KT Order Block indicator

MT4/MT5

- Description

KT Order Block indicator automatically detects and marks strong bullish and bearish order blocks across multiple timeframes. It uses a unique combination of price action to reveal the area of price reversal, originating from significant buy and sell orders strategically placed by major market players.

Read More

Features

- 🎯 Algorithmic Precision: A refined and distinctive order block algorithm meticulously crafted to precisely identify the most pivotal order blocks, often triggering price reversals.

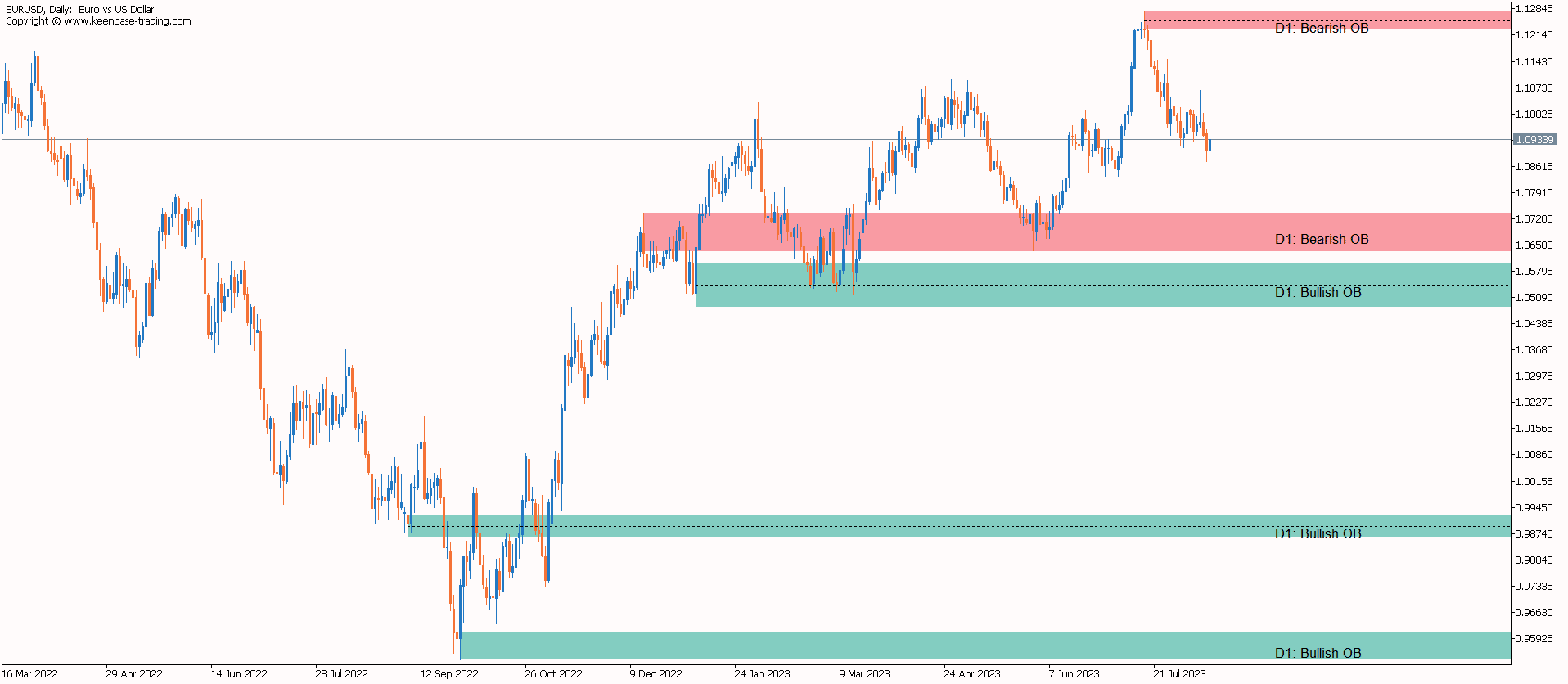

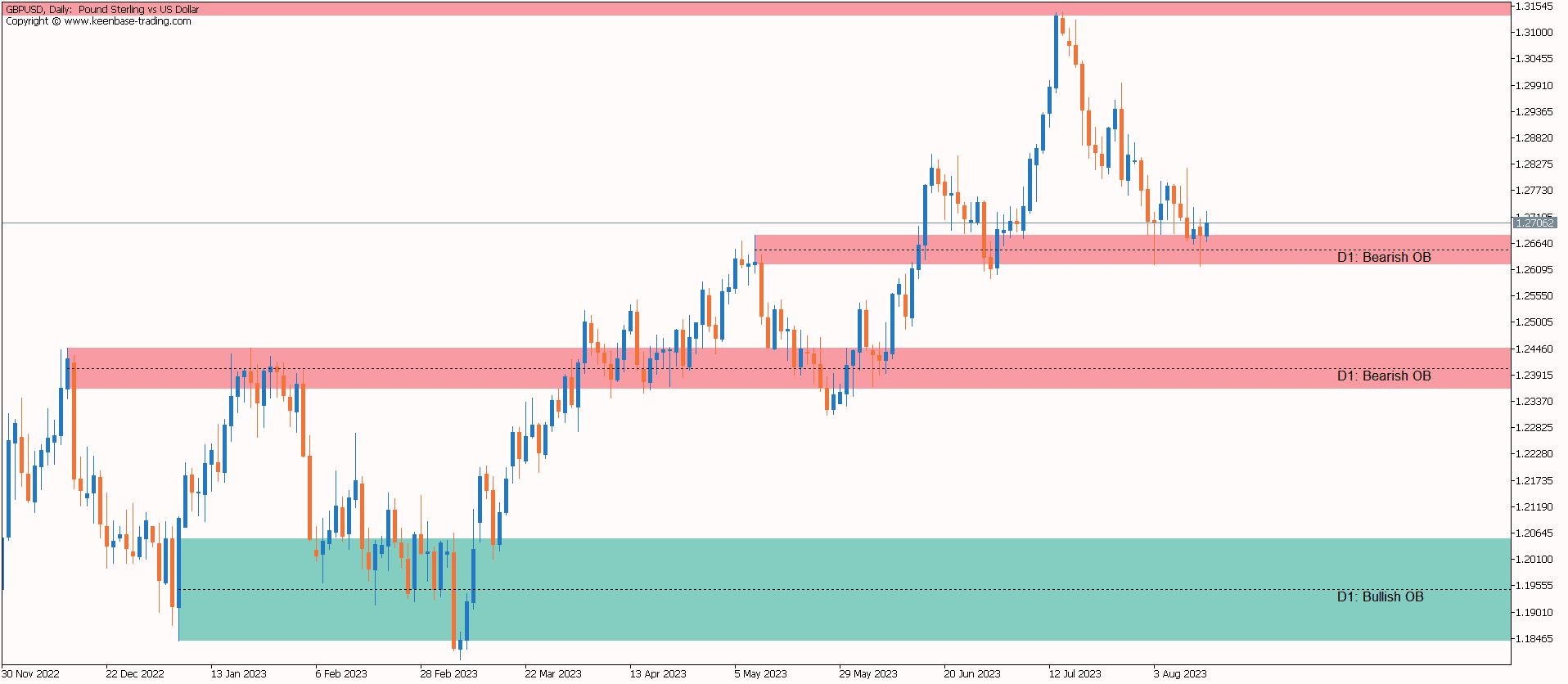

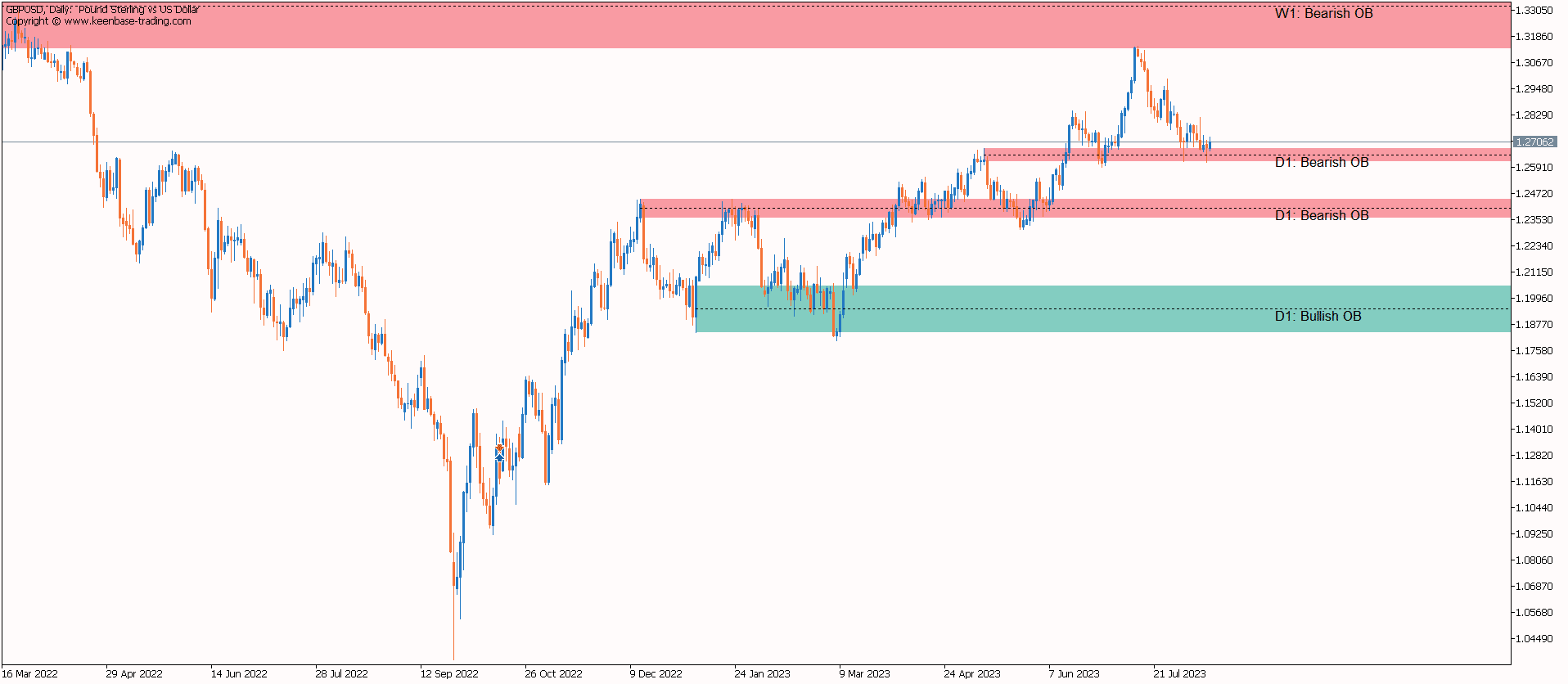

- 🌐 Holistic Market View: Simultaneously displays order blocks from up to three timeframes, revealing a comprehensive market perspective through multi-timeframe analysis.

- 📊 Chart Clarity: Ensures a clear and organized chart by meticulously preventing any overlap of order blocks, eliminating clutter and potential confusion.

- 🖼️ Pre-Loaded Chart Template: Our Order Block indicator comes with a pre-loaded chart template that harmonizes seamlessly with the indicator's properties, ensuring an optimized visual experience.

- 📈 Reversal Anticipation: It incorporates a 50% markup line within each order block, providing a tool to anticipate potential reversals stemming from these blocks.

- 🎨 Dynamic Color Adaptation: Offers the flexibility to dynamically switch the colors of bullish and bearish order blocks, adapting to the prevailing price action.

- 🔧 Tailored Customization: Empowers users with complete customization options, allowing adjustments ranging from order block amplitude to colors and width, ensuring alignment with individual preferences.

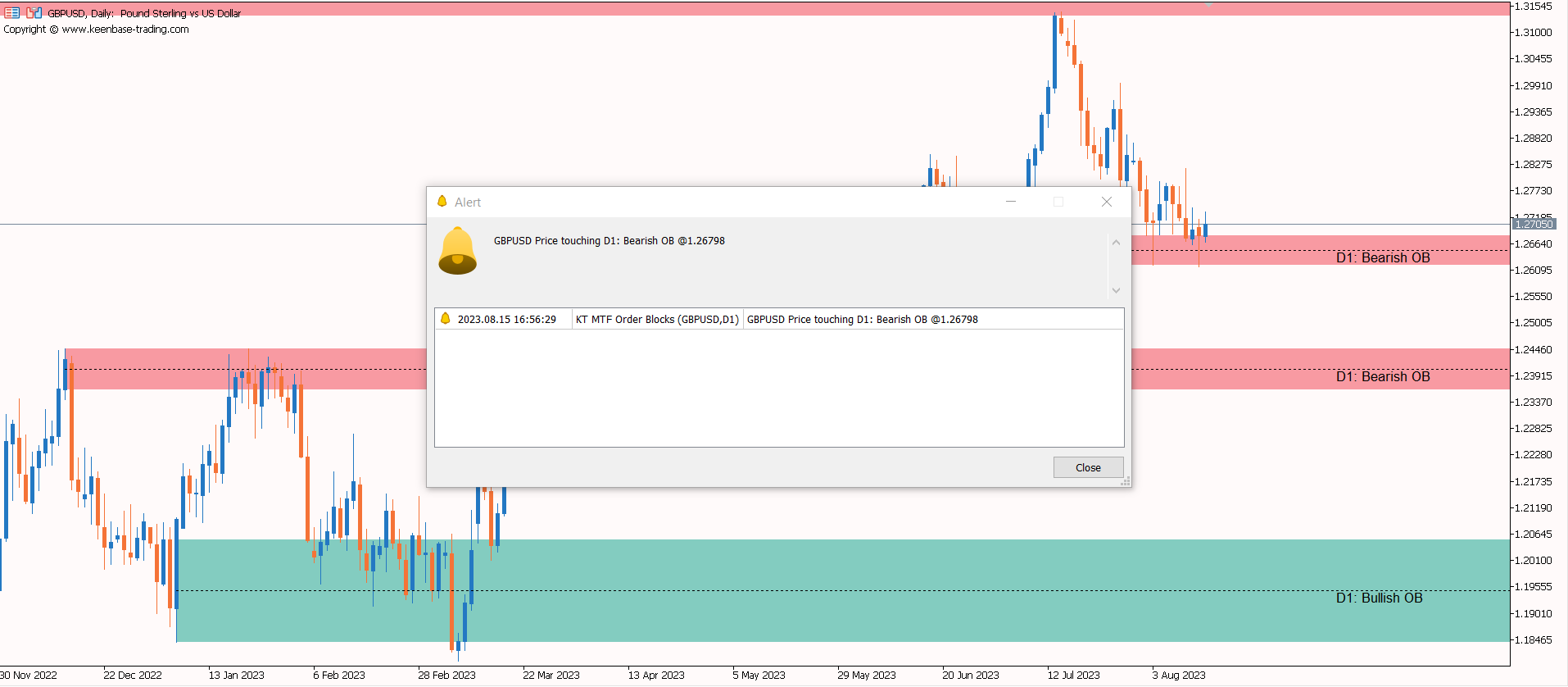

- 🔔 Proactive Alerts: Provides various alert options, including PopUp notifications, mobile alerts, email notifications, and sound cues, each activated when price approaches an order block.

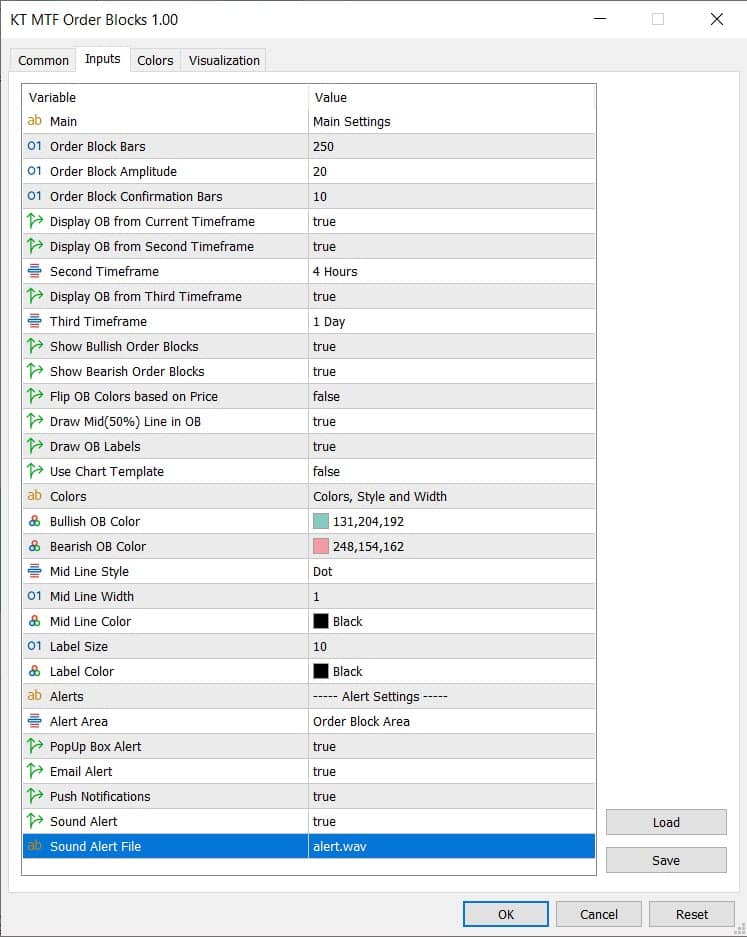

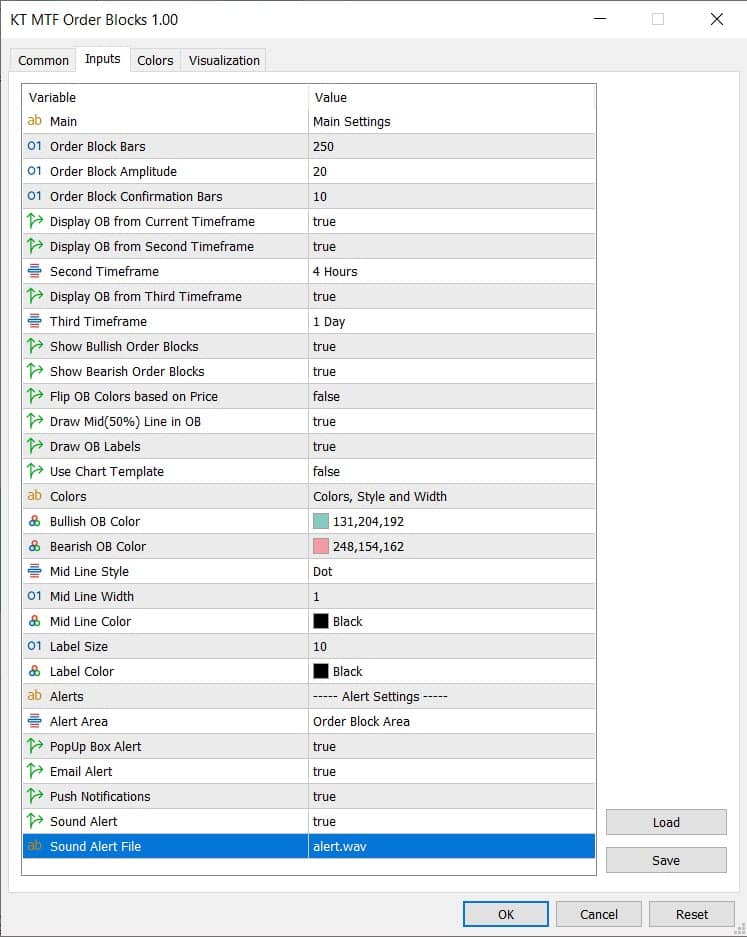

Inputs Settings

- Order Block Bars: Specify the number of bars to identify order blocks. The order blocks from the recent bars hold stronger influence on price behavior.

- Order Block Amplitude: You can adjust the value to detect order blocks. Greater values yield fewer but more accurate blocks; smaller values increase the number of blocks detected.

- Order Block Confirmation Bars: Define the number of bars for order block confirmation. A higher value enhances the strength of the identified order block.

- Display OB from Current Timeframe: When enabled, it displays order blocks from the current chart timeframe.

- Display OB from Second or Third Timeframe: Activating this option showcases order blocks from the chosen alternate timeframes.

- Show Bullish/Bearish Order Blocks: With this input, you have the choice to display exclusively bullish or bearish order blocks.

- Flip OB Colors based on Price: Enabling this feature causes the colors of bullish and bearish order blocks change based on the current price movement.

- Draw Mid(50%) Line in OB: Activating this option results in the display of a 50% Fibonacci line within each order block.

- Use Chart Template: Enable this setting to load a dynamic chart template that perfectly complements our order block indicator.

Key Takeaways

- Order blocks are concentrated buying or selling areas significantly influencing market trends and liquidity, often serving as future support or resistance zones.

- Our Order Block indicator automates the identification of order blocks, is versatile across various market types and timeframes, and offers customization for different trading styles and strategies.

- Traders should integrate order blocks with other technical indicators for comprehensive analysis while avoiding mistakes such as over-reliance on order blocks without considering support/resistance levels and appropriate timeframes.

Understanding Order Blocks

Order blocks refer to specific areas on a trading chart that signify large quantities of buy or sell orders placed by significant players in the market. When these hefty volumes are triggered, they can cause considerable shifts in price, thereby crucially affecting both liquidity and overall market sentiment.

These order clusters frequently serve as focal points for subsequent price movements, thus becoming essential instruments for traders.

Our discussion will delve deeper into what constitutes an order block, its role within the market structure framework, and how it impacts movements in price action.

Defining Order Blocks

In the trading realm, an order block is discerned on charts by pinpointing zones where there has been a substantial shift in price or abrupt alterations in its trajectory.

At the level where an order block exists, it’s typical to find accumulations of pending orders from various traders that have the potential to instigate volatility in prices.

These blocks are signified on a chart by groupings of bars or candlesticks that denote intense levels of buying or selling at those specific price points.

The process for detecting order blocks involves scrutinizing historical price actions and monitoring ongoing interest and transactions at particular prices within the framework of the current market structure.

The Role of Order Blocks in Market Structure

Regarding market structure, order blocks are pivotal segments within the market known for their substantial buy or sell activity, which may serve as key areas of support or resistance in future price movements.

Order blocks illuminate crucial turning points by identifying the last contrasting candle before a significant move, revealing imbalances, and suggesting possible regions where prices might reverse to kick off another major trend.

These blocks also highlight specific price levels with dense liquidity accumulation often associated with the strategic trading behavior of large institutional participants. This highlights critical zones that capture considerable attention across various financial markets, such as stocks, futures, forex, and cryptocurrencies.

These concepts remain applicable over diverse time frames within each respective market environment.

Impact on Price Action

Order blocks play a significant role in shaping price action as they:

- Counteract the buying or selling momentum, potentially leading to periods where prices consolidate or reverse.

- Often, they return to unexplored order block zones, completing the remaining parts of initial orders, which can trigger a bounce back or continue an existing trend.

- Equip traders with crucial information for assessing risks and forecasting likely profitable movements in price.

Grasping how to order blocks gives traders important insights that enhance their trading approach.

The size and strategic placement of order blocks are instrumental for traders when pinpointing vital exit points. This is due to their connection with essential support and resistance levels, where changes in price direction frequently occur.

Key Features in Details

The KT Order Block Indicator presents a flexible display that can be adapted to various financial markets and timeframes, complete with comprehensive alert capabilities.

Within the MT4/MT5 environment, it identifies critical zones of purchase and sale by marking them with color-coded rectangles on the chart and using arrows or lines to enhance visibility.

Its advanced notification system is designed to alert traders through several means – visually on-screen, via sound notifications, and push notifications to mobile devices and emails – whenever price crosses into an order block.

With this indicator, traders have full control over its visual presentation. They can modify colors, adjust the size of blocks displayed on their charts, and even choose up to four different timeframes for concurrent visualization to highlight these important areas more effectively.

Identifying Bullish and Bearish Order Blocks

The KT Order Block Indicator is a tool designed to aid traders by highlighting bullish and bearish order blocks, which could indicate imminent trend reversals or continuations.

During a market price action downtrend, bullish order blocks come into play as zones with an active accumulation of buy orders from institutional traders and banks. This activity often suggests a possible reversal toward an upward trend.

Conversely, bearish order blocks emerge when the market exhibits an uptrend. Significant areas indicate that major players like institutional traders and banks are piling up sell orders—often acting as signals for potential pauses or reversals in the ongoing upward price movement toward a bearish trend direction.

Recognizing Bullish Order Blocks

During periods of downward movement in the market, bullish order blocks emerge as key zones where notable purchasing has occurred, suggesting possible reversals to an uptrend. To pinpoint a bullish block on the chart within a downtrend, one should find the lowest point of the latest candle and couple it with its preceding high.

Then, encompass this segment with a rectangular shape extending toward the right edge of your visual graph representation. Order block indicators are valuable tools that help traders easily recognize these bullish blocks by illuminating them in navy blue.

Identifying when trends might pivot is crucially associated with observing bullish order blocks—especially those forming at downtrends’ endpoints, which can be indicative signs.

Recognizing Bearish Order Blocks

During an uptrend, bearish order blocks represent zones where substantial selling has occurred, hinting at a possible reversal to a downtrend. Specific features identify these order blocks.

- A bullish candle or bar is followed promptly by an aggressive downward move.

- This block creates a new lower low and is anticipated to become a resistance level.

- A large candle typically highlights it with an upper wick, which denotes rejection of higher price levels.

To pinpoint these bearish order blocks on your chart while observing an uptrend, you should mark out the peak price of the last bullish candle before it shifts downward and track down through to the following swing low. Encase this segment within a rectangle that stretches rightward across your chart, as this forms your potential zone for future resistance based on past price action.

Integrating our Order Block Indicator into Your Trading Strategy

Utilizing the Order Block Indicator within your trading approach can improve recognition of trends, pinpoint entry and exit points accurately, and manage risks.

The MT4 and MT5 version of this indicator caters to diverse trading techniques, including scalping and swing trading, by marking out probable zones where market reversals could occur.

Order blocks serve as a compass for traders seeking to make informed decisions regarding when to enter trades based on signs that key players are making substantial moves in the market.

Traders need to pay attention to periods of consolidation following an identified order block because such patterns often precede significant directional shifts that signal viable opportunities for entering a trade.

Determining Trend Direction

The Order Block Indicator assists traders in identifying the prevailing direction of a trend by marking bullish and bearish order blocks on charts. This tool provides insights into market trends by plotting these blocks, indicating whether the current momentum is bullish or bearish.

When used alongside trend indicators like moving averages, the Order Block Indicator can help gauge the robustness of ongoing trends and ensure that order blocks correspond with contemporary market movements.

The indicator also accentuates key zones of support and resistance. Breaches in these areas may indicate an impending continuation or change in trend direction.

Fine-Tuning Entry and Exit Points

Order blocks can sharpen the accuracy of pinpointing entry and exit points, enhancing trading precision and bolstering risk management. When a price revisits the range of an order block following a breakout, it may indicate an opportune moment to enter the inception of a new trend.

Order block indicators assist traders in positioning pending orders at the onset of trend movements, which helps mitigate risks while facilitating early market entry.

Incorporating Fibonacci retracement levels with these strategies improves recognition of possible order block formations, providing supplementary confirmation for determining entries and exits.

Managing Risk-Reward Ratio

When utilizing order blocks in trading, it is essential to maintain a well-managed risk-reward ratio by properly sizing positions and employing strategic stop-loss orders.

These stop-losses are optimally positioned slightly past the pivotal areas of the block, safeguarding against abrupt market price shifts while controlling risk exposure.

The distance from this predetermined stop-loss point to the expected profit target determines the risk-reward ratio. This helps guarantee that prospective returns merit taking on said risks.

Traders need to tailor their position sizes according to their appetite for risk and current market conditions, which includes assessing factors like leverage and how far away the entry point is from where they set their stop loss level.

Combining with Other Indicators

Utilizing order blocks with other technical indicators can reinforce trading decisions by providing extra verification of market trends and cues for possible reversals.

When order blocks are integrated with indicators such as the RSI, MACD, or Supertrend, traders gain reinforced confirmations on prevailing market directions and potential turnaround signals.

To refine trading strategies further:

- Employing Fibonacci retracement levels.

- Conducting an in-depth analysis on a lower timeframe upon the price encountering an order block.

- Implementing volume-centric indicators like Accumulation/Distribution and On-Balance-Volume (OBV).

These tools can be employed hand-in-hand with order blocks to scrutinize how shifts in volume relate to price fluctuations, which could signal substantial orders from institutional players within the market.

Applications of KT MTF Order Block Indicator

- Identifying Key Reversal Points: Our order block indicators helps traders locate critical areas on the chart where price reversals are likely to occur due to significant buy or sell order placements.

- Confirmation for Entry and Exit: Traders can use the order blocks to confirm their entry and exit points for trades, enhancing the accuracy of their trading decisions.

- Enhancing Support and Resistance Analysis: The indicator assists in pinpointing levels of support and resistance, aiding traders in placing stop-loss orders, setting profit targets, and understanding potential price movements.

- Fine-tuning Risk Management: By recognizing areas of substantial order activity, traders can manage their risk more effectively by adjusting position sizes and placement of protective stops.

- Filtering Trade Setups: The indicator acts as a filter for trade setups, allowing traders to focus on opportunities that align with the identified order blocks, increasing the probability of successful trades.

- Integrating with Trend Analysis: When combined with trend analysis, the indicator can help traders identify order blocks that align with the prevailing trend, offering valuable insights for trend-following strategies.

- Spotting Breakout Zones: Traders can utilize the order blocks to identify potential breakout zones where strong order activity might lead to significant price movements.

- Incorporating into Swing Trading Strategies: The order blocks can be integrated into swing trading strategies, aiding traders in capturing price swings over short to medium-term horizons.

- Fine-tuning Entry Timing: The indicator's alerts can notify traders when price is nearing an order block, assisting them in timing their entries with precision.

- Analyzing Price Action Context: Traders can analyze the price action around order blocks to gain insights into market sentiment and potential shifts in supply and demand dynamics.

Installing and Using the Order Block Indicator

Setting up the Order Block Indicator is easy, providing users with a user-friendly interface and instantaneous evaluations of market structure. It is designed to work across all trading pairs, thus making it an adaptable tool for scrutinizing various markets such as cryptocurrencies, forex, stocks, indices, and commodities.

Traders can sharpen their approach by employing order block indicators to pinpoint supply and demand zones within the market—key areas where price reversals are likely to occur.

For those who utilize MT4 or MT5 for trading activities, a range of Order Block Indicators exists, including but not limited to the basic version. There’s an Order Block Breaker variant and one tailored around Smart Money Concepts.

Installation Process

Obtain the indicator file and transfer it to ‘Indicators’ directory under the data folder of your MT4 or MT5. Specifically, you should download a ‘.ex4’ or '.ex5' file of the Order Block Indicator and ensure it is placed correctly in that folder.

To add the installed Order Block Indicator on your chart, here are the exact steps to follow:

- Firstly, adjust settings enabling both automated transactions and DLL imports, which permits the smooth operation of said indicators on your platform.

- Open your MT4 or MT5 terminal and go to its Navigator window.

- Unfold the list under the Indicators section.

- Look for the indicator you’ve just installed (Restart your MT4/MT5 if the indicator name is not in the list).

- Drag and drop the KT Order Block indicator onto a chart.

The user interface enables easy customization and maneuverability within the indicator’s visual and operational preferences. After installation, management and access to the Order Block Indicator are conveniently available through MT4/MT5's Navigator window.

The design of this block indicator is versatile, providing options to modify button size and placement in harmony with a trader’s existing chart layout.

Options within the settings allow for diverse representation of order blocks and allowing users to select display features. This flexibility ensures traders can personalize how information appears according to their needs.

KT Order Block Indicator facilitates real-time examination of market structure, providing in-depth observations for various timeframes and financial markets. This indicator is adept at conducting analyses across multiple intraday periods and daily, weekly, and monthly charts.

For pinpointing order blocks that considerably affect price action within the market, it’s advised to utilize higher timeframes, such as daily or weekly, when applying the order block indicator.

The tool includes a complex system for alerts and notifications encompassing visual signals on your screen, desktop terminal alerts, mobile app notifications, and email messages.

The indicator activates such notifications upon price entry into an identified order block area.

Common Mistakes to Avoid When Using Order Block Indicators

Traders must avoid common pitfalls when using Order Block Indicators, such as relying solely on order blocks without considering support and resistance levels or the importance of time frames. Sorely relying on order blocks can result in missing out on broader market trends and critical indicators.

Integrating order block analysis with additional technical analysis methods often yields more reliable signals.

Overlooking established support and resistance levels while employing Order Block Indicators might cause inaccurate interpretations of market cues. Analyzing order blocks within a one time frame could lead to a lack of awareness regarding larger market movements.

Relying Solely on Order Blocks

Sole dependence on order blocks can lead to misunderstanding market cues and neglect of overall market movements. An order block indicator ought to be used merely as an additional analysis instrument, not the only foundation for making trading choices. It enhances informed trading rather than dictating it entirely.

Ignoring Support and Resistance Levels

Ignoring support and resistance levels while utilizing order block indicators might result in flawed analysis and deceptive signals. Trading with order blocks without accounting for the larger context, such as these crucial levels, may lead to failed trades and a heightened chance of incorrect signals.

Frequently serving as support or resistance, order blocks can cause price reversals upon multiple encounters with these zones. Should an order block level be breached, it can shift functions between acting as a support or resisting Price movements.

Overlooking Time Frame Considerations

Choosing the right time frame while employing order block indicators can obstruct decision-making and negatively influence trading results. The effectiveness of using an order block indicator hinges on picking a suitable time frame, as it determines how relevant the trading signals are.

Whether traders aim for long-term or short-term trades will dictate the most beneficial time frame when utilizing an order block indicator. Ignoring the effect different time frames have could result in flawed analysis and raise the risk of receiving misleading signals.

Summary

In summary, the KT Order Block Indicator serves as a significant instrument that grants traders an alternative view of market dynamics and fluctuations in price.

It assists by shedding light on the actions of sizeable market players, potentially forecasting imminent price reversals while pinpointing strategic entry and exit points for trades.

When amalgamated with supplementary technical analysis techniques, this indicator can amplify trading strategies, refine precision in analyzing the market, and increase the likelihood of successful trading results.

It’s crucial to employ this tool judiciously—it should complement rather than constitute the sole foundation for your trading choices.

Frequently Asked Questions

What are order block indicators?

Order blocks pinpoint precise zones in price action where major participants in the market have established substantial buy or sell orders. These indicators are considered crucial for comprehending the dynamics of the market.

How do you predict order blocks?

You can forecast order blocks by drawing horizontal lines that link these points by recognizing significant swing highs and lows on the price chart. Technical indicators such as RSI, MACD, or Bollinger Bands can provide extra confirmation when combined with order blocks analysis.

How do you know which order block is right?

Begin by identifying a significant move and then sketch out a rectangle that spans from the peak to the trough of the order block region, projecting this shape rightward.

Keep an eye on the area encompassing the order block, as it’s common for prices to revisit this zone, which often lies within the 62% to 79% range of Fibonacci levels.

What are bullish and bearish order blocks?

During downtrends, areas where institutional traders are actively purchasing can be recognized as bullish order blocks, suggesting a possible trend reversal. Conversely, bearish order blocks in uptrends signify areas that hint at impending reversals of the current trend.

How can I install and use the Order Block Indicator?

Download the Order Block Indicator and insert it into your MT4 or MT5's Indicators folder to set up and utilize this tool. Afterwards, you can control and operate it from within the Navigator panel on the left side.

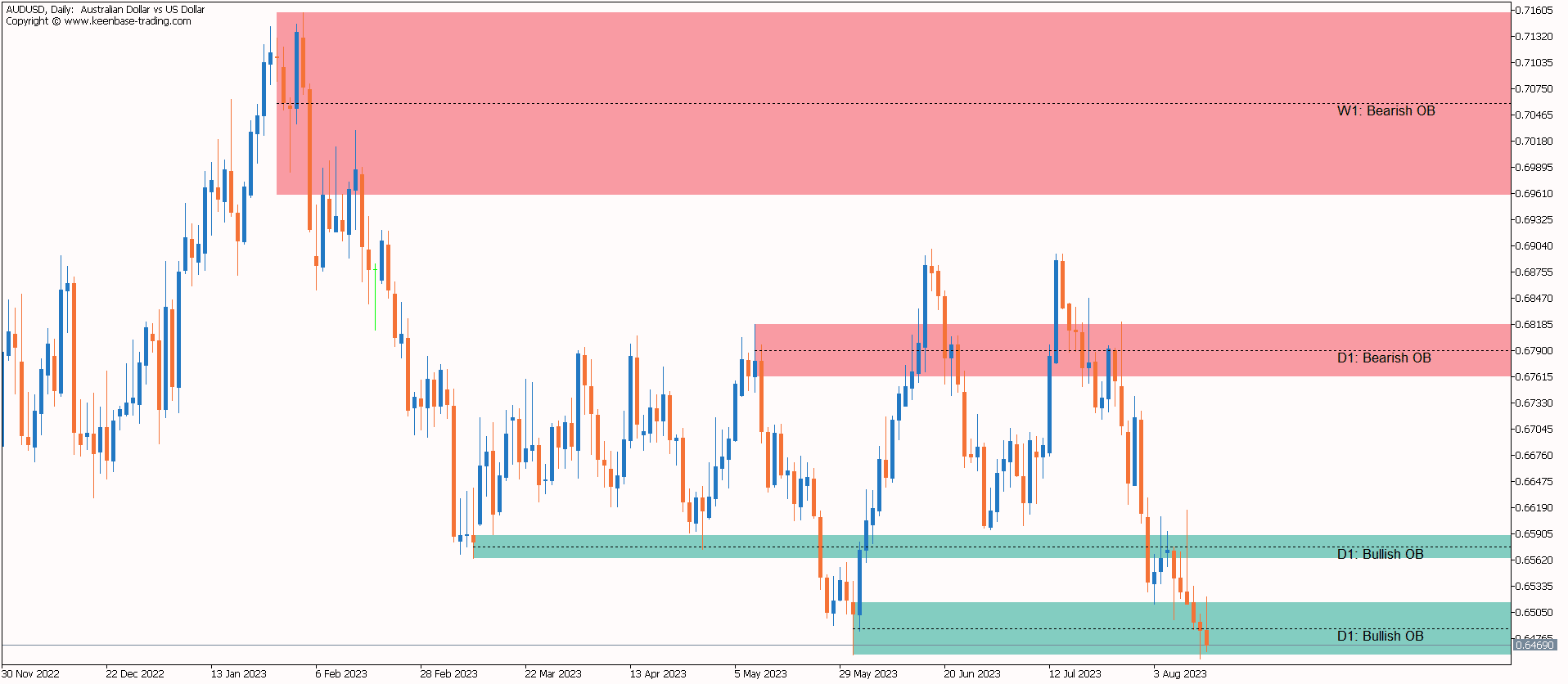

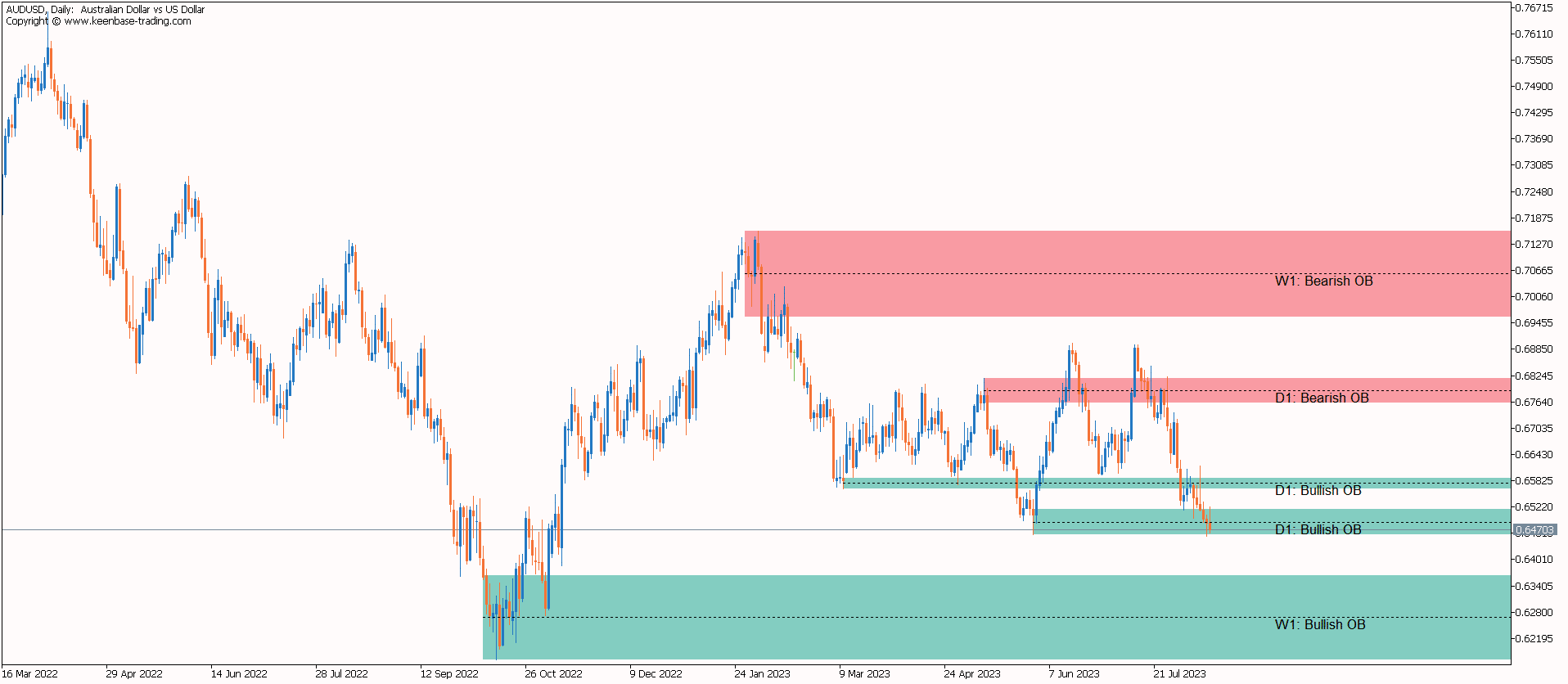

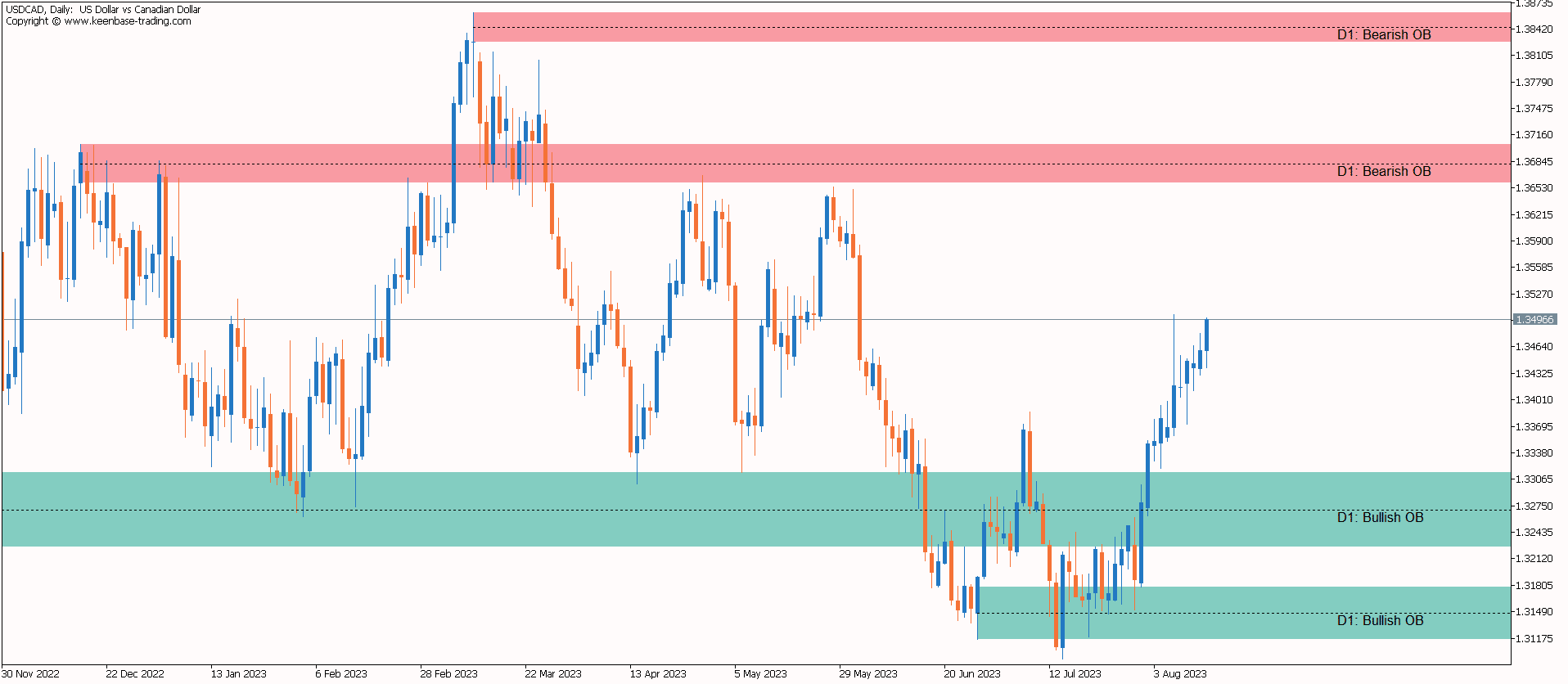

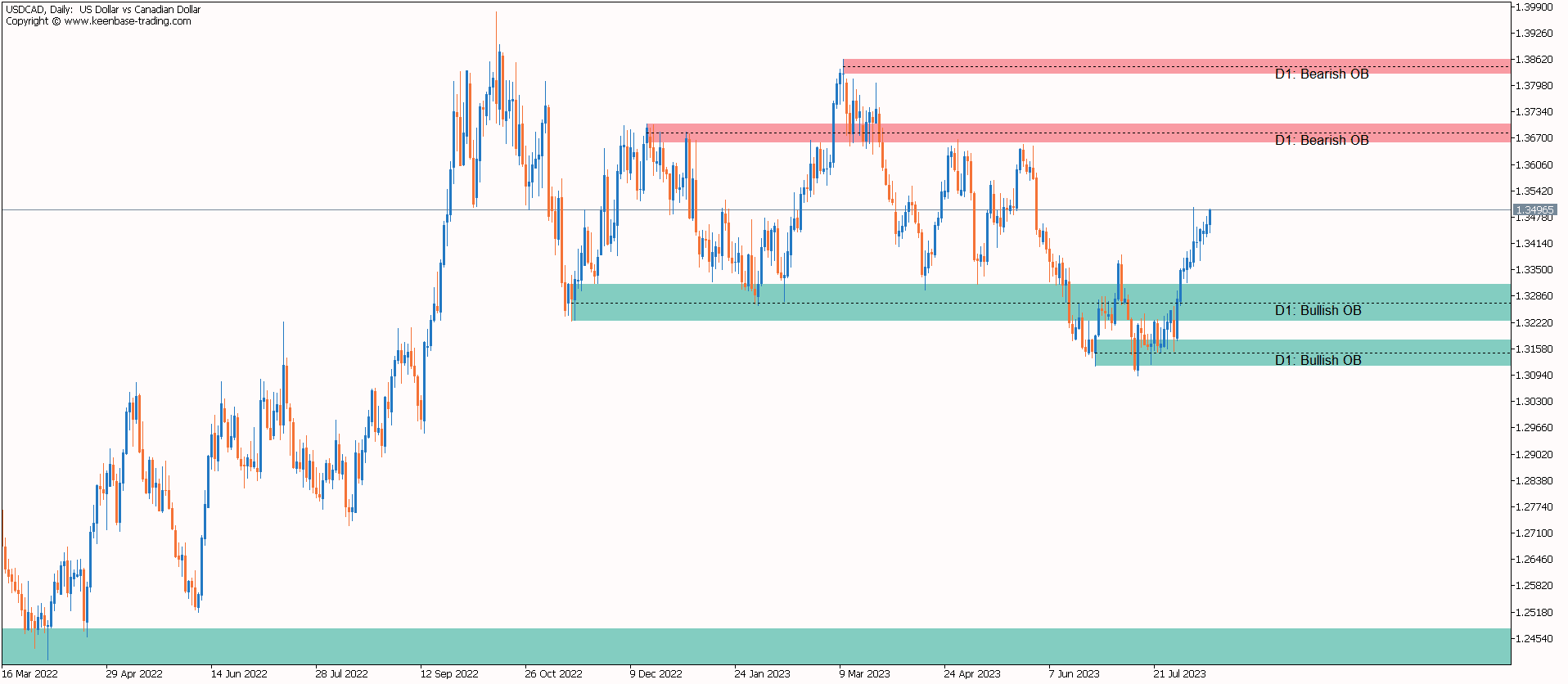

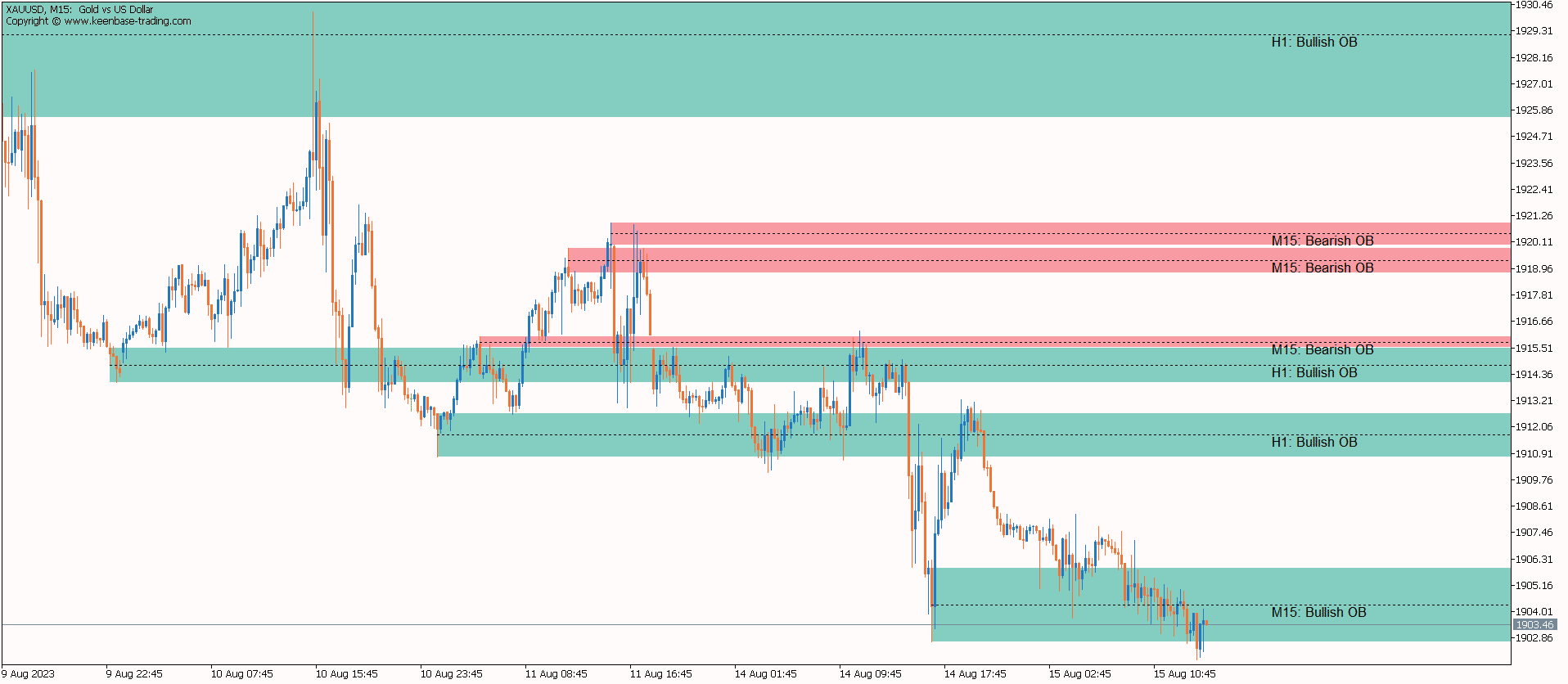

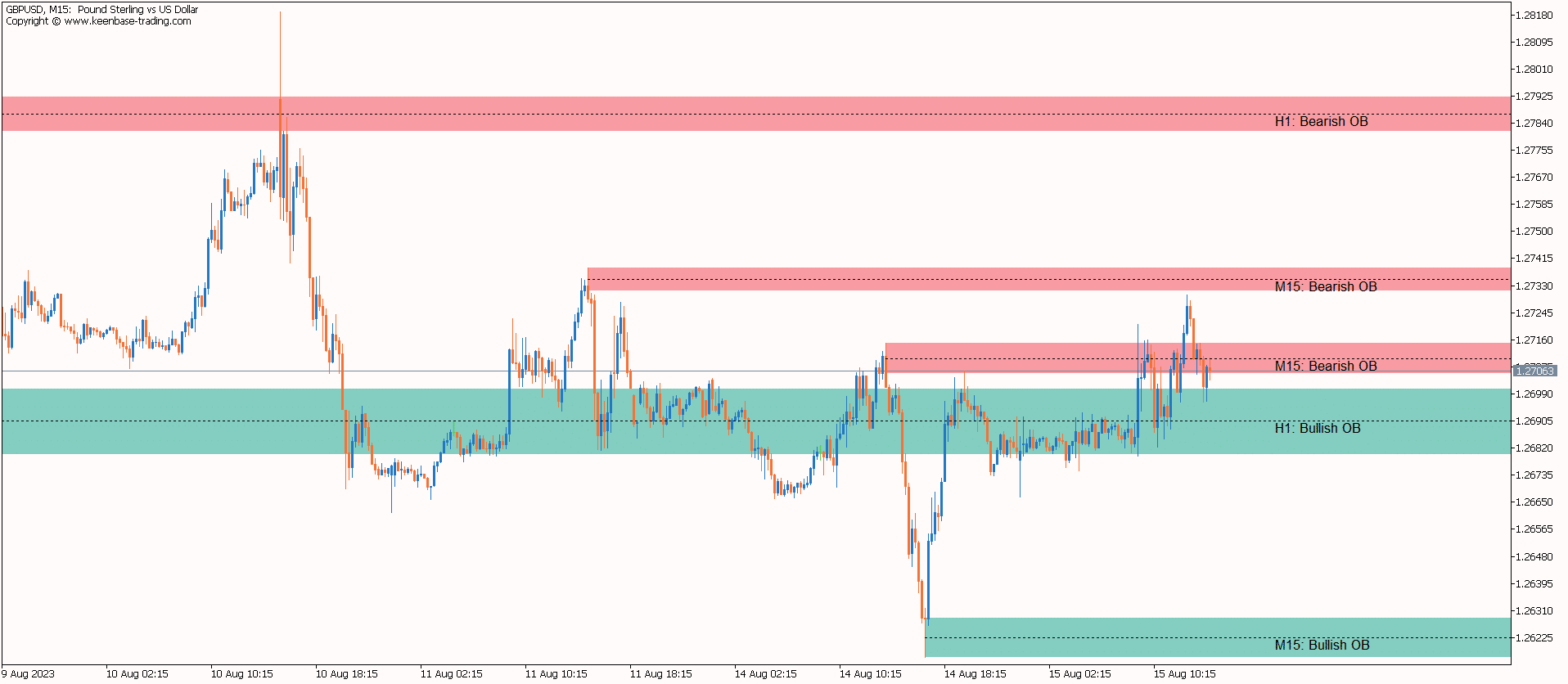

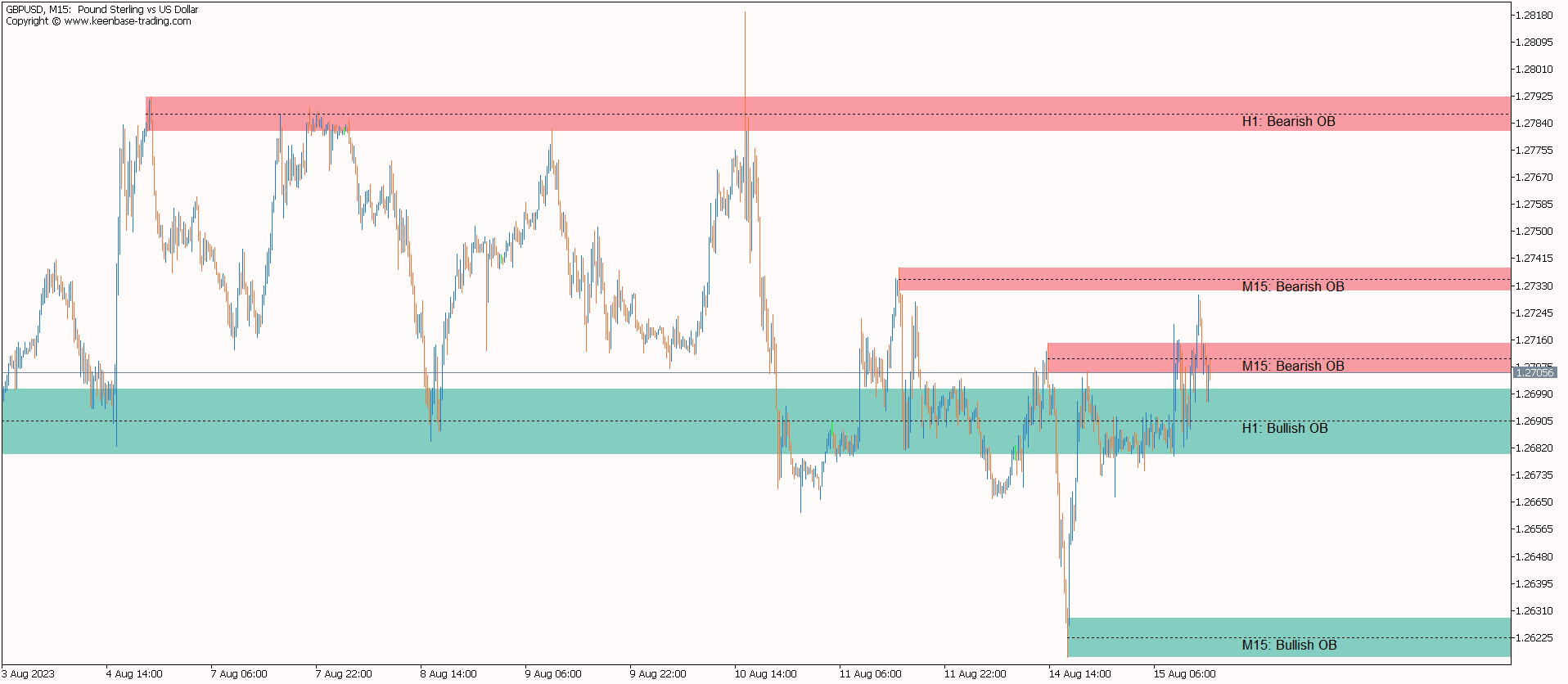

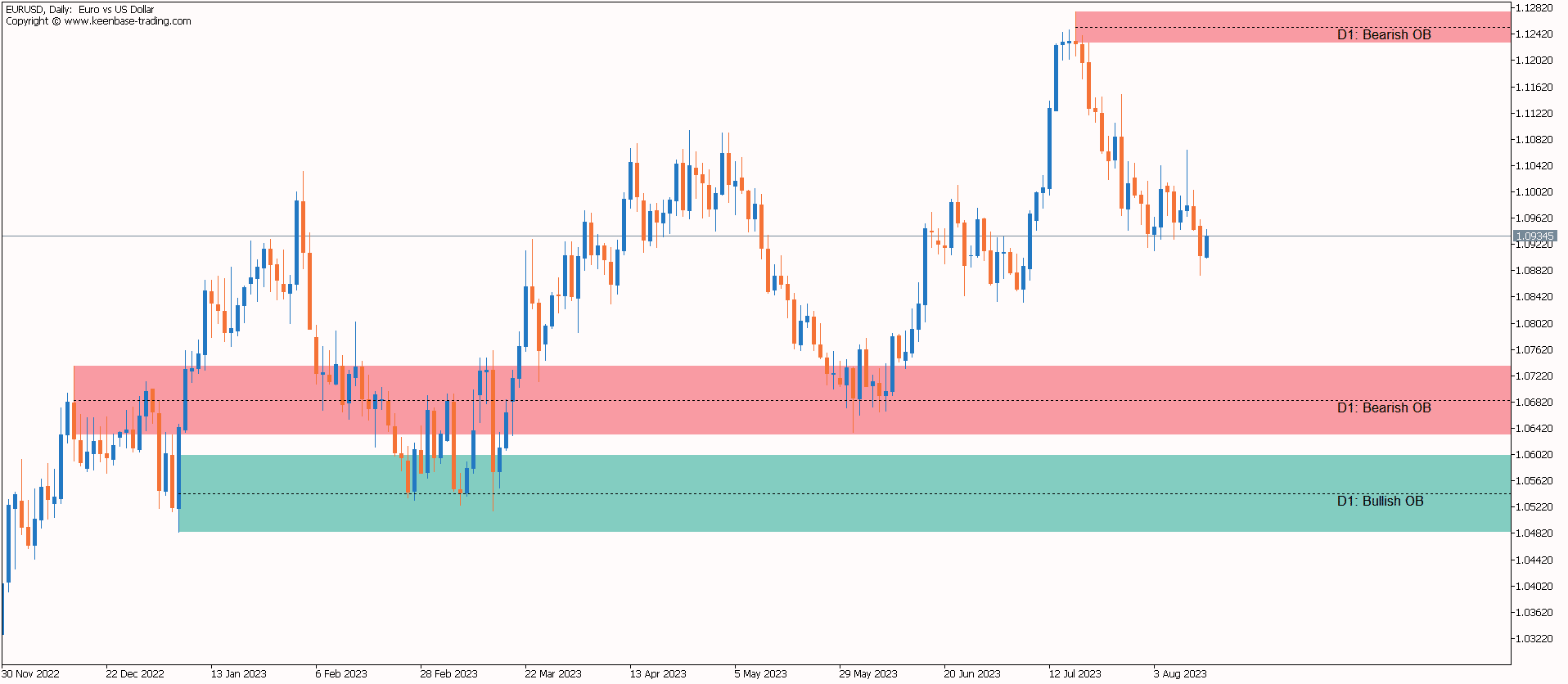

Screenshots

You Might Also Like

Help others make better choices. Please review your recent purchase.

By sharing your review, you will help others to make advised decision about what they buy from us. Thanks for contributing.

You must log in to submit a review.