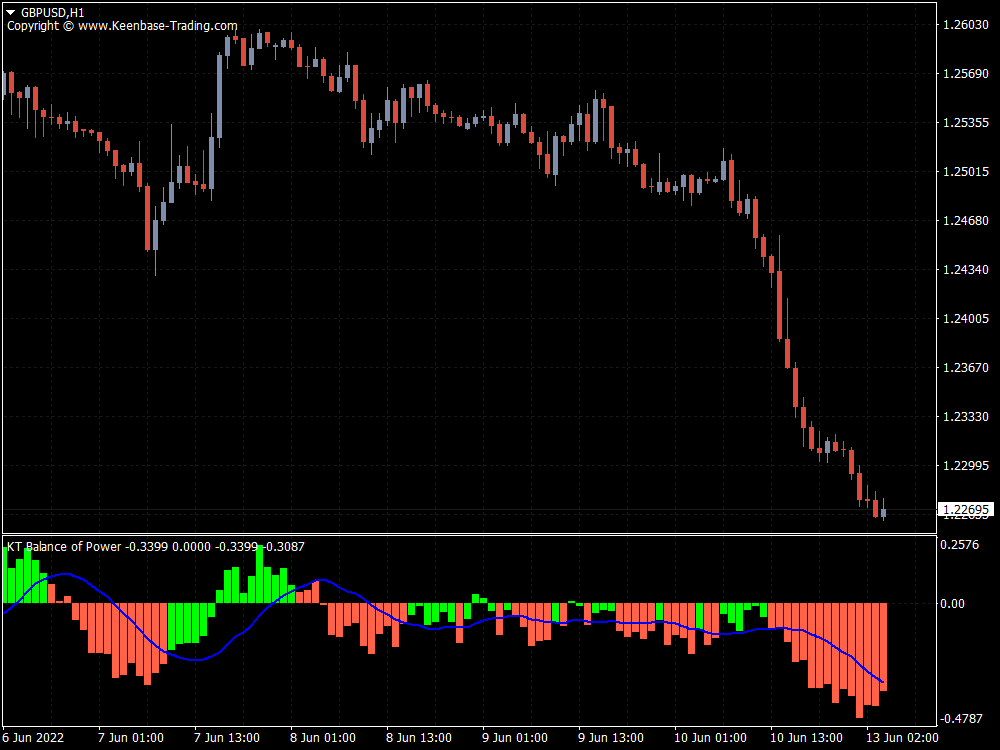

This indicator measures buyers' capacity to push an underlying instrument's price trend to an exceptionally high price against the ability of sellers to pull the price to a special low price.

In simple terms, the BOP accurately identifies trends in the financial markets by detecting systematic buying and selling signals.

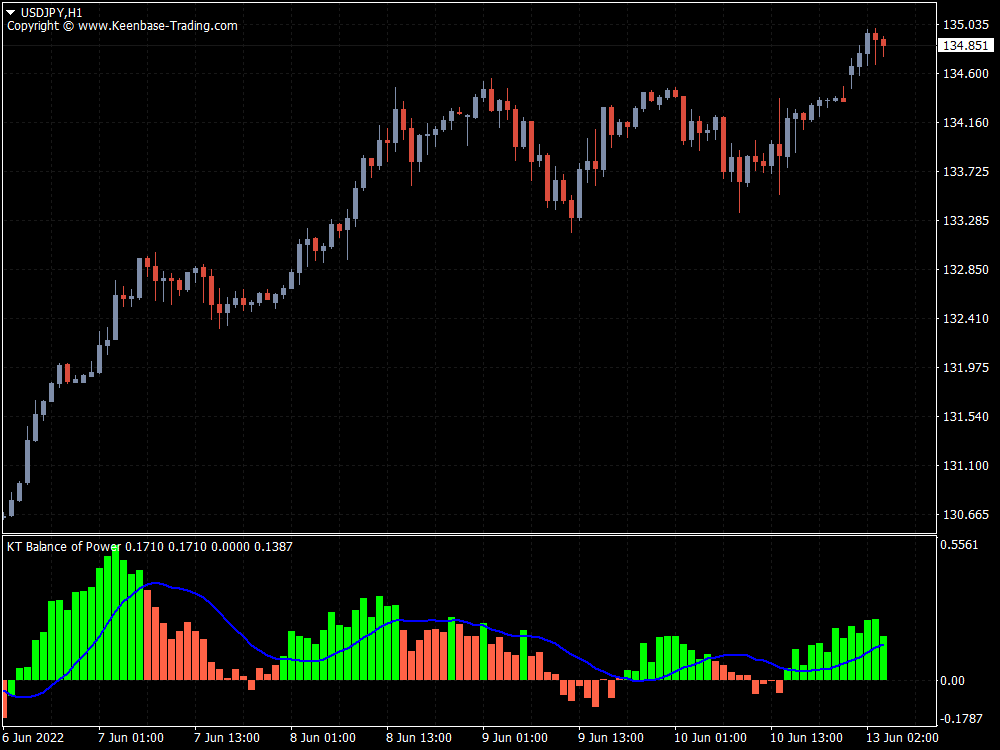

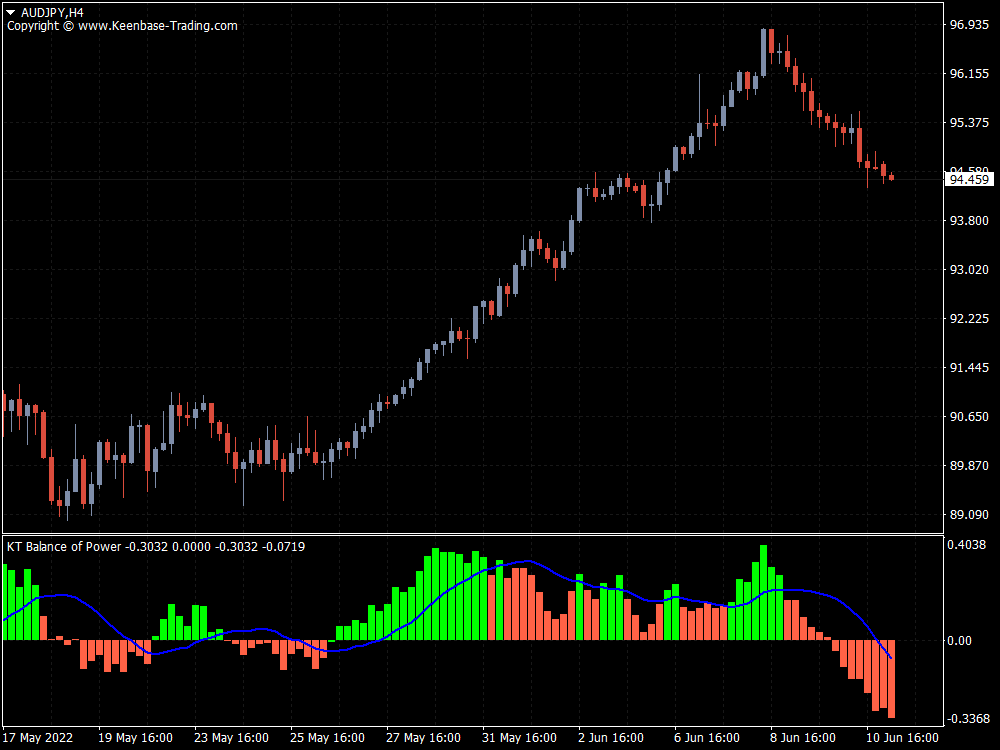

A reading near 1.00 indicates bulls are in control and trading conditions are in overbought levels, while a reading near the -1.00 mark shows bears are the dominant figure and the instrument is in oversold levels.

A reading near 0 indicates neutrality between both biases and can also highlight a potential trend reversal.

Features

- Quickly find the buying and selling pressure among the traders.

- It comes with simple inputs settings.

- The Balance of Power works on all time frames and is compatible with all financial instruments on MT4 and MT5.

- This indicator has customizable parameters to allow you to personalize your charts better.

- Traders can use BOP to identify suitable buy or sell entries on trades.

- This indicator allows you to identify the instrument's overbought and oversold levels.

- It helps evaluate the strength of market trends.

- BOP occupies the bottom of your chart, leaving your price chart free of clutter.

- The indicator is easy to set up and requires only minimal computer resources.

- It can be used to find buy-sell entries using the zero-line crossovers.

- It can be used to identify overbought and oversold markets.

- Like any other oscillator, the Balance of power indicator can identify regular and hidden divergence between the price and BOP oscillator.

- It can also be used to find bullish and bearish market trends.

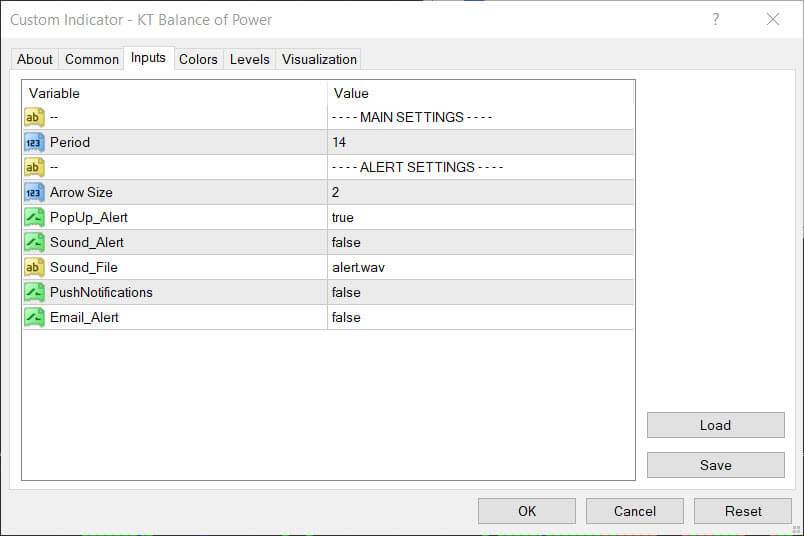

Inputs

Key Uses for Market Open Traders

Traders looking to take advantage of the market open in any market sessions, such as New York, London, Tokyo, or Sydney, can integrate it into their routine to immediately catch trading signals.

Market opens are good times to spot trend continuations or sharp reversals, as it is when traders in those time zones react to market developments of the trading session.

Key Uses for Post News Traders

The Indicator fuses seamlessly with fundamentals trading as it generates buying and systematic selling signals depending on the news’ effect on market trends or momentum, mainly when used on the lower time frame charts.

Key Uses for General Pattern Traders

Pattern traders tend to wait for confirmations on trades before placing an entry or exit. Here, BOP can help confirm developing trends.

For instance, a pattern trader can get a trade confirmation when an asset moves away from oversold conditions and over the neutral level.

Combine the Balance of Power Indicator with Other Indicators

While BOP works well to identify price movements, it can also work with our other indicators, expert advisors (EAs).

Summary

The KT Balance of Power Indicator helps traders identify the market bias. Try out the BOP Indicator on a demo account to get a feel for this momentum indicator and hone your trading skills.