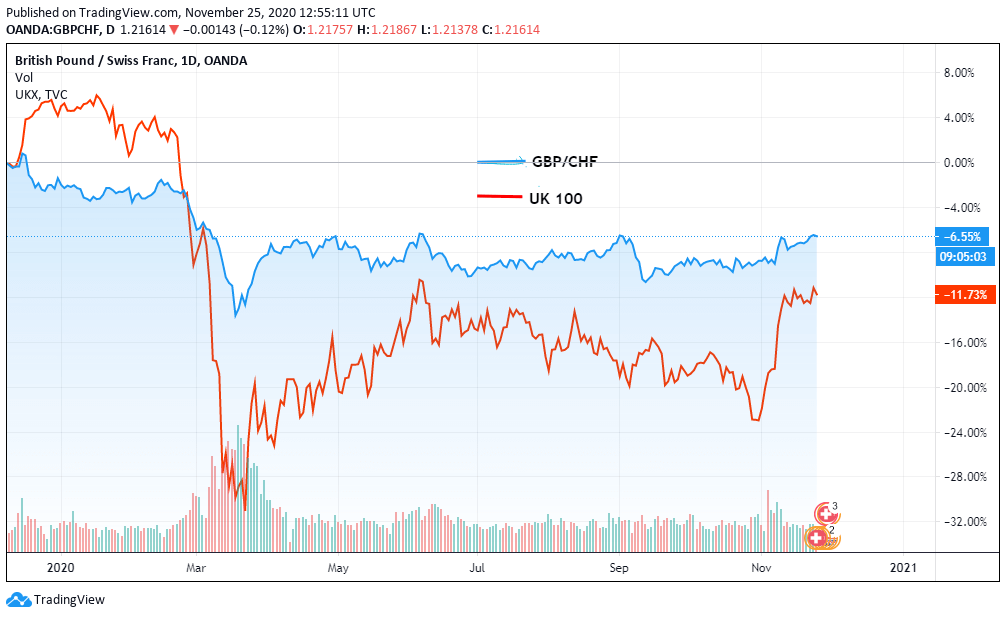

Despite the fact that the stocks and the Forex market are entirely different markets, there is a strong correlation between the domestic currency's success and the country's stock market's success.

When a country’s stock market performs well, there will be capital inflows from foreign investors who intend to earn higher returns.

To invest in the domestic economy, foreign investors will have to convert their money into local currency market, increasing domestic currency demand in the Forex market.

In turn, the value of the domestic currency will also increase.

Conversely, when the stock market is on a downtrend, it will result in capital flight by foreign investors who want to avoid further losses.

The capital flight can also result from foreign investors' profit-taking when they believe that the stock market has reached its peak.

When exiting the domestic stock market, the foreign investors convert their capital to other currencies, which results in an increase in supply in the Forex market hence depreciation.

Furthermore, when the stock markets open, it coincides with the Forex market hours in different time zones.

Therefore, during these Forex sessions, the pairs with the domestic currency experience higher liquidity than when the local stock markets are closed.

Although stock markets impact the Forex market to some extent, there are glaring differences between Forex vs stocks.

Volume Traded

The primary difference between Forex vs stock trading is liquidity. By liquidity, we refer to the volume traded daily in either market.

The Forex market is highly liquid among all the financial markets. In a single day, an average of $6.6 trillion is traded in the forex market compared to about $600 billion in the stock market.

Keep in mind that forex trading strategy involves the buying and selling of currencies. There are trillions of currencies in circulation worldwide, so the volume traded can be significantly higher.

Furthermore, the increase in international trade encourages the Forex market's liquidity, necessitating Forex exchange 24/7.

On the other hand, stock trading involves buying and selling publicly listed companies – which are finite. That is why the volume traded tends to be lower.

To track the traded volume during the different market sessions, consider downloading our KT Forex Volume indicator and KT Volume Profile indicator.

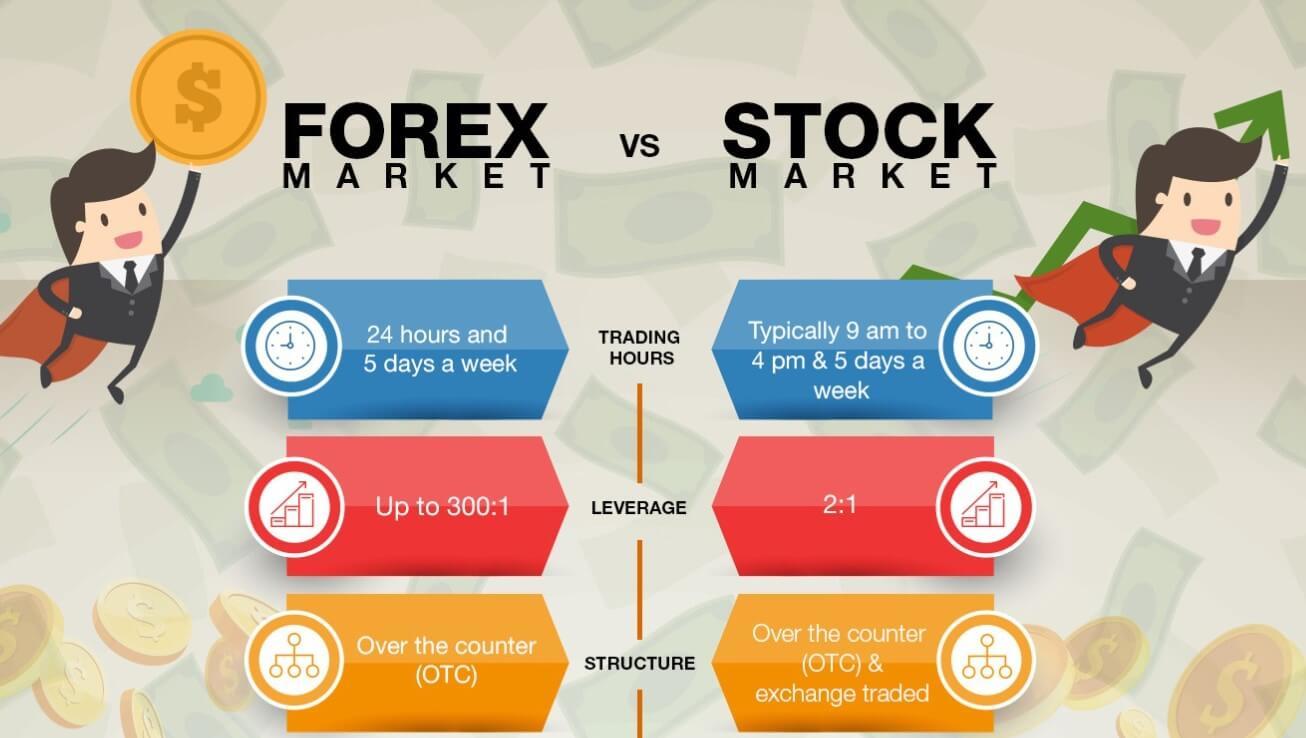

Trading Hours

Although the Forex and stock market hours overlap, the trading hours differ.

The Forex market is open 24/7, while the stock market is only open during regular business hours, depending on the country. Therefore, traders interested in stock trading can only do so when the markets are open.

Given that there are several stock exchanges across different time zones, it becomes impossible for a stock trader to monitor every stock market simultaneously.

For example, if a trader wants to trade stock from Germany, Australia, and the US, they will have to be awake 24 hours a day to catch the stock markets when they open.

On the other hand, since the Forex market is open 24 hours a day, a forex trader is at liberty to choose their trading schedule.

While the interbank Forex market is open 24/7, retail traders can only trade in the forex market 24 hours a day during the weekdays from Sunday 5 PM EST to 4 PM EST on Friday.

Higher Leverage

The margin requirements in Forex and stock trading are different. Forex traders have access to very high leverages compared to stock traders.

In the Forex market, brokers give traders leverage up to 2000:1. On the contrary, stock trading only attracts small leverages.

That means Forex traders are uniquely positioned to reap higher profits than stock traders.

For example, say you have $1000, and your Forex broker offers you a leverage of 2000:1 that allows opening a trading position worth $2,000,000. In this case, a 10% change in the price will earn you $2000.

On the other hand, a stock trader can only get a leverage of up to 5:1, which means that with $1000, they can only buy stocks that work for $5000.

Therefore, a 10% change in price can earn them $500, which is much lower than the $2000 made by the Forex trader.

However, using high leverage can also be dangerous. For example, in the Forex trader case, a 5% change in the price would result in a loss of $1000, which would wipe out their trading balance.

We suggest using KT Equity Protector EA on your Metatrader account to prevent such a situation. Also, you can read our article for a detailed explanation of equity and floating profit/loss.

Trading Fees

Trading Forex attracts meager commissions. Most Forex brokers do not even charge commissions on trades since they earn their revenue through spreads—the spread in the difference between the broker’s buying and the selling price of a currency pair.

When trading stocks, traders must pay a commission to the brokers. However, these commissions are fixed arbitrarily by the stockbrokers and hence lack the transparency of the spreads.

Price Movements in Forex vs Stocks

In Forex trading, the price of major currency pairs is primarily affected by economic news and geopolitical events.

For example, say you are trading the GBP/USD, the economic fundamentals in the UK and the US and some events that impact either country will move the GBP/USD pair's price.

If there are improvements in the UK economy or there are favorable events regarding the UK, the pair's price will increase.

The GBP/USD price will also increase if the US economy is deteriorating or adverse events impact the US.

The price of the currency pair will drop if the UK economy is performing poorly or the news of adverse events is likely to affect the UK.

Similarly, GBP/USD's price will also drop if the US economy is performing better if positive events surround the US economy.

This example shows that the forex market's price movement largely depends on fundamental factors that affect the base and quote currencies.

In addition, the price of a particular stock also responds to the news surrounding a specific company.

The news can range from financial performance to company leadership changes. However, daily, the price movement in the stock market is primarily driven by forces of demand and supply.

When the demand for a particular stock increases, its price will go up. Conversely, the stock price will drop if demand decreases, resulting in more sellers than buyers.

This aspect of the stock market makes it easier for price manipulation to occur.

Remember that the shares issued by a company are finite for a single stock, making it easy for majority shareholders to manipulate the prices.

As a result, large trades in a single stock can cause significant changes in the price without a difference in the company's fundamentals.

A sizeable short sell can cause the prices to drop significantly, while a large buy order can cause a disproportionate increase in the price.

Price manipulation in the Forex market is almost impossible due to its sheer size.

It is hard for a few prominent participants to manipulate a currency pair's price by placing large trades.

To hold a stock for the long term, we recommend keeping track of its Coppock curve to speculate the possible exit.

Regulations

The Forex market is decentralized and unregulated, which means that there is no central location where traders go to buy and sell currencies – it is done purely online.

Furthermore, the Forex market makers can set the quotes as competitively as they see fit.

On the other hand, several financial market regulators strictly regulate the stock market. So, Forex and stock trading occurs in different regulatory spaces.

While there are some advantages of strict regulations in the stock market, short-term traders enjoy the benefits of trading in an unregulated market. Some of these benefits include:

No limits to price changes

The Forex market price can fluctuate as much as possible without the intervention of a third party.

Forex traders benefit from such unlimited fluctuations when fluctuations of more than 10% within a short period in stock trading, the regulator suspends trading on that particular stock.

Trading is resumed once the market goes back to normal trading conditions. While such trading style halts may protect some stock traders, it also disadvantages those traders who would have made legitimate profits from such fluctuations.

No Restrictions on Short-Selling

In Forex trading, you can short the market under any prevailing condition. Therefore, Forex traders can benefit from catastrophic events that result in disproportionate price changes.

In stock trading, regulators ban short-selling of a particular stock or the entire market.

For example, during the Covid-19 pandemic's peak, some countries in the EU suspended short selling in specific blue-chip stocks.

Conclusion

Forex trading is more popular worldwide compared to stock trading. While there are several advantages of trading in the Forex market than in the stock market, the choice depends entirely on your trading objectives.