We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

What is Supply and Demand in Forex

Any trader relies on the basic concepts of supply and demand to find profitable opportunities. But what exactly is supply and demand in Forex?

To become a successful Forex trader, it is essential to have a strong understanding of the basic principles of supply and demand.

By definition, Supply represents the amount of a particular good or service available, while demand represents the amount of the desired good or service.

In Forex trading, these terms can be applied to specific currency pairs to understand their market movements better.

This blog post will explore how this concept applies to the Forex market. So whether you're new to Forex trading or just looking to brush up on your skills, read on for everything you need to know about understanding supply and demand in Forex.

What is Supply and Demand in Forex Trading?

Understanding currency prices returning to their specific zones in the Forex market is critical to successful trading. One of the most effective ways to identify this price return is by recognizing supply and demand zones.

In fact, we have developed a supply and demand indicator that illustrate price points where price moves are likely to turn around or reverse.

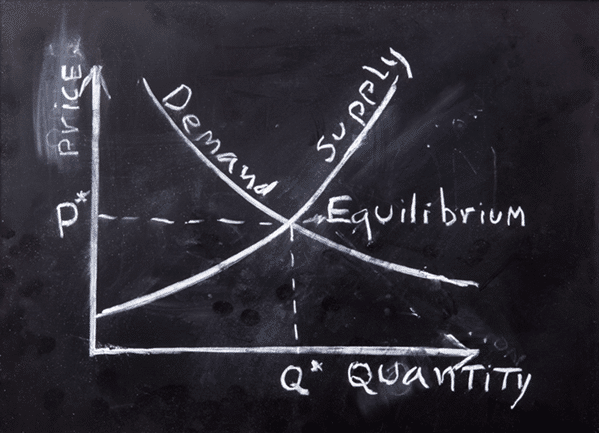

Supply occurs when price activity refuses to move higher than a certain point, while demand occurs when price action will not dip lower than a certain level.

By understanding the balance between these two price movements, traders can take advantage of opportunities in the Forex trading market.

In Forex trading, supply and demand analysis aims to identify levels where the price has reacted previously and will likely respond again.

As a successful Forex trader, you'll want to look for high-regulated areas of pivots S&R levels that often occur at critical points of significant shifts in supply and demand.

With a keen eye on these levels, you can ride out the waves created by shifts in these forces for significant profits!

How Does it Affect the Prices of Currencies?

Trading Forex occurs in the Forex market, an international platform where different currencies are exchanged at their current rates.

These prices of currencies are determined by a combination of factors such as supply and demand, where traders buy to sell for a profit in the future when prices rise.

The interplay between supply and demand heavily influences the prices of currencies in the global market.

When demand is more significant than supply, it typically leads to an increase in currency prices. Conversely, when supply outstrips demand, prices may decline.

Unexpected news can cause drastic changes in currency prices in Forex trading. Gathering and analyzing information about global events and politics can greatly affect currency prices.

The market prices of currencies can be significantly affected by a variety of drivers, both macroeconomic and geopolitical.

When tensions are high in the international community, large-scale investors often find it beneficial to move their assets away from riskier currencies, such as emerging markets.

When economies do well, and political climates improve, currencies can become more desirable and increase in value.

What Factors Influence the Amount of Supply and Demand for a Currency Pair?

The amount of selling pressure and buying interest, or demand and supply, for a currency pair greatly influences its exchange rate.

In addition, factors such as economic policies, politics, inflation, and the country's current account balance affect the spot currency rate for a particular pair.

In addition, trends within the Forex market can considerably affect the availability of currencies to purchase or sell, as well as their cost.

News events should also be monitored and tracked to anticipate any forthcoming exchange rate changes affecting a currency pair's supply and demand levels.

The more desirable a particular currency pair appears to investors—taking into consideration any trading platform fees—the higher its demand will be, which can result in an appreciation of its price.

To measure investor opinion on a currency pair, look at price charts indicating buying or selling pressure.

Another influential factor is the rate of inflation – when money begins to lose its value due to this economic multiplier effect, strong currency markets tend to result in a corresponding rise in foreign exchange rates.

Ultimately, navigating these fluctuating market forces is an art for savvy investors and traders.

How Can You Take Advantage of Supply and Demand Imbalances in the Market?

Gaining an edge in the markets involves taking advantage of supply and demand imbalances by recognizing support and resistance levels from price charts.

Identifying support and resistance levels can be done by analyzing the market's price structure over different time frames, ranging from seconds to years.

By recognizing support and resistance levels for a particular asset class, one can use an appropriate trading strategy, such as entering at a support level or short selling when a resistance level is identified.

Doing so allows traders to capitalize on any short-term imbalances between buyers and sellers during different market cycles.

Common Mistakes When Trading Supply and Demand levels

Beginning traders often overlook price action, enter trades without researching the market, and are slow to accept losses.

Price action is one of the most critical indicators of supply and demand dynamics, and, as such, traders must incorporate it into their analysis to correctly read the market.

Also, by understanding the context of a particular trade, or the larger narrative of the overall market, traders can avoid some risky trading decisions.

Finally, accepting losses fast helps reduce potential risk and allows traders to focus on profitable trades that may follow.

Bottom Line

Understanding the concept of supply and demand in Forex trading is essential for any trader looking to maximize their profits.

By recognizing support and resistance levels from price charts, traders can take advantage of short-term imbalances between buyers and sellers that may exist during different market cycles.

Understanding supply and demand in Forex trading allows you to make better decisions when trading currencies at different price levels.

However, it’s essential to understand common mistakes traders make when trading on supply and demand to avoid falling victim to them.

With this knowledge, you’re well-equipped with the tools necessary for successful currency trading.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: