We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

What is a Stop Out Level in Forex and How to Place Them?

If you're new to Foreign Exchange trading, you might have heard the term "stop out level" and wondered what it means.

A stop out level is a point at which your broker will automatically close your trade if it reaches a certain level of loss.

In this post, we'll explain what a stop out level is in Forex trading, how to place one, and why they can be helpful. So let’s dive right in.

Understanding the Stop Out Level in Forex Trading

Stop-out levels in Forex trading are just what they sound like - a way for traders to set limits on their losses. It's a risk management tool that protects from trading too heavily and losing too much capital.

Essentially, it prevents traders from going further into debt if their trades continuously fail; at some point, the stop-out level is hit, and the trader's exposure is automatically limited until they can replenish their funds.

An excellent example of how this works is when a trader sets an exposure limit of 10%; when that limit is reached, any open positions they might have will be automatically closed, thus preventing them from continuing to incur losses.

Having a stop-out level helps mitigate losses and keep results within desired boundaries.

How is a Stop Out Level Different From a Margin Call?

A stop out level and a margin call level have one significant difference: the timing of when they are triggered.

It is calculated when an investor’s equity ratio to used margin falls below their Forex broker has set threshold.

On the other hand, a margin call warning is typically made when the equity an investor holds in their trading account decreases to a specific value or percentage.

As such, brokers generally tend to trigger a free margin call before initiating a stop out level so that investors can’t lose more than their deposits.

Investors need to be aware of these two terms, as understanding them could save them from significant losses.

Why Do Brokers Have Stop Out Levels?

Brokers use stop-out levels to limit risk when trading stocks, Forex market currencies, and other asset classes.

These brokers have such levels to protect themselves and their clients from losing their capital.

By setting a predetermined level, brokers can protect themselves and their clients from taking on too much loss in the event of significant market fluctuations.

Stop-out levels can also help traders stay disciplined by avoiding decisions that may lead to unnecessary losses.

When traders reach a certain level, such as an 85% maintenance margin, they may be automatically prevented from opening any new trading positions until the level is lowered again.

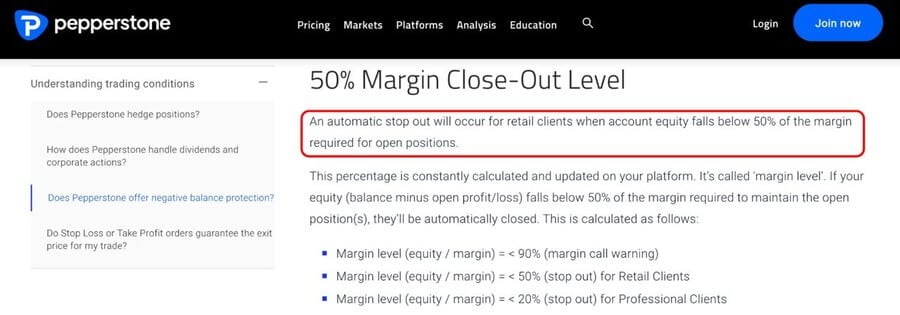

For instance, in the below screenshot, you can see the Pepperstone broker has a stop-out level as soon as their client’s account equity falls below 50% of the margin required (if a percentage above 50 is your used margin).

Ultimately, stop-out levels offer an essential safety net for brokers and their clients and keep everyone involved in the stock market sure of their investments.

How Can You Place a Stop Out Level on Your Trades?

Placing a stop-out level on your trades is essential to protect the funds from a negative account balance. Basically, It offers negative balance protection.

This can be done by setting up a specific portfolio value where, should the market move against you and your current positions suffer losses, your positions will be closed automatically, and further losses will be prevented.

You can do this individually for each or all of your positions simultaneously on your broker's trading platform.

Benefits and Risks of Using a Stop Out in Forex Trading

Forex trading can open up opportunities to increase profits but also present risk. One way traders minimize this risk is by taking advantage of a stop-out level.

A stop-out level is similar to a stop loss in that both are used to significantly reduce potential losses through the automatic closure of trades if they start exceeding predetermined amounts.

However, with a stop-out level, traders also have the option to wait and take a short position to bounce back.

The benefit of a stop-out level lies in its ability to protect traders from potentially disastrous outcomes while still granting them flexibility and discretion.

Setting a stop-out level allows you to take advantage of trading opportunities without taking too much risk with your capital, so you can stay confident and in control of your trades.

Of course, there are also potential risks when using the stop-out feature. Below are a few notable ones.

Lack of Flexibility

Since a stop-out level sets the maximum equity that a position can remain open, it limits traders from adjusting their strategy and leveraging additional risk to gain more reward potentially.

Volatility Concerns

A stop out level is triggered when margin levels drop below a specific value. This can occur due to an increase in volatility during certain market hours or an unfavorable market move, resulting in potential losses for the trader.

Forced Liquidation

When the stop-out level is reached, and all open trades are closed by the broker, this forced liquidation may result in the trader losing money even if they had profitable trades at that time.

Slippage Risk

During volatility, stop-out orders may be filled at prices different than expected, leading to additional losses for the trader.

Conclusion

Stop-out levels are essential for protecting the broker and the trader in Forex trading.

By understanding what a stop-out level is, how it works, and how to place one on your trades, you can trade with more confidence and less risk.

Do you use it to stop out levels in your Forex trading? If not, it's time to start using them to your advantage. Happy Trading!

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: