Short Summary

- KT Trade Manager EA is an innovative trading utility that simplifies forex trading with proper Risk Management, Trade Management, Partial Closure, and Trailing Stop features.

- It offers advanced features, including Take Profit Levels, Auto Lot Sizing, Account Exposure Management and Auto Break Even Functionality for optimal profits.

- Regularly reviewing its settings and testing in a demo account can maximize the potential of this tool for successful Forex trading.

Understanding the KT Forex Trade Manager EA

Imagine a tool that can help new and professional traders easily navigate the complex world of forex trading. A tool that can manage market orders efficiently across all types of symbols, including Forex, Crypto, Stocks, Futures, Commodities, Indices, and Metals.

A tool that can help you establish your risk level, entry point, stop loss, and take-profit.

This innovative trading utility is designed to simplify the trading process by offering a host of features that can help professional traders effectively manage their trades.

It enables proper risk profiling through a risk percentage or a custom lot size calculation. This ensures you can manage your trades based on risk tolerance, a critical aspect of successful forex trading.

But that’s not all. You can efficiently manage and selectively close live trades with its user-friendly interface. This feature becomes particularly useful when you want to close trades quickly, an essential tool for any serious forex trader.

It also offers the Trailing Stops option, which allows traders to set a trailing stop loss for active orders. In addition, it provides a quick breakeven and partial closure function making it suitable for new and professional traders.

Benefits of Using our Forex Trade Manager Dashboard

The benefits of using our Forex Trade Manager are numerous. For starters, it offers enhanced risk management and efficient trade execution. This means you can configure it to keep the risk constant, even if the stop loss distance is adjusted.

This feature is crucial in forex trading, where the risk/reward ratio is pivotal in the overall trading strategy.

The Auto Break Even feature is another benefit that cannot be overlooked. It has been designed to adjust the stop loss, allowing traders to break even once the trade has moved to a certain profit point.

This safety net is designed to give manual traders a better standing when entering trades. This helps to guarantee that profits are not lost due to a sudden market reversal.

Key Components of an Effective Trade Manager

The right tool can make all the difference in effective forex trading. It is designed with many features that make it an essential tool for any serious forex trader.

It facilitates manual traders to calculate risk reward, set the stop loss, and take profit via its panel, which offers robust account exposure management.

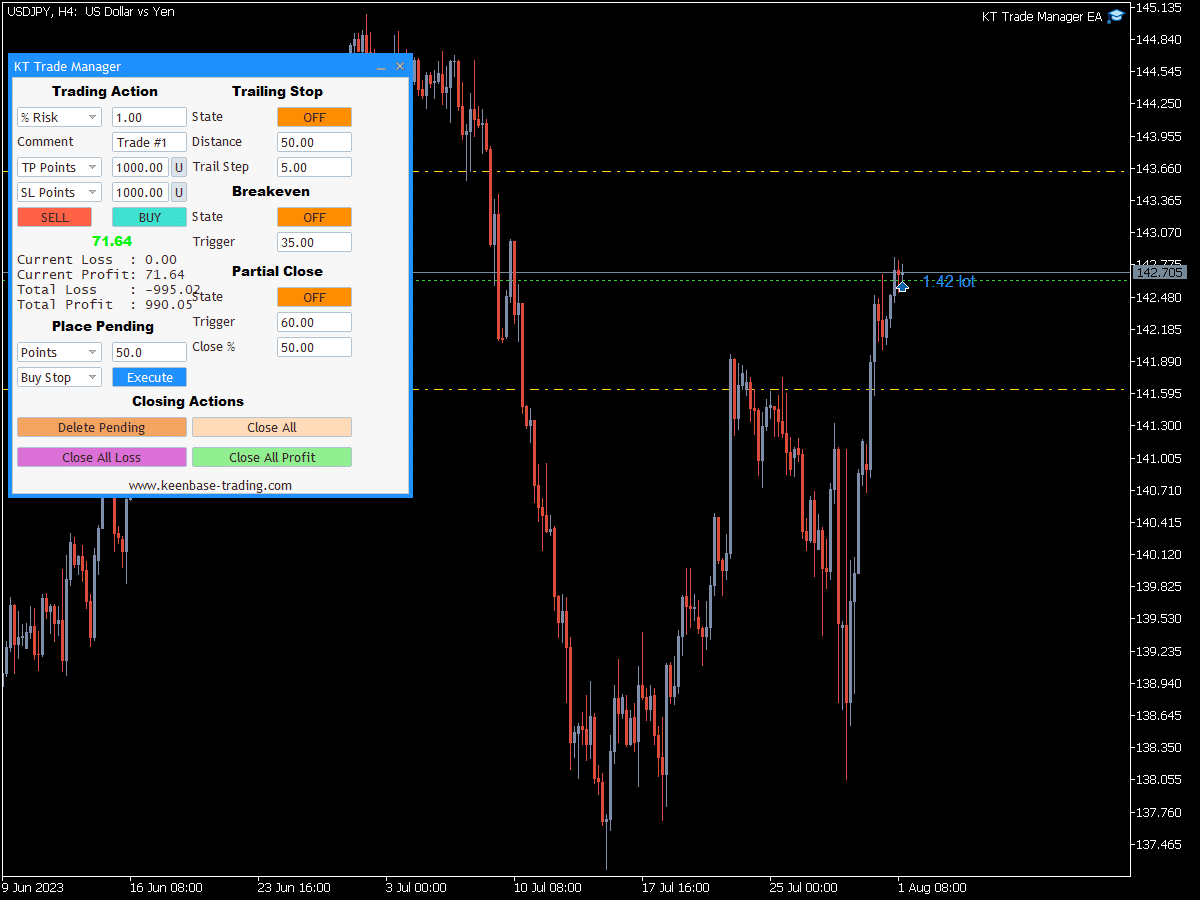

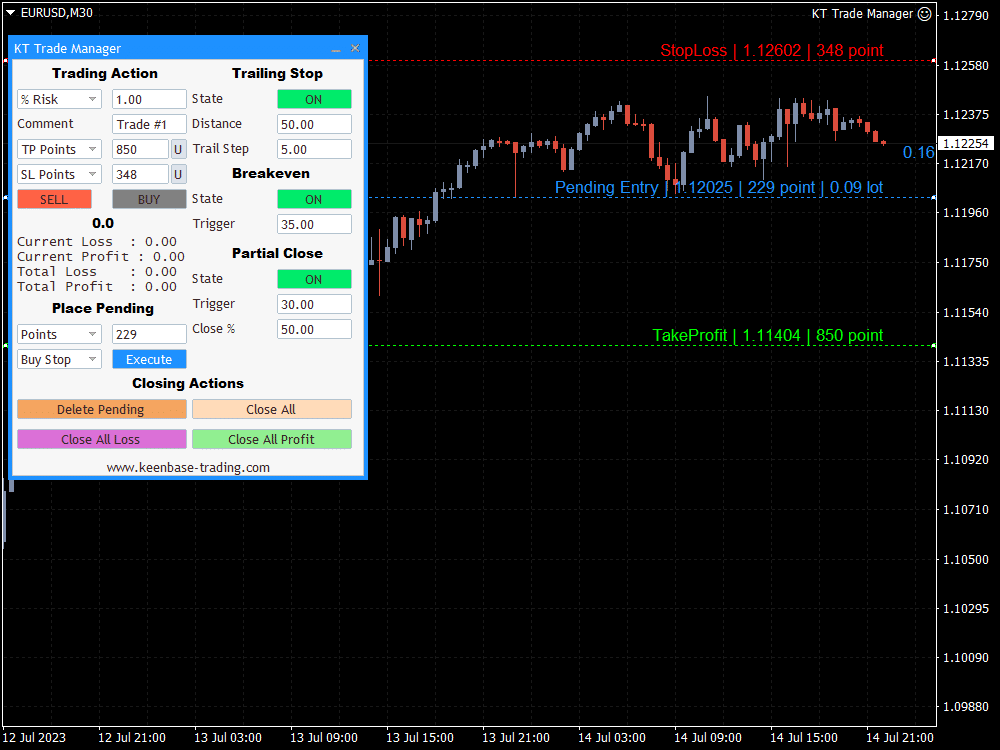

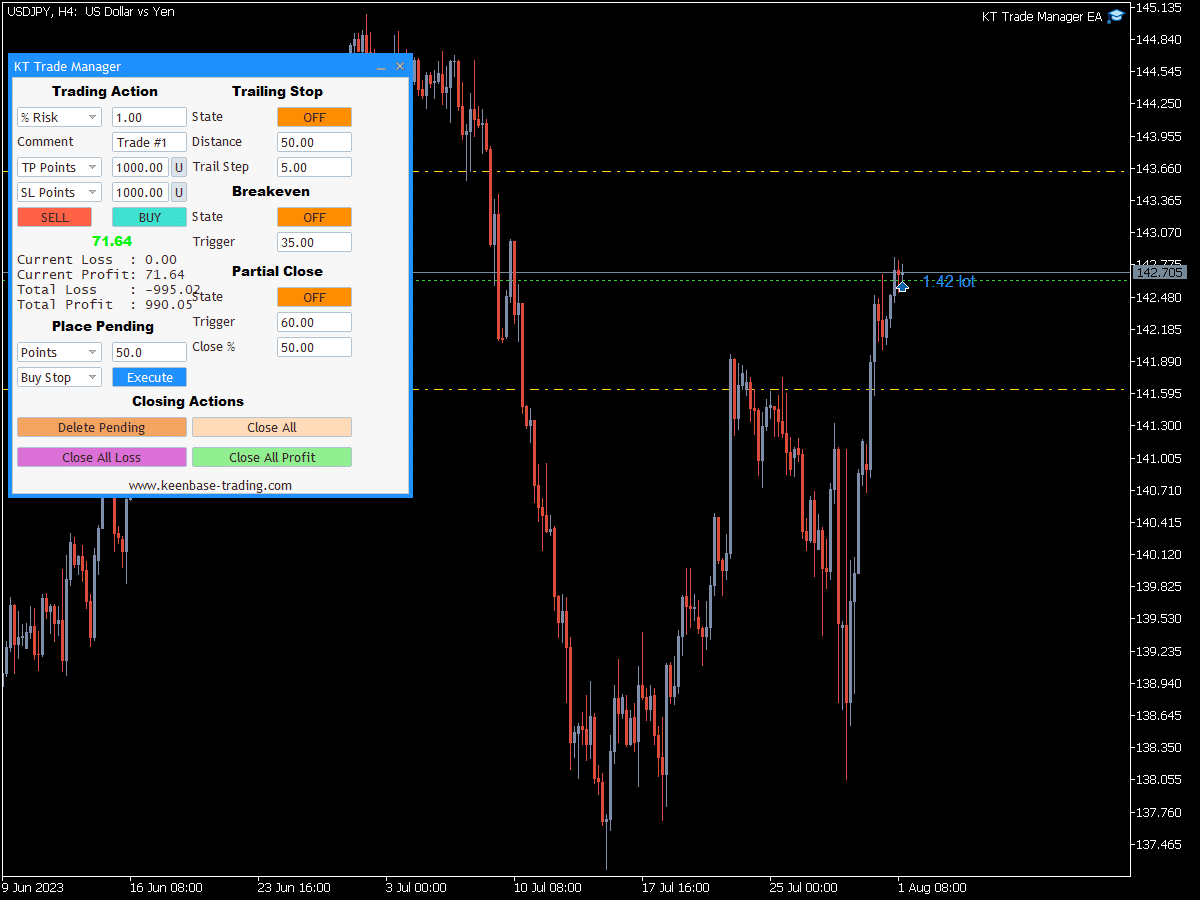

Another essential feature is the trade lines on a chart. It draws the three horizontal lines on the chart representing the entry price, stop loss and take profit for a quick trade entry at your desired price.

Implementing our Trade Manager in Your Trading Strategy

Now that we have understood the basics and its benefits, let’s explore how it can be incorporated into your existing trading strategy.

The most efficient approach to utilizing this tool is to leverage its user-friendly interface to quickly place your entry, stop loss, take profit, breakeven, partial profit, trailing stop and idea validation with a few clicks.

The recommended approach for establishing take-profit and stop-loss levels is to identify key areas of support or resistance. Doing so ensures that you enter and exit the market at optimal prices.

Implementing it into your trading strategy is not a one-time process. It requires regular tweaking and adjusting based on the changing market conditions. Therefore, monitoring your trading performance and making necessary adjustments is crucial.

By implementing this tool in your trading strategy, you can streamline your trading process, manage your trades more efficiently, and potentially increase your profitability in the Forex market.

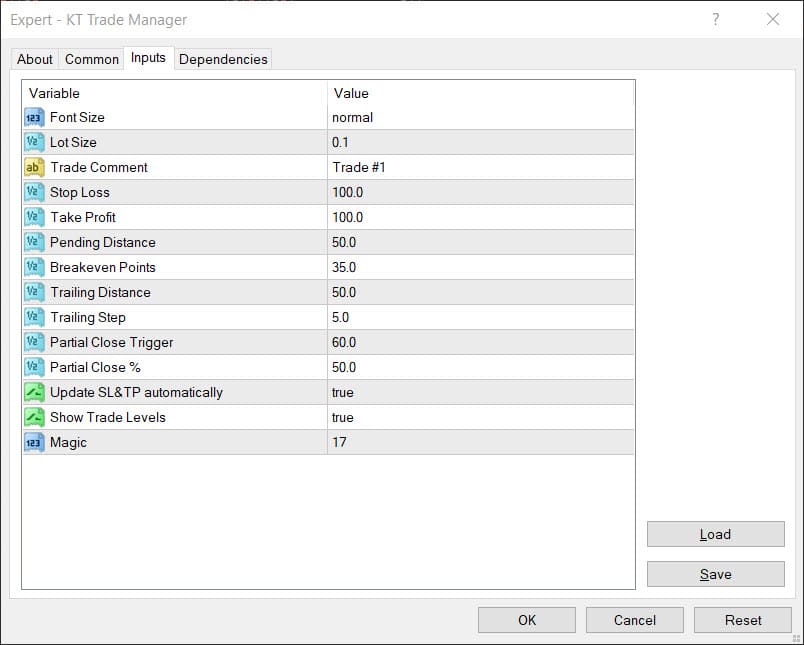

Setting Up the KT Trade Manager EA

Setting up this tool is a relatively straightforward process. After the installation, The first step involves enabling Expert Advisors in your MT4/MT5. This can be done by selecting the “AutoTrading” button and verifying the boxes in Tools > Options > Expert Advisors.

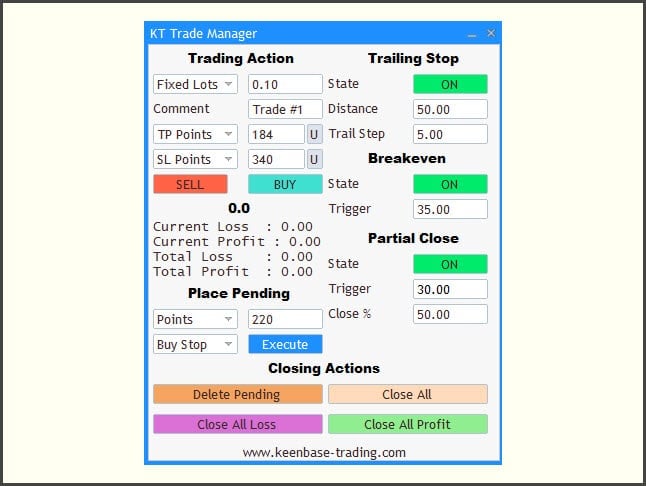

Once the Expert Advisors are enabled, the next step is configuring its settings. This involves personalizing the settings to suit your trading style and preferences. For instance, you can adjust the risk management settings, set the entry and exit points, and define your stop loss and take profit levels.

It is also advisable to enable the “chart shift”. Press F8 > Common to open the options. Ensure that the “chart shift” is checked for this to work properly. Then adjust the space on the right by sliding the arrow left or right.

Customizing Trade Manager EA Settings

Customizing its settings can greatly enhance your trading experience. The settings allow traders to customize the EA to their trading styles and preferences. This can be achieved by adjusting the settings, such as the proper risk management features, order execution, trailing stop etc.

One of the key settings that can be customized is the risk profiling feature. This feature lets you control the risk you will take on each trade. By adjusting this setting, you can ensure that your trades align with your risk tolerance.

Advanced Features of Trade Manager EA

This is not just a tool for placing and managing trades; it is a comprehensive trading utility packed with various advanced features that can take your trading performance to the next level. From partial closure to breakeven, it offers advanced features to enhance your trading strategy.

These features can help you maximize profits, minimise losses, and make more informed decisions.

Account Exposure Management

Managing account exposure is an essential aspect of successful forex trading. It involves managing the potential risk and reward associated with any open position. It offers the Account Exposure feature, enabling traders to monitor their account exposure per symbol to manage risk and exposure.

Account exposure management, a crucial aspect of money management, can be achieved by setting stop-loss and take-profit levels, a maximum drawdown limit, and a maximum exposure limit. By effectively managing your account exposure, you can ensure that any adverse effects of a forex trade are tolerable.

The Account Exposure feature visually represents your account exposure on the chart. This allows you to monitor your exposure in real-time and make necessary adjustments to your trading strategy.

By effectively managing your account exposure, you can mitigate potential losses and enhance your profitability in the forex market.

Auto Break-Even Functionality

Another advanced feature is the Auto Break-Even Functionality. This feature refers to the capability of automatically shifting stop-loss orders to a break-even point when a positive price movement covers some of the trade’s risk. This feature can be beneficial in managing risk and safeguarding profits.

It has been designed to minimize the risk associated with trading. It automatically adjusts the stop loss so the trade breaks even when the price moves in the desired direction by a predefined number of points. This helps to guarantee that profits are not lost due to a sudden market reversal.

The Auto Break-Even Functionality is a safety net that protects your profits if the market reverses. By automatically moving the stop loss to break even when a trade has reached a predefined number of profit points, you can ensure that your profits are safeguarded, enhancing your overall trading performance.

Tips for Maximizing the Potential of KT Trade Manager EA

While it offers many features and advanced functionalities, it is essential to leverage these features to their full potential to maximize your trading success.

Here are some expert tips on how to get the most out of this tool to improve your Forex trading results as a professional trader.

Regularly Reviewing and Adjusting Settings

The first step to maximizing its potential is regularly reviewing and adjusting your settings. Given the dynamic nature of the Forex market, keeping up with the changing market conditions and adjusting your trading strategy accordingly is crucial.

This involves conducting regular self-assessments to analyze your trading performance, evaluate your risk tolerance, and assess your trading objectives. By doing so, you can identify areas of improvement and make necessary adjustments to your settings.

Another important aspect of regular review and adjustment is lot size management. It is recommended to set achievable objectives, understand the risks linked to each trade, and utilize the features such as stop-loss orders. Doing so can effectively manage your risk and enhance your trading performance.

Finally, adjusting your position sizes and stop-loss levels is important based on your risk tolerance and market conditions. Doing so can ensure you are trading within your risk limits and maximizing your profits.

Combining the KT Trade Manager EA with Other Tools

Another effective way of maximizing its potential is by integrating it with other Forex tools. This can optimize its capabilities by leveraging the features of other tools. For instance, you can incorporate it with order flow analysis. This tool can help you discover prospective trading opportunities in the market.

Similarly, Forex trading robots can automate your trading strategies, freeing up your time and reducing the possibility of human error.

Another tool that can complement the features is the Support and Resistance levels or supply demand zone. This indicator automatically plots the significant support/resistance levels to enhance trade management.

Integrating it with other Forex tools allows you to streamline your trading process, strengthen your trade evaluation, and optimize your trade management.

Choosing the Right Trade Manager EA for Your Needs

The world of Forex trading is vast, as are the tools available to traders. Choosing the right Trade Manager for your needs is all about finding the tool that aligns with your trading style and meets your specific trading needs and goals.

Finding the right Trade Manager can be daunting, but it's possible with the right research.

Comparing Different Trade Manager EAs

To choose the best Trade Manager for your needs, it’s important to compare different EAs based on their features, performance, user reviews, and profitability. Evaluating these factors can help you choose a management EA with features and performance that suit your trading style and needs.

For instance, you should consider the trading strategies supported by the EA, the lot management features, the order execution speed, and the customer support. These features can greatly enhance your trading experience and improve your trading performance.

Finally, it would be best to consider other factors, such as the cost of the EA, user-friendliness, and compatibility with your trading platform. These factors can play a crucial role in your overall trading experience.

Testing KT Forex Trade Manager in Demo Account

Testing it in a demo account before using it in a live trading environment is crucial. Testing this tool in a demo account offers a safe and secure environment for traders to experiment with, evaluate, and become familiar with the software and trading strategies.

Testing in a demo account allows you to practice and refine your techniques without any financial risk, ensuring that all the paid money is saved for real trading. You can experiment with different settings, try different trading strategies, and understand how the EA performs in other market conditions.

Demo testing involves configuring the EA, personalizing the settings, and executing the EA in a demo account. By following these steps, you can better understand how the EA works and how it can enhance your trading performance.

Summary

In conclusion, It is an invaluable tool for new and professional traders. It offers many features and advanced functionalities that significantly enhance your trading performance.

Whether you are looking for a tool to streamline your trading process, manage your trades efficiently, or maximize your potential profits, we have covered you. So gear up to revolutionize your forex trading experience with this tool.

Frequently Asked Questions

Is KT Trade Manager EA a fully automated Self Trading EA?

No. This tool is designed to enhance the trading experience for manual traders. It can execute and manage trades using the instructions from the user.

How to install and use this tool?

To install this Forex Trade Manager in MT4/MT5, place the product ex4/ex5 file in the ‘Experts’ folder of MQL4/MQL5 and enable the MT4/MT5 to allow expert advisors.

Then select the ‘Expert Advisors’ section in the Navigator window and click the “Plus” icon to choose the EA. Finally, drag it onto the charts to ensure that it’s active.

What are the benefits of using this Trade Manager EA?

It provides an improved risk profile, streamlined trade execution, and numerous advanced features to refine your trading strategy.

It offers a range of features to help you manage your trades more effectively, including automated order placement, profile and loss monitoring, and customizable settings.

What advanced features does this Trade Manager EA offer?

It offers advanced features such as Auto Lot Sizing, Quick break-even, Partial Profits, and many more to help you maximize your profits.