SuperTrend Indicator Formula

The upper and lower lines are calculated using the combination of median price and Average True Range(ATR) with a multiplier.

Median Price = (High + Low)/2

ATR with multiplier = Multiplier*ATR

Complete formulas have been explained here - Supertrend formula.

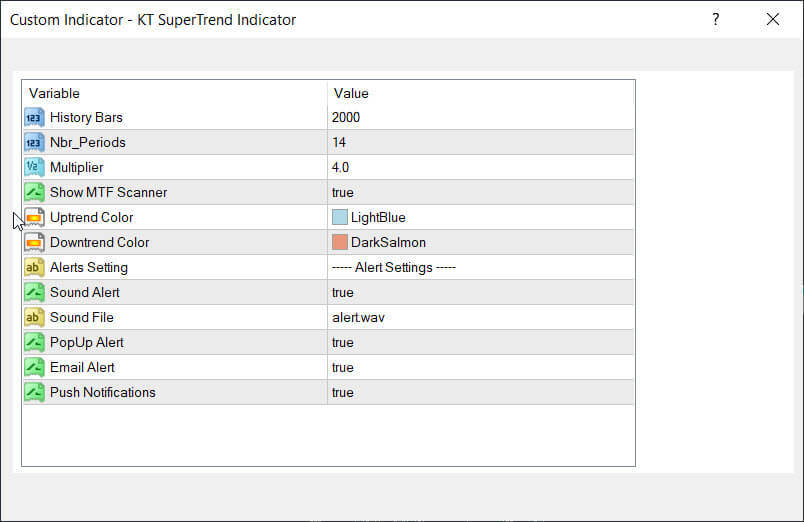

Inputs Parameters of Supertrend

What exactly is Supertrend?

The Supertrend works using the instrument's median closing price and ATR that can be used to identify long-term trends and also provides the buy and sell signals with every new emerging trend or signal.

How to Read Supertrend MT5 Effectively?

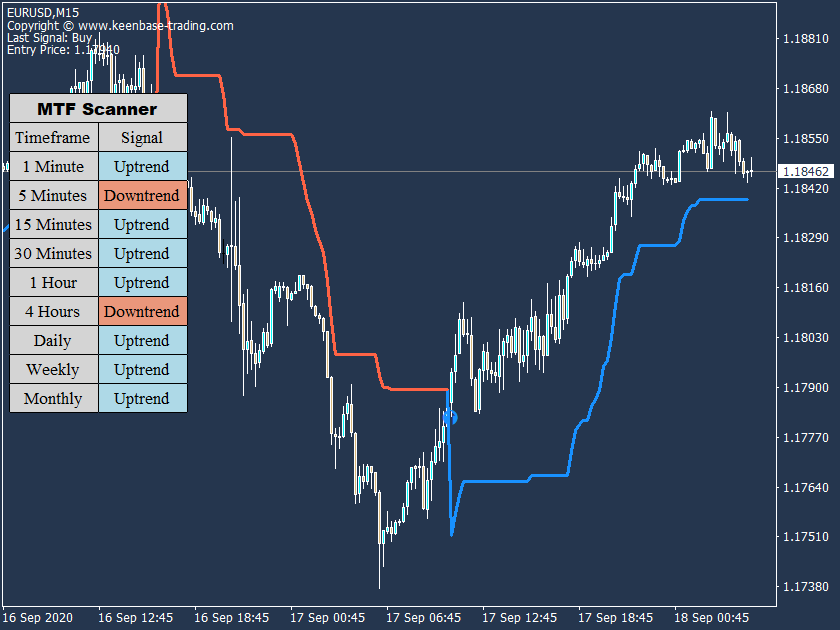

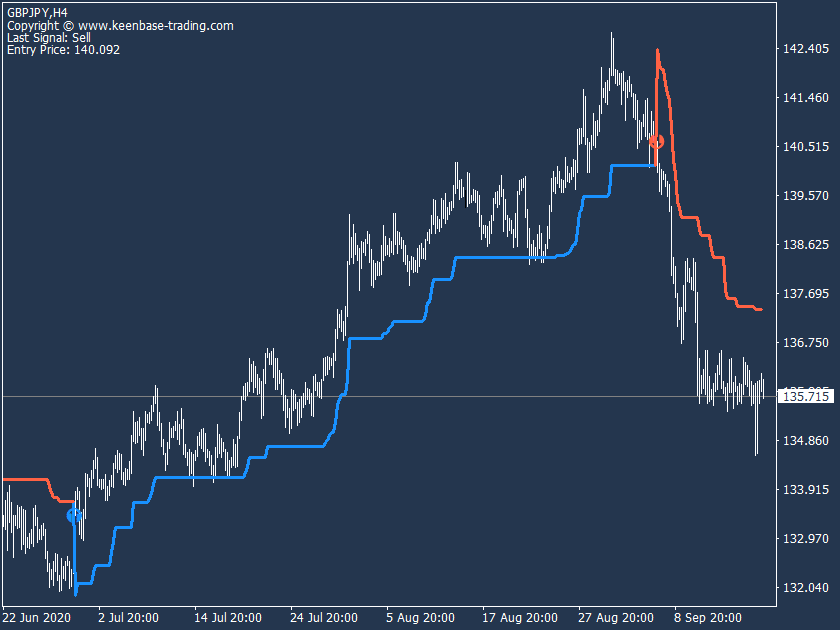

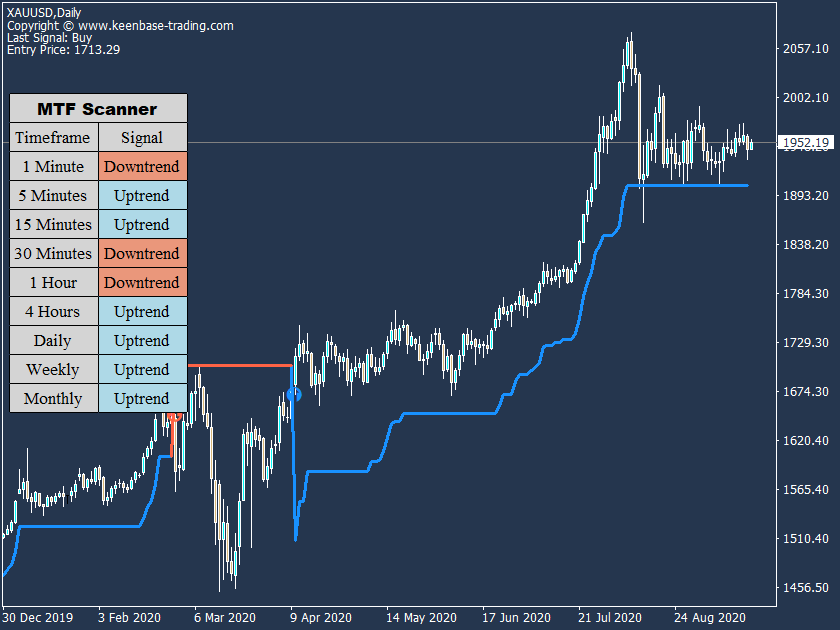

It's straightforward to interpret the super trend indicator as it consists of only two lines.

The blue line shows an uptrend, while the red line shows a downtrend. The blue and red arrows appear when a transformation occurs in the trend direction, which can be used to identify buy and sell signals.

Example of an Advanced Supertrend Trading Strategy

We can create a well-known intraday trading strategy using supertrend and moving average crossovers.

- Fast Moving Average = 5

- Slow Moving Average = 20

- Buy Signal: When fast MA crosses above the slow MA with a blue supertrend line.

- Sell Signal: When fast MA crosses below the slow MA with a red supertrend line.

Stop Loss can be placed at the last swing, high or low.

Applications of Supertrend Indicator MT5

- It can be used to design effective intraday trading strategies using the combinations of 2-3 Metatrader indicators.

- It can be used to place an initial stop loss or trailing stop to capture some profits in trending markets.

- When combined with other indicators, it effectively provides the new buy and sell signals.

- The signal's accuracy can be enhanced by including a multi-timeframe analysis. That's why the KT Supertrend comes with an MTF scanner.

- It can also be used as an exit signal. For example, intraday or swing trading entries can be closed when the supertrend changes direction.

Disadvantages

- SuperTrend is a lagging indicator. Sometimes the entry opportunities appear very late.

- We strongly do not recommend using it in choppy markets as It fails drastically during the sideways market.

- It is not sensible to use it as a standalone entry signal. Instead, we suggest combining it with two to three more indicators to design a well-suited trading strategy.

- It can provide multiple false signals in a consolidated market.