We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

Master the Market: Your Guide to ICT Order Blocks for Forex Trading

Navigating the forex market requires insight into the moves of institutional traders. One essential tool to consider is the ICT order block, where the action unfolds, signaling significant buy or sell areas that could pivot market direction. This article cuts to the chase on detecting and utilizing these crucial zones, such as the ICT order block, to potentially fortify your trading plan without drowning you in jargon or unrealistic promises.

Key Takeaways

- ICT Order Blocks are supply and demand zones institutional traders use to discretely enter prominent positions, often leading to price reversals in forex markets.

- Incorporating order blocks into trading strategies involves identifying these zones on charts, using them for guided entries and exits, and implementing risk management through proper position sizing and stop-loss orders.

- Advanced techniques include understanding the role of liquidity, combining order blocks with other trading tools for optimized strategies, and learning from case studies to improve trade success.

Unveiling ICT Order Blocks

Imagine possessing an instrument that uncloaks the covert forces shaping market movements. This is precisely the role of ICT order blocks in forex trading.

These specialized supply and demand zones are highly influential for catalyzing price reversals, with their significance tied to their adoption by large financial institutions for orchestrating orders, a practice that ensures their ongoing pertinence within trading activities.

Order blocks differ from conventional supply and demand zones, typically from a base formed over two or three candles. In contrast, order blocks arise out of narrow-range consolidations. Hence, they appear less frequently.

Their effectiveness as a tool is directly connected to strategies employed by key players in the market. This association indicates that they will persistently impact how prices are shaped within these arenas.

The Foundation of Order Blocks

Order blocks can be considered the secluded strategy spaces for institutional traders. These are designated areas within the price scale where substantial buy or sell orders have been positioned, signaling regions of intense market transactions. Institutions leverage these zones to achieve several objectives.

- Inconspicuously initiate sizable positions.

- Fragment their large orders into tinier parcels that align with existing liquidity and aim for an improved mean entry price.

- Shield their significant impending orders from other traders who might exploit such information.

- Set sizeable trades without triggering adverse fluctuations in price.

Essentially, it’s a form of defense mechanism employed by institutions.

Varieties of Order Blocks

Consider order blocks as conference spaces where differing market perspectives converge.

Bullish order blocks can be pinpointed to a region characterized by an accumulation of substantial institutional buy orders, suggesting an upward price trajectory might ensue after a phase of descending activity.

Conversely, bearish order blocks are areas densely populated with sell orders from significant players in the market that often signal impending downward movements following a period of rising prices.

This dynamic resembles a choreographed routine between bullish and bearish forces, each punctuated by bouts of consolidation preceding shifts in price advantageous to their respective positions.

Recognizing Order Blocks on Charts

Understanding the concept of order blocks, as well as their different kinds, is essential for traders. To spot these on a chart, look for distinct patterns that emerge after a significant trend in the market.

Key reversal patterns indicating an order block include formations like head and shoulders and specific candlestick configurations such as pin bars. A particularly telling sign is an Engulfing pattern where one candle completely surpasses another—this can highlight the area of a potential order block.

When prices return to this zone of an identified order block range and show confirming signals like a pin bar or Engulfing patterns, it often marks a credible point at which traders might consider entering trades aligned with the direction of what appears to be an emerging new trend.

Integrating Order Blocks into Your Trading Strategy

Imagine possessing a secretive instrument within your trading toolkit that hints at upcoming actions by significant players in the market, like banks. That is precisely the role of forex order blocks.

They are designed to aid traders by providing insights for timed entrances and exits into trades. As with any trade implement, its effectiveness hinges not on the tool itself but on the skill with which it’s employed.

Integrating forex order blocks into your strategies can be incredibly valuable when analyzing market movements. They should not be used as the sole determinant for making trading decisions.

Traders can place strategic pending orders aligned with newly forming trends—secured by stop losses near recent extreme price points—by taking cues from order blocks.

When embedding order blocks in their broader strategies, traders should also weigh long-term market direction because these blocks often arise at pivotal moments when trends reach peaks or troughs and when fresh pricing trajectories commence.

When to Enter Trades Based on Order Blocks

In the realm of order blocks, timing plays a crucial role. Traders should initiate trades when the price breaks out and then reverts into the range of an order block, which may suggest that a new trend is emerging after a phase of consolidation.

To confirm the robustness of an order block, it’s important to observe whether the price returns inside its range and advances at least halfway through without recording a lower low. This serves as a strong signal for entry.

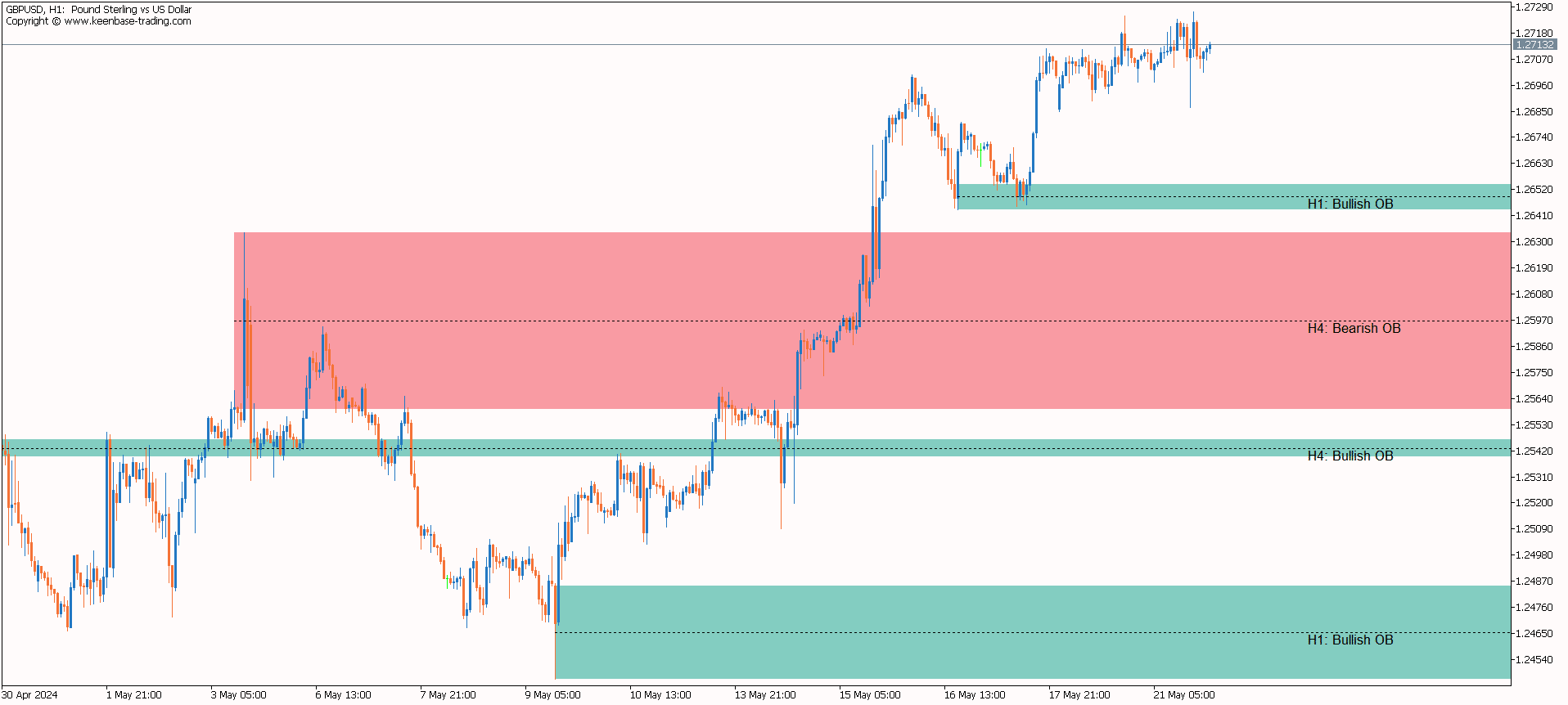

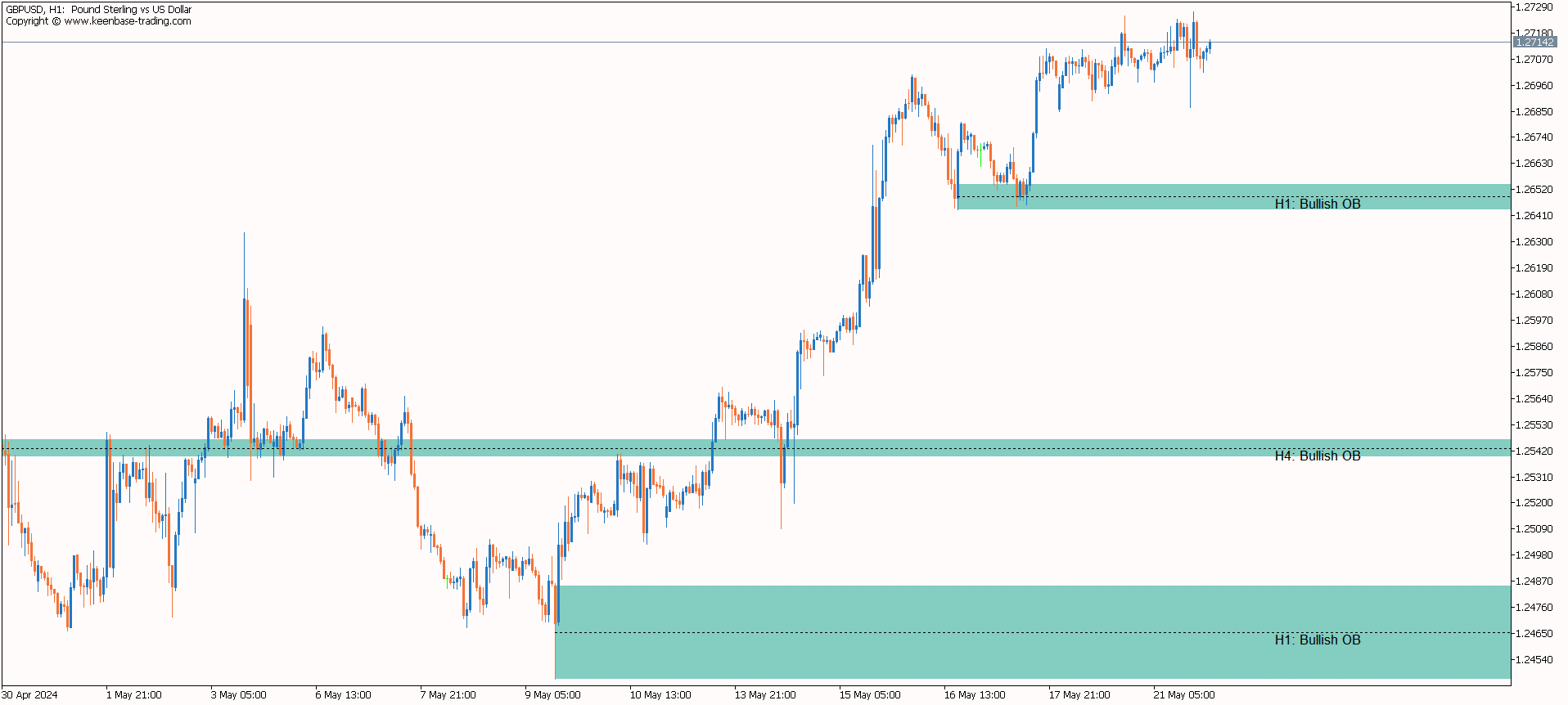

Identifying high-probability entries becomes more reliable on higher timeframes like 1H or 4H because these represent tremendous respect and significance in market movements.

For those trading concerning an order block, setting up stop losses just beneath or above it, depending on whether you are taking bullish or bearish positions, can be vital in managing risk adeptly.

Managing Risk with Order Blocks

In the context of trading with order block strategies, it is imperative to prioritize risk management. This involves critical practices such as establishing stop-loss orders, determining appropriate sizes for positions, and setting levels at which to take profits.

When participating in trades involving order blocks, traders are often counseled to limit their risk exposure to 1% and 3% of their total account balance per trade through meticulous position sizing.

Concerning bullish order blocks specifically, securing a safety net by placing stop losses below the low point of the block can safeguard against price declines.

Conversely, when dealing with bearish blocks, stops should be situated above the peak to defend against upward shifts in price.

Adjustments made to one’s position size, considering the personal appetite for risk and prevailing conditions in the market, should also reflect an individual trader’s overarching strategy for managing risks and achieving trading goals.

To Protect investments while enabling potential profit gains within forex trading using these methods: employing trailing stops allows traders to lock in earnings and curtail possible financial setbacks, thus aligning well with conventional wisdom on swiftly limiting losses while permitting successful positions ample room to grow exponentially.

When applied effectively, the fusion of such advanced techniques provides a significant means through which traders may secure their accounts while harnessing benefits inherent in utilizing order blocks during forex market transactions.

Measuring the Effectiveness of Order Block Strategies

Tracking their performance is indispensable to fully utilizing order block strategies. Assessing the effectiveness of order block strategies requires tracking the performance of trades entered at order blocks thought to have a high likelihood of success.

A key performance indicator for order block strategies is the win/loss ratio, which precisely measures the number of successful trades compared to unsuccessful ones.

By analyzing the risk-to-reward ratio of previous order block trades, traders can gain insights into the potential long-term profitability of their strategy and make informed decisions for future results.

The effectiveness of an order block strategy can be validated by observing its past performance in various real market scenarios represented on actual price charts.

Advanced Techniques: Trading Order Blocks Like a Pro

Ready to take your order block trading to the next level? Delve into sophisticated techniques, including the concepts of breaker and mitigation blocks. An order block indicates a pivotal point where market control transitions between buyers and sellers, constituting critical battlegrounds for bullish and bearish forces.

Breaker blocks are formed following an intense price movement and subsequent initial pullback—key zones wherein the prevailing trend might either resume or pivot.

Mitigation blocks refer to those regions where the price has experienced a pause after retracing, presenting traders with an alternative chance to engage as the market re-evaluates the primary order block’s relevance.

For enhanced entry precision—and thus elevating potential trade success—traders must observe confirmatory signals within these identified order block areas based on keenly watching price action developments.

The Role of Liquidity and Order Block Zones

The lifeblood of the market’s functionality can be likened to liquidity, which is essential for its efficient operation.

Banks tactically utilize order blocks as ‘iceberg orders,’ which enables them to discretely enter trading positions while managing their influence on the prevailing market price and preserving adequate liquidity sweeps.

These order blocks are often associated with an increased chance of sparking reversals in the market, as prices tend to revisit these zones. Such regions are significant for institutions when they initiate trades and offer individual traders insight into potential trading opportunities.

Fair value gap (FVG) with order blocks create areas that signify a high probability that prices might return—offering compelling entry points for those looking to trade.

For the effective functioning of these order blocks within markets, sufficient liquidity is imperative since it ensures large orders can be fulfilled without prompting substantial fluctuations in price. Here, hefty trading volumes provide necessary counter-orders, helping mitigate any significant impact caused by such transactions.

Combining Order Blocks with Other Trading Tools

Are you seeking to enhance your trading techniques? Consider combining order blocks with additional trading tools and indicators. These instruments might help spot potential order blocks.

- The Accumulation/Distribution indicator reveals possible zones for order blocks by depicting how changes in price correlate with trading volumes.

- Confirm the existence of an order block using auxiliary indicators like RSI, MACD, or Stochastic Oscillator.

- Customized aids such as the KT MTF Order Block Indicator, Order Block Breaker Indicator, and Order Block Edge are specifically designed to assist traders in pinpointing probable order block locations by utilizing candlestick volumes to identify points where trends may reverse.

Link up chart patterns alongside pairs of order blocks, including fair value gaps, Supertrend indicator, XMaster formula indicator, and supply and demand markers, which can help establish entry and exit strategies.

They also play a role in detecting early signs of trend shifts, thereby boosting one’s overall trade strategy proficiency.

Adding other tradecraft instruments like Fibonacci retracement or volume profile into the mix with order blocks makes it feasible to solidify trade confirmations, thus lessening the entire practice experience for individuals engaged in trading activities.

Case Studies: Successful Order Block Trades

Is there a better way to grasp concepts than by examining real-world examples? Consider the efficacy of various trades executed through the use of order blocks. To spot an order block, one can search for reversal patterns within trends in price actions—specifically, the Engulfing pattern serves as an indicator.

Confirmation indicators such as pin bars or engulfing patterns strengthen the credibility of these potential trade setups. Upon observing these confirmation signals, a trader might proceed with executing their trade at a point that offers high probability—a gift from identifying an accurate order block.

The ability to consistently achieve profits regardless of changing market conditions demonstrates the strength and reliability inherent in a trading strategy based on order blocks.

ICT Order Blocks in Various Market Conditions

The market is ever-evolving, like the sea that shifts with each wave. Like an experienced mariner, a skilled trader must navigate these changing tides adeptly.

Order blocks typically offer excellent reliability in trends, as opposed to flat or consolidation phases of the market. Thus, traders should tailor their strategies based on the market's prevailing state.

Traders must align their order block strategies with the existing conditions in the marketplace because when markets consolidate, these techniques might not perform optimally and could lead one astray if they operate under the assumption that past ICT order blocks will reliably forecast future price directions.

When a bullish or bearish trend reaches its conclusion, ICT order blocks frequently suggest an impending shift in price direction and serve as valuable indicators for predicting reversals in trends.

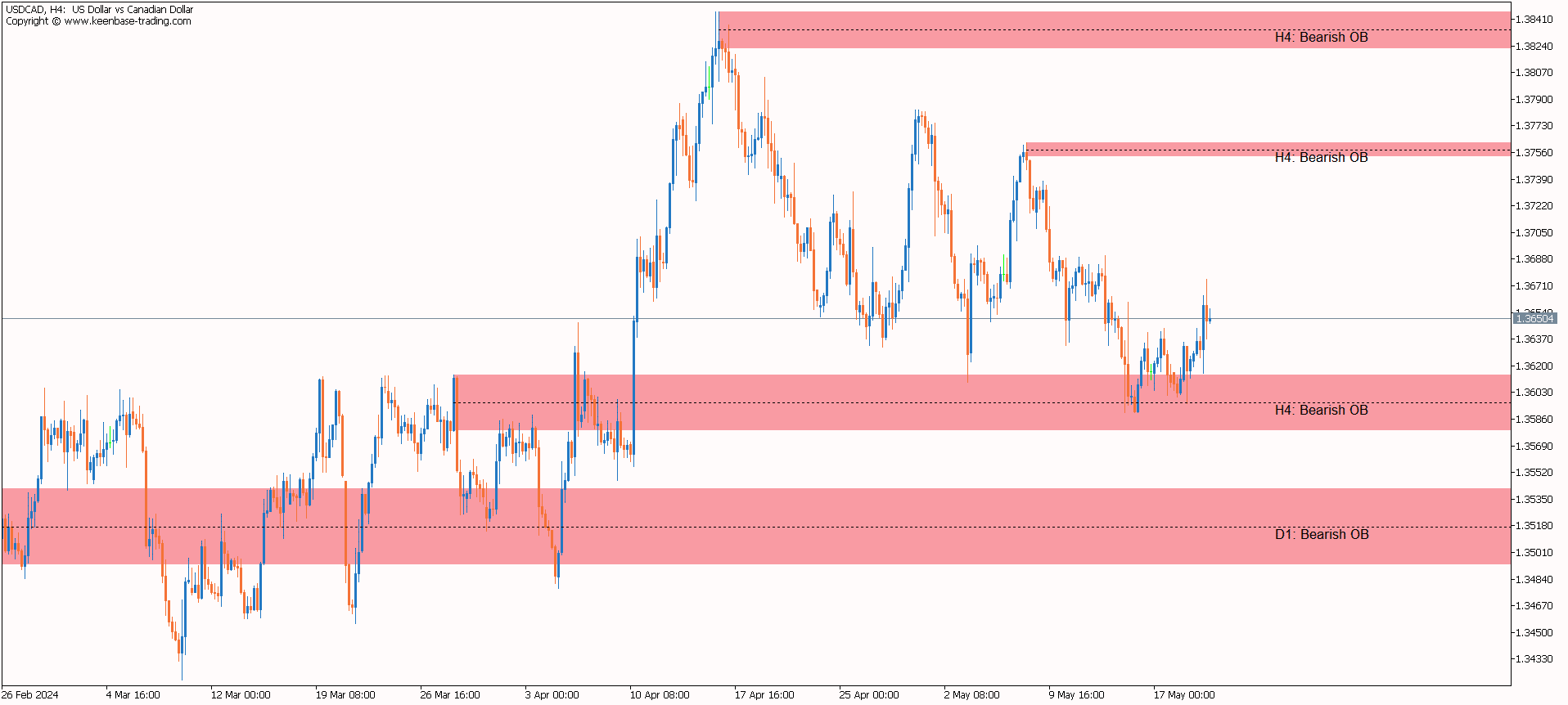

Bull Markets and Bearish Order Blocks

During times when bulls dominate the market, driving prices ever upward, there comes a moment where signs of bearish sentiment can emerge. Recognizing these signals as bearish order blocks amidst a bullish trend is crucial for traders. It allows them to capitalize on potential downturns by predicting decreases in prices.

These bearish order blocks typically appear within an uptrend as substantial sell orders from institutional sellers encounter existing buyer liquidity. This collision can prompt a reversal since the union of sell orders could overwhelm and consume buyers’ liquidity.

In bull markets, resistance levels often witness the formation of such blocks when sizable quantities of sell transactions are initiated by institutional traders, thereby utilizing all available market liquidity.

For those trading these markets, spotting bearish order blocks is essential for identifying prime moments to initiate short trades or exit long positions effectively before an anticipated decline takes hold within the market landscape.

Bear Markets and Bullish Order Blocks

When the market is dominated by bearish sentiment, prices tend to decline continuously as sellers maintain control. When bullish momentum emerges, it manifests through bullish order blocks - these signify where institutional buyers perceive that an asset’s value is too low and begin accumulating positions in anticipation of a potential upward movement in price.

These zones are often revealed by bullish, engulfing candlestick formation, which signals traders about the possibility of an impending trend reversal.

Within the trading sphere, particularly among those associated with the inner circle trader community, there’s reliance on these bullish order blocks for pinpointing optimal entry points for initiating long trades.

They also serve to recognize levels of support capable of disrupting or potentially reversing downward trends into ascending ones.

Sideways Markets and Order Block Consolidation

In markets where the price movement is predominantly lateral due to a balance between bullish and bearish forces, order blocks appear as consolidation ranges, marked by an equitable distribution of institutional orders.

These consolidations within the sideways market often precede potential breakouts, indicating that there might be an impending shift in trend direction and thus presenting chances for traders to position themselves strategically for entry following the direction of such breakouts.

Grasping how order block consolidation takes shape during these periods of horizontal trading can greatly aid traders in mapping out their trades.

These consolidated regions often act as significant levels that not only forecast possible directional shifts – or breakouts – but also predict rebounds within the confines of the existing market structure.

Practical Steps to Identify Order Blocks

Delving into the practice of trading, one must seek periods where prices consolidate within narrow bands that show minimal variation between highs and lows to pinpoint order blocks on a chart.

This indicates large players, like banks, might be placing block orders. An authentic order block becomes apparent when there’s a sudden and decisive price movement away from this tight consolidation zone—suggesting it’s an area where banks have been actively setting up their positions.

To accurately mark these zones on a trading chart, traders must ensure they include all parts of the consolidation in question, as this represents the potential extent of bank-level block trades.

Analyzing solely through a single timeframe lens can yield deceptive clues leading to suboptimal trade entries or exits. Hence, meticulously examining multiple time frames is crucial for confirming accurate signals from order blocks.

Chart Setup for Order Block Identification

A neatly arranged chart can be compared to a meticulously set table, enhancing the enjoyment of what’s before you.

On timeframes such as H1 or H4, order blocks stand out more prominently because smaller order blocks from lower timeframes are consolidated into more giant candlesticks that are less in number.

An order block on a chart is indicated by drawing a rectangular shape starting at the high and low points of the preceding candlestick before an engulfing pattern occurs. This rectangle extends rightward to showcase the boundary of the order block.

Zooming out on your chart improves visibility for identifying necessary support and resistance zones linked with these order blocks, making it easier to pinpoint their ranges. By doing so, critical levels connected to these structures become more apparent against other elements within the chart landscape.

Drawing and Confirming Order Blocks

Order blocks are akin to discovering hidden gems on a trading chart. To mark out a bullish order block, pinpoint the last low of a preceding bullish candle before an impressive price surge and create a rectangular extension from this point up to the latest peak.

Conversely, when mapping out a bearish order block, highlight the highest point of the final bearish candle before noting an extensive downtrend and extend your rectangle down to the recent swing bottom.

The potency of an order block is gauged by how quickly the price departs from it. Swift movements indicate that you’ve identified an order block with a higher probability.

When verifying whether you have found such treasure as an authentic order block, watch for prices re-engaging with your highlighted zone and subsequently thrusting forth in alignment with new market momentum.

These blocks act as critical support or resistance zones, aiding traders in making educated decisions regarding where to place their stop losses or at what junctures they could consider entering into trades.

Practice Makes Perfect: Simulating Order Block Trades

Practicing a strategy is the most effective way to comprehend it. Traders are advised to use demo accounts to practice order block trades, thereby developing their skills without financial risk.

Simulating order block trades entails spotting trends, detecting potential order blocks, and making simulated trades as the price exits the order block’s identified range.

Simulating trades with order blocks enhances traders’ understanding of these zones and the ability to identify high-probability setups. Visualizing potential trade entry points involves sketching a mental rectangle from the top to the bottom of the order block and extending this laterally.

Identifying tight-range consolidations and waiting for pin bars or engulfing patterns can be confirmation signals before simulating trades.

Practitioners gain substantial benefits from practicing with different timeframes and under various market conditions, enhancing their skill in distinguishing genuine order block patterns from deceptive price movements.

Common Pitfalls and How to Avoid Them

In trading, utilizing order block strategies comes with inherent challenges. Rest assured that we’re here to support you. Implementing robust risk management is essential while applying order block strategies to avoid decisions driven by emotion and maintain a commitment to a uniform trading strategy.

Misinterpreting Price Action and Order Blocks

Traders often fall into the trap of misreading order blocks and price action. There are widespread false beliefs that order blocks inevitably lead to a price reversal or that any movement past an order block is meaningful, highlighting the importance for traders to look for confirmation cues.

Overreliance on Order Blocks

Relying excessively on order blocks as a market strategy is another frequent error. Traders may neglect thorough analysis of the broader market by focusing too much on these blocks, which aren’t always reliable indicators of forthcoming price trends.

This overdependence can result in traders executing trades without adequate verification, thus amplifying their exposure to the risk of engaging in unprofitable transactions.

Ignoring Market News and Events

Neglecting the impact of market news and events is an oversight that could lead to substantial financial consequences. It’s essential for traders using order block strategies to pay attention to these factors, as they profoundly affect market behavior.

Events in the economic realm can either strengthen or weaken order block signals by introducing increased volatility, requiring traders to adapt their approaches actively.

Failure to consider changes in market conditions prompted by news events may result in misjudging the correct levels for order blocks, potentially leading to trading errors.

Keeping abreast of when and what type of news is released helps traders predict market shifts and modify their order block strategies accordingly to avoid unfavorable price movements.

Summary

Navigating the forex market can be intimidating, yet with an understanding of ICT order blocks, you’re prepared to conquer trading. Remember that ICT order blocks signify a transition of market control from buyers to sellers or the reverse, acting as conflict zones for bulls and bears.

These zones are beneficial for traders in determining strategic points for entering and exiting trades. Like any tool, its value hinges on your application of it.

Enhance your proficiency with order block trading by practicing on demo accounts and simulated trades while ensuring you integrate through market analysis and risk management within your strategy.

Frequently Asked Questions

What is order block by ICT?

Within the realm of price action, there are distinct regions known as order blocks where substantial buy or sell orders have historically been positioned by major market players such as institutional traders, hedge funds, and banks.

These zones are thought to exert a considerable influence on the subsequent direction of market prices.

What is an ICT breaker block?

According to the Inner Circle Trader (ICT), an ICT breaker block refers to a failed order block that causes a substantial change in market liquidity, altering the market structure from bullish to bearish or vice versa.

What is ICT order flow?

ICT order flow serves as a comprehensive indicator that assists in examining the flow of orders and forecasting upcoming price movements, adhering to the principles set forth by ICT.

What are ICT order blocks, and how do they influence the market?

In forex trading, ICT order blocks represent crucial zones of supply and demand that can exert a potent influence on price reversals. These areas are expected to continue impacting trading significantly due to their persistent use by major financial institutions for placing orders.

How are bullish and bearish order blocks different?

Bullish order blocks are signs of an upcoming uptrend following a decline, whereas bearish order blocks suggest a possible downtrend succeeding a price increase.

These indicators provide traders with insights into market sentiment and the likelihood of future movements in price.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: