We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

How Long Does It Take to Learn Forex Trading? A Practical Guide

One question that often arises among aspiring traders is: "How long it takes to learn Forex trading?" The answer is complex and varies from person to person, depending on factors like commitment, prior experience, and natural aptitude.

Unlike conventional professions, there is no fixed timeline or curriculum for becoming proficient in Forex trading.

It’s not merely about memorizing market terms or understanding technical indicators; it’s about developing a disciplined mindset, crafting a robust trading strategy, and adapting to the ever-changing market conditions.

The goal of this article is to provide realistic insights into the Forex learning process. We will explore how much time it typically takes to learn Forex trading, highlight key focus areas like technical analysis and trading strategies, and offer practical tips for accelerating the journey.

Whether you’re a beginner starting from scratch or someone with prior trading experience, this guide will help you navigate the learning curve effectively.

Forex trading, also known as foreign exchange trading, is one of the most dynamic and challenging financial markets in the world. With a daily trading volume exceeding $6 trillion, it provides plenty of daily opportunities for those who can master its intricacies.

Traders buy and sell currency pairs, seeking to profit from the price fluctuations driven by global economic events, geopolitical developments, and market trends. However, the promise of high rewards is accompanied by significant risks, making Forex trading both enticing and demanding.

Learning Forex trading and mastering it is a journey, not a destination. It requires consistent effort, patience, and the willingness to learn from both successes and failures.

By the end of this article, you’ll have a clear understanding of the steps involved, the common challenges, and the resources you can leverage to become a successful Forex trader. Let’s dive into what it takes to unlock the potential of this exciting market.

The Core of The FX Market

The foreign exchange market (Forex) is a decentralized global marketplace where currencies are traded around the clock across major financial hubs, such as London, New York, Tokyo, and Sydney. Previously, we briefly explained all Forex market hours on our blog.

Unlike centralized markets like stock exchanges, the Forex market operates through an over-the-counter (OTC) system, where trades occur directly between participants without a central clearinghouse. This decentralized nature ensures continuous trading, high liquidity, and significant price volatility.

At the heart of Forex trading are currency pairs, which represent the relative value of one currency against another. A currency pair comprises two components: the base currency and the quote currency.

For example, in the pair EUR/USD (Euro/US Dollar), the Euro is the base currency, and the US Dollar is the quote currency. The exchange rate reflects how much of the quote currency (USD) is needed to purchase one unit of the base currency (EUR).

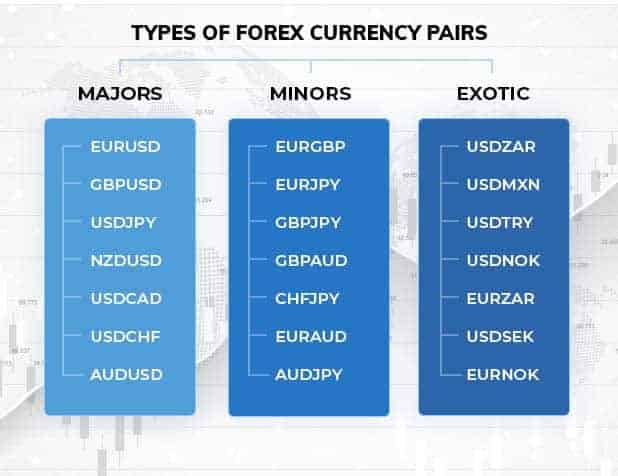

Currency pairs fall into three categories:

- Major pairs, such as EUR/USD and USD/JPY, involving the most traded global currencies.

- Minor pairs, like EUR/AUD, which exclude the US Dollar but include other significant currencies.

- Exotic pairs, such as USD/ZAR (US Dollar/South African Rand), combining a major currency with one from an emerging market.

Market Drivers

1. Central Bank Policies:

Central banks, such as the Federal Reserve (Fed), European Central Bank (ECB), and Bank of Japan (BoJ), play a crucial role in influencing currency values. They adjust interest rates, implement quantitative easing, and execute open market operations, all of which affect exchange rates.

- When the Federal Reserve increased interest rates aggressively in 2022 to combat inflation, the US Dollar strengthened significantly, causing the EUR/USD pair to drop below parity for the first time in decades.

- In contrast, the Bank of Japan’s continued monetary easing during the same period weakened the Japanese Yen, leading USD/JPY to climb above 150, a 32-year high.

2. Economic Data:

Economic indicators, such as GDP growth, unemployment rates, inflation rates, and manufacturing output, provide traders with insight into a country’s economic health. Positive economic data typically strengthens a currency, while negative reports lead to depreciation.

- In 2023, robust employment data in the US signaled economic resilience, boosting the USD against weaker-performing currencies like the British Pound.

3. Geopolitical Events:

Geopolitical tensions and unexpected news significantly impact Forex markets, often causing abrupt price movements.

- Russia-Ukraine Conflict (2022–Present): The invasion caused substantial volatility in the Forex market. The Euro initially weakened as the conflict heightened energy insecurity in Europe, while the Swiss Franc (CHF), often seen as a safe-haven currency, appreciated sharply.

- Brexit Referendum (2016): The British Pound (GBP) experienced one of its most volatile periods, losing more than 10% against the US Dollar (USD) in a single trading day after the UK voted to leave the European Union.

- US-China Trade Tensions (2018–2020): During the trade war, the Chinese Yuan (CNY) experienced significant devaluation as markets reacted to escalating tariffs and geopolitical uncertainty.

Assessing Your Readiness to Learn Forex Trading

Before you get into Forex trading, it’s important to evaluate your readiness for this demanding yet rewarding journey. Here are key questions to help you evaluate your motivation, resources, and preparedness:

- Are You Willing to Invest Time and Effort?

Forex trading requires a significant time commitment to learn market dynamics, strategies, and risk management. Are you ready to dedicate hours each week for consistent learning and practice? - Do You Understand the Financial Risks?

The Forex market is volatile like the seven seas, and losses are inevitable, especially in the beginning. Are you prepared to lose money without letting emotions cloud your judgment? - Do You Have Clear Goals?

Why are you pursuing Forex trading? Whether it’s financial independence or personal growth, having clear, realistic Forex goals is essential. - Are You Financially Ready?

Do you have risk capital—money you can afford to lose—without jeopardizing your financial stability? - Do You Have Access to the Right Resources?

Are you equipped with a reliable trading platform, educational materials, and tools for analysis? Would you consider joining a trading community or seeking a mentor? - Can You Handle the Psychological Challenges?

Are you prepared to maintain discipline during losing streaks and avoid impulsive decisions driven by greed or fear?

Assessing your readiness is the most important first step in your Forex trading journey. Honest answers to these questions will help you determine if you are prepared to commit the time, effort, and resources required to navigate this challenging yet potentially rewarding market.

Key Areas to Focus on When Learning Forex Trading

Forex consists of different areas, methods, concepts, and sections. We have listed the main Key areas to focus on when learning forex trading.

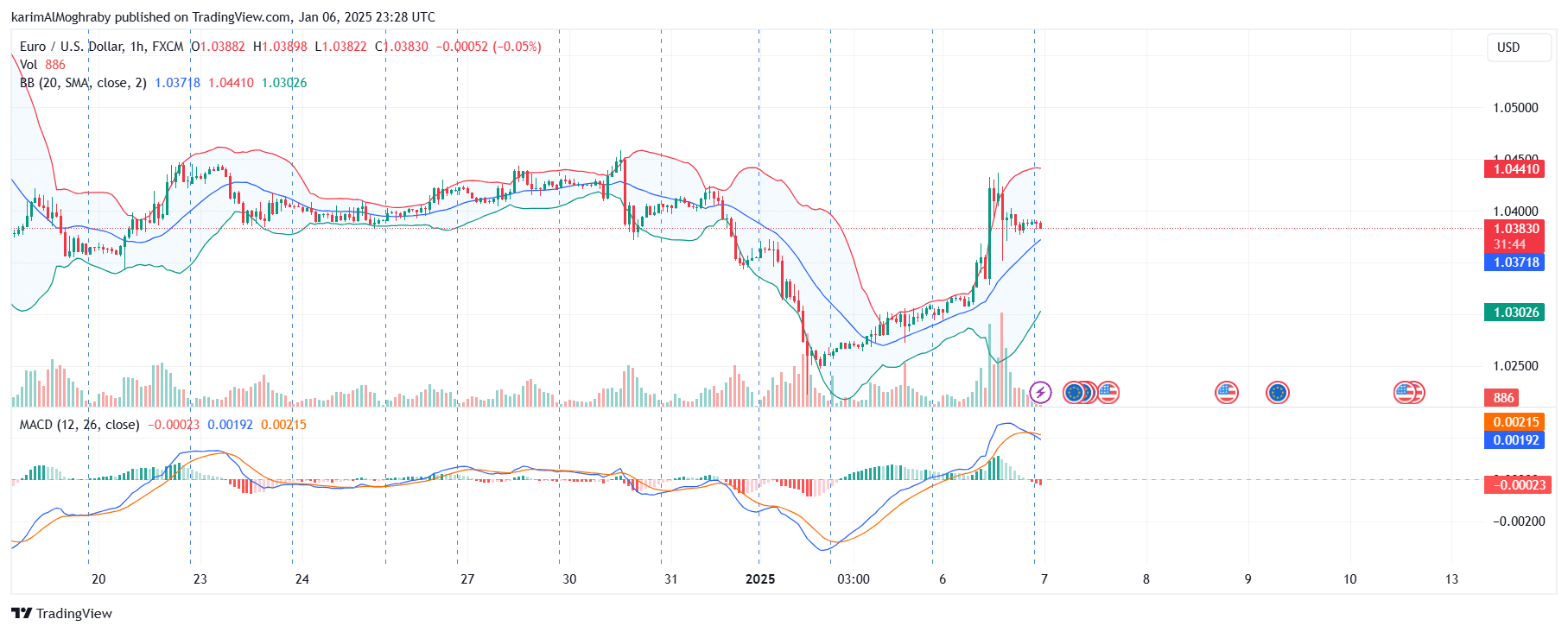

1. Technical Analysis

Technical analysis focuses on understanding historical price movements to forecast future trends. Traders analyze charts to identify patterns, such as head-and-shoulders or ascending triangles, which signal potential market behavior.

Recognizing key levels like support and resistance is serious for predicting price reactions.

Identifying Trading Opportunities

Technical tools allow traders to identify high-probability trade setups. For example, a bullish engulfing candlestick near a strong support zone may suggest a reversal. Combining tools like moving averages with price action further refines these opportunities.

Tools and Indicators

Key technical indicators include:

- Bollinger Bands: Highlight volatility and potential price breakouts.

- MACD (Moving Average Convergence Divergence): Detect trend reversals and momentum shifts.

- Pivot Points: Identify intraday pivot S/R levels.

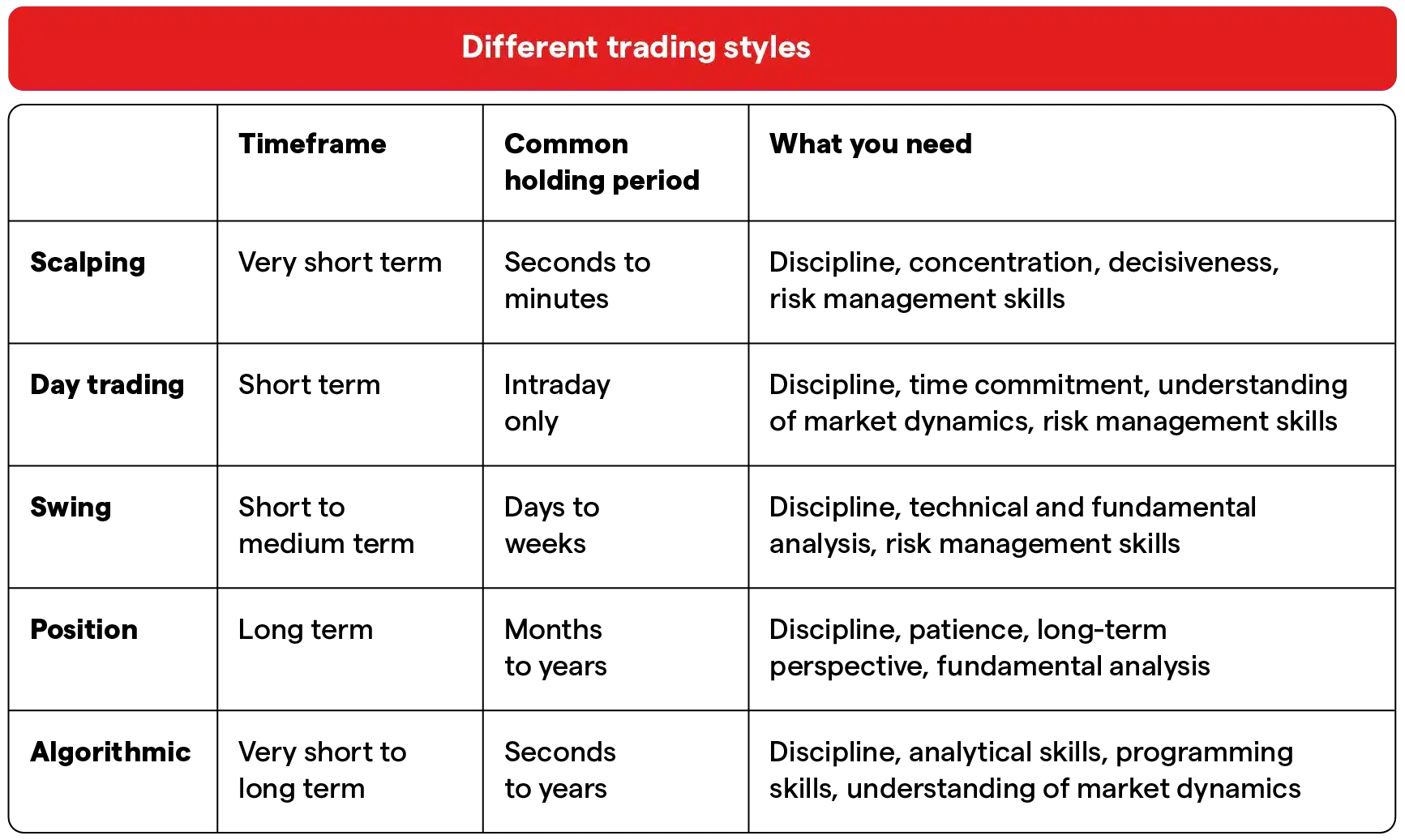

2. Trading Strategies and Techniques

Each trading style caters to different goals, below are the most common three among retail traders:

- Day Trading: Quick trades focusing on small price movements within a single day.

- Swing Trading: Medium-term trades based on multi-day trends.

- Position Trading: Long-term trades driven by macroeconomic factors.

Customizing Strategies

Strategies must align with individual risk tolerance and objectives. For example, a risk-averse trader may prefer swing trading, while an aggressive trader might explore scalping.

Learning Through Demo and Live Trading

Demo accounts offer a risk-free environment to practice strategies. However, live trading introduces real emotional stakes, which are crucial for honing discipline and decision-making.

3. Fundamental and Sentimental Analysis

Fundamental Analysis

Fundamental analysis evaluates economic, political, and financial factors that influence currency values. Key components include:

- Economic Indicators: GDP growth, employment data, and inflation rates provide insights into a currency's strength. For instance, a higher-than-expected US Non-Farm Payroll (NFP) report often strengthens the USD.

- Central Bank Policies: Interest rate decisions and monetary policies by institutions like the Federal Reserve or European Central Bank significantly impact currency trends.

Sentimental Analysis

Market sentiment reflects the collective attitude of traders toward a particular currency or asset. Sentimental analysis seeks to gauge whether the market is optimistic (bullish) or pessimistic (bearish).

- Risk-On vs. Risk-Off: During periods of geopolitical tension, traders may flock to safe-haven currencies like the Swiss Franc (CHF) or Japanese Yen (JPY). Conversely, optimism in global markets might drive demand for riskier assets like the Australian Dollar (AUD).

Combining fundamental and sentimental analysis helps traders anticipate long-term trends and respond to major events, such as central bank announcements or geopolitical developments.

4. Risk Management

Risk management is the cornerstone of sustainable trading. Essential strategies include:

- Stop-Loss Orders: Automatically cap losses by exiting trades when the price moves unfavorably.

- Take-Profit Orders: Secure gains at predefined levels to protect profits.

Money Management Techniques

Traders should adhere to the 1-2% rule, ensuring that no single trade jeopardizes their overall capital. Proper position sizing also prevents overexposure to volatile markets.

Handling Losses

Losses are part of trading. Reviewing each losing trade to identify errors ensures continuous improvement and better decision-making.

To excel in Forex trading, focus on developing expertise in technical, fundamental, and sentimental analysis, while refining your trading strategies and risk management techniques, you can check out the links above for EAs that can help you in your trading journey and make it simpler.

Each component complements the other, creating a well-rounded approach that allows traders to navigate the Forex market’s complexity and volatility with confidence.

Factors That Influence Learning Time

Learning Forex trading is a highly individualized process nothing works for everyone the same way. The learning curve is influenced by several factors that determine how quickly a trader can develop the skills and knowledge needed to navigate the market effectively.

While some traders may achieve confidence in as little as six months, others may take years to master the complexities of the Forex market. Here are the key factors that impact the learning timeline and the typical durations associated with gaining proficiency.

Impact of Individual Factors

1. Commitment and Dedication

Success in Forex trading requires a significant investment of time and effort. Traders who dedicate consistent hours each day to learning, practicing, and analyzing trades are more likely to progress quickly.

Those who treat Forex trading as a side hobby with minimal engagement may find the learning process much slower.

2. Available Time

Full-time learners or individuals who can devote 20–30 hours per week to trading education often progress faster than those balancing trading with full-time jobs or other commitments.

3. Prior Experience

Traders with prior exposure to financial markets, such as stock trading or investment analysis, may find it easier to grasp Forex concepts like technical analysis, market trends, and risk management.

4. Natural Ability and Cognitive Skills

Problem-solving skills, analytical thinking, and emotional discipline play a significant role in how quickly an individual learns Forex trading. Some people naturally excel at analyzing patterns and making decisions under pressure, which can accelerate their progress.

Typical Forex Trading Learning Timelines

1. Short-Term (6–12 Months)

Most beginners can gain basic confidence within this timeframe. During these months, they learn foundational concepts such as technical analysis, trading strategies, and risk management while practicing with demo accounts.

2. Intermediate Stage (1–2 Years)

Becoming consistently profitable often takes one to two years. This stage involves transitioning from demo trading to live trading, refining strategies, and developing emotional discipline to handle real money and market volatility.

3. Advanced Mastery (3+ Years)

Achieving mastery in Forex trading—characterized by consistent profitability, advanced strategy development, and adaptability to changing market conditions—typically requires three or more years of continuous learning and practice.

Role of Resources in Forex Trading Learning

1. Trading Courses

Well done structured courses provide step-by-step guidance on key topics such as technical analysis, trading platforms, and market psychology. These courses can significantly shorten the learning curve by offering curated content and practical exercises.

2. Professional Guidance

Getting mentored from experienced traders assists beginners avoid common mistakes and focus on effective strategies. Professional guidance provides personalized feedback, which accelerates learning.

3. Forex Education Programs

Comprehensive education programs, often offered by brokers or trading academies, combine theoretical learning with hands-on practice. These programs often include interactive webinars, tutorials, and access to demo trading platforms.

4. Self-Learning and Online Resources

Free resources like YouTube tutorials, blogs, and online communities are invaluable for self-paced learners. However, the abundance of information requires discernment to avoid unreliable or overly simplistic material.

The time it takes to learn Forex trading depends on a combination of individual factors and the quality of resources available. While most traders gain confidence within 6–24 months, achieving consistent profitability often requires 1–2 years or more.

By committing to structured learning, utilizing professional resources, and dedicating sufficient time, aspiring traders can accelerate their journey toward mastering the Forex market.

Accelerating Your Forex Trading Learning Process

Mastering Forex trading is a journey that can take years, but with a structured approach and the right resources, you can significantly accelerate your progress.

Building a solid foundation, accessing expert guidance, and leveraging effective tools are key to shortening the learning curve and developing the skills needed to trade confidently.

Importance of Structured Learning

Structured learning provides a clear roadmap, ensuring you focus on the most critical aspects of Forex trading without becoming overwhelmed by unnecessary distractions. A solid foundation begins with understanding market mechanics, technical and fundamental analysis, and risk management.

By following a step-by-step approach, you can build a strong knowledge base that serves as the cornerstone of your trading journey.

For instance, starting with a reputable Forex education program or trading course ensures you learn the essentials in a systematic way. This not only speeds up the process but also minimizes the risk of developing bad habits or misconceptions early on.

Tips for Speeding Up the Forex Learning Journey

Join Trading Communities

Engaging with online trading communities or forums connects you with like-minded individuals and experienced traders. Platforms like Reddit’s Forex threads, Discord groups, or dedicated trading forums provide valuable insights, discussions, and tips.

Learning from others’ experiences, mistakes, and successes can help you avoid common pitfalls and discover new strategies.

Learn from Experienced Traders and Mentors

Having a mentor or guide can significantly accelerate your learning. Experienced traders provide personalized feedback, helping you refine your strategies and focus on areas for improvement.

Mentorship programs or workshops offer direct access to expert knowledge, allowing you to fast-track your understanding of the market.

Utilize Demo Accounts

Demo accounts are essential for building practical skills without risking real money. They allow you to experiment with different trading strategies, test tools like technical indicators, and become familiar with trading platforms.

For example, using a demo account to practice day trading or swing trading provides hands-on experience that builds confidence.

Back-Test Strategies

Back-testing involves using historical market data to evaluate the effectiveness of a trading strategy. By applying your strategies to past price movements, you can identify strengths and weaknesses, refine your approach, and ensure your methods are robust before using them in live trading.

Accelerating your Forex learning process requires a combination of structured education, practical experience, and access to expert insights.

By engaging with trading communities, learning from mentors, utilizing demo accounts, and rigorously back-testing strategies, you can shorten the learning curve and build the skills needed to succeed in the dynamic Forex market.

With discipline and focus, you can turn a steep learning journey into a more efficient and rewarding experience.

Common Mistakes to Avoid When Trading Forex

Forex trading offers immense potential, but it’s also fraught with pitfalls that can derail aspiring traders. Avoiding these common mistakes is essential for building a sustainable and successful trading career.

1. Unrealistic Expectations and Lack of Research

One of the most widespread mistakes among new traders is entering the Forex market with unrealistic expectations. Many fall for the promises of overnight wealth and instant success propagated by fake gurus selling the dream online.

These self-proclaimed experts often advertise courses or signal services claiming to guarantee profits, only to leave traders disappointed and financially drained.

To succeed, traders must understand that Forex trading is not a get-rich-quick scheme. It requires thorough research, continuous learning, and consistent effort to navigate the complexities of the market.

2. Emotional Trading and Ignoring a Trading Plan

Emotions are a trader’s worst enemy. Fear, greed, and overconfidence often lead to impulsive decisions, such as over-leveraging or doubling down on losing trades. Trading without a well-defined plan amplifies the risk of making costly mistakes.

A solid trading plan serves as a roadmap, outlining entry and exit points, risk parameters, and profit targets. Sticking to this plan, even during volatile market conditions, is critical for maintaining discipline and avoiding emotional trading.

3. Ignoring Risk Management and Technical Analysis

Neglecting risk management is one of the primary reasons traders fail. Placing trades without stop-loss orders, risking excessive capital, or ignoring position sizing exposes accounts to catastrophic losses. Similarly, dismissing technical analysis can lead to poorly timed trades and missed opportunities.

Risk management tools, like stop-loss and take-profit orders, combined with a strong understanding of technical analysis, are essential for protecting capital and making informed decisions.

4. Lack of Patience and Persistence

Many traders give up too soon, frustrated by early losses or slow progress. Patience and persistence are vital traits for success in Forex trading. The learning curve is steep, and setbacks are part of the journey.

Viewing losses as learning experiences and staying committed to improvement is key to long-term profitability.

To succeed in Forex trading, steer clear of fake promises, stay disciplined, and focus on mastering the fundamentals. By avoiding common mistakes and adopting a patient, persistent approach, you can build a solid foundation for trading in the world’s most dynamic financial market.

Final thoughts

Forex trading is a dynamic and complex market that offers immense opportunities for those willing to invest the time and effort to learn its intricacies.

As we’ve explored, achieving success in Forex trading begins with understanding the Forex market’s decentralized nature, the role of currency pairs, and the key drivers that influence price movements, such as central bank policies and geopolitical events.

Assessing your readiness for this journey is the first step, requiring an honest evaluation of your motivation, time commitment, and financial resources.

Focusing on key learning areas is essential for building a strong foundation. Mastering technical analysis, exploring various trading strategies, and developing effective risk management techniques form the pillars of a successful trading career.

These skills help traders make informed decisions, identify opportunities, and protect their capital from unnecessary losses.

However, knowledge alone is not enough. Success in Forex trading demands a commitment to continuous learning. The market is ever-evolving, influenced by economic shifts, political changes, and technological advancements.

Aspiring traders must stay updated, refine their strategies, and adapt to new conditions. Avoiding common mistakes, such as unrealistic expectations, emotional trading, and neglecting risk management, is critical for maintaining discipline and building consistent profitability.

The journey to becoming a successful Forex trader is not an easy one. The learning curve is steep, and losses are inevitable, especially in the early stages. However, with persistence, patience, and a structured approach, aspiring traders can overcome challenges and progress toward their goals.

By setting realistic expectations, focusing on gradual improvement, and leveraging the support of trading communities and mentors, success becomes an achievable reality.

Forex trading is a marathon, not a sprint. While the road may be long and filled with obstacles, those who approach it with dedication and a willingness to learn will find that the rewards are worth the effort.

With the right mindset and preparation, you can turn the complexities of the Forex market into opportunities for growth and financial success.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: