How the Hull Moving Average Works

The Hull Moving Average (HMA) is a technical indicator that ingeniously combines the exponential moving average (EMA) and the weighted moving average (WMA) to create a more responsive and smoother trend line.

The HMA is designed to solve the age-old dilemma of making a moving average more responsive to current price activity while maintaining curve smoothness. By focusing more on recent price action, the HMA eliminates lag altogether, providing a clearer and more accurate representation of the market trend.

The HMA formula is: HMA = (2 * (P - EMA) + WMA) / 3, where P represents the current price, EMA is the exponential moving average, and WMA is the weighted moving average. This unique formula allows the HMA to react swiftly to price changes, ensuring that traders receive timely and reliable signals about the current trend.

How to Calculate Hull Moving Average

The Hull moving average is calculated using three weighted MA combinations:

- WMA1 = P x WMA

- WMA2 = P/2 x WMA

- Raw HMA = (2 x WMA1) - WMA2

- Final HMA = WMA(sqrt(P)) of Raw HMA

P = Period

WMA = Weighted Moving Average

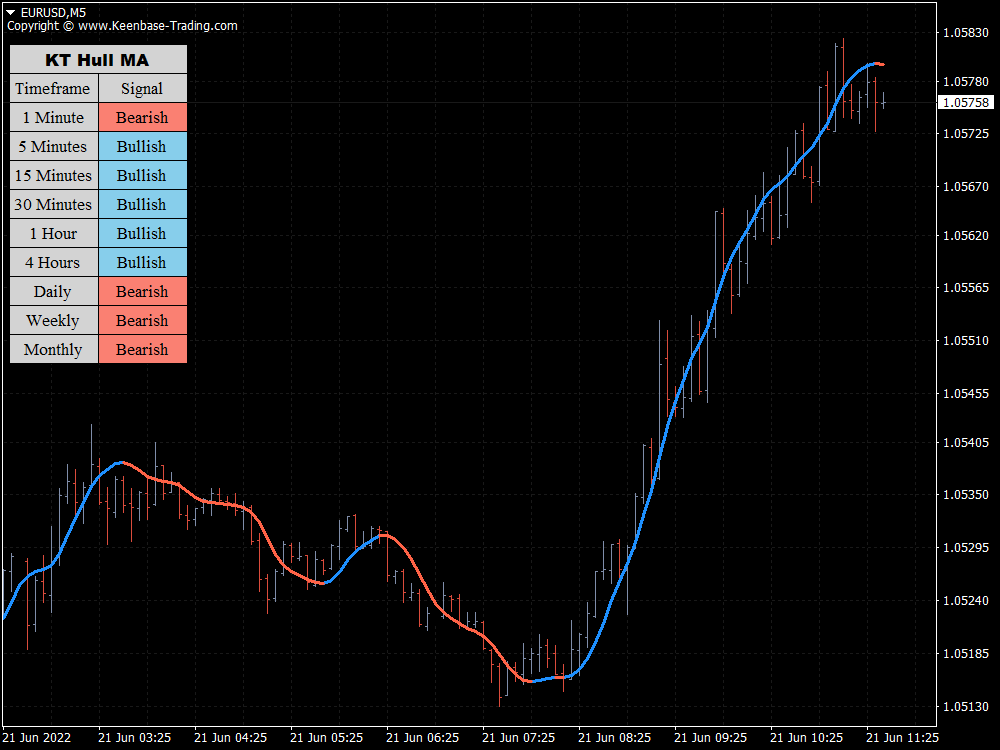

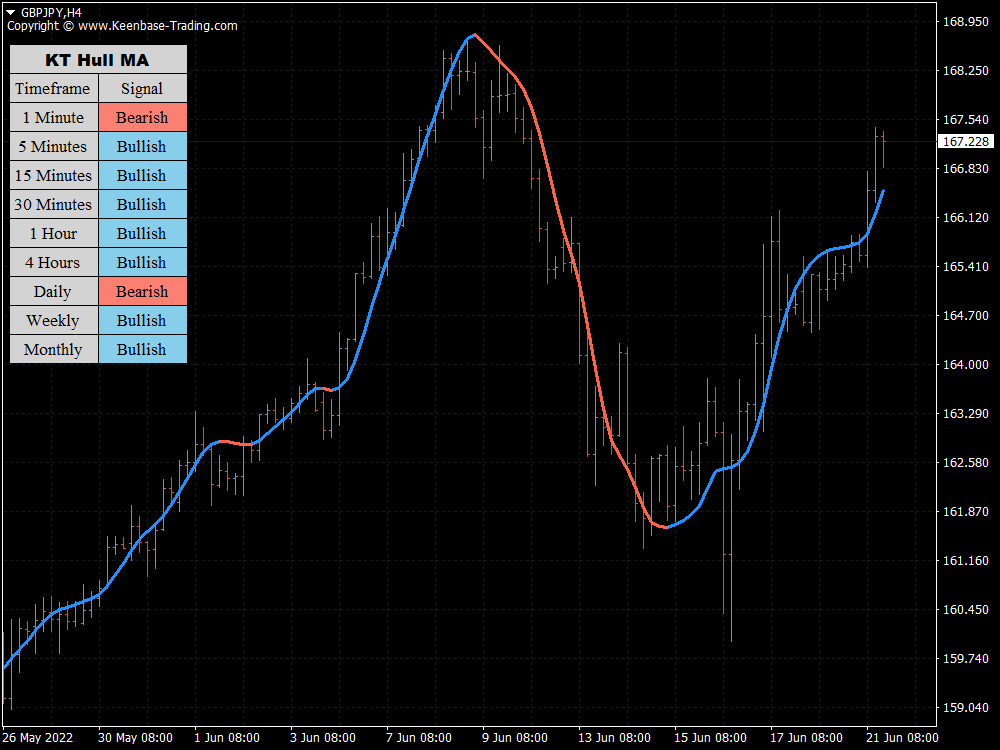

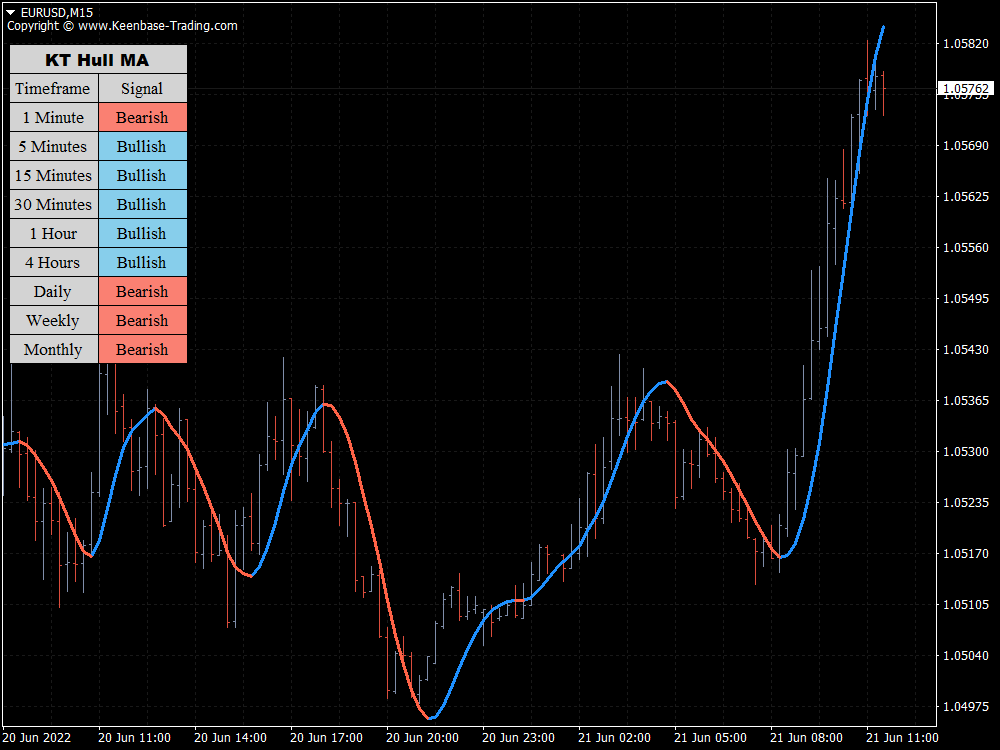

The HMA indicator plots visually represent market trends on a price chart. These indicator plots change color to signify bullish or bearish market conditions, helping traders to easily identify trends and make informed trading decisions.

Installing and Customizing the HMA Indicator

Installing the HMA indicator on MetaTrader is a straightforward process. Begin by downloading the HMA indicator files and extracting them to the MetaTrader “Indicators” folder. After restarting the MetaTrader platform, the HMA indicator will be available for use.

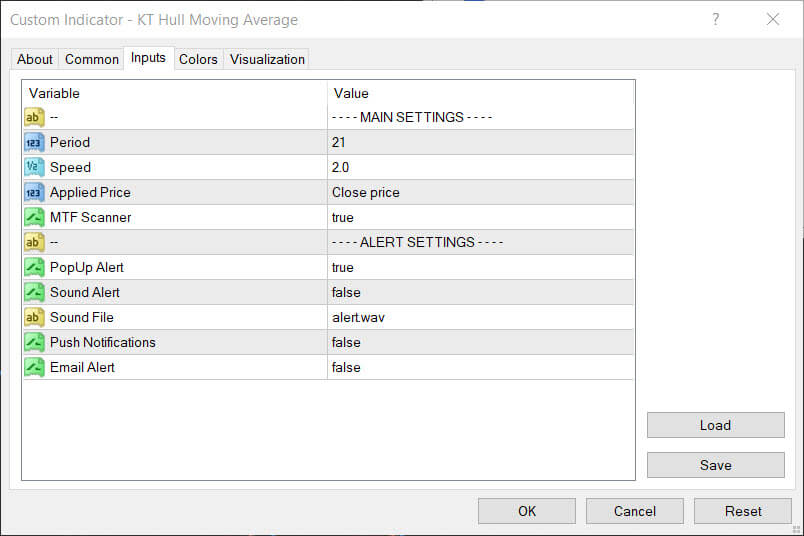

To customize the HMA indicator, traders can adjust several settings to suit their trading style. The period setting determines the number of candles the indicator will use to transform price data into a moving average. The shift setting allows traders to adjust the position or distance between the indicator and the price level.

Additionally, the method setting offers options such as simple, exponential, smoothed, and linear weighted calculation methods. The price setting specifies the type of price data the indicator will use for calculating the average, providing flexibility in how the HMA is applied to different trading scenarios.

Hull Moving Average Indicator Strategies

HMA can be used as a standalone indicator. However, we suggest using it with other indicators to improve the signal’s accuracy. The HMA is particularly effective in analyzing and interpreting price movement, helping traders to identify trends and make informed decisions.

Also, it’s practical to confirm the HMA’s signals using the Multi-timeframe scanner.

Using the HMA Indicator in Trading

The HMA indicator can be a powerful tool in a trader’s arsenal, offering various ways to generate trading signals. One common method is to use the HMA as a trend indicator. A bullish trend is confirmed when the HMA is above the price action, while a bearish trend is confirmed when the HMA is below the price action.

Traders can also identify potential trading opportunities by looking for crossovers between the HMA and the price action. A bullish crossover occurs when the price action crosses above the HMA, signaling a potential upward movement.

Conversely, a bearish crossover happens when the price action crosses below the HMA, indicating a possible downward trend. These crossovers can serve as entry and exit points, helping traders make informed decisions based on the current market conditions.

Inputs

Benefits of the HMA Indicator

The HMA indicator offers several significant benefits to traders. Its ability to eliminate lag altogether and improve smoothing simultaneously makes it a highly responsive and accurate trend indicator.

By filtering out market noise, the HMA delivers a smoother indicator line that is less prone to false signals, providing clearer insights into market trends.

Moreover, the HMA indicator is adaptable across all timeframes, making it a versatile tool for traders who analyze multiple timeframes. It can be used across various currency pairs within any forex trading system or strategy, offering additional confirmation of current market trends.

This adaptability and precision make the HMA indicator a valuable asset for traders seeking to enhance their trading performance.