Configuring the KT Liquidity Sweep Filter Indicator

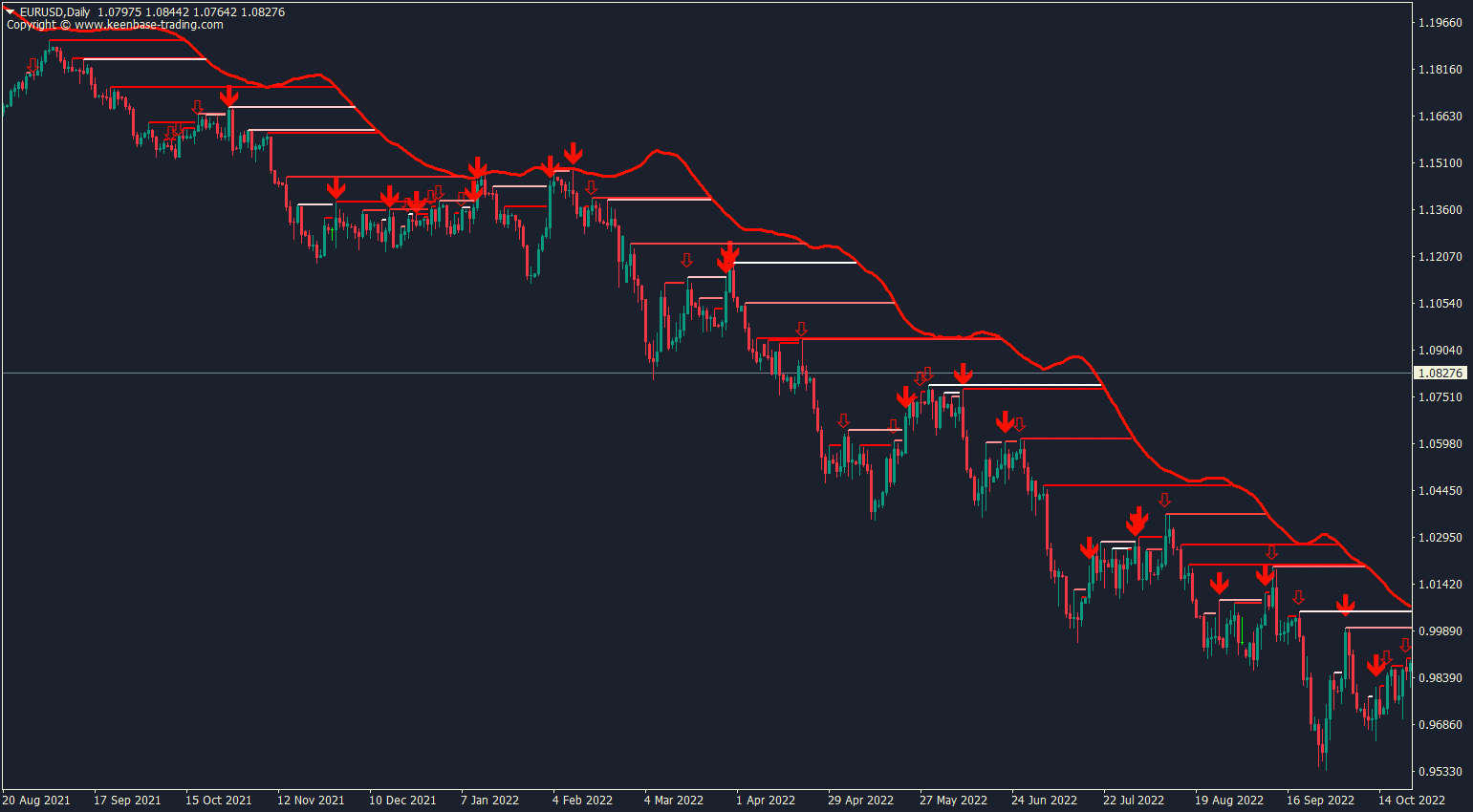

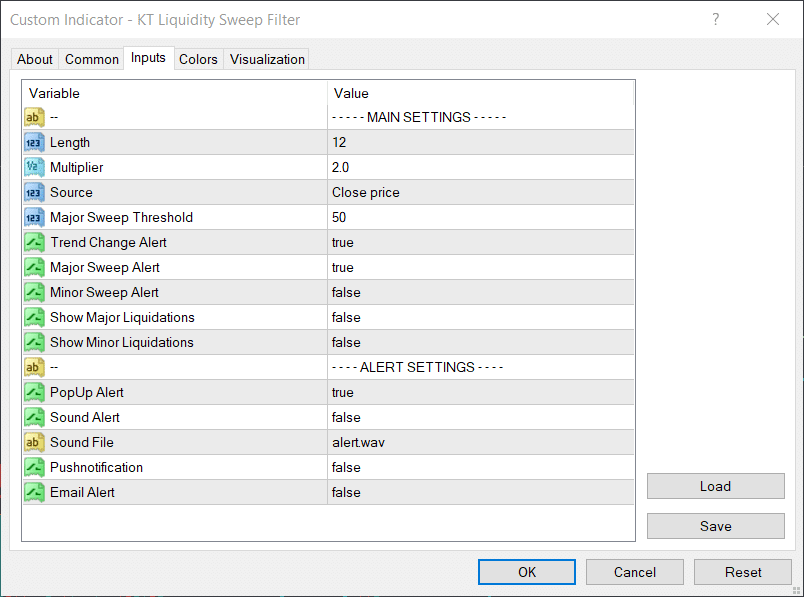

- Trend Filter Settings: Adjust the length and multiplier to align signals precisely with your chosen instrument and timeframe.

- Major Sweep Threshold: Adjust this setting to reduce overly frequent or false signals, enhancing signal reliability.

- Alert Customization: Enable or disable notifications separately for major and minor signals.

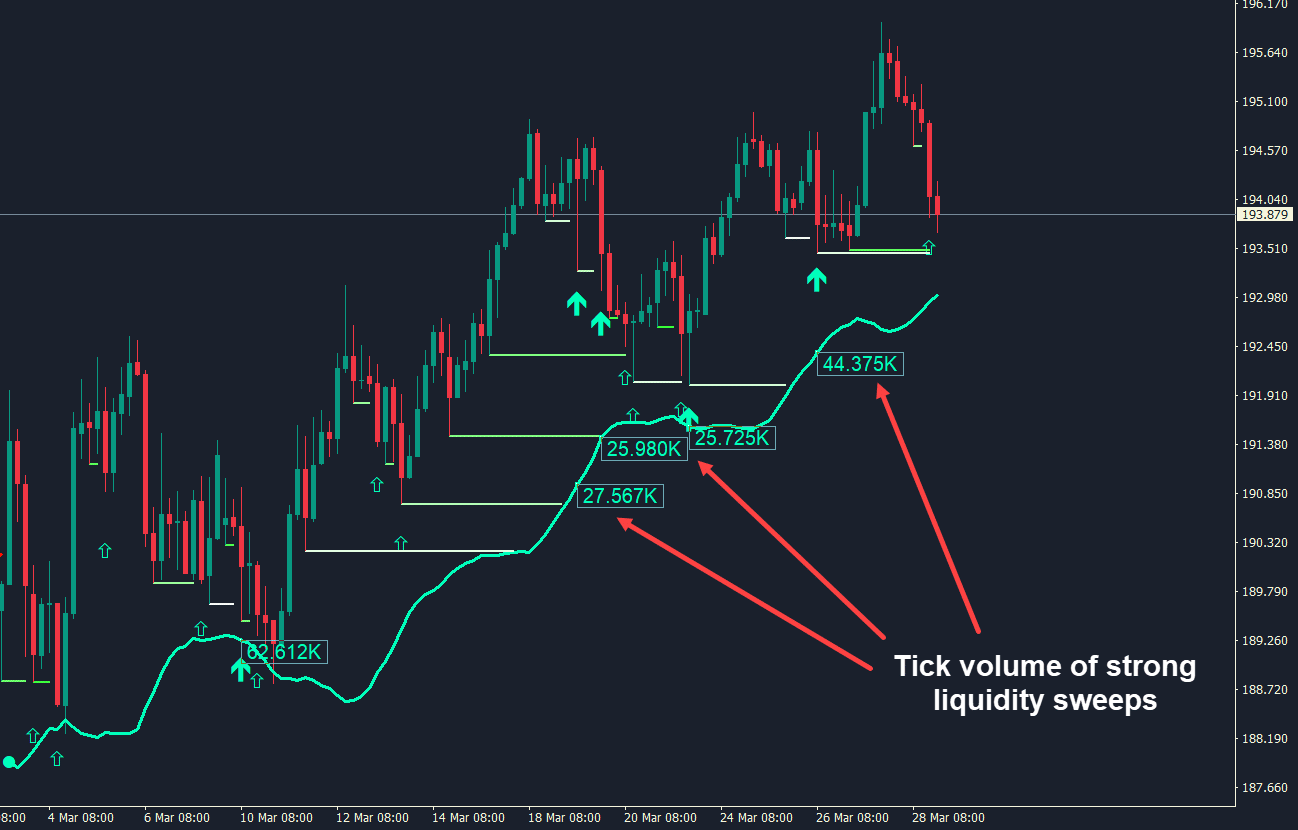

- Sweep Volume Display: Easily enable or disable numerical displays showing the total volume involved in major and minor liquidity sweep candles.

Understanding Liquidity Sweeps and Their Importance

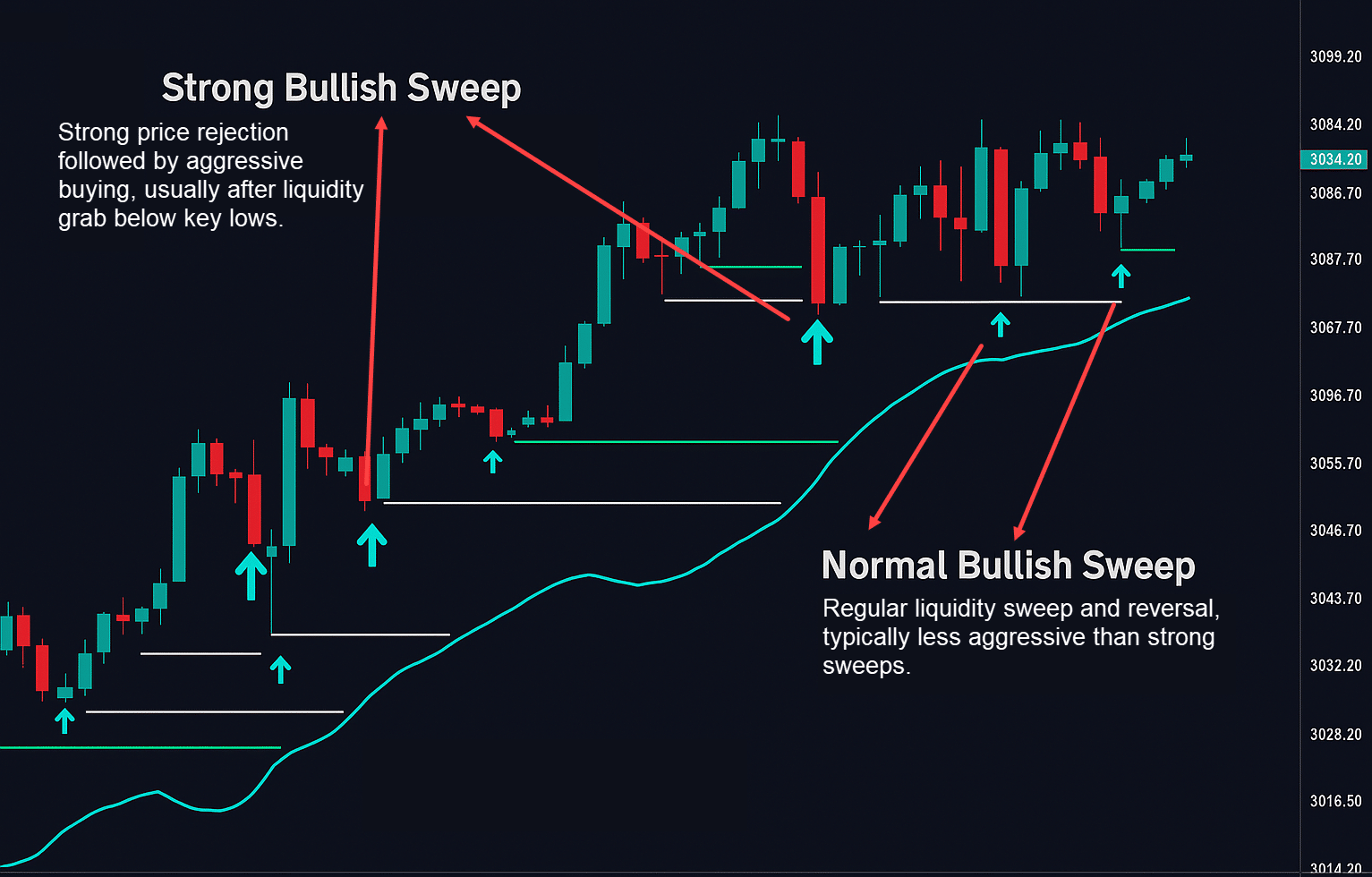

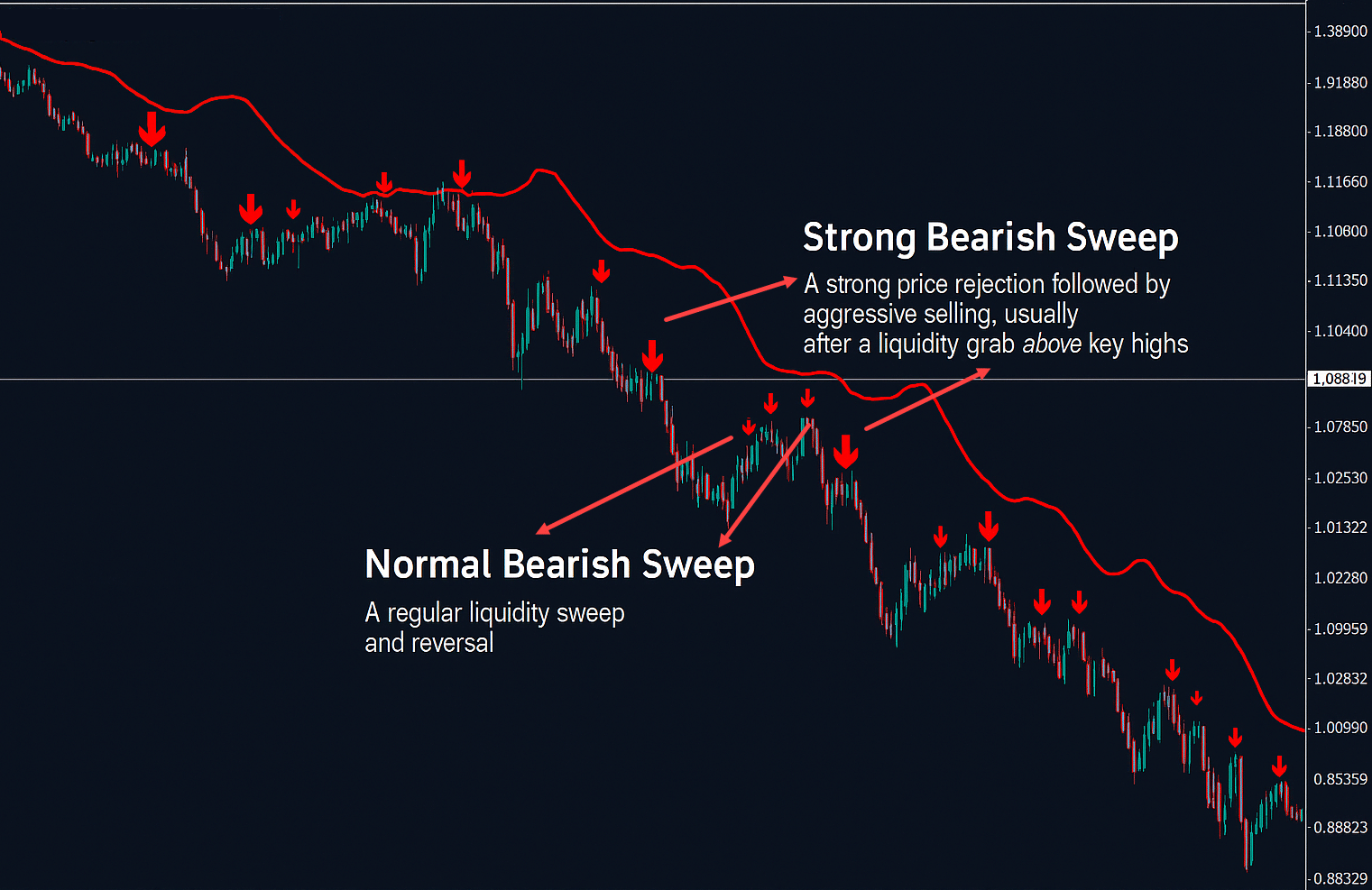

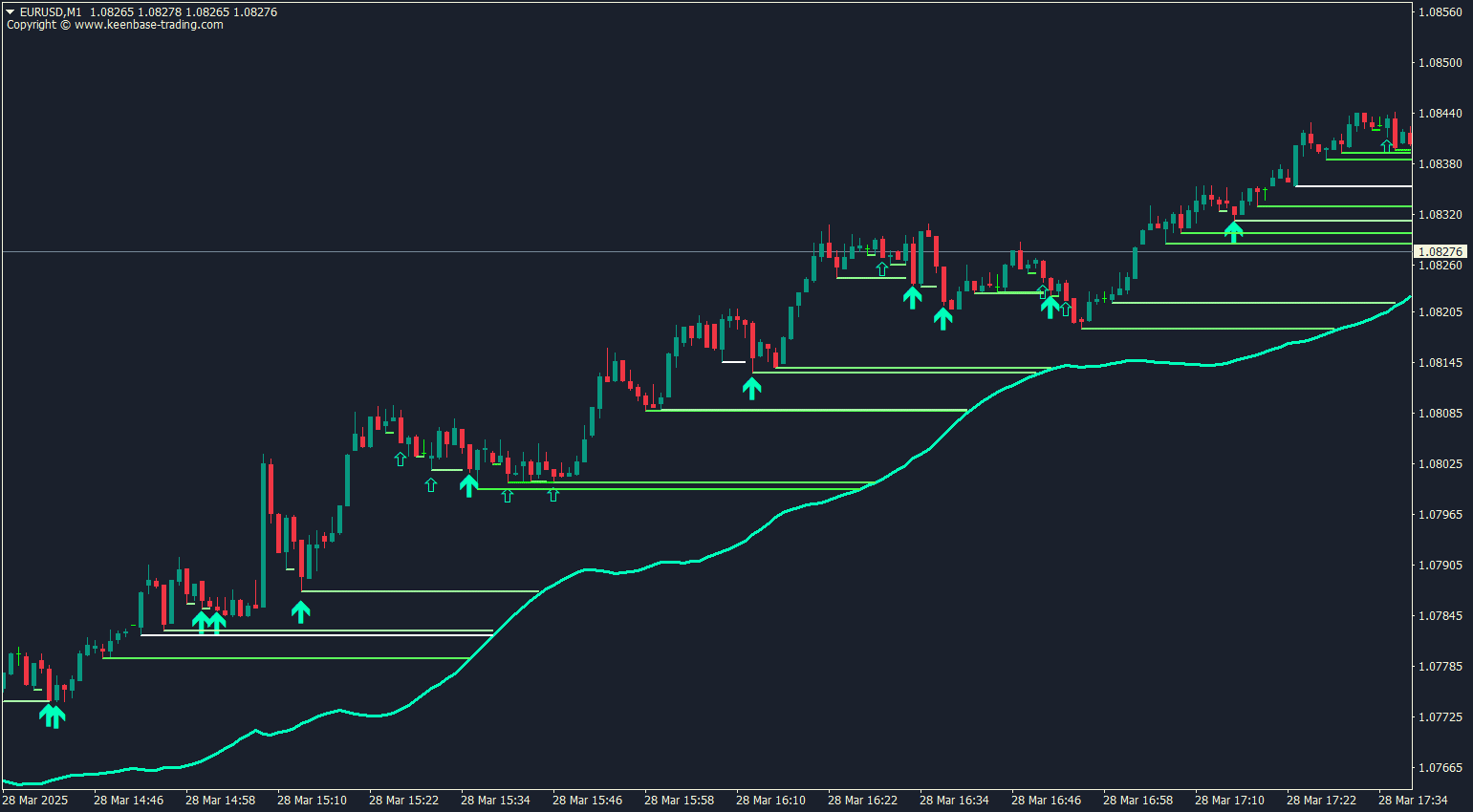

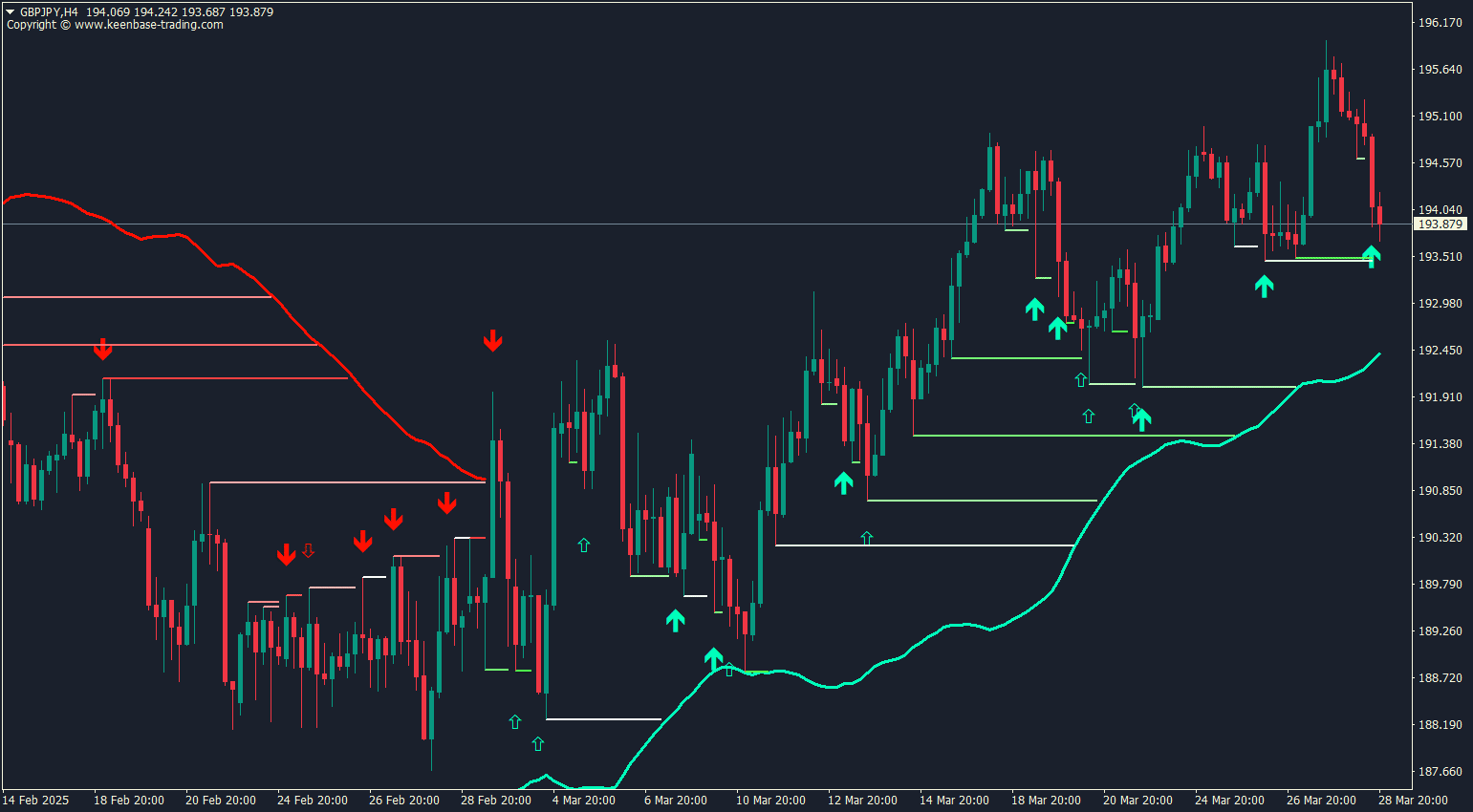

Liquidity sweeps happen when price briefly moves through significant levels, triggering clustered stop-loss orders and quickly reversing direction—forming distinctive wicks on charts. These sweeps reveal areas where large institutional traders execute substantial orders, driving rapid price movements.

The KT Liquidity Sweep Filter indicator precisely identifies these critical zones using price action and volume data, enabling traders to anticipate market reversals and effectively capitalize on trend-following opportunities.

Liquidity Sweeps vs. Liquidity Grabs: What's the Difference?

While liquidity sweeps involve price movement aimed at triggering a cluster of stop-loss orders across broader market levels, liquidity grabs specifically target precise, clearly-defined price points. Recognizing this subtle difference helps traders better anticipate market movements and enhances the accuracy of trading decisions.

Utilizing Liquidity Sweeps in Your Trading Strategy

Effectively using this indicator involves closely observing price reactions at key liquidity zones where large order accumulations typically occur. Visual identification of these liquidity sweeps provides valuable insights into market behavior, improving your trading decisions.

By clearly highlighting significant trading activity, the indicator helps traders anticipate potential market reversals and key trend continuations. Combining this insight with your own analysis, such as support and resistance identification, can substantially enhance the accuracy and effectiveness of your trading strategy.

Benefits of Using the KT Liquidity Sweep Filter Indicator

- Avoid False Breakouts: Helps traders minimize false breakout entries by accurately highlighting significant liquidity zones and confirming trend direction.

- Improved Market Reversal Prediction: Clearly identifies major liquidity events, giving traders an edge in anticipating genuine market reversals instead of temporary fluctuations.

- Highly Adaptable: Versatile settings enable traders to easily adapt signals to their unique trading style and preferences.

Common Challenges and Troubleshooting

- Reducing Market Noise: If you're receiving too many signals, try increasing the major sweep threshold or fine-tuning the trend filter settings to clearly distinguish genuine liquidity events from market noise.

- Resolving Signal Delays: If alerts seem delayed, double-check your platform’s alert settings and ensure your system resources (e.g., CPU, internet connection) aren't causing performance lag. Regularly reviewing these factors will ensure timely, efficient notifications.

Final Thoughts

The KT Liquidity Sweep Filter indicator empowers traders by clearly pinpointing critical liquidity zones and identifying reliable market reversal opportunities. Its customizable settings enable you to adapt the indicator precisely to your trading style, enhancing signal accuracy and reducing false breakouts.

By strategically leveraging this powerful tool, traders can significantly improve their decision-making process and consistently achieve better trading outcomes.