Features

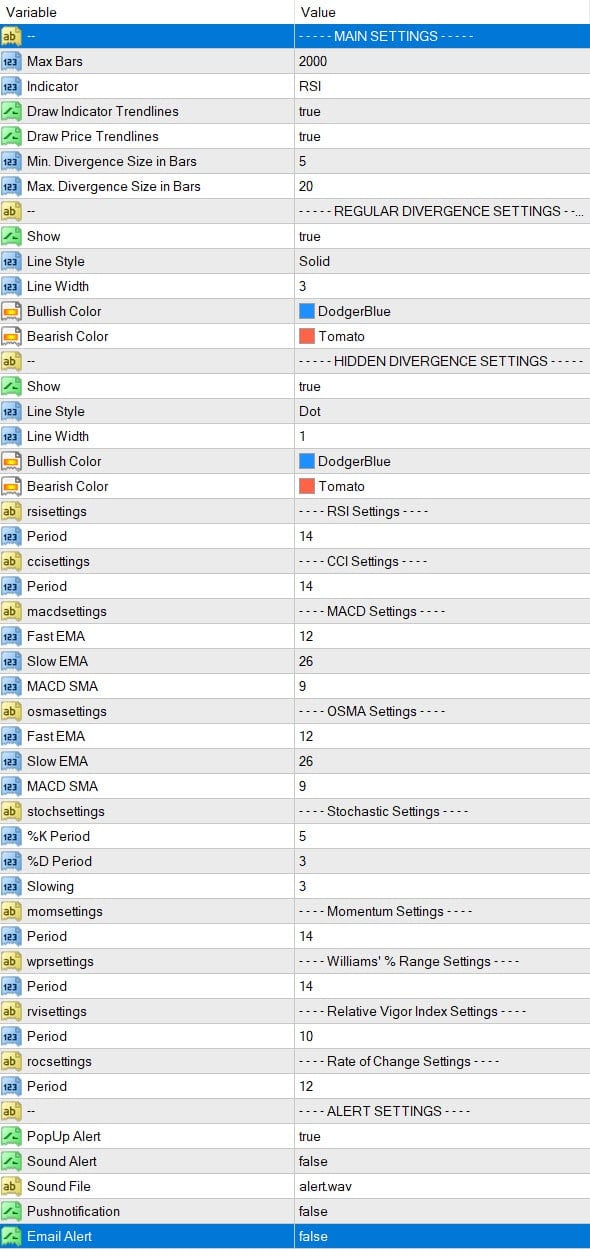

- No Interference: You can add the All in One divergence indicator on the chart using various oscillators multiple times without interfering with the divergences from different oscillators.

- Adjustable Parameters: You can customize everything directly from the input settings, from oscillator settings to colors.

- Regular/Hidden Divergences: This tool identifies both regular and hidden divergences between the price and oscillator.

- No Clutter: Unsymmetrical divergences are filtered out and discarded to ensure improved accuracy and reduce clutter.

- Real-Time Alerts: You can receive real-time trading alerts through various channels, including Pop Up, Email, Phone (push notifications), and Sound, as all Metatrader alert options are supported.

- Compatible with EAs: Importing this divergence indicator into an expert advisor is a seamless process, making it easy to integrate and utilize within your own automated strategy. The indicator output value can be easily accessed using the signal buffer.

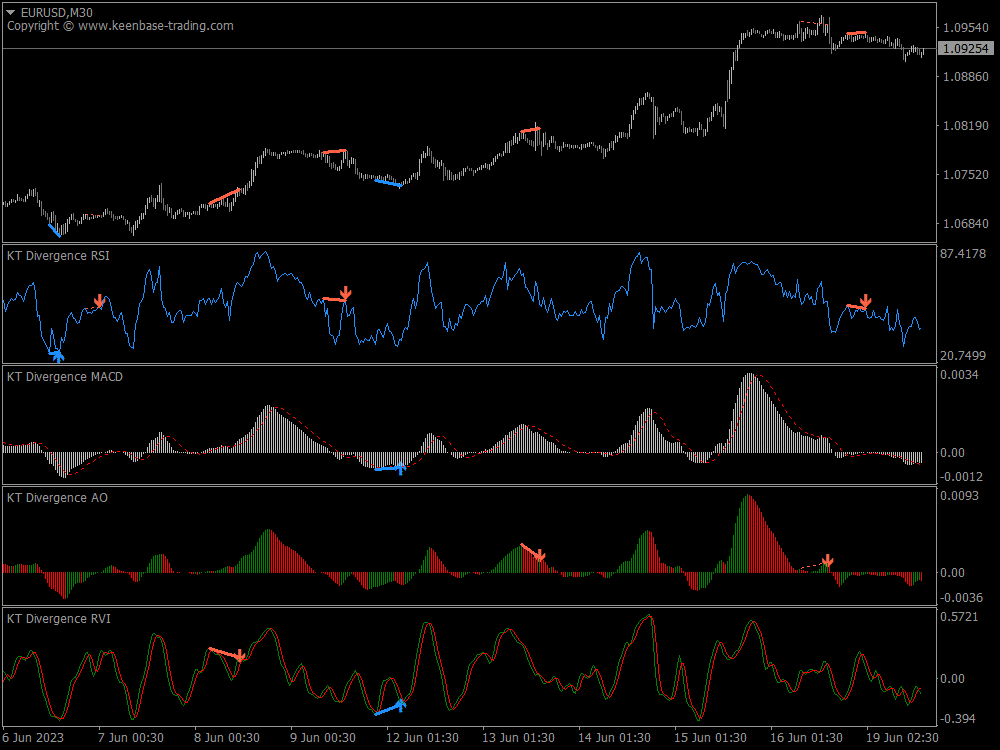

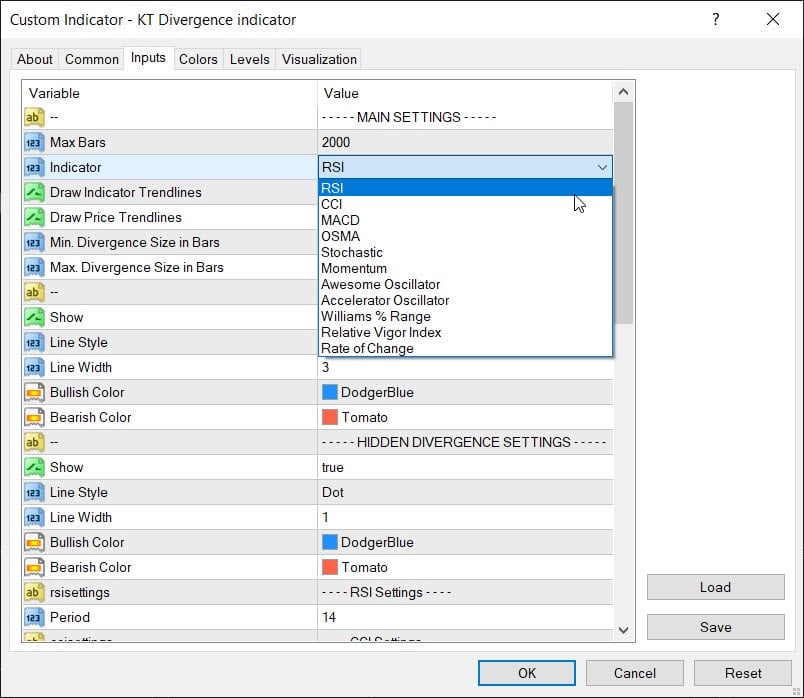

Included Oscillators in All in One Divergence Indicator

This All-in-One Divergence indicator for MT4/MT5 has a comprehensive set of 11 oscillators. Additionally, we continuously strive to meet user requests by adding more oscillators to enhance the indicator's functionality.

List of Included Oscillators

- RSI indicator

- CCI

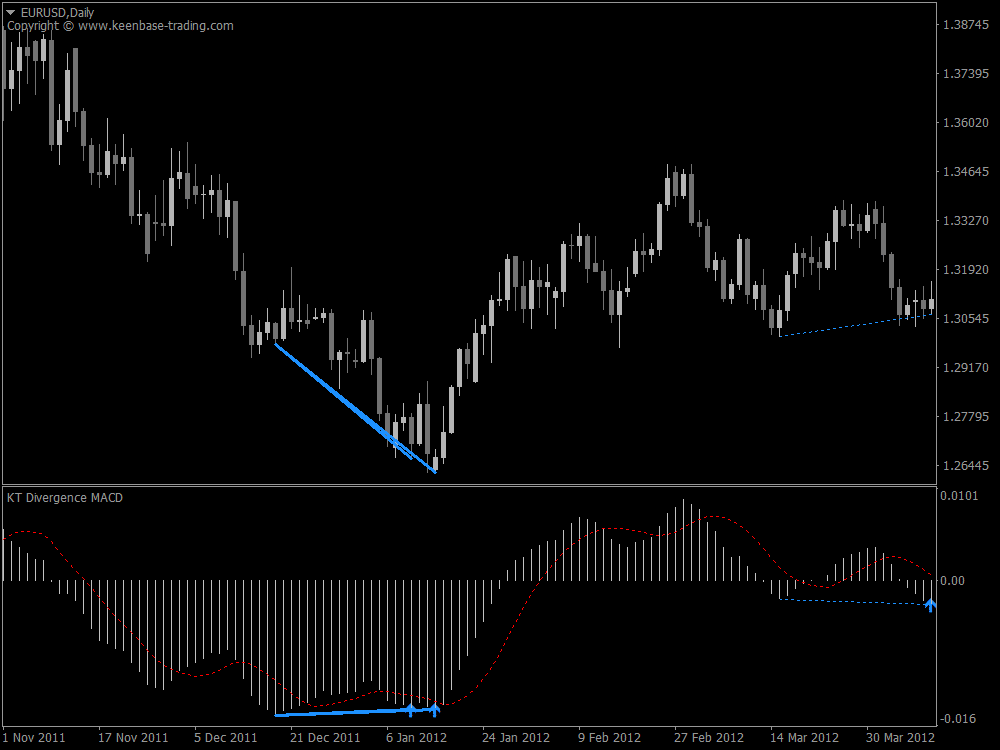

- MACD

- OSMA

- Stochastic

- Momentum

- Awesome Oscillator (AO)

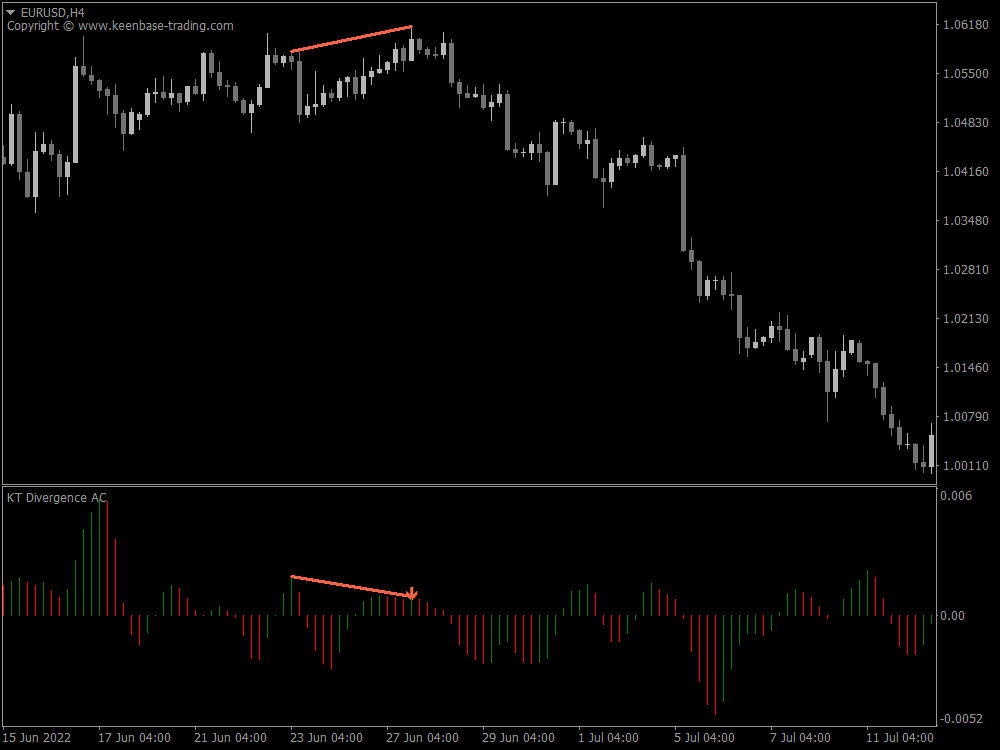

- Accelerator Oscillator (AC)

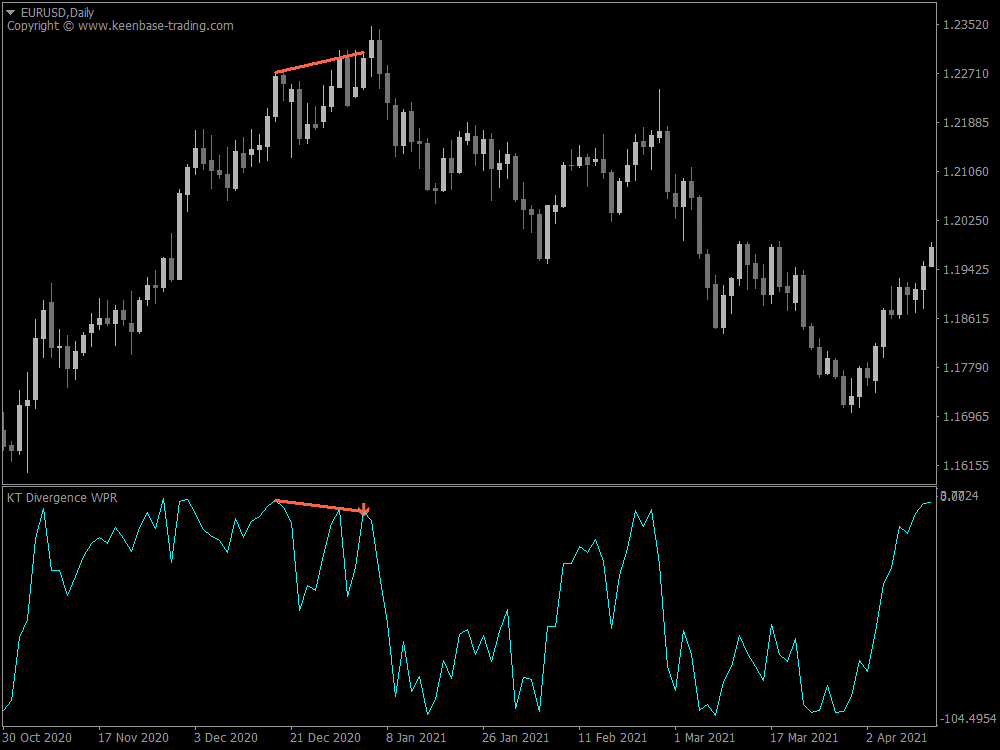

- Williams % Range

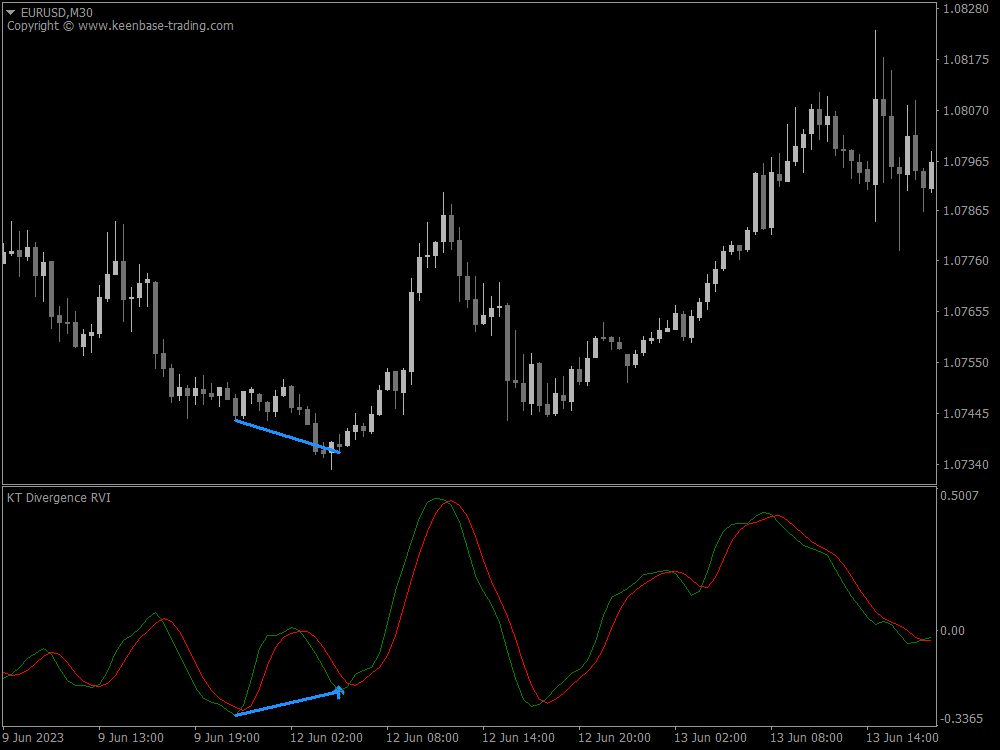

- Relative Vigor Index

- Rate of Change (ROC)

Inputs

Understanding the Divergence Trading

Divergence is useful for detecting potential trend reversals. It involves observing the price chart and an oscillator to identify discrepancies.

When the price moves in one direction, but the oscillator moves in the opposite direction, it signals a possible shift in momentum.

This can be seen when the price makes a new higher high while the oscillator fails to do the same.

This discrepancy suggests that momentum is weakening, indicating a potential upcoming reversal. By recognizing these divergences, traders can make informed decisions about possible trend changes in the market.

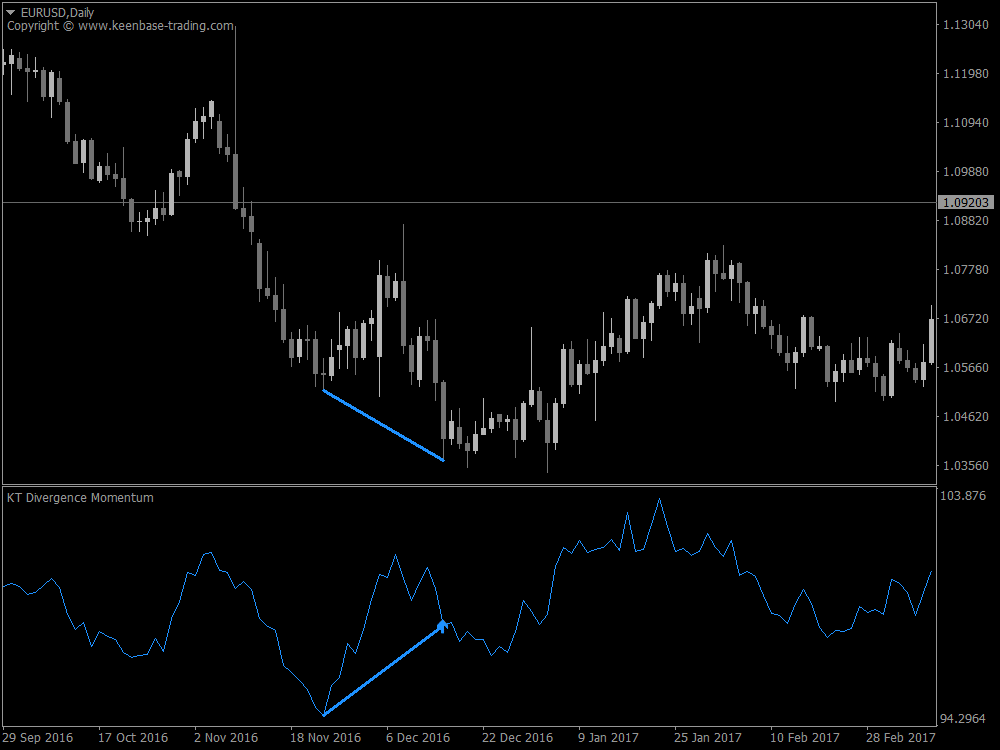

Bullish Divergence

A bullish divergence signal occurs when the price moves lower while the oscillator moves higher.

It shows a weakening of bearish momentum and suggests a potential reversal to the upside.

To confirm the setup, traders should wait for a close above the previous swing high or look for other confirmation signals, such as a break above a resistance level.

Once confirmed, entry orders can be placed just above the high of the reversal candle, with stops below the low of that candle.

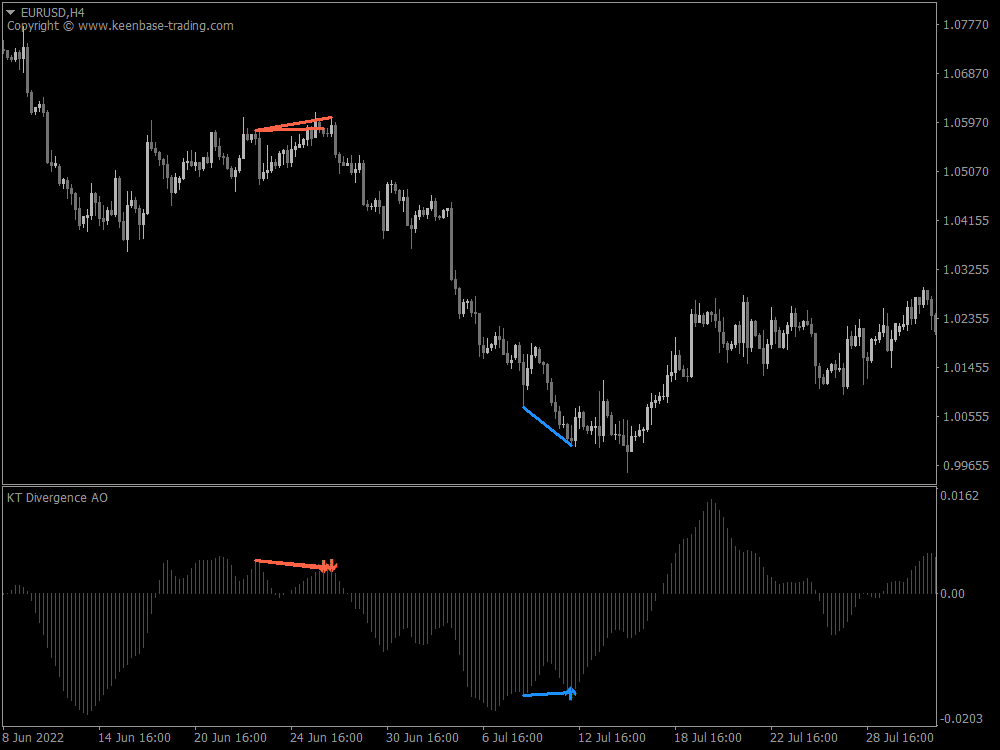

Bearish Divergence

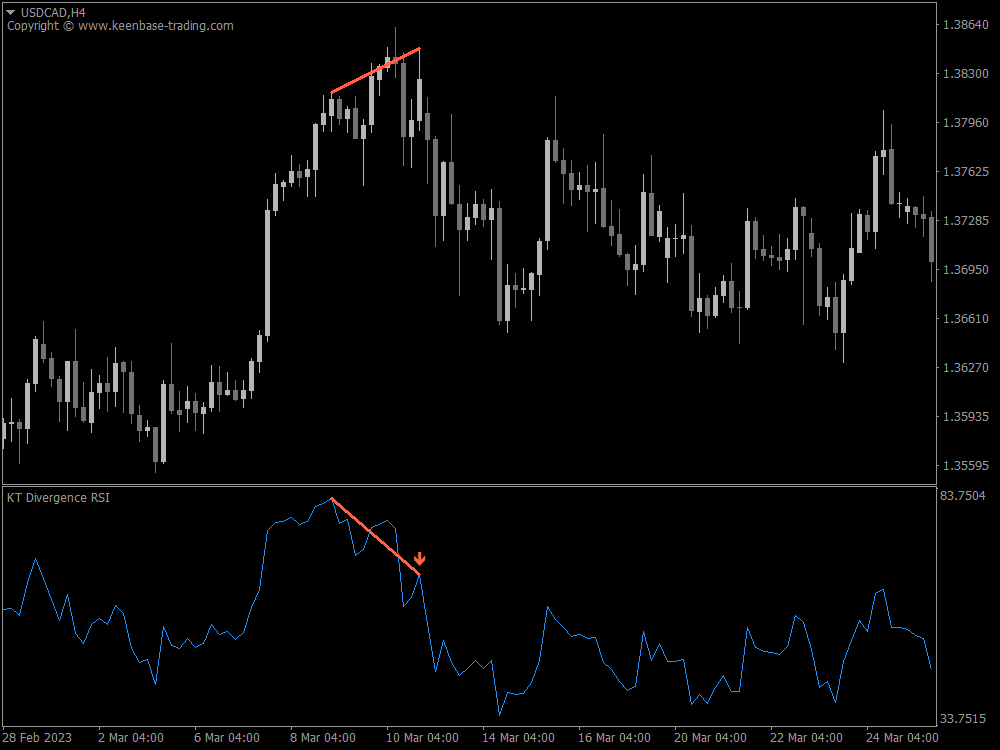

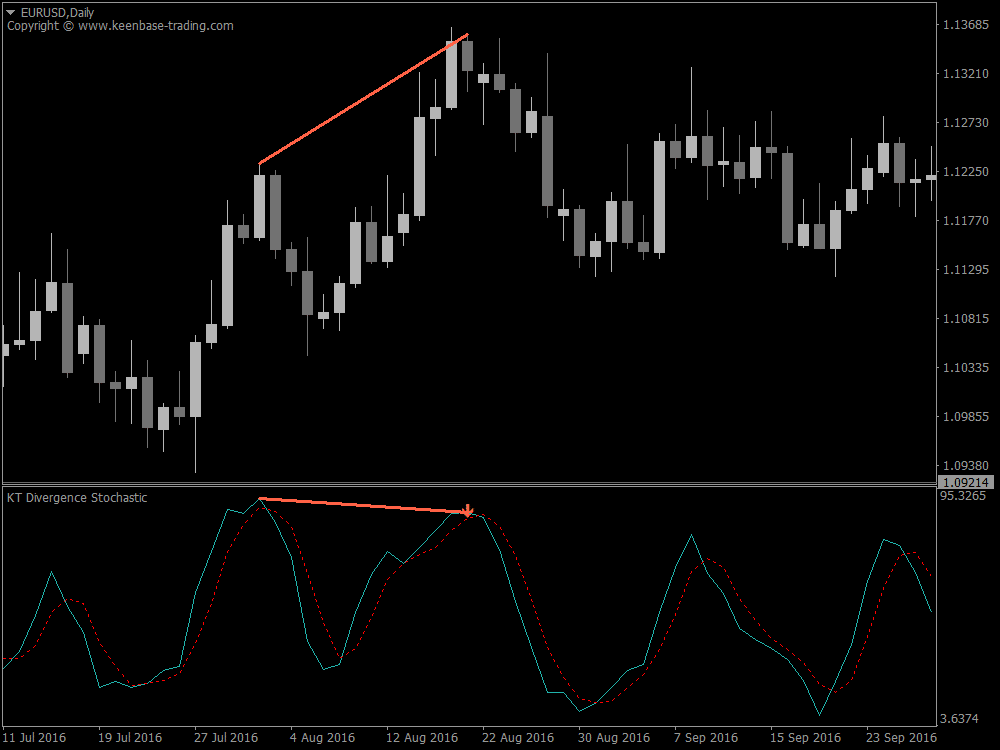

A bearish divergence occurs when prices rise while the oscillator moves lower.

This indicates weakening bullish momentum and suggests a potential reversal to the downside.

To confirm this setup, traders should wait for a close below prior swing lows or look for other confirmation signals, such as a break below support levels, before entering any trades.

The stop-loss should be set just above the high of the reversal candle.

Regular Divergence

The price forms lower lows in regular divergence (bullish), while the oscillator creates higher lows. This suggests that the momentum for a potential bullish reversal is building up.

On the other hand, a regular divergence (bearish) is observed when the price forms higher highs, but the oscillator creates lower highs. This indicates a potential bearish reversal as the momentum weakens.

Hidden Divergence

In hidden divergence (bullish), the price forms higher lows while the oscillator forms lower lows. This indicates that the underlying bullish momentum remains intact despite the price retracement, suggesting a potential uptrend continuation.

Conversely, this type of divergence is observed when the price forms lower highs, but the oscillator forms higher highs.

This suggests that despite the price's attempt to rally, the underlying bearish momentum persists, indicating a potential continuation of the downtrend.

They are useful for traders to identify when a trend is likely to resume after a temporary pullback or correction.

By recognizing hidden divergences, traders can align their strategies with the prevailing trend and potentially capitalize on favorable trading opportunities.

Pro-Tips to Use All in one Divergence Indicator for MT4 & MT5

Wait for a Breakout

It is crucial to prioritize confirmation before entering any trade. One reliable method to validate a divergence is by patiently observing the price movement and waiting for it to breach its previous low or high point.

This confirmation step adds more reliability to your trading strategy, ensuring you enter trades with greater confidence and precision.

Trade Confirmation

It's advisable to use more than one indicator. Combining it with other indicators, such as support resistance lines, trend lines, or candlestick patterns, is highly recommended to maximize the effectiveness of your trading decisions.

You can comprehensively understand the market dynamics and make more informed trading decisions by incorporating multiple tools and indicators.

Fundamental Analysis

In addition to technical analysis, keeping an eye on economic data from various reliable sources is crucial for anticipating specific price movements in the Forex market.