Features

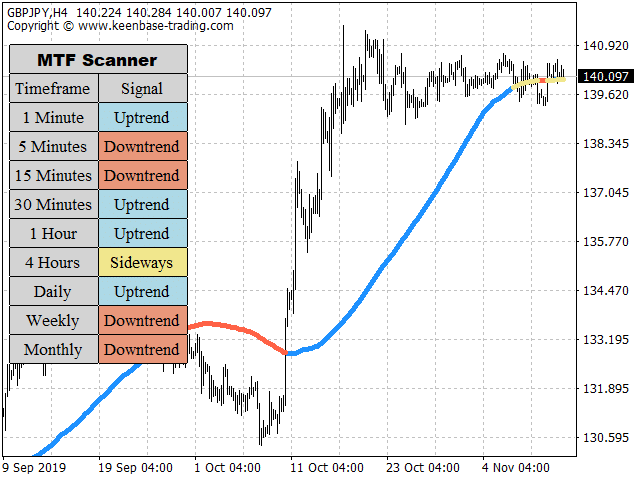

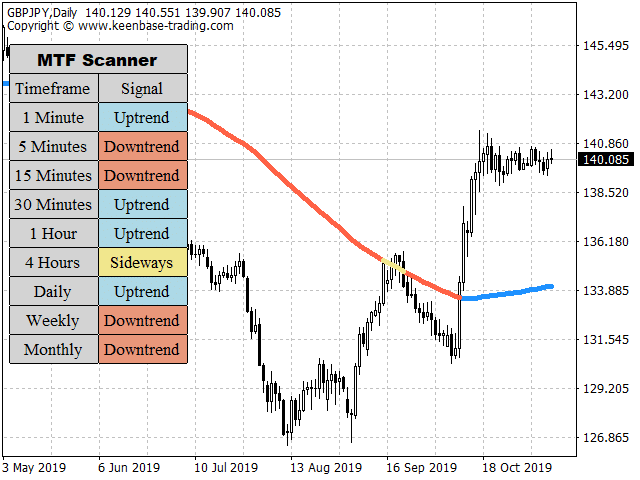

- Get a bigger picture with an inbuilt MTF-Dashboard, which shows the trend direction in every timeframe.

- When implemented, it dramatically improves the performance of trend trading strategies.

- It shows the trend strength without any fuss.

- Avoid bad trades by staying out in the duration of uncertainty.

- It can be imported by an expert advisor with a simple code.

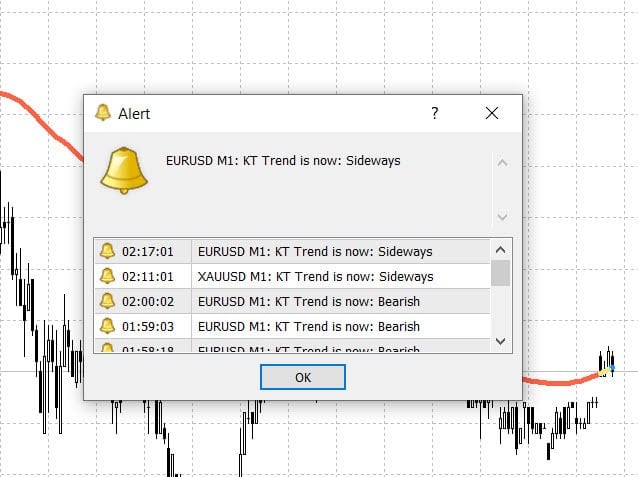

- All Metatrader alerts included, providing timely trading signals based on various indicators and models.

What is Uptrend in Trend Direction?

In an uptrend, also known as a bullish trend, the overall price movement of an asset is upward with consecutive higher swing highs and higher swing lows. A trend trading strategy typically only looks for long trades during an uptrend.

What is Downtrend?

In a downtrend, also known as a bearish trend, the overall price movement of an asset is downward with consecutive lower swing lows and lower swing highs. A trend trading strategy typically only looks for short trades during a downtrend.

What is Sideways trend?

In a sideways trend, the supply and demand are nearly in equilibrium. It usually occurs during consolidation before the price reverses into a new trend. A trend trading strategy usually avoids new positions during a sideways trend.

Indicator Settings and Parameters

The KT Trend Filter indicator offers several customizable settings and parameters to fit individual trading strategies. These include:

- Period: This setting determines the number of bars used to calculate the trend filter, allowing traders to adjust the indicator’s responsiveness to price data.

- Sensitivity: This parameter controls how sensitive the indicator is to price movements, enabling traders to fine-tune the balance between responsiveness and stability.

- Trend Strength: This setting specifies the minimum strength of a trend required to generate a trading signal, helping traders to focus on strong trends.

- Signal Line: The signal line is crucial for generating buy and sell signals, providing clear entry and exit points based on the trend direction and strength.

By adjusting these parameters, traders can tailor the KT Trend Filter Indicator to their specific trading needs, enhancing their ability to capture profitable trends.

Using the KT Trend Filter Indicator Effectively

The KT Trend Filter Indicator is versatile and can be used in various ways to identify and confirm market trends:

- Trend Identification: The indicator helps traders identify the direction and strength of a trend, making it easier to align their trades with the prevailing market direction.

- Signal Generation: Based on the trend direction and strength, the indicator generates buy and sell signals, providing clear guidance for entering and exiting trades.

- Trend Confirmation: The indicator can be used to confirm the trend direction and strength, adding an extra layer of confidence to trading decisions.

By leveraging the KT Trend Filter indicator, traders can enhance their trading strategies, improve their market analysis, and make more informed trading decisions.

Installation and Setup

If you've purchased from the MQL5 marketplace, the indicator will be installed directly to your MT4 or MT5 automatically.

Manually installing and setting up the KT Trend Filter indicator is straightforward. Follow these steps to get started:

- Download the indicator file: Obtain the KT Trend Filter indicator file from My-Downloads.

- Copy the Indicator file: Place the downloaded indicator file into the indicators folder under MQL4/MQL5 folder of your MetaTrader platform.

- Restart MetaTrader: Restart the MetaTrader platform to ensure the indicator is properly loaded.

- Add to Chart: Open a new chart and add the KT Trend Filter Indicator to it.

- Adjust Settings: Customize the settings and parameters to suit your trading strategy.

By following these steps, you can quickly set up the KT Trend Filter Indicator and start using it to enhance your trading strategy. Note that this is a custom indicator and may not be available on all trading platforms.

Advantages of KT Trend Filter Indicator

- It helps you to cut the losses early. It’s recommended to close a trading position if the trend changes its direction to the opposite side.

- It helps to lower the cost of your transactions as trend following discourages high-frequency trading against the market trend.

- Price action setups are more effective if they align with the trend direction, as confirmed by trend indicators.

- It helps to catch the strong trends early.

- Trend following trading systems saves tons of time as it doesn’t provide trading opportunities too often.