Key Uses for Market Open Traders

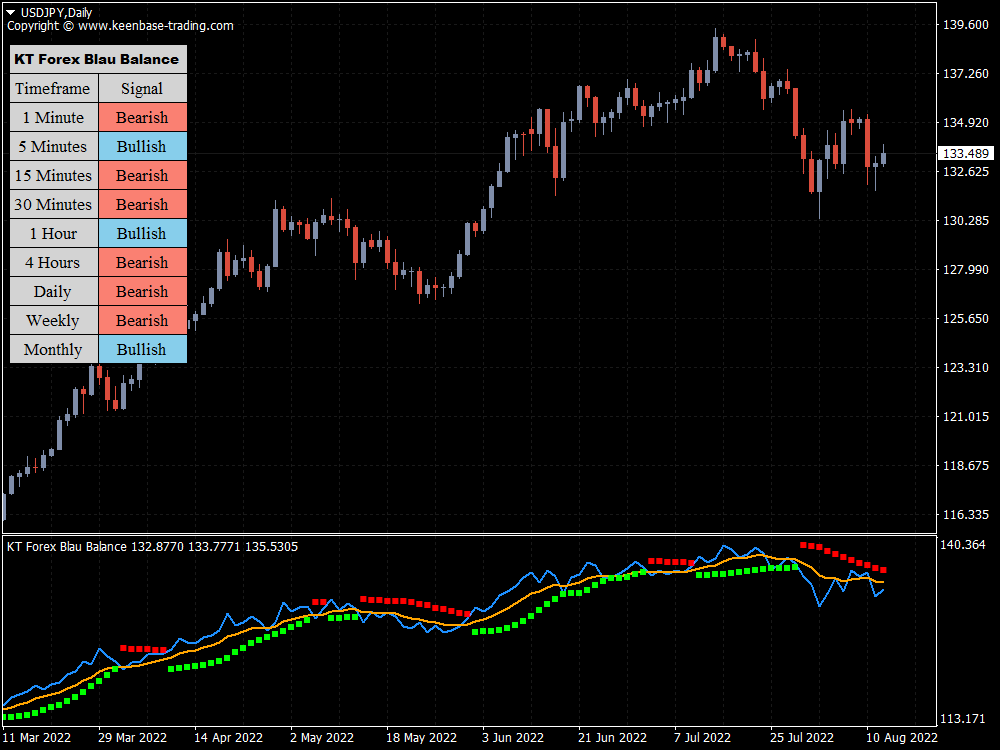

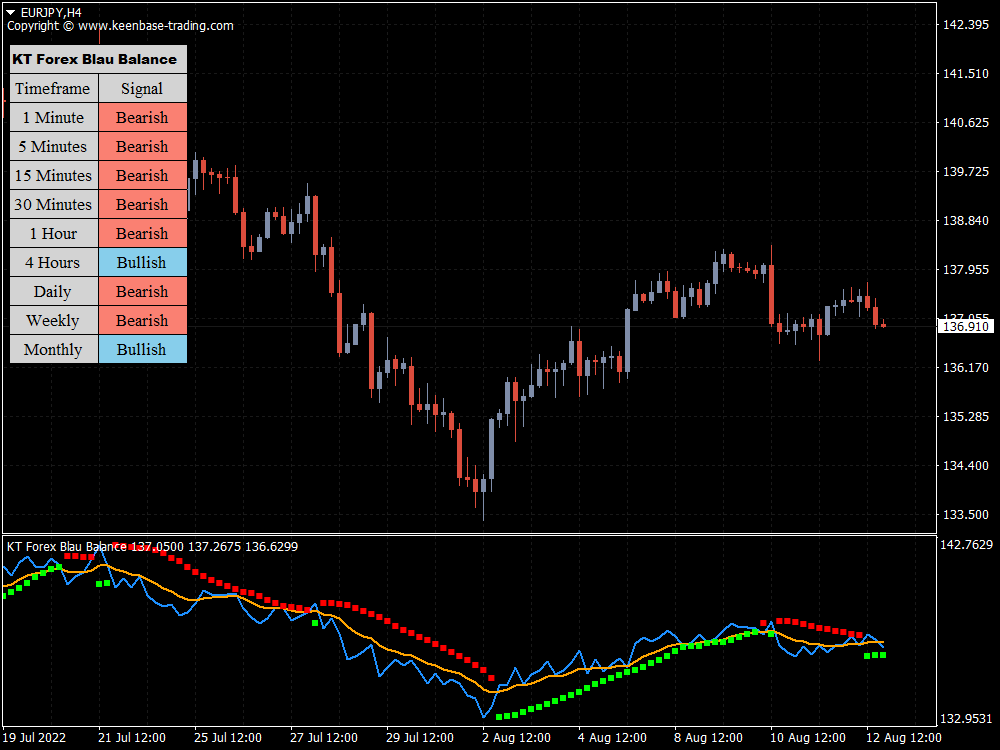

Here, you would first decide on your most preferred market session open (e.g., New York, London, Tokyo, or Sydney) and wait for its start. Then, once the period has started, you may refer to this indicator by observing the color of the dots.

For instance, if it turns red, this could suggest that a particular session might be bearish for some time. So, of course, you should consider this information along with other confirmation factors.

Key Uses for Post News Traders

For these traders, this indicator can act as one of the exit triggers for riding a news-based breakout. Wait for the dots to change color before exiting!

For any news trading, it’s best to focus on time frames not above 15M to observe the fast-moving pace of the market better.

Key Uses for General Pattern Traders

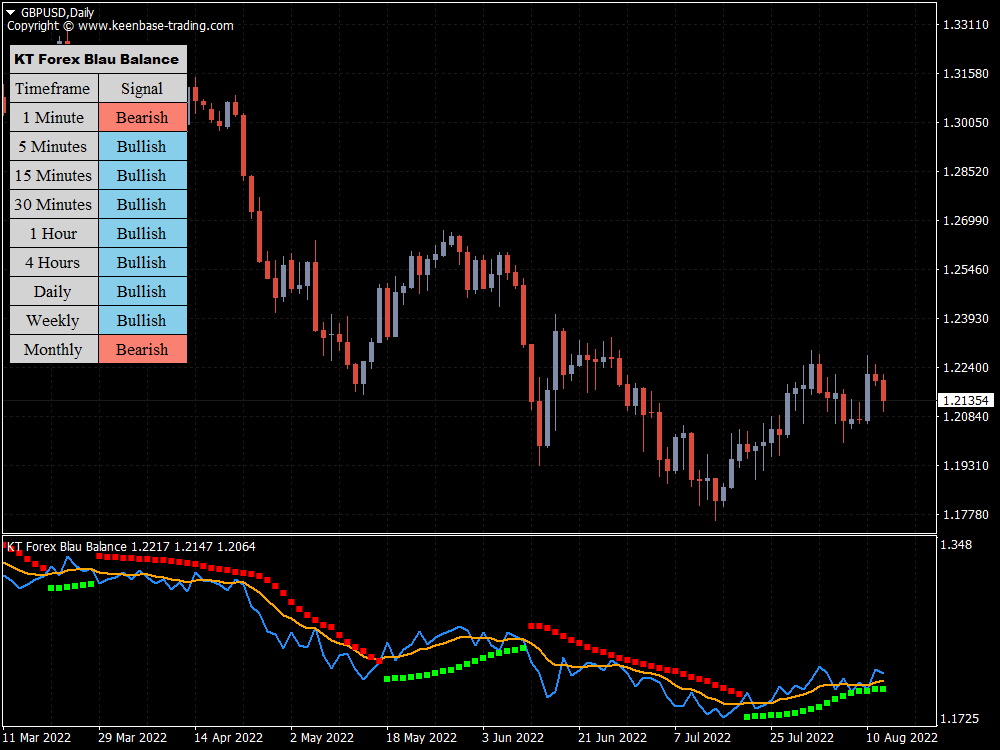

Most pattern traders do not immediately enter a trade once fully formed. Instead, they would usually look for extra things for confirmation. This is where you can use the Forex Blau Balance.

Again, the color of the dots can determine whether to go long or short. For instance, if a bearish pattern appears but the indicator still shows green, this could imply a less favorable trading opportunity.

It may be best to wait for red for extra confluence to avoid a stop loss.

Combine the Forex Blau Balance Indicator with Other Indicators

Like any tool, you can combine the Blau Balance with other indicators like Moving Averages, Relative Strength Index, Bollinger Bands, etc., to increase the success rate of your trading systems.

You can also use the Expert Advisors (EAs) indicator for automated trading. Make sure you test the strategies using a demo trading account first!

Summary

Overall, the Forex Blau Balance indicator is a simple but powerful indicator to identify transition points in the market. It can act as a great confirmation trigger to your existing strategy and syncs well with other indicators and EAs.