Applications of HH HL LH LL Indicator MT5/MT4

- It can be used to place the stop-loss and profit targets.

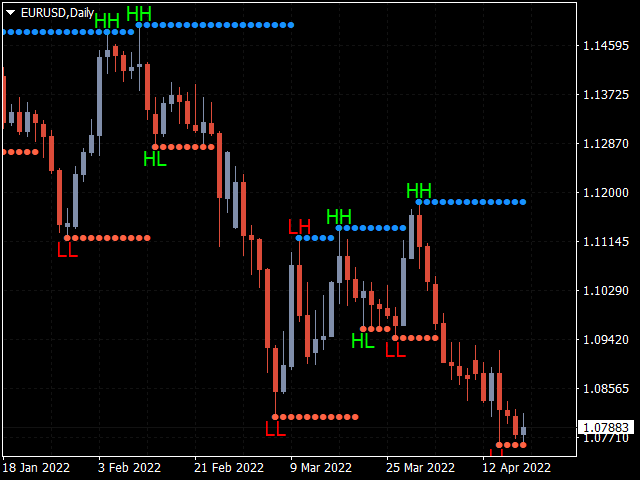

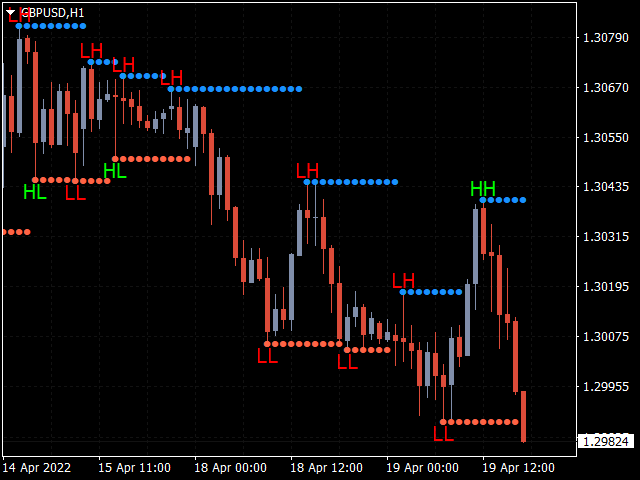

- Traders can use it to identify market trends. For example, In a bull trend, prices tend to make continuous higher highs, while in a bear trend, the price makes successive lower lows.

- Apart from Forex, this indicator is very effective in identifying the swing points in the stock market.

- It can be used to trade breakouts in the market. For example, a bullish breakout happens when the closing price of the last closed bar is higher than the previous higher high, and a bearish breakout happens when a bar closes lower than the previous lower low.

- It can be beneficial for price action trading.

- With a bit of practice, it can be used to identify clear peaks and troughs in the market.

- It also helps carry out a comprehensive technical analysis before a trading session begins.

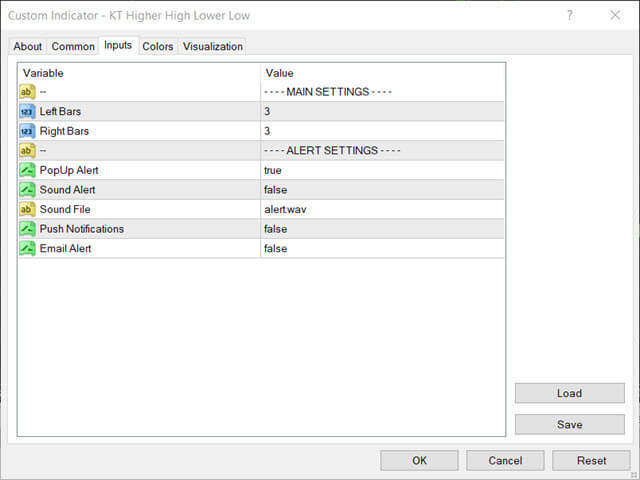

- Traders can customize the indicator's inputs to suit their specific trading strategies.

Trading Strategies with HH HL LL LH indicator

Trend Following Strategy

The financial instruments tend to move up and down in a non-linear way. For example, an up move in a stock price is always followed by a correction.

Using the above information, we can design a pull-back strategy by combining the KT Higher High Lower Low indicator with a 100-period moving average.

- Buy Entry: Go long when the price is above the moving average and touches a lower high level.

- Sell Entry: Go short when the price is below the moving average and touches a higher low level.

Counter Trend Strategy

We can use the same information but in the opposite way to trade some mean reverting instruments. Mean reversion theory states that the instrument price will always revert to its historical mean price.

We can design a counter-trend strategy on some mean reverting instruments by combining the Bollinger Bands with this indicator.

- Buy Entry: Go long when the price is at a lower low with a nearby lower Bollinger bands level.

- Sell Entry: Go short when the price is at a higher high with a nearby upper Bollinger bands level.