Intraday Forex traders need to know leading currency exchanges' opening and closing times. There are five main leading currency exchanges with the following timings:

Pro Tip: If you are often confused with different time zones, You can use the time zone converter.

Understanding the Different Trading Sessions

The Forex market is open 24/7, but retail traders can only trade during the business week, from Monday to Friday.

Trading in the Forex market begins at 09.00 PM GMT on Sunday and closes at 08.00 PM GMT on Friday. Note that the opening and closing of all market hours adjust forward during summer by 1 hour.

Forex's trading day comprises several market sessions that usually cover the Sydney, Asian, London, and New York market hours.

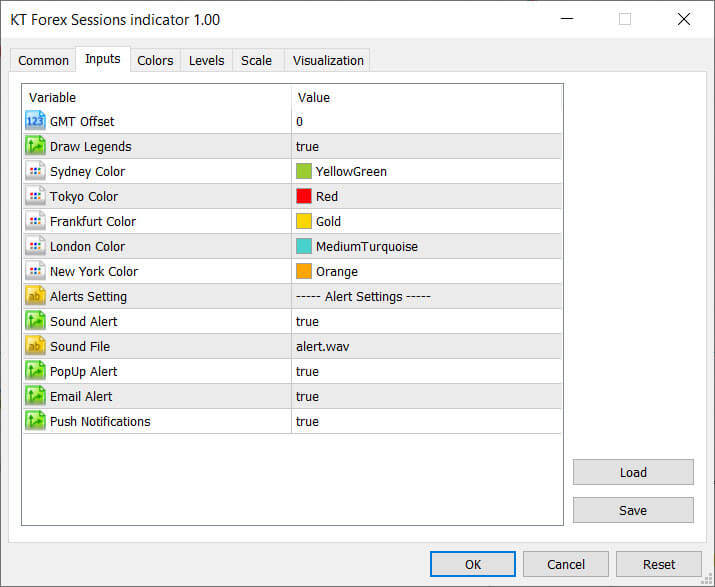

Sydney Market Hours

The Sydney session opens when the Australian market opens at 9.00 PM GMT and closes at 5.00 AM GMT. The New Zealand session is also included in the Sydney session.

In New Zealand, the forex market opens at 10.00 PM GMT and closes at 4.45 AM GMT.

Tokyo Market Hours

The Tokyo session starts when the banking hours begin in Japan. This time period is between 11.00 PM GMT and closes at 7.00 AM GMT.

The Tokyo trading session encompasses most of the market hours in Asia. It is thus commonly referred to as the Asian session.

European Market Hours

The European session begins when major business hubs open in Europe. For example, in Frankfurt, Germany, trading sessions start at 6.00 AM GMT, while London opening begins at 7.00 AM GMT.

The Frankfurt forex trading hours end at 2.00 PM GMT while London closes at 3.00 PM GMT.

Therefore, the European market hours span from 6.00 AM to 3.00 PM GMT. Usually, when traders talk of the European hours, they mainly refer to the London session.

North American Market Hours

The New York forex trading session starts from 12.00 PM GMT to 8.00 PM GMT. During the New York session, the trading activity covers Canada, Mexico, and most of South America.

Forex trading in New York dominates the North American market hours. Overall, this session experiences the second-highest trading volume after the London session.

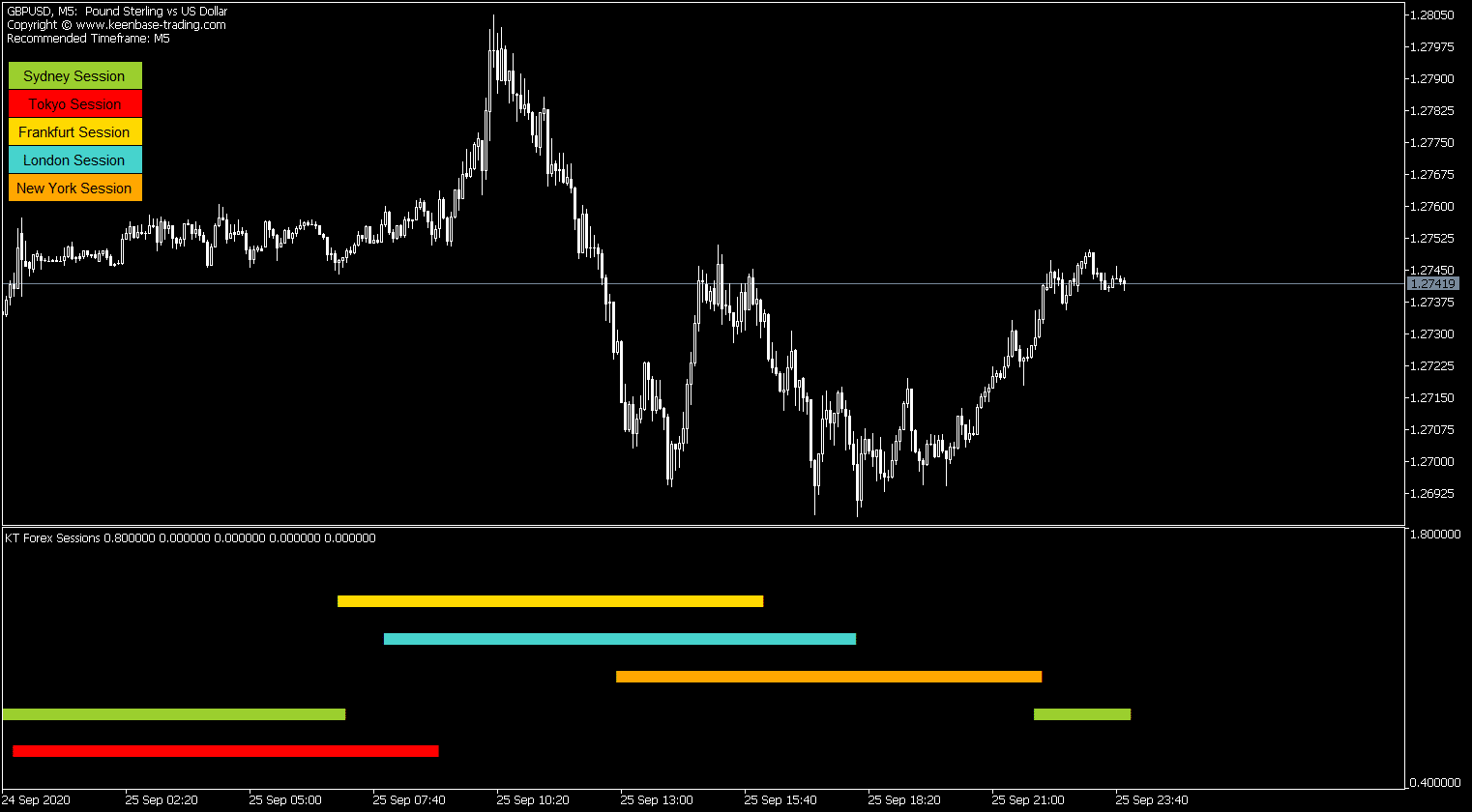

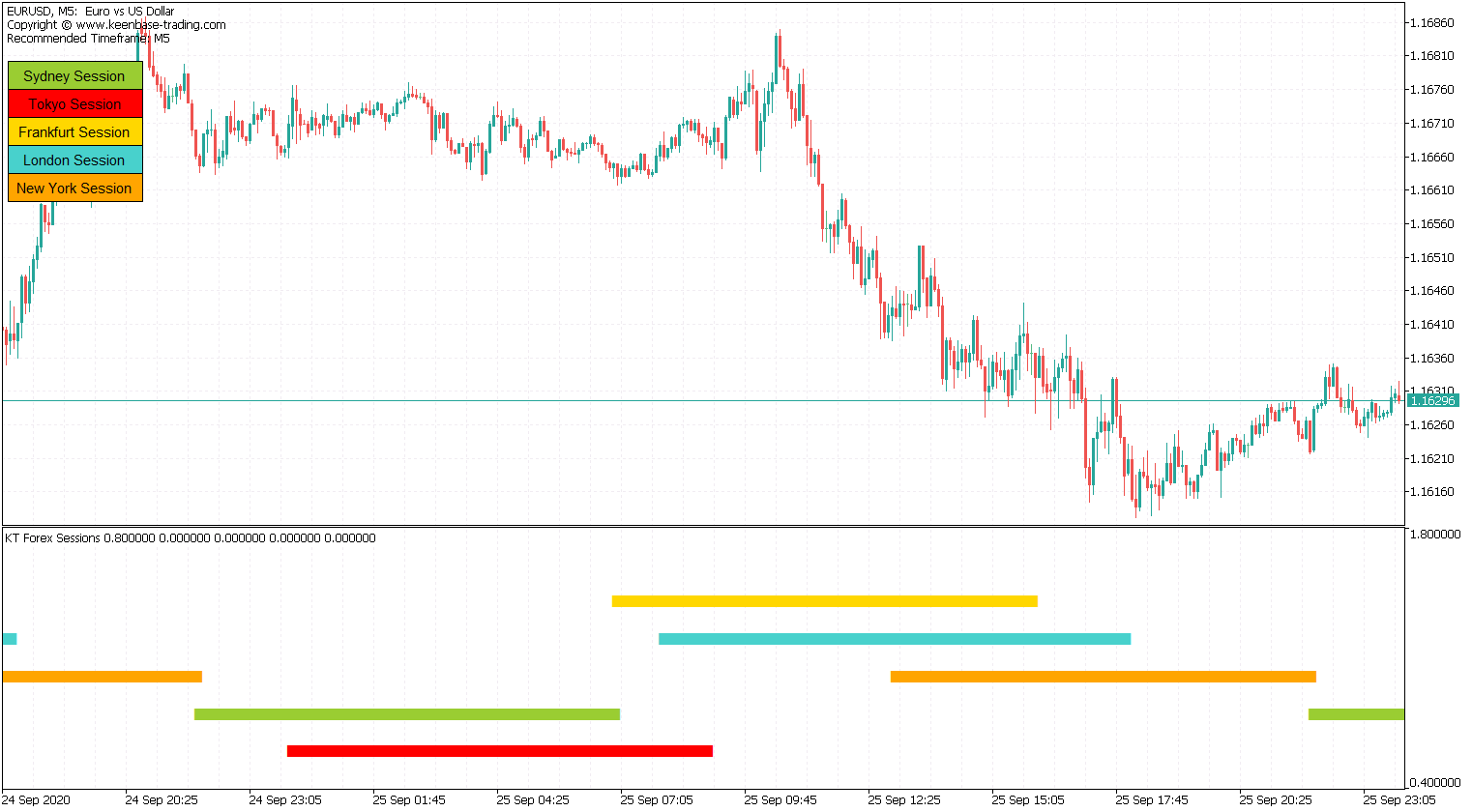

The London-New York Session Overlap

The overlap is between 12.00 PM GMT (New York Market Opens) to 3.00 PM GMT (London Market Closes).

The London and New York forex trading sessions are the largest in terms of volumes traded. Combined, about 70% of daily trading activity occurs during this overlap. The EUR/USD and GBP/USD are the most traded currency pairs.

The New York and London session overlap usually provides the best times to trade as they provide better liquidity and tighter spreads.

Market Hours and Volatility

The trading volume increases during the overlaps because of increased demand for Foreign Exchange when most international markets are active.

During the Sydney and Tokyo session, the market has significantly lower liquidity. Since fewer sellers and buyers are in the market, abnormally large buy or sell orders can substantially impact the prices.

Notably, recent flash crashes in the Forex market occurred during the Sydney session.

Geopolitics and Economic News

Adverse geopolitical events tend to weaken the domestic currency in the forex market, while favorable ones will make the domestic currency stronger relative to other currencies.

Similarly, a series of positive economic news releases will make the domestic currency appreciate, while negative financial news will depreciate the domestic currency.

Trends are Created During Market Overlaps

In FX, the market trend is formed during the trading sessions overlap.

For example, the AUD/JPY trend is established during the Sydney and Asian session overlap.

Similarly, the EUR/USD and GBP/USD trends are formed during the European and North American overlap.

The trends are primarily a result of the demand. For example, if there is a net demand for the EUR, the EUR/USD pair will be bullish; similarly, if there is a net demand for the USD, the pair will be bearish.

Market Volatility is also Influenced by the Market Hours.

A few high-impact news is announced during the start of a new market session.

For example, The Non-Farm Payroll (NFP) is always released on the first Friday of the month during the beginning of the New York session (8 AM EST).

When First Friday is the first day of a month, the NFP is released on the second Friday.