We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

Position Sizing in Forex - The Definitive Guide

Position sizing in Forex means allocating a lot size or trade volume to one or several active trade positions in a way that does not subject the account to risk of ruin from a sequence of losses.

Position sizing is all about risk management. Forex trading in itself is a risky but potentially profitable investment vehicle.

The use of position sizes that are inappropriate to the setup increases the risk levels and can jeopardize a Forex account in times of adversity.

The skill of position sizing in Forex can make all the difference between living to trade another day or an account blowout.

No position size fits all situations. Position sizing in Forex is individualized and must suit the trader’s unique circumstances. Several factors must be considered in calculating position sizes. These are as follows:

- Account capital or equity.

- The percentage exposure i.e. the %age of your account equity to be risked in all active trades.

- Stop-loss.

- Currency pair being traded.

Here is how each factor influences position sizing in Forex.

Account Equity

How much money you have in your account as your trading balance has a direct bearing on how much you can use to setup your trades.

Look at it this way. If you have some money on your person and you are going to engage in a road journey of 12 hours, how much money would you carry on your person relative to your anticipated expenses?

You would need money for fuel, feeding, and also keep some for contingency expenses.

If you carry just enough to fill your tank and get a meal without taking extra for contingencies, what would you do if you ran into some trouble along the way (such as a car breakdown)?

The same scenario every trader will encounter at some point in the world of trading. Sadly, many traders are unprepared for this, and so do not consider the role that adequate financing of a trading account plays in position sizing.

Correct position sizing in Forex starts with having an adequately capitalized account.

You need to the minimum trade size your brokerage offers and then check for yourself if your proposed account capital can trade within the provided sizes with some room to spare for contingency trades, scaling in and out of positions, etc..

If your broker only allows mini-lot trade sizes, but allows you to deposit a minimum of $200 as starting capital, you are being setup to lose money.

One mini-lot requires $10,000 volume, and even if your broker still allows a leverage of 1:200 (no longer possible in UK and the EU), you will need at least $50 to setup the least trade size.

At 25% of your account size, you are already overexposed and over-leveraged. It will only take four losing trades to take your account down.

But if you had an account size of $2,000, then $50 for a mini-lot trade using a leverage of 1:200 will take just 2.5% of your account. You would then need to lose at least 40 trades in a straight sequence to have your account blown.

Therefore, you can see that the first step to correct position sizing in the Forex is to have a well-capitalized account.

However, this is not all that there is to it because if you do not pay attention to the next point, even a large account size will not help you.

Percentage Exposure

The capital is used in all active positions in the market, expressed as a percentage, is known as percentage exposure.

It is a generally agreed principle in Forex market that no more than 1-3% of your total account equity should be committed to ALL positions in the market.

Some traders make the mistake of allocating 3% to a single trade, and then sling on close to 5 trades at once.

This doesn't seem right. If you sling on five positions at once, the total capital devoted to all of them combined should not exceed 3% of your account size.

Using our previous example, we already saw that using $50 out of a $200 account flouts this rule, but the second example does not.

However, if the trader with the $2000 account suddenly gets greedy and decides to trade a Standard Lot, this would instantly breach the risk exposure rules.

You can easily calculate this. Assuming I have a $5000 account and you want to trade 0.5 lots, how can you calculate your risk exposure and adjust it to match proper position sizing rules?

A lot size of 0.5 is equivalent to $50,000 in trade volume.

Using the leverage of 1:30 on an EU broker, you would require $1666 as a margin for any trades. This would exceed the exposure rule. So you properly resize the position to match the 3% rule by reducing your lot size.

Using 0.1 lots would reduce the margin required to $333; still too large as 3% of the account capital is $150. Resizing to 0.04 lots (4 micro-lots) would reduce the margin requirement to $133, which is within the risk exposure limits.

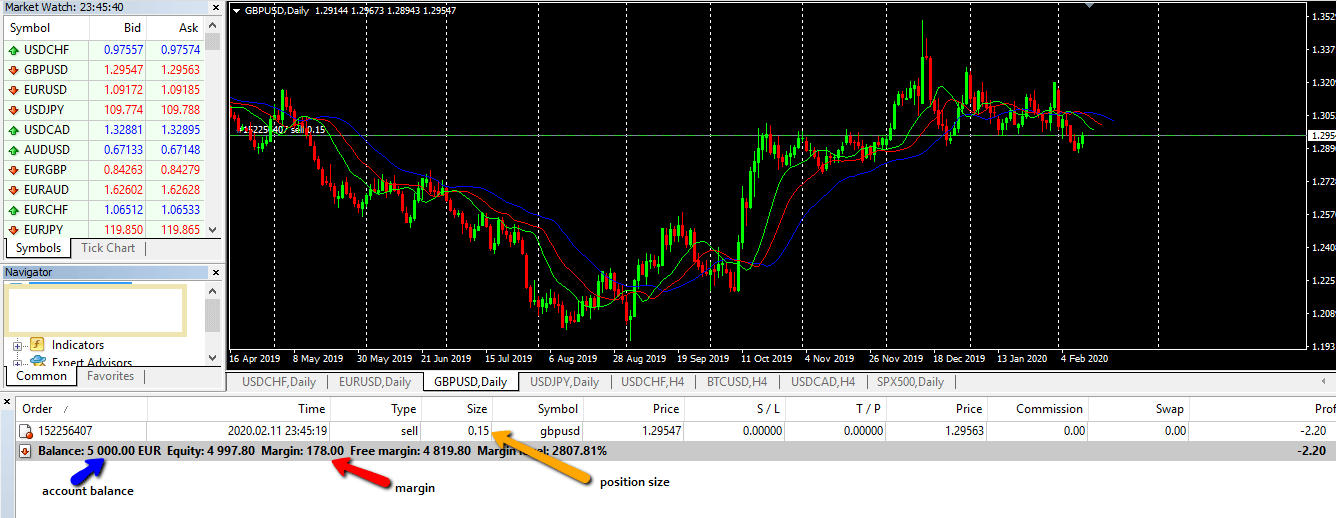

Snapshot showing account balance, margin and position size

While the account capital can be increased to accommodate larger position sizes, the percentage exposure factor should be kept static or even dropped below 3% to reduce risk.

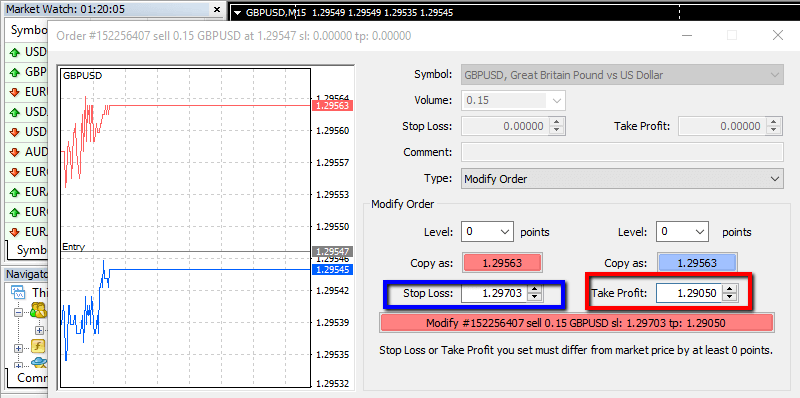

Role of Stoploss in Position Sizing

The stop loss is used to protect a trader’s capital from a trade position that has moved adversely, leading to a loss. The question is: what does the setting of a stop loss have to do with position sizing?

Many traders have no idea that there are rules behind the setting of a stop loss, and it is not to be set arbitrarily.

The stop loss is also considered as a risk to trade because if it is activated, the trade will lose the monetary value of the number of pips used in setting a stop loss.

For instance, a 50-pip stop loss on a Standard Lot is equivalent to $500.

If a trader chooses a particular lot size and sets a stop loss, a good question to ask is if the account can handle such a loss if indeed the trade moves against the trader and triggers the stop loss.

The key is to ensure that stop loss is as tight as is allowable, not too close as to choke a trade, and not too lose as to give away too many pips to the market in setting the protection level.

Therefore, stop loss in trades should not be too large. Instead, set them as close to the key levels as possible. A good stop loss should be not too far below support and not too far below a resistance level.

Position Size can differ by Currency Pairs

Major currency pairs such as the EURUSD or GBPUSD typically have low spreads because they are very liquid and are the most traded currency pairs in Forex.

But when you hit the exotic pairs such as the USDNOK, GBPZAR, USDTRY, or USDRUB, it is a different ball game entirely.

These exotic pairs have a notable characteristic: they are illiquid and therefore have wider spreads.

Spreads on the USDTRY, for instance, have been known to be as high as 322 pips during intensely volatile trading periods. Moves of up to 800 pips in a matter of seconds have followed the interest rate decisions of the Turkish central bank.

A Forex account may obey the proper position sizing principles discussed earlier, but trading on pairs that are too volatile for your circumstances can negate everything.

If you are trading an exotic pair, please ensure that you make adequate allowance for spread costs and wild swings in your position sizing.

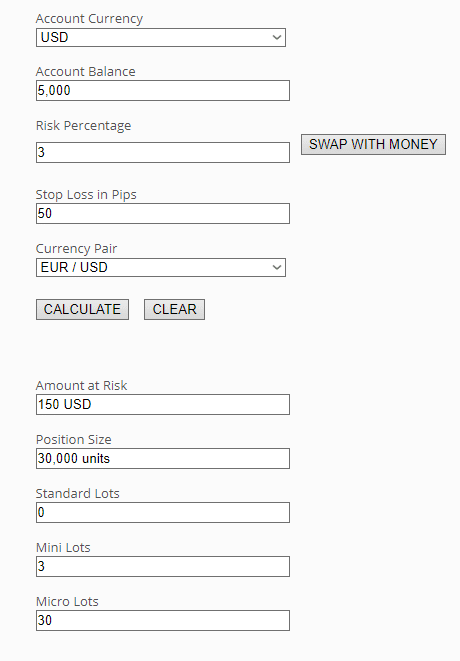

Position Size Calculator

Correct position sizing in forex can be achieved by using all the factors that have been examined above and compiling an automatic position size calculator.

That way, the trader does not need to calculate position sizes manually, with the attendant risk of making mistakes.

Here is an example of a position size calculator. The calculator uses a $5000 account balance, with an exposure of 3% and a 50-pip stop loss.

The calculator also factors the difference in the monetary value of each pip, which differs from one currency pair to another.

Once the figures are entered, click on CALCULATE and the position sizing parameters will be listed clearly.

For this example, a $5000 account for a trader who wants to set up a position on the EURUSD and is risking 50 pips as a stop-loss can only use $150 as a risk.

This equates to the use of 3 mini-lots of 0.3 lot size. In this instance, the leverage is 1:200 (i.e., 30,000 units of currency in trade size divided by the $150 to be risked in the trade).

Take Your Trading to Next Level

You Might Also Like: