Applications

With this modified indicator, you can choose a custom number of candles to allow to the left and right side of the fractal.

For example, you can display the fractals that have "three" successive candles with the highest high in the middle and one lower high on both sides, or you can display the fractals that have "Eleven" consecutive candles with the lowest low in the middle and five higher lows on both sides.

There are multiple uses of fractals in trading, such as:

Entry Points

Fractals provide optimal entry points for the stop market orders in breakouts trading. Fake breakouts are a large-scale problem in trend trading strategies.

Instead of going with an instant market order, it's always best to enter at the last fractal price with a stop order to avoid fake breakouts.

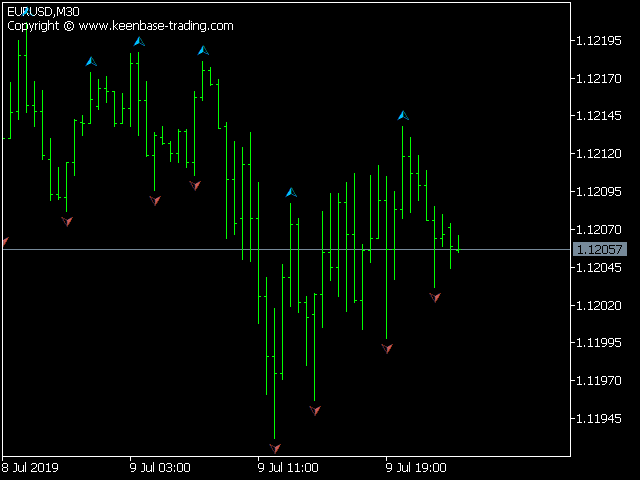

Trend Line Plotting

You can plot the perfect trend lines by connecting the last two or three fractals. For example, you can connect the previous two bullish fractals to plot an Up trend line and a Downtrend line by connecting the last two bearish fractals.

Support and Resistance

Fractal points can also be used to plot the support and resistance levels. For example, if two-three fractals appear near the same price, it could signify a strong support/resistance level.

Price Action Trading

When it comes to identifying the price patterns, Fractals provides an excellent reference point to monitor the forming price action and candlestick patterns which can indicate the upcoming reversal in the market.

Benefits of using Fractals Indicator

- It helps spot the reversal points during technical analysis.

- It helps plot the Fibonacci retracement levels by connecting the previous fractals.

- Fractals work with the same efficacy across all time frames.

- The fractal pattern highlights the price movement uniquely.

Advantages

- They provide clear entry points in the market.

- Fractals can be used to find the optimal stop loss and profit target.

- Advanced traders can use fractals to detect the potential tops and bottoms.

Disadvantages

- The entry points provided by the Fractals are not ideal. In most cases, the entry is at a higher price, which means an expensive contract. However, it is also true that we also avoid lots of fake breakouts by compromising on the entry price.

- If you are trying to find some chart patterns using fractals, you must wait for the two extra bars for the pattern confirmation, as fractals require a minimum of two extra bars after finding the swing high or low.

- In some rare occurrences, the fractals can repaint and change their positions during backtesting, so they are not very reliable to use in automated trading.

Pro-Tips

- As the fractals are lagging indicator, it's always best to combine them with other indicators and trading systems.

- Consider using them on higher time frames as the reversal points plotted by fractals are usually chaotic and not very reliable.

- It's best to use fractals with multi-timeframe analysis to improve their effectiveness.

- If the price moving in a sideways movement, it's always best to use the moving average with fractals to capture the potential breakouts.