Recommendations

Understanding the KT Heiken Ashi EA

The KT Heiken Ashi EA is a sophisticated trading robot that leverages the Heiken Ashi candlestick charting technique to identify and capitalize on market trends. By analyzing Heiken Ashi candles, the EA can discern patterns and trends that might be missed with traditional candlestick charts.

This expert advisor is designed to trade in alignment with the trends identified by Heiken Ashi candles, using a combination of these candles and other technical indicators to generate precise trading signals.

The Heiken Ashi EA is fully automated, making it an ideal tool for traders looking to engage in hands-free trading across various currency pairs and timeframes. This automation ensures that trades are executed with precision and consistency, adhering to the predefined strategy without the need for constant manual intervention.

Features

- Broker Compatibility: The KT Heiken Ashi EA has been designed to work seamlessly with various trading accounts, ensuring compatibility with different brokers and their specific trading conditions. This enables traders to choose their preferred broker without worrying about compatibility issues.

- Advanced Risk Management: Each trading order executed by the EA is protected by fixed ATR (Average True Range) stop-loss and take-profit levels. This robust risk management feature helps limit potential losses and secure profits at desired levels, promoting a disciplined and controlled trading approach.

- Safe Trading Strategies: The EA strictly adheres to safe trading practices, avoiding risky techniques such as martingale, grid, averaging, or other high-risk strategies that could jeopardize trading capital. The EA aims to provide consistent and sustainable results using reliable and proven trading methods.

- User-Friendly Inputs: The EA offers a user-friendly inputs settings featuring simple and intuitive input parameters. Regardless of their experience or technical knowledge, traders can easily configure and customize the EA according to their preferences. This ensures a seamless and hassle-free trading experience.

- Self-Contained System: The EA is a self-contained system that does not require additional downloads or external dependencies. All necessary components and dependencies are embedded within the EA, simplifying the installation process and ensuring smooth operation without further complications.

- Flexible Customization: Traders can customize and fine-tune the EA’s parameters to align with their trading preferences and risk tolerance. This allows for a personalized trading experience and the ability to adapt the EA to different market conditions, enhancing its versatility and adaptability. Additionally, the EA supports customizable trading sessions, allowing traders to adapt their trading activities to various market conditions and personal schedules.

- Real-time Trade Monitoring: The EA provides real-time trade monitoring and detailed performance statistics. Traders can track the progress of their trades, review historical performance, and make informed decisions based on comprehensive data. This real-time feedback empowers traders to stay updated and make timely adjustments if necessary.

- Built-in Risk Management: The EA incorporates built-in risk management features, including the option to set a maximum risk percentage per trade or a fixed lot size. This empowers traders to control risk exposure and implement prudent risk management practices, ensuring capital preservation and long-term profitability.

- Backtesting and Optimization: The EA offers the ability to backtest trading strategies and optimize parameters to enhance performance. Traders can simulate historical market conditions, evaluate the EA’s performance under various scenarios, and fine-tune its settings accordingly.

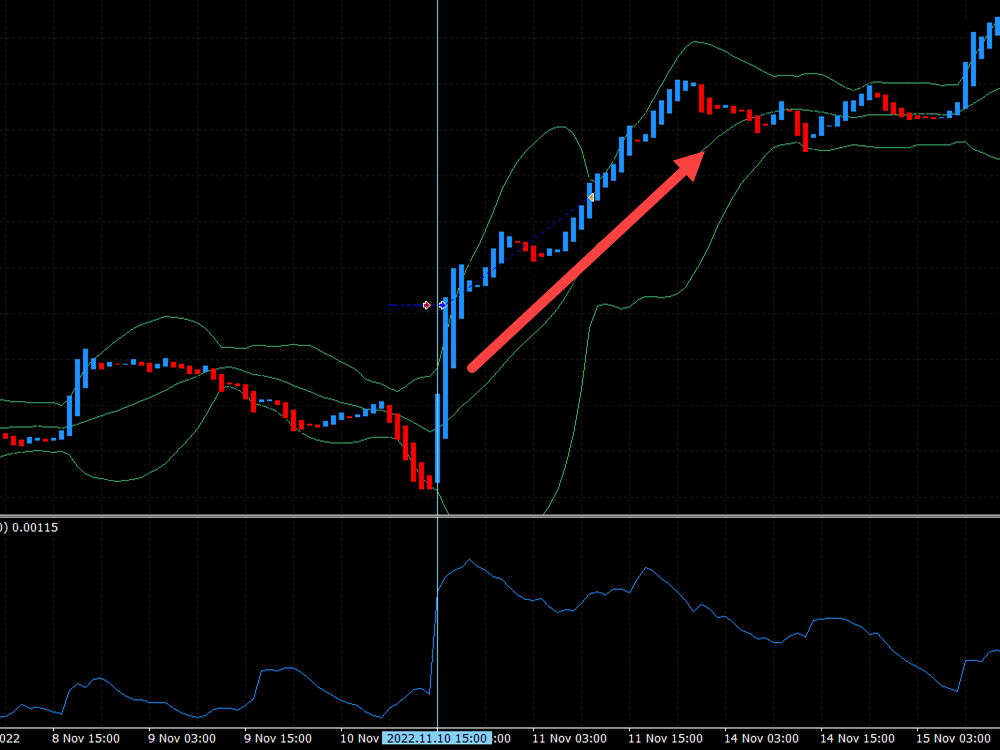

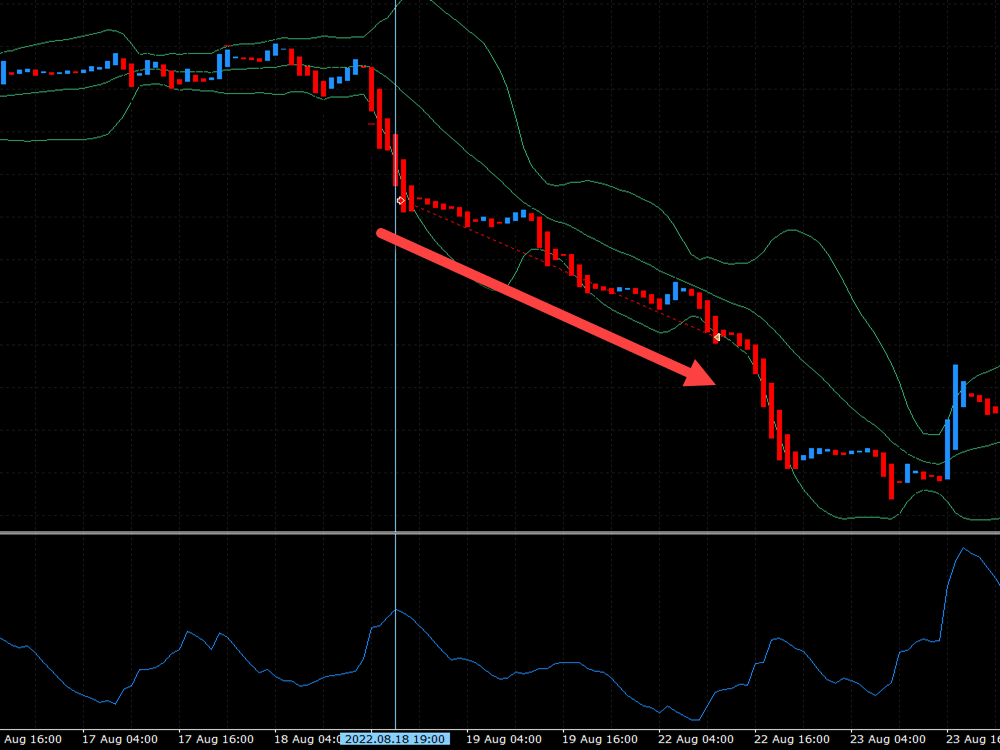

Trading Strategy and Position Management

The Heiken Ashi EA employs a robust trend-based strategy that integrates Heiken Ashi candles with additional technical indicators to generate reliable trading signals. This strategy is built on a set of predefined rules that dictate when to enter and exit trades, considering both the direction and strength of the trend.

One of the standout features of the EA is its flexible position management settings, which allow traders to tailor their trading sessions and money management modes to their specific needs.

While some Heiken Ashi EAs allow users to disable certain setups, apply techniques like the losing trade inverse martingale, or adjust trading direction based on market outlook, it's important to note that these approaches can significantly increase risk if not used cautiously.

Such strategies may expose traders to higher drawdowns and unpredictable outcomes, highlighting the need for a well-considered and disciplined trading approach.

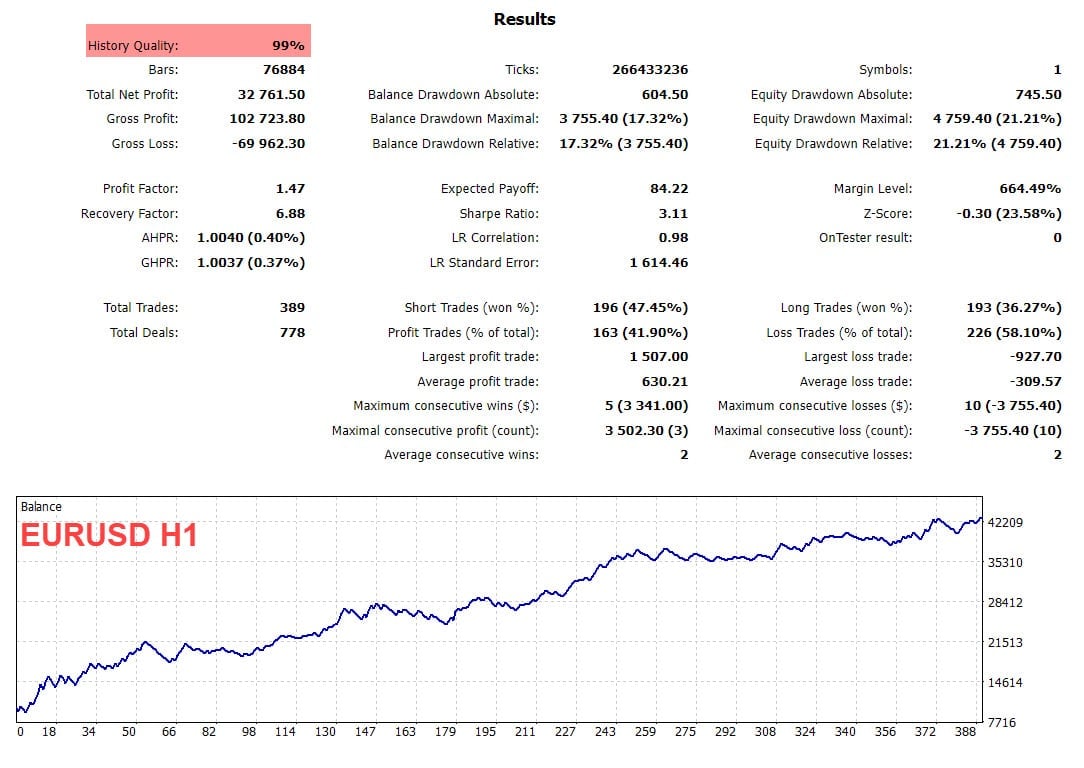

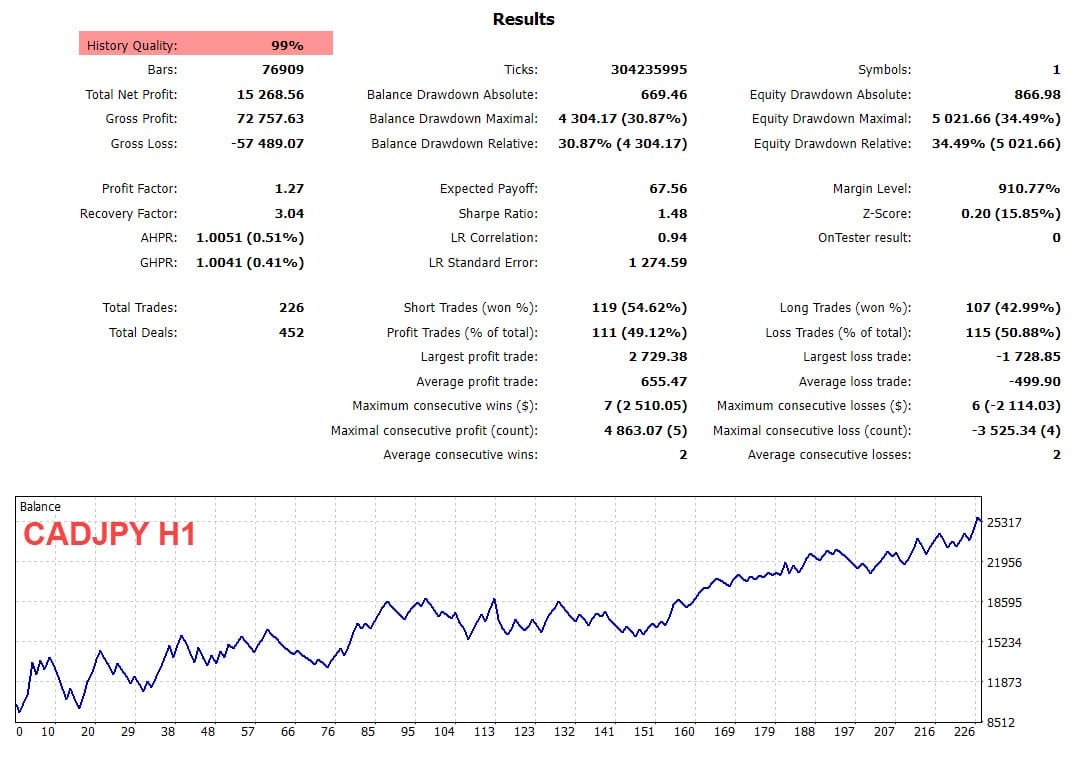

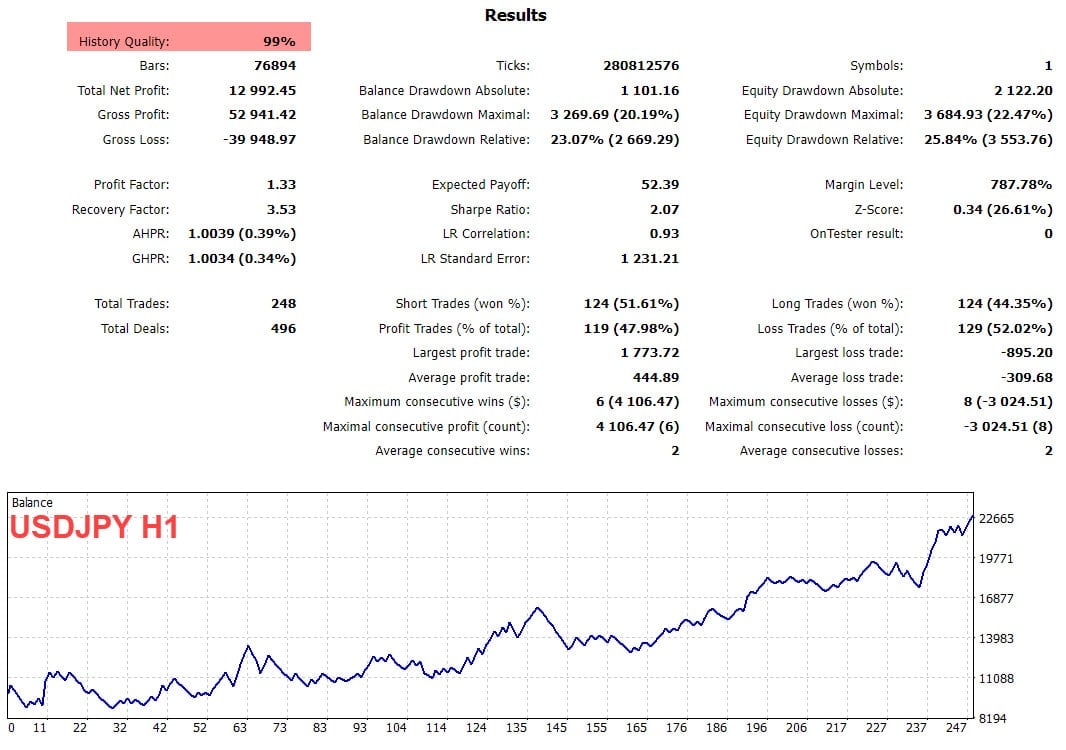

Backtesting and Optimization

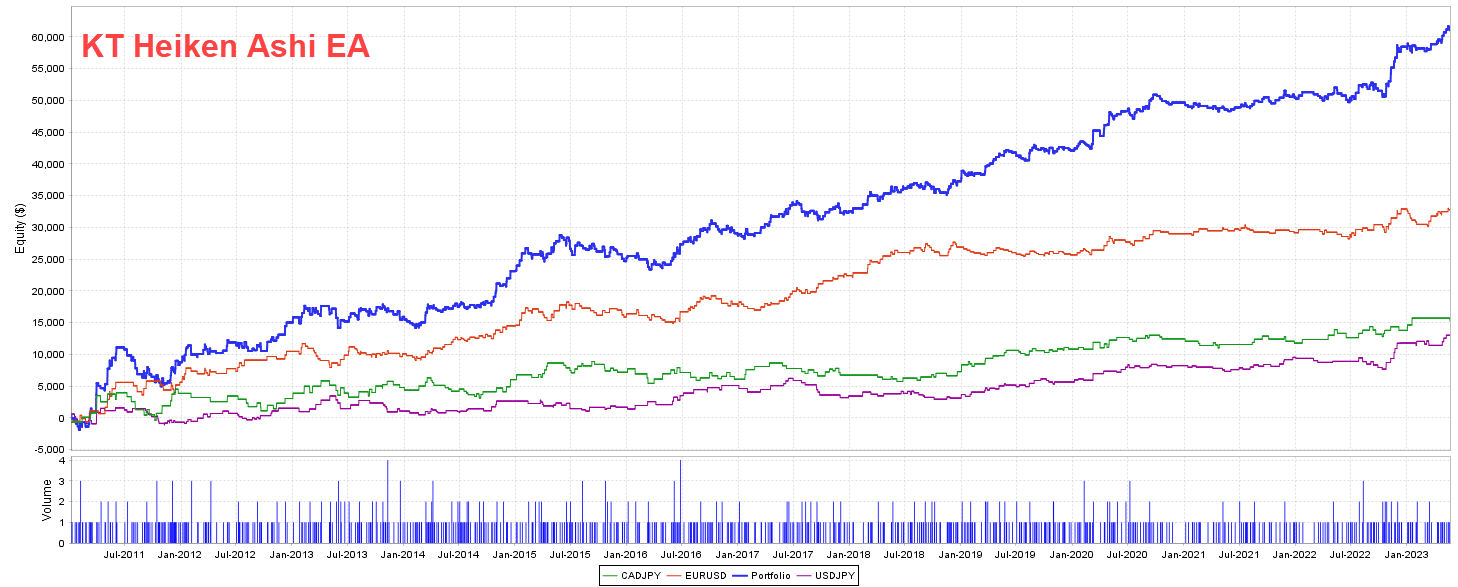

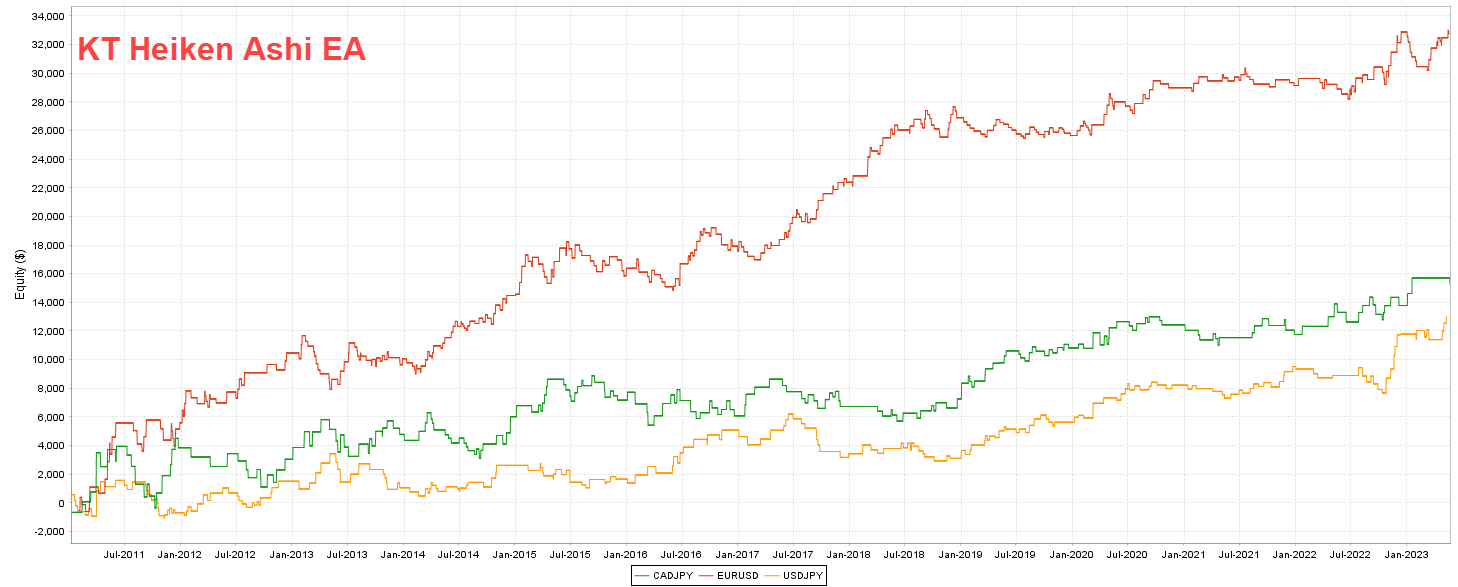

Backtesting and optimization are critical components in assessing the performance and reliability of the Heiken Ashi EA. By backtesting the EA on historical market data, traders can evaluate its profitability and risk management capabilities under different market conditions.

This process helps identify the EA’s strengths and weaknesses, providing valuable insights into its potential performance in live trading scenarios. EA Optimization involves fine-tuning the EA’s parameters to achieve the best possible results, and can be conducted using various methods such as genetic algorithms and walk-forward optimization.

These techniques help ensure that the EA is configured to maximize profitability while minimizing risk. By thoroughly backtesting and optimizing the Heiken Ashi EA, traders can make informed decisions about its deployment in live trading, enhancing their chances of success.

Conclusion

With its comprehensive features, the KT Heiken Ashi EA empowers traders to engage in efficient and profitable trading by leveraging the power of Heiken Ashi, Bollinger bands, and Average True Range(ATR).

By combining advanced technical indicators with robust risk management and customization options, the EA aims to provide traders with a reliable and effective tool for capturing trend price movements and achieving their trading goals.