We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

What Is Scalping in Forex? Everything You Need To Know.

Forex scalping is a trading strategy traders use to quickly buy and sell currency pairs to generate small profits on each transaction.

It requires fast-paced reflexes, precise timing, and an intimate understanding of market conditions. Scalpers must also have a deep knowledge of technical analysis indicators and strategies to be successful.

This article will discuss scalping in forex trading, its advantages, disadvantages, and tips for success. We'll also give you an overview of the best practices for implementing this popular day-trading technique to maximize your potential profit while minimizing risks.

So, if you want to level up your Forex scalping game and understand what scalping is in Forex, read on!

What is Scalping in Forex Trading

Scalping in Forex is a method of trading the currency market that involves taking many short-term positions daily to make small profits. It involves targeting micro-trends, opening a position when one trend begins, and closing it when it turns against you.

This strategy is contrary to position trading, which is focused on more significant gains from fewer long-term trades. In addition, scalping is a demanding strategy as it requires more discipline than day trading.

Day traders also close their positions at the end of the day, whereas scalpers must do so in much quicker time frames, meaning they have to be highly alert and pay attention to even minor fluctuations in the market.

This means scalpers must take into account current market conditions and anticipate potential changes quickly, requiring extensive knowledge and experience. Additionally, they must assess their risk efficiently and accurately with sound risk management strategies.

Is Forex Scalping For Me?

To make consistent profits using the scalping strategy, you must be aware of technical analysis, which involves - indicators, support/resistance levels, trend lines, pivot points, moving averages, and more. This skill can help identify potential entry and exit points for your scalp trades.

You must also be able to react quickly to news or other events that may cause dramatic shifts in price movements.

Finally, as a scalper, you must be prepared to handle large amounts of volatility since most micro-trends will eventually reverse direction, resulting in losses if proper exit strategies are not implemented in time.

If you are technically sound and capable of handling the scenarios mentioned above, scalping is definitely for you.

Example of a Scalp Trade

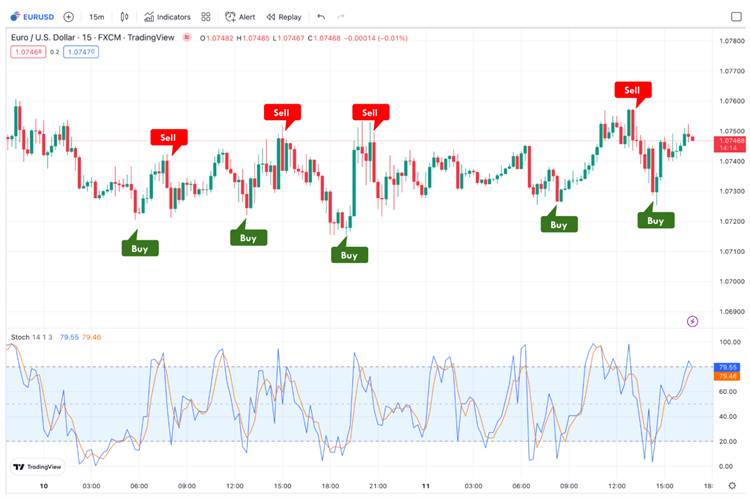

In the below EUR/USD price chart, we used the 15-min timeframe for scalping the market. By applying the Stochastic oscillator, we generated a few trading Forex signals based on the overbought and oversold regions presented by this trading indicator.

You can see multiple entries and exits here (Buy/Sell signals) in quick intervals. Although the trades taken here are hypothetical, they will give you a clear understanding of how Scalping works in the live markets.

Example of Scalp Trades (Based on Stochastic Indicator) Source: TradingView

Pros of Forex Scalping

- Scalp trading enables you to make small, frequent profits without exposure to significant risk.

- Scalp traders can capitalize on minor shifts in the market that other longer-term traders could miss out on.

- This form of trading works better for new or inexperienced traders to gain valuable experience in a low-risk environment.

- As trades aren’t open long enough for market conditions to change significantly, traders can quickly develop an understanding of how the markets work without risking too much capital.

- Scalping typically requires less capital than other types of trading strategies. This allows more people, including those with limited funds, to participate in trading without needing much capital upfront.

- Scalp trading offers greater flexibility than other strategies by allowing traders to use different methods simultaneously.

- Scalping offers increased liquidity since traders constantly enter and exit positions; this means buyers and sellers will typically be available when needed.

Cons of Forex Scalping

- Scalp trading involves higher transaction costs. As with any form of trading, transaction costs will be associated. The higher the volume of trades, the more costly it can become due to commissions and other fees.

- Scalp traders are often required to employ high leverage levels (to maximize profit percentage), which can result in increased risk.

- Traders who prefer scalping must have a thorough understanding of market conditions and technical analysis to be successful.

- The nature of scalp trading requires traders to make decisions quickly and accurately, often relying on instinct or intuition. Hence traders need to have a solid understanding of the markets they are trading in and be able to analyze price movements to identify opportunities quickly.

Best Practices for Implementing a Scalping Strategy

Scalping can be incredibly lucrative, but it carries a particular risk. There are several critical best practices to ensure success when using a scalping strategy.

Having an Edge

You should have an advantage over other traders in the market. For example, one may take advantage of news that has not been widely disseminated yet or use technical indicators to predict price movements and open successful positions accordingly.

Without an edge, as a Forex scalper, you will be playing a guessing game and will only be able to luck out so often before you start losing money.

Be Aware of Your Risk Appetite

Never risk more than you are comfortable with. As a scalper, you should know the maximum amount you are willing to lose on any individual trade before entering any position. This ensures potential losses don’t become too large and unmanageable if things go south.

Don’t Over Scalp

You must be patient and wait for good setups before entering positions. It can take time to find the right conditions for successful scalps – rushing into trades without proper preparation can lead to losses and adverse outcomes.

Learn Before You Earn

Practice your strategies on a demo account before jumping into live trading with real money on the line.

Demo accounts allow you to test out systems without risking your own capital – this way; you can get a better feel for how profitable your strategies may or may not be in real-world conditions before committing any money towards them.

By following these best practices and staying disciplined, you will have a greater chance of success using a scalping strategy in the Forex market.

Final Thoughts

Finally, scalping in Forex trading requires knowledge and experience to be successful. Therefore, it would be best if you only began scalping after you have mastered the basics of Forex and have a good understanding of the market.

As mentioned, don’t forget to always practice trading with a demo account before betting with real money. This will allow you to get used to the strategy without risking any capital.

Scalping can be a great way to make money, but it may not be suitable for everyone, so be sure to do your research before trying it out. Good luck!

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: