What is KT Risk Management Indicator?

Risk Management is a remarkable tool designed to provide key insights into the potential risks associated with each of your trades.

At its core, this indicator simplifies evaluating risk percentages on your open positions, providing a clear snapshot of your current trading situation.

KT Risk Management indicator is truly one of a kind, offering a range of distinctive features that make it stand out in the wide range of risk management tools.

It goes beyond the typical functions of an indicator, giving you valuable information such as your account balance, leverage used, the total risk per trade, and a summary of all floating points – the unrealized profits or losses on your open positions.

What sets the Risk Management indicator apart is its ability to adapt in real-time as you open long or short positions.

As you enter each trade, the indicator works diligently to minimize your risk, ensuring you're always in control, no matter what the market throws at you.

One of the key elements of this tool is its ability to provide a clear overview of your account's floating points, expressed as a percentage of the overall risk.

This means that the indicator is always there whether you're enjoying a profitable trade run or facing a string of losses, providing crucial insights to help you effectively manage your risk level.

In simpler terms, this indicator acts as your personal trading assistant, continuously updating you about your trading scenario and helping you make informed decisions.

It puts you in the driver's seat, ensuring you always know what's happening with your trades, so you can make proactive adjustments to your strategy, minimize potential losses, and maximize your trading success.

What Information Does This Indicator Display?

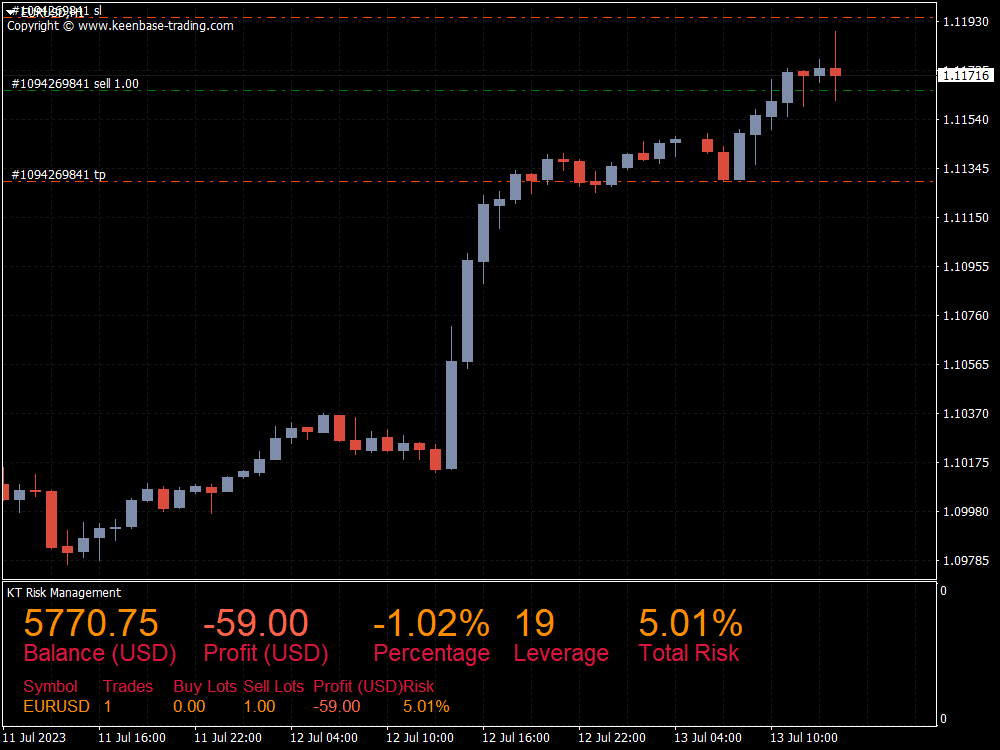

This indicator displays the below information on the MT4 and MT5 charts as a currency exposure table every time you initiate a position in your trading account.

- Account balance

- Floating point

- Percentage

- Leverage

- Total risk

- Risk per trade

Therefore, it is an all-in-one solution, providing you with all this crucial information to manage your trade effectively.

Features of KT Risk Management Indicator

Risk Visualization

The indicator displays potential risks directly on the charts, providing a clear view of the risk associated with each open position.

Real-Time Updates

It provides real-time updates, ensuring traders have the most current information about potential risks.

Account Balance Display

The indicator shows the current account balance, allowing traders to understand their financial standing.

Floating Profit/Loss Display

It displays each open position's floating profit or loss, providing insights into unrealized gains or losses.

Leverage Information

The indicator shows the leverage used, helping traders understand the extent of their exposure to potential losses.

Open Positions Overview

It offers an overview of all open positions and their parameters, assisting traders in monitoring and managing their portfolios effectively.

Risk Percentage Calculation

The indicator calculates net exposure in risk percentage for each open position, enabling traders to understand their risk level better.

With KT Risk Management indicator, you can maintain an optimal balance of account risk by continuously monitoring the account floating point, which provides real-time updates on unrealized gains or losses, allowing you to adjust your trading strategy proactively.

Risk Per Trade Display

It displays the risk per trade, providing an additional layer of risk assessment.

By providing these fundamental insights, the KT Forex Risk Management indicator gives traders a comprehensive understanding of the risk landscape of their trading activity.

This can lead to more informed decision-making and potentially safer trading strategies.

Pro-Tips to Use KT Risk Management Indicator

It's a powerful tool, but the KT Risk Management indicator requires thoughtful usage to monitor the losing and profitable trades.

Here are some pro tips on how to make the most of this indicator:

Modify Your Risk Tolerance According To Your Trading Strategy

Knowing your risk tolerance is crucial before diving into Forex trading with KT Risk Management Indicator.

Use the indicator's percentage risk calculation to adjust your trading strategy according to your comfort level of risk exposure.

Monitor Your Leverage

Leverage can significantly magnify both your profits and losses.

Regularly monitor the indicator's leverage information and adjust it according to market conditions and your risk tolerance.

Use it With Other Indicators

The KT Risk Management indicator is not a standalone tool for predicting market movements. It doesn't provide any buy or sell signals.

Therefore it is best used with credible technical analysis tools and indicators for a well-rounded trading strategy.

Regularly Check Your Account Balance

Keep an eye on your trading capital and account balance displayed on the indicator.

It gives you a snapshot of your financial health and allows you to manage your funds effectively.

Keep an Eye on Floating Profits and Losses

Regularly monitor your floating profits and losses.

These can give you a sense of how your current open positions are performing and whether you need to close any positions to lock in significant profits.

Understand Your Positions

The open positions overview provides a comprehensive look at all your open trades.

Make sure to understand the details and adjust your trades as necessary.

Watch the Risk Per Trade

Pay close attention to the risk value per trade display and your risk-reward ratio.

This will help you diversify your trades and avoid putting too much risk on a single trade.

Using KT Risk Management Indicator Like A Successful and Professional Trader

As mentioned, when applied to your MT4 or MT5 charts, this indicator reveals a panel detailing your account balance, floating profit/loss, leverage in use, and parameters of open positions.

However, it does not advise on trading signals or orders independently. It is crucial to use other credible indicators actually to trade the markets.

For instance, we can form a comprehensive trading strategy using the Relative Strength Index (RSI). If the currency pair's value is below an RSI of 30, it suggests an oversold state, presenting a likely opportunity to place a buy order.

We can also use the RSI indicator to get into short positions.

When the RSI exceeds 70, indicating an overbought currency pair, initiating a short position can be advantageous, considering the probable price decrease.

Bottom Line

This indicator makes vital parameters such as risk and account balance readily accessible, aiding effective trading decisions.

Using the KT Risk Management indicator intelligently can give you a powerful edge in the ever-changing Forex trading landscape.

Remember, if you want to become a profitable trader, it's all about managing risk and making informed decisions.