Indicator Features

- It combines several market dynamics into a single equation to provide a clear depiction of the market trend.

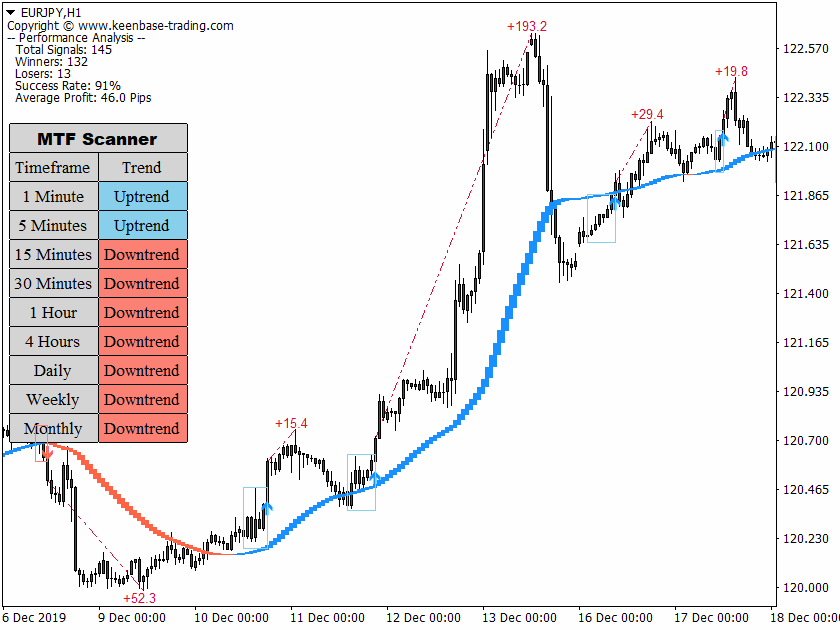

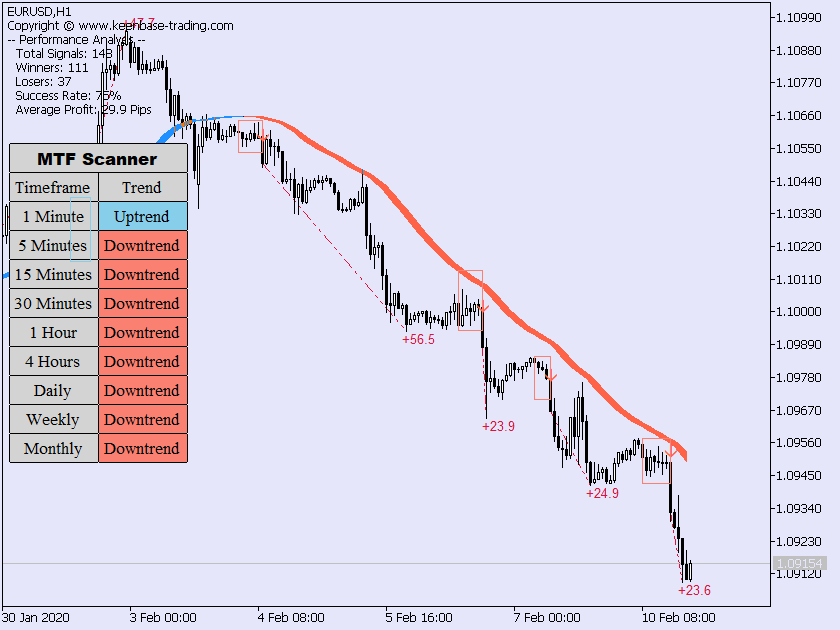

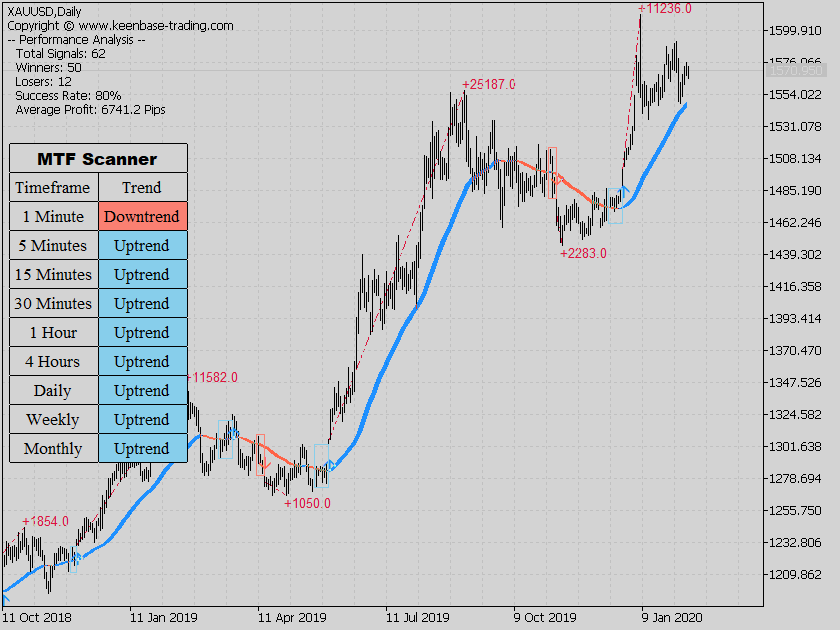

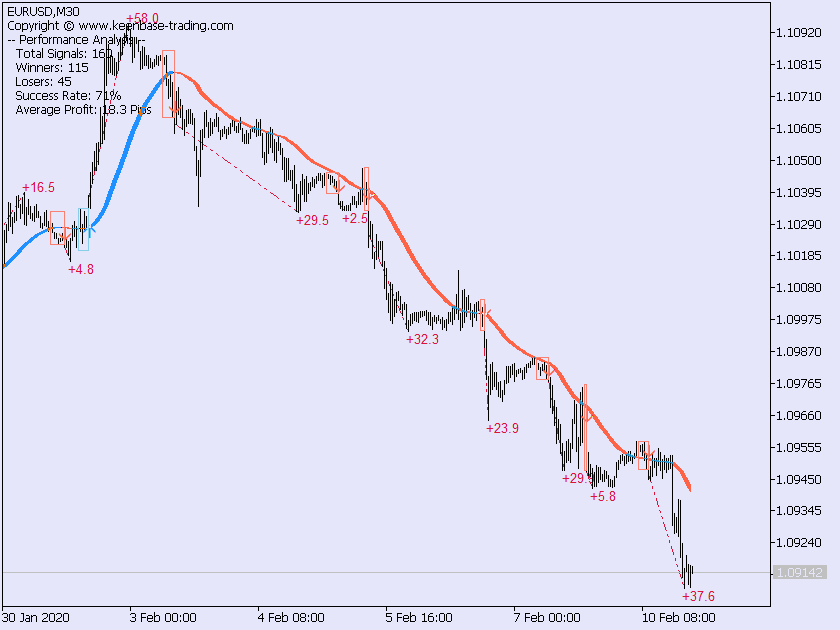

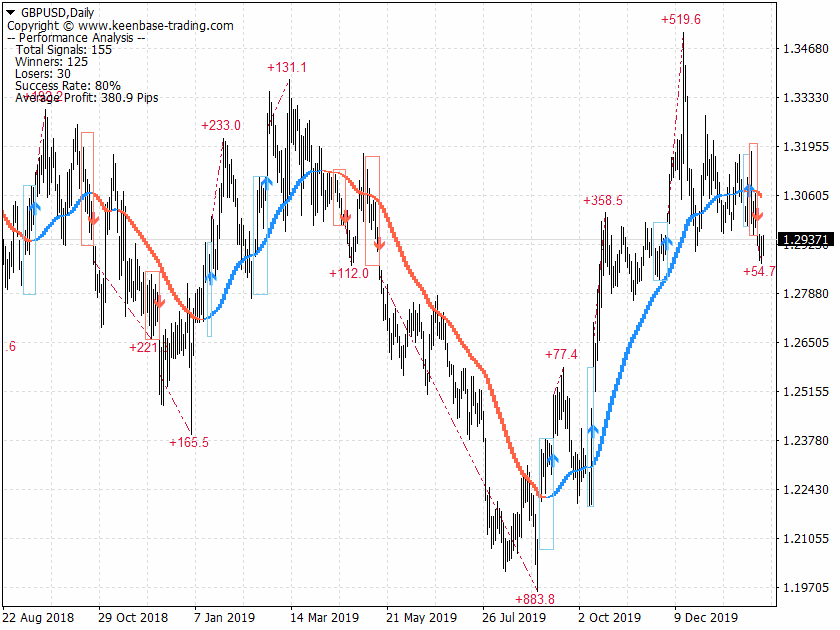

- Draws the rectangular box with entry signals to adequately mark the entry points with local maxima and minima.

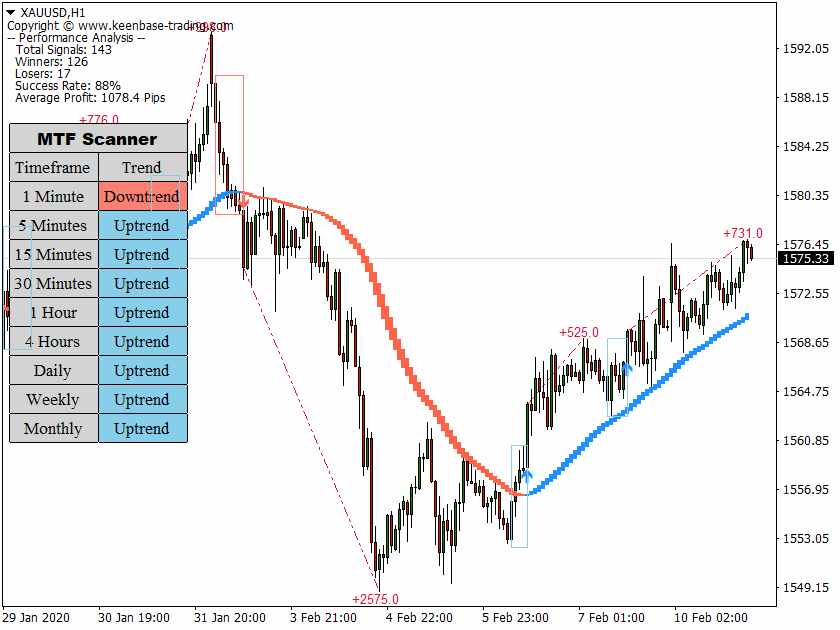

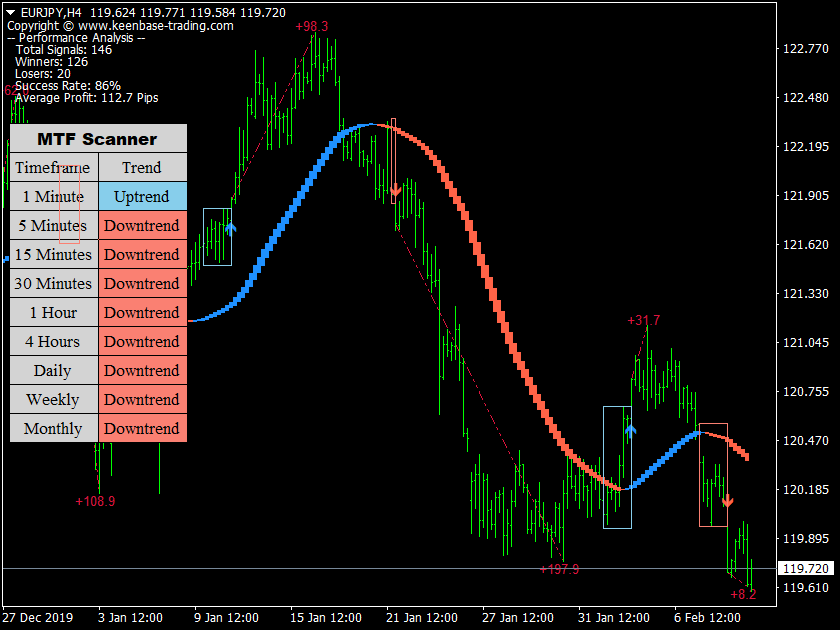

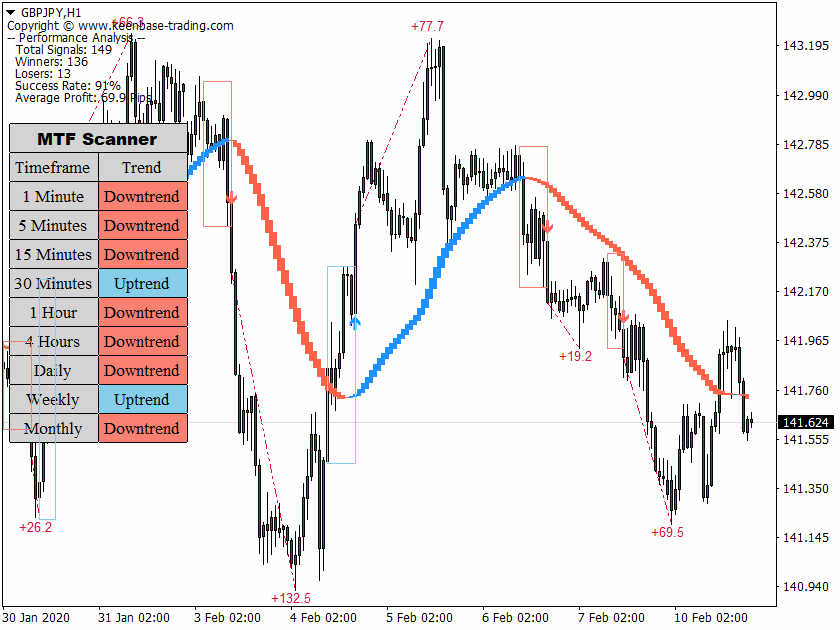

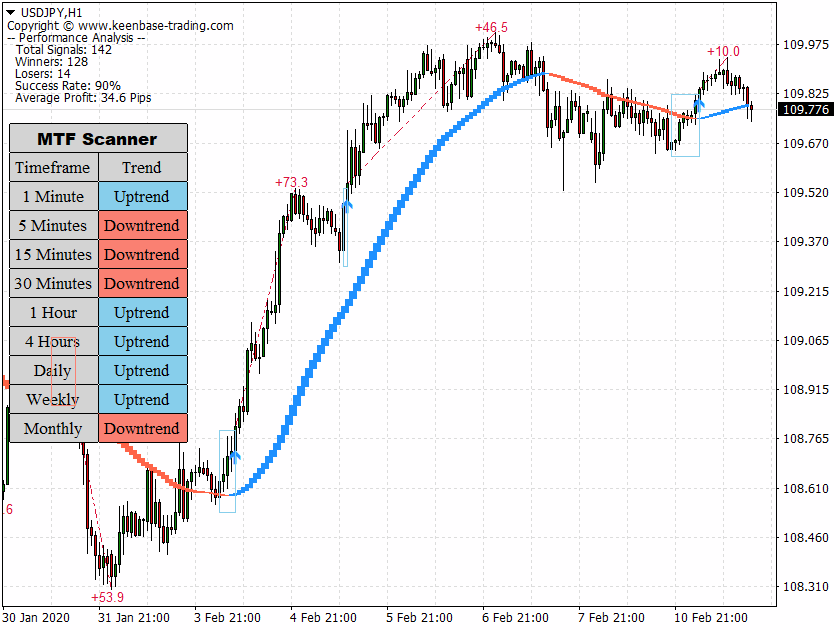

- The indicator measures the accuracy of its signals, and simplistically provides several performance metrics.

- It includes a multi-timeframe dashboard that scans all the available time-frames and shows the established trend direction in each time-frame.

- Compared to Ichimoku, this indicator provides better and more accurate trend following signals.

- Provide excellent results when combined with the volume analysis and volume indicators to predict reversals and the best times to enter or exit trades.

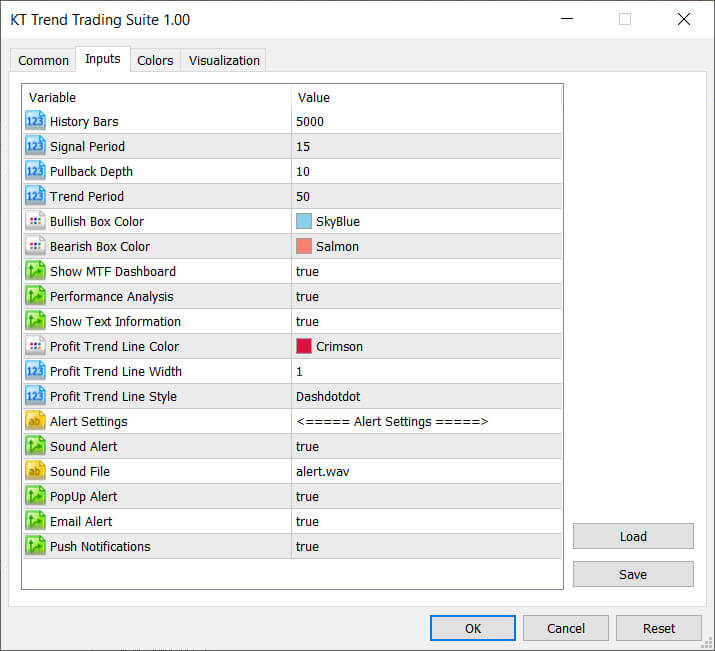

Input Parameters

- History Bars: Number of history bars to include for the signals generated in past.

- Signals Period: Its an integer value that decides the magnitude of entry signals.

- Pullback Depth: Its an integer value that decides the depth of pullback that usually occurs before a trend continuation move.

- Trend Period: Its an integer value that is used to find the main trend direction.

- Show MTF Dashboard: Show/Hide the Multi-Timeframe scanner dashboard.

- Performance Analysis: Show/Hide the performance analysis metrics(including the MFE trend line).

- Rest of the inputs are self explanatory.

Discover the Power of the KT Trend Trading Suite

The KT Trend Trading Suite indicator is a comprehensive technical analysis tool designed to help traders identify and capitalize on trends in the financial markets.

This indicator works as a complete set of suite of tools that provide a complete solution for trend trading, including trend identification, entry and exit points, and risk management.

This indicator is designed to work on multiple time frames and can be used on various financial instruments, including Forex, stocks, and commodities.

By offering a holistic approach to trend trading, it ensures that traders have all the necessary information to make informed decisions and maximize their trading potential.

Benefits of Using a Trend Indicator

Using a trend indicator like the KT Trend Trading Suite can provide several benefits to traders. One of the main advantages is that it helps traders identify trends early, allowing them to capitalize on potential profits.

Trend indicators can also help traders avoid false signals and reduce losses by providing a clear picture of the market’s direction. Additionally, trend indicators can be used in conjunction with other technical analysis tools to create a comprehensive trading strategy.

By integrating various indicators, traders can develop a robust approach that adapts to different market conditions and enhances their overall trading performance.

Using KT Trend Trading Suite with Trend Lines

Trend lines are a fundamental concept in technical analysis and are used to identify trends in the financial markets. A trend line is a line that connects a series of highs or lows on a chart, indicating the direction of the trend.

Trend lines can be used to identify both uptrends and downtrends, and can be applied to various time frames.

The KT Trend Trading Suite can be used with KT Auto Trend Lines to identify trends and provide entry and exit points for traders. This combination helps traders visualize the market’s direction and make more informed trading decisions.

Market Volatility and Trend Trading

Market volatility is a key factor in trend trading, as it can affect the direction and strength of trends. The KT Trend Trading Suite takes into account market volatility when identifying trends and providing entry and exit points.

By analyzing market volatility, the indicator can help traders adjust their trading strategy to suit the current market conditions. This can include adjusting position sizes, stop-loss levels, and take-profit targets.

By being aware of market volatility, traders can better manage their risk and optimize their trading outcomes, ensuring they are well-prepared for any market scenario.

How to Use this Indicator

The KT Trend Trading Suite indicator is easy to use and can be applied to various financial instruments and time frames. To use the indicator, traders simply need to attach it to their chart and adjust the settings to suit their trading strategy.

The indicator will then provide trend direction, clear entry points, and other relevant information to help traders make informed trading decisions.

The indicator can be used in conjunction with other indicators, such as the Commodity Channel Index (CCI) and Moving Averages, to create a comprehensive trading strategy. By combining these tools, traders can develop a well-rounded approach that leverages the strengths of each indicator for optimal trading performance.