Definition of Aroon indicator MT5 | MT4

The name 'Aroon" is derived from the Sanskrit language, which means "dawn's early night." Tushar Chande initially presented it in a research paper.

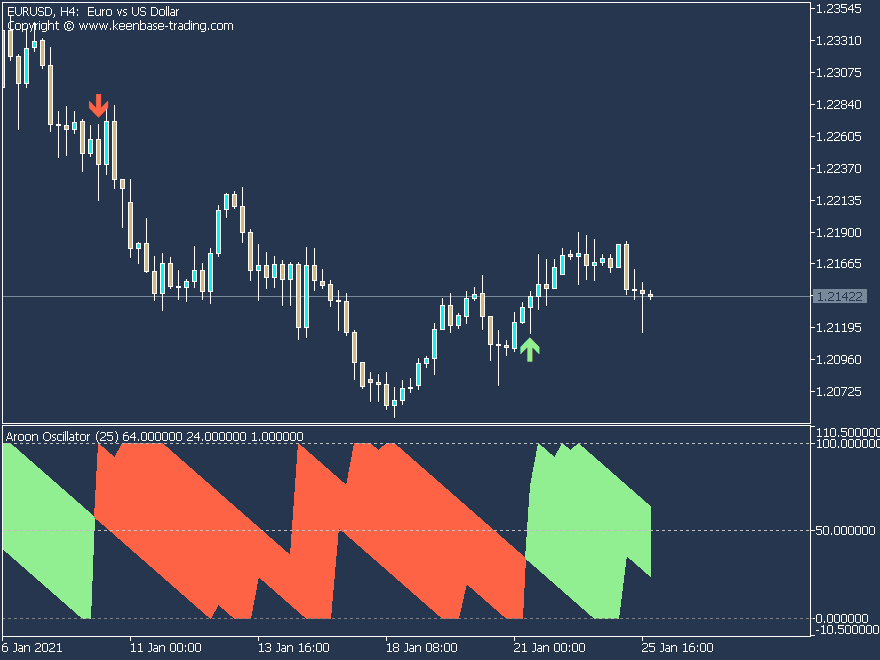

It can show the starting of a new trend and its strength by counting the times between highs and lows over a fixed period. The Aroon oscillator oscillates ranging from 0 to 100.

Aroon indicator is quite different from other popular oscillators because it comprehends time period with the asset's price move. For example, on a Daily Timeframe, you can interpret the Aroon oscillator MT4 like this:

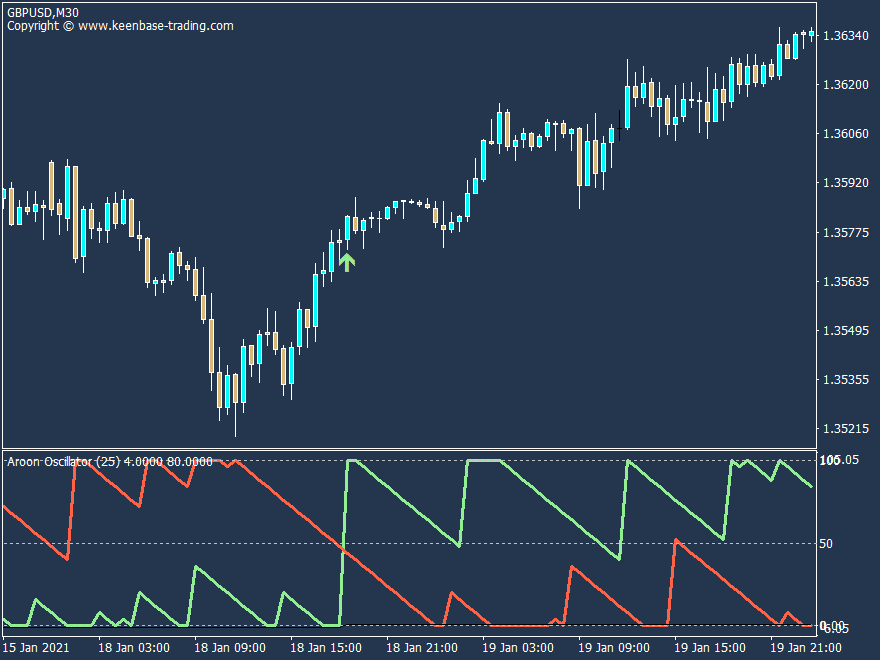

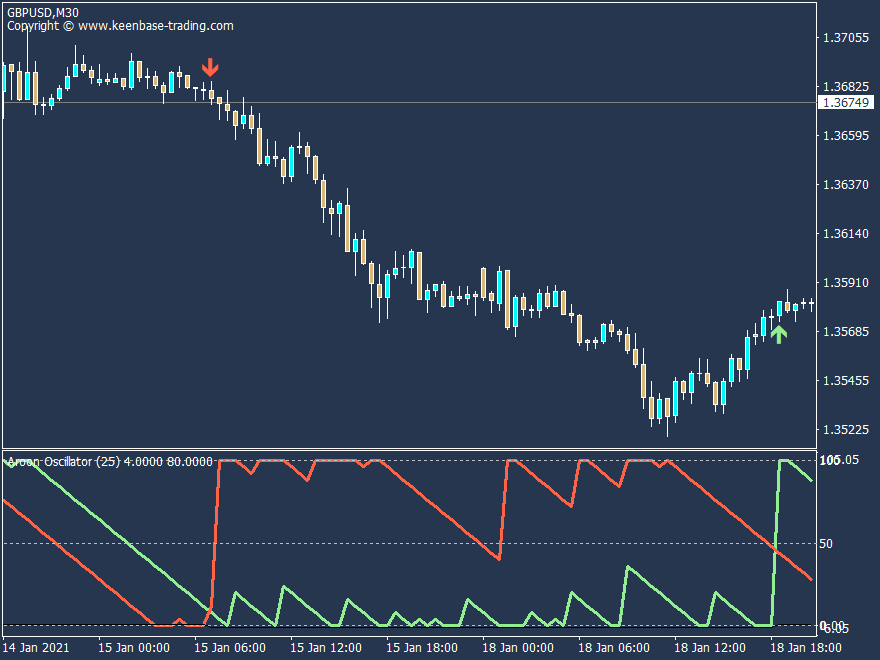

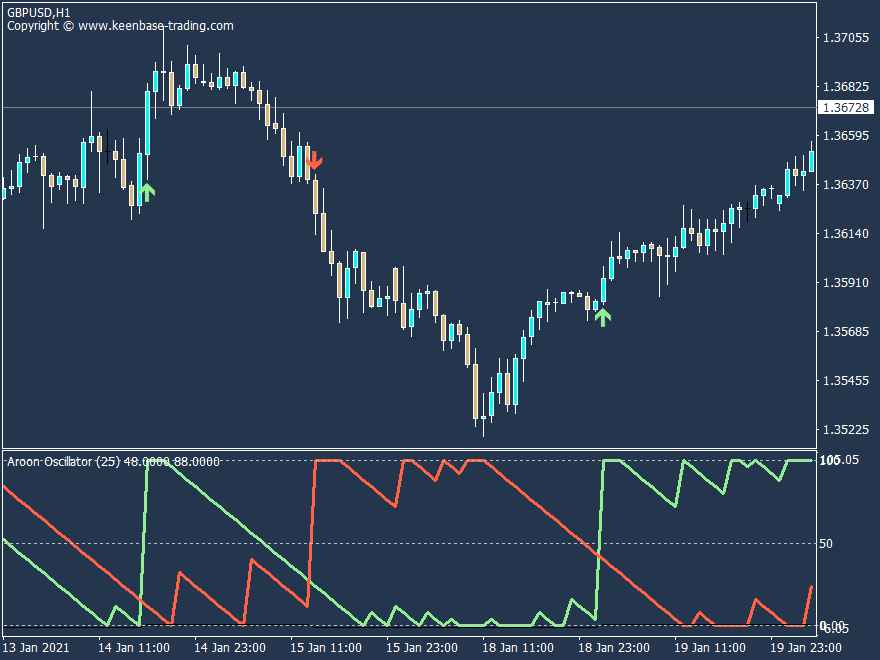

- Aroon Green: The Aroon Green line measures the number of days that have passed since the 25-day high.

- Aroon Red: The Aroon Red line measures the number of days that have passed since the 25-day low.

- Overbought Market: When Aroon Green line reaches 100.

- Oversold Market: When Aroon Red line reaches 100.

How is the Aroon indicator calculated?

The Aroon oscillator consists of two buffers lines as follows:

- Aroon-Up = ((P - Days Since P-day High)/P) x 100

- Aroon-Down = ((P - Days Since P-day Low)/P) x 100

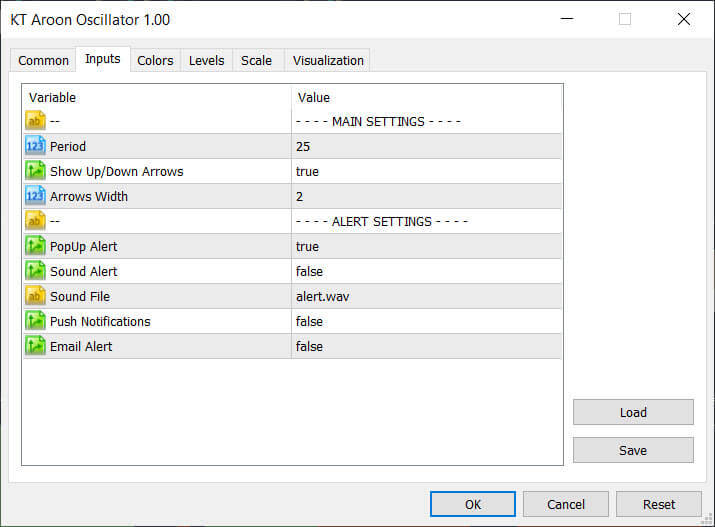

Where P is the number of periods chosen by the user, usually, the P is set to 25.

How to use the Aroon indicator in technical analysis?

You can use it for new entries and the trend confirmation to enhance an existing trading strategy.

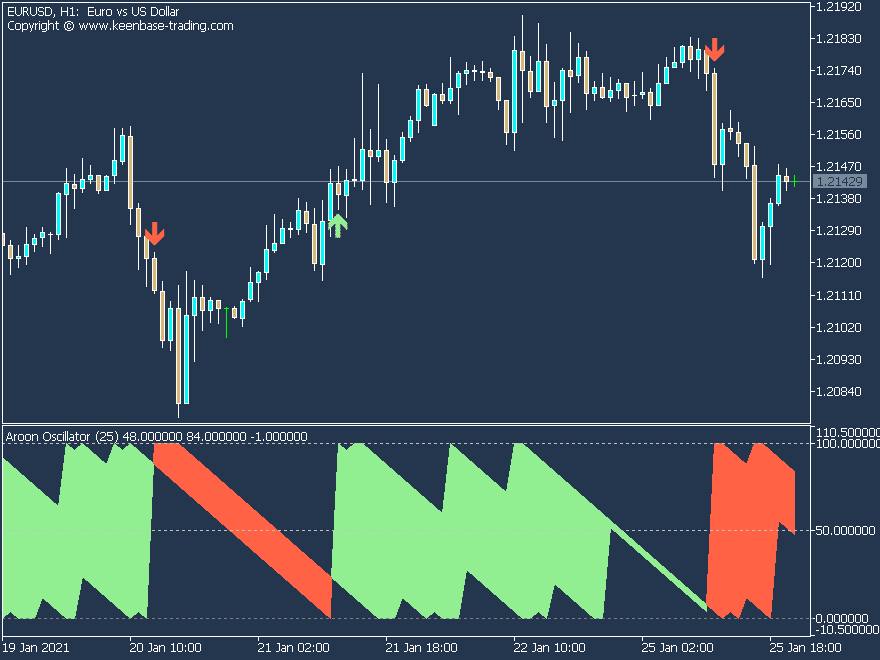

The Aroon Up and Down line crossovers can be used for the new entries, while the Aroon lines placement can be used to identify the market trends.

Advantages

- It shows the new emerging market trend remarkably.

- It can also show the interval of consolidation. For example, if the Aroon lines are reading below 50 or moving parallel, the traders could have indecision. However, trading can be resumed when the Aroon line move above the 50 level.

- Aroon lines crossover (Up and Down Arrows) can be used as new trade signals.

Disadvantages

- Undoubtedly, the Aroon MT5 is a famous and helpful indicator among traders. However, it's still a lagging indicator by nature, so sometimes, the signals appear very late.

- It can produce multiple false signals during choppy market conditions, especially the Aroon crossover signals.

- Most of the time, using it as a standalone indicator is insufficient. Instead, it would be best to combine it with price action and other indicators to improve its success rate.

- Compared to other momentum oscillators, the overbought and oversold signals provided by the Aroon indicator are not trustworthy.

Aroon Indicator Download

You can instantly download the indicator (ex4/ex5) file after the successful payment.