We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

A Beginner Guide to Risk Management in Forex

This article will start over with the basic understanding of risk management in Forex and dwell deep into some powerful risk management techniques that must be possessed by all Forex traders.

Introduction

Trading is the process of exchange of goods. It is similar to that of the barter system that was followed several years ago. In this system, there was negligible or no involvement at all.

The technology evolved and came to the internet – the World Wide Web, which led to the introduction of online trading. Online trading changed the trading industry in many useful ways.

However, it came with some significant downsides. Risk in trading shot up to a whole new level. This is because traders began to gamble instead of speculating in the marketplace. Hence, the linear risk took an exponential turn.

The failure to understand between “trading” and “gambling” has changed online trading's essence among the people. In trading, one can reduce risk using risk management techniques, while gambling gives you no sight for risk reduction.

Trading | Gambling |

|---|---|

Proper risk management | No Risk Management |

Based on strategy | Based on luck |

Higher success probability | Lower success probability |

The foreign exchange market is the largest in the world in terms of trading volume. It has over $5 trillion coming in and going out every single day. This makes the market liquid as well as volatile.

Amateur traders look at it as a money maker tool and enter to make some quick buck. But, due to slight or absolutely no knowledge about Forex trading, they end up losing the majority of the time.

As per statistics, more than 90% of the traders are inconsistent and hence unsuccessful in trading. And we believe that this massive gap between successful and unsuccessful traders is associated with improper risk management in Forex.

With the inability to understand the importance of risk management in Forex, traders significantly lose money in the market and go bankrupt. Hence, to address this vital issue, several techniques have been designed to reduce risk on trades and investments in the Forex market.

Step by Step Risk Management in Forex

There are tons of risk mitigation tools and techniques over the internet. Here are some effective methods we have listed out, which will be helpful to all types of traders – starting with beginner level to the intermediate level.

1. Do not trade based on emotion/greed – Could lead to considerable losses.

Yes, you read it right. Forex trading can be highly rewarding but equally risky. It can be dangerous to the extent that a trader could lose all the invested capital. As a matter of fact, the percentage of traders who lose their entire capital in trading is significant in value.

Here is a typical scenario of a novice Forex trader:

They start trading with some capital in their accounts and a fixed lot size. Initially, they make good profits. With this, emotions take over, and they begin to leverage their positions. In other words, they risk more money to generate bigger profits.

In this stage, the trades move in the opposite direction. As a result, the amount of loss would be greater than the amount they gained previously, as the lot size got larger.

The cycle repeats all over again and leads to the balance approaching the zero mark.

Trade No. | Lot size (units) | Profit/Loss |

|---|---|---|

1 | 10,000 | + $15 |

2 | 50,000 | + $60 |

3 | 55,000 | + $65 |

4 | 150,000 | - $140 |

5 | 100,000 | - $100 |

6 | 15,000 | - $14 |

7 | 10,000 | + $10 |

8 | 25,000 | + $50 |

9 | 100,000 | + $100 |

10 | 200,000 | - $250 |

11 | 150,000 | - $300 |

12 | 100,000 | + $50 |

Cell | Cell | Total = - $450 |

Initial Account Balance = $500

Closing Account Balance = $500 - $450 = $50

From the above illustration, it can be inferred that novice traders end up losing their account balance in greed to generate maximized profit.

Hence, traders, especially the newcomers, must always trade based on their analysis and not let greed or emotions hinder it, as it could lead to significant losses over time.

2. Know to play Defensive – Always set a stop-loss

There are two directions in the market. As retail traders are by far impossible to achieve 100% consistency in trades. In the sense that even trades of a professional speculator go against their desired direction sometimes.

However, the professionals deal with negative trades by placing stop-loss on each position. The pro traders always cut their losses quickly using a stop loss and never let them run for a long time.

On the contrary, novice and few intermediate traders do not square off their positions when the market goes against them. They let the loss flow until the price reverses in their desired direction. In other words, these sets of traders don’t trade with a predefined stop loss.

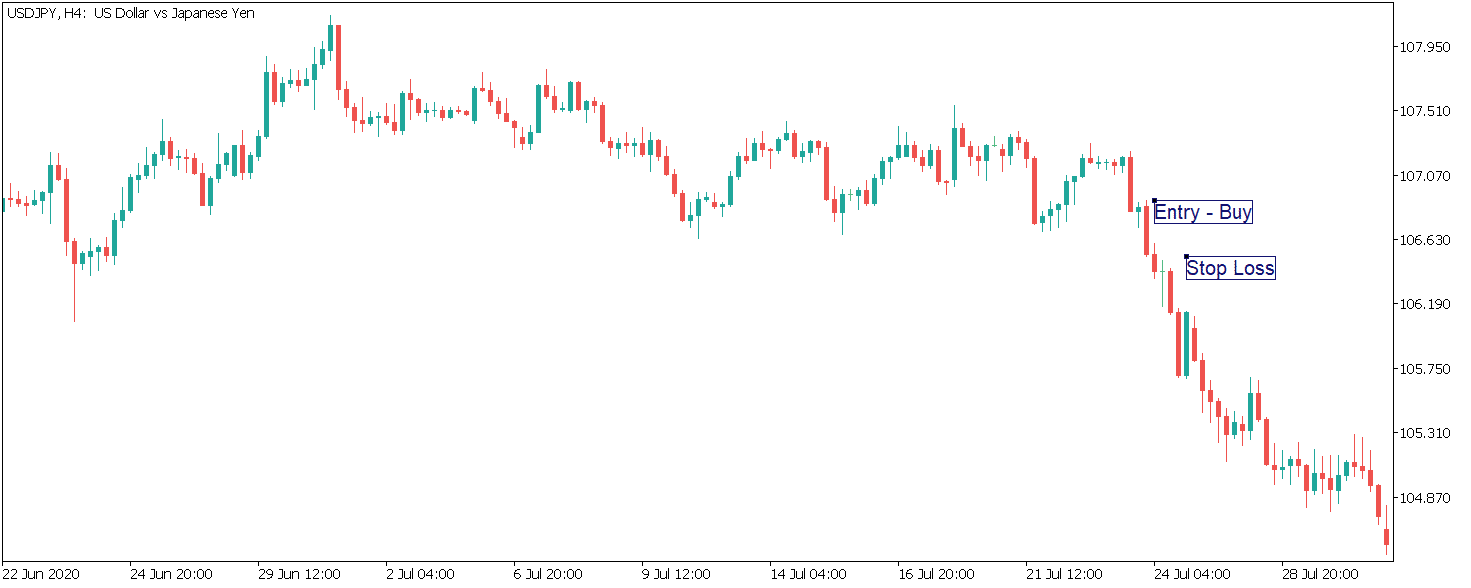

Let’s say Jon and Bran went long on USDJPY at the point shown in the below chart. Jon places a stop loss as illustrated, while Bran does not place any stop loss.

As the market moves, the trade begins to travel south against the traders' favor. The price continuously falls, which triggers the stop loss set by Jon.

Jon goes away with some loss, while Bran is still running on a loss almost four times as that of Jon.

Hence, one must always know to play defensive (by setting a Stop loss) when the market comes aggressive on you. Losses are part of the game and must embrace and learn from such trades.

3. Fix the risk percentage on your trades to determine the right position size

Comes to risk management in Forex, risk percentage, and position sizing are the most vital tools to manage risk effectively.

Beginners fail to realize the importance of position sizing and take a lot of sizes based on the profit they can produce. And such an approach is incorrect.

The lot size must always be based on the number of dollars(or any equivalent currency) one can afford to lose on the trade.

Position Size Calculator is a tool that determines the number of lots a trader can trade with, to keep the loss fixed. Precisely, one can evaluate their lot size by inputting their risk percentage and the stop loss on a trade. Let us understand the working of a position size calculator with the following example.

Account balance: $1,000

Risk Percentage: 2% => $1,000 x 2% = $20

Currency pair: EURUSD

Stop-loss: 30 pips

Pip Value: 10 pips / standard lot

Position/Lot size: ? (to be determined)

Position size in lots = Risk in $ / (Stop loss x pip value) = $20 / (30 x $10)

Position size in lots = 0.06 Standard Lots = 0.6 Mini Lots = 6 Micro Lots

Thus, one must trade with 0.06 lots to have a maximum loss of $20.

Knowing your risk percentage is indeed as important as the strategy you are following. It is one of the biggest causes of the account balance to go nil.

For instance, let’s say a trader risks 10% on every trade. If all the trades hit the stop loss, the trader would lose all his account balance in just ten trades. In conclusion, the lower the risk percentage, the lower is the risk on the account balance going bankrupt.

As a rule of thumb, traders must never risk more than 3% of their account balance. Even if your account balance is significantly less (around $100), the 3% rule must not be violated.

Always remember, success in Forex trading comes with reducing risk, not by trying to leverage profits.

4. Beware of Leverage

Leverage trading is a tool that allows traders to maximize their profits with minimum investment value. However, on the dark side, it is associated with the highest risk.

Leverage is the mechanism where brokers facilitate traders to open larger positions with smaller deposits. For example, a leverage of 1:100 allows trades to open a position worth $10,000 with just $100.

With leverage, one can big win, but can lose big as well. Many novice traders get caught up by the former part and face the latter part in reality.

Here is an example of two traders trading with different leverage to understand the risk involved in leverage trading.

Header | Alice | Bob |

|---|---|---|

Account Balance | $1,000 | $1,000 |

Applied Leverage | 10x | 100x |

Leveraged Value | $10,000 | $100,000 |

Trade P/L (-50 pips) | - $40 | - $400 |

Loss Percentage | 4% | 40% |

Remaining Balance (%) | 96% | 60% |

Hence, traders must never speculate with high leverage until and unless they have a consistent record of making profits.

Conclusion

Forex trading is a risky business yet extremely rewarding. However, success in trading does not come solely with the strategy used. Some several other tools and applications must be incorporated to see big positive numbers in your trading history. And one such instrument in the toolbox of success is risk management in Forex.

It is a powerful weapon that eventually leverages profits (by reducing risk) when applied correctly. However, it is crucial to know that Risk management in Forex is not a standalone objective tool. All the very best!