We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

Best Time to Trade GBP/USD: A Guide for Forex Traders

On any given day, more than $6.6 trillion changes hands in the global Forex market, making it the largest and most liquid financial market worldwide.

Within this massive marketplace, the British Pound (GBP) to US Dollar (USD) currency pair, also known as the ‘cable,’ is one of the most traded currency pairs, accounting for approximately 11% of total Forex daily transactions.

Given its popularity and volatility, understanding the ideal time to trade GBP/USD becomes paramount for novice and experienced traders.

In Forex trading, timing is not just about when you’re available to trade; it’s about when the market conditions are optimal for the currency pairs you’re trading.

So, when is the best time to trade GBP/USD?

This article delves deep into this question, exploring the GBP/USD Forex pair dynamics and uncovering when it’s most favorable to trade this pair.

Understanding the GBP/USD Pair

Before diving into the timing specifics, it’s essential to understand the GBP/USD currency pair.

In the world of Forex, currencies are traded in pairs because a currency’s value is relative to another currency’s value. The GBP/USD pair tells traders how many U.S. dollars (the quote currency) are needed to purchase one British Pound (the base currency).

The GBP/USD pair is one of the ‘major’ currency pairs in the Forex market, indicating it’s one of the most frequently traded. This is mainly due to the economies that these currencies represent: the U.S. and the U.K., two of the largest and most influential economies globally.

It is also a widely traded currency, making it crucial to understand the optimal times to trade it for success in Forex trading.

As such, the pair is significantly impacted by economic factors from both countries. Interest rates, unemployment figures, inflation reports, GDP growth, and political stability are among the key elements influencing the value of both currencies.

However, it’s not just domestic considerations that affect this pair. Global geopolitical events, such as changes in trade policies, wars, and international financial crises, can also cause volatility in the GBP/USD pair.

Understanding these factors provides the groundwork for determining when to buy or sell this currency pair.

What is The Best Time to Trade GBP/USD Pair?

The best time to trade a currency pair is when the market is most active, resulting in greater volatility and potentially more significant price movements.

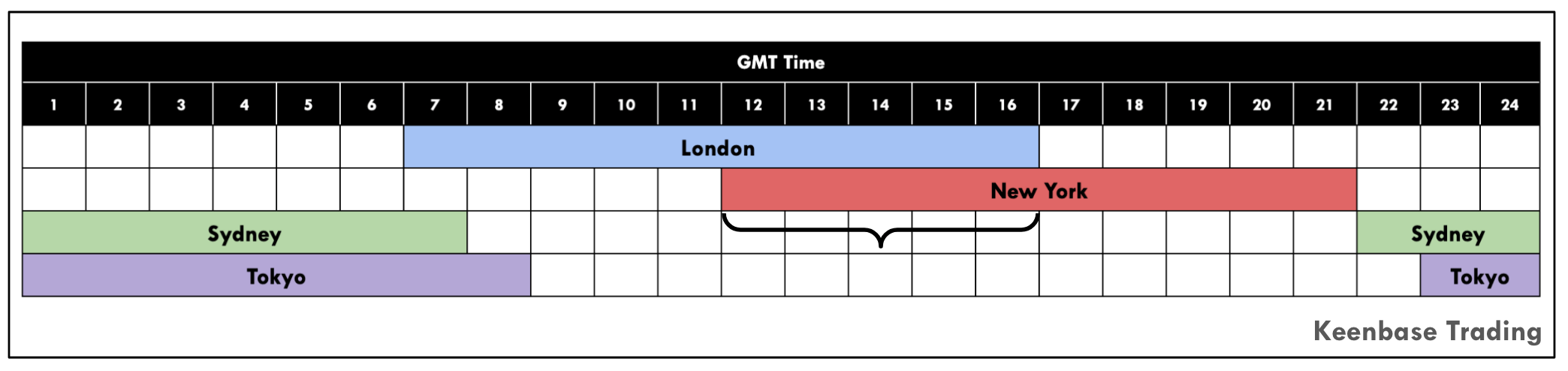

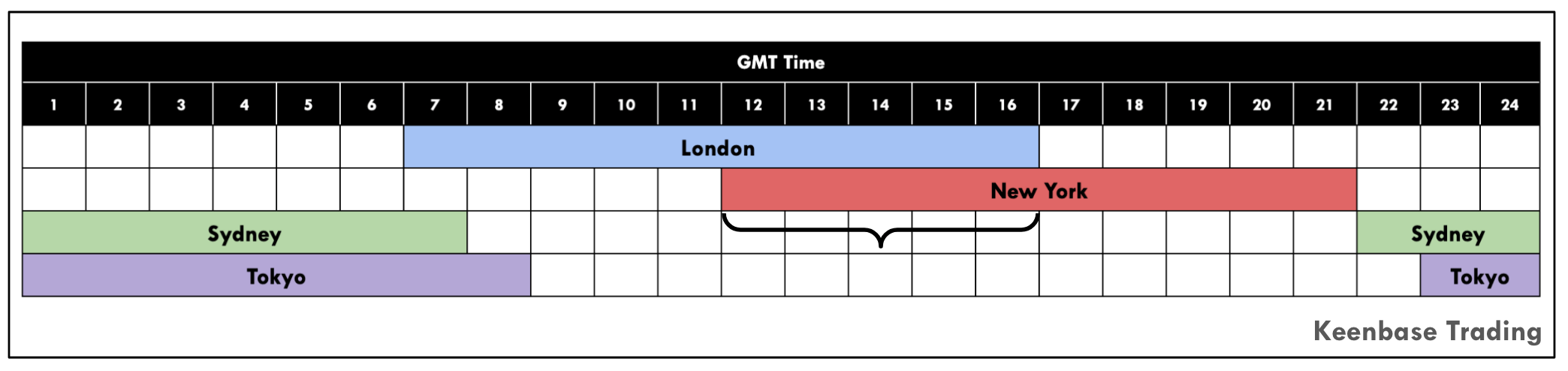

For the GBP/USD pair, the highest levels of volatility are generally observed during the London and New York sessions, especially during their overlap. Monitoring economic data and market overlaps is crucial in the currency market.

London and New York Sessions: GBP/USD Trading Hours

As previously noted, the London session is a major hub for Forex trading.

During this time, the British Pound typically experiences the most volatility. Numerous economic reports are released in the early hours of the London session, including GDP, employment figures, and inflation data. These reports often trigger significant price movements in the GBP/USD pair.

The New York session likewise offers increased volatility for the USD. U.S. economic indicators such as GDP, consumer confidence, and Federal Reserve statements are often released during this session.

These releases can cause substantial price swings in USD currency pairs, including GBP/USD. The GBP/USD pair is one of the most liquid currency pairs, known for its high trading volume, tight spreads, great liquidity, and volatility.

The London/New York Overlap and the GBP/USD Pair

While the London and New York sessions are individually crucial for trading GBP/USD, they overlap (from 12:00 PM to 4:00 PM GMT), which traders often regard as the “sweet spot” for trading this pair.

Both GBP and USD are subject to higher trading volumes and volatility during this period due to simultaneous market activity from traders in both regions.

This overlap often results in significant price movements in the GBP/USD pair. It’s also worth noting that major economic news from both regions can be released during this overlap, amplifying market volatility and potential trading opportunities.

The London/New York overlap isn’t just about increased volatility. It’s also when liquidity is at its highest, meaning large orders can be executed more easily without significantly impacting the market price.

Liquid currency pairs, such as GBP/USD, benefit from this high liquidity, resulting in tighter bid/ask spreads and greater market depth.

This liquidity makes it easier for traders to enter and exit positions, reducing the likelihood of slippage (the difference between the expected price of a trade and the price at which the trade is executed).

Empirical Evidence Supporting These as the Best Times to Trade

Several studies have shown that the highest levels of volatility in the GBP/USD pair occur during the London/New York overlap.

One study by the Bank for International Settlements found that Forex markets' volatility is heavily influenced by "geographical factors" and that trading volume and price volatility are highest when the working hours of major financial centers overlap.

Another study in the Journal of Forex & Stock Trading found that the GBP/USD pair exhibited the most significant price fluctuations during the London/New York overlap. The researchers concluded that this period offered the best profit opportunities, albeit at the expense of higher risk.

While it's important to remember that past performance doesn't indicate future results, this empirical evidence strongly supports the notion that the London/New York overlap is generally the best time to trade the GBP/USD currency pair.

However, this does not mean profitable opportunities cannot be found outside this time frame. As we'll explore in the next section, various factors can cause significant price movements in the GBP/USD pair outside these peak volatility periods.

Nevertheless, for traders looking to maximize potential profit from major price swings in the GBP/USD pair, the London/New York overlap should be a primary focus.

But does timing matter in Forex trading? Let's see!

Importance of Timing in Forex Trading

Why does timing matter so much in Forex trading?

The answer lies in the unique 24-hour, five-days-a-week operation of the Forex market. With participants from every time zone, trading activity varies across different times of the day.

While it’s possible to execute trades at any time, not all hours offer the same opportunities, trading volume, volatility, and liquidity vary throughout the day, mainly influenced by the opening hours of the different global financial markets.

The higher the trading volume, the higher the liquidity and volatility, translating to more price movement and potential opportunities for traders. The forex market runs continuously due to the different time zones of four parts of the world, highlighting the non-stop nature of trading.

Consider This For Instance

During a specific market's opening hours, trading volume in that market's currency tends to increase, leading to more significant price movements. For the GBP/USD pair, this means paying attention to the opening hours of both the London and New York markets.

Determining the best time to trade isn't merely about identifying when the market is most active. It also involves understanding your trading strategy, risk tolerance, and the specific characteristics of the GBP/USD pair.

Therefore, the best time to trade GBP/USD will differ from the best time to trade GBP/JPY, which differs from the best time to trade EUR/GBP, etc.

Understanding Forex Market Sessions

The Forex market operates 24 hours a day, five days a week, due to the global nature of the economy.

Its continuous operation is facilitated by rotating markets across different time zones, offering ample trading opportunities. To make the most of these opportunities, it’s crucial to understand the four major market sessions: Sydney, Tokyo, London, and New York.

The British Pound is one of the world's most traded currencies, particularly in the GBP/USD pair.

The Sydney Session

Image source: https://www.edigitalagency.com.au/flags/australia-flag-map/

It is the first to open, kicking off the trading week.

Starting at 10:00 PM GMT on Sunday and closing at 7:00 AM GMT on Monday, this session marks the beginning of the Forex trading day.

While the Australian Dollar and the AUD currency pairs are the most traded during this session, the activity is generally lower than during other sessions due to the smaller market size.

The Tokyo Session - Best Time To Trade GBP/JPY?

Image Source: https://commons.wikimedia.org/wiki/File:Flag-map_of_Japan.svg

Also known as the Asian session, it begins at 11:00 PM GMT and ends at 8:00 AM GMT.

During this session, the Japanese Yen (JPY), the third most traded currency in the world, experienced the highest trading volume. However, it's worth noting that the trading volume and volatility can still be relatively low compared to the London and New York sessions.

The overlap of London and Tokyo markets (8 AM to 9 AM GMT) is the best time to trade pairs like GBP/JPY.

The London Session - Best Time To Trade EUR/GBP

It starts at 7:00 AM GMT and concludes at 4:00 PM GMT.

As the world's financial capital, London accounts for approximately 43% of all Forex transactions. This session is known for high volatility and trading volume, with the GBP trading experiencing significant movements.

It's often considered the most important session for trading the Forex market and the best time to trade pairs like EUR/GBP.

The New York Session

It runs from 12:00 PM GMT to 9:00 PM GMT.

As the second largest Forex market by trading volume, it sees a lot of action, especially in the USD. The market can also see increased volatility at the start of the session due to the overlap with the end of the London session.

Overlaps occur when two sessions are open simultaneously among these four significant sessions. These overlaps are crucial for Forex traders as they offer the highest liquidity and volatility levels, providing increased trading opportunities.

The most notable overlap is between the London and New York sessions (from 12:00 PM to 4:00 PM GMT), which are informally known as GBP/USD trading hours. Both GBP and USD see higher trading volumes during this overlap, leading to potentially more significant price movements in the GBP/USD pair.

Another necessary overlap occurs between the Asian (Tokyo) and Oceanic (Sydney) sessions (from 12:00 AM to 7:00 AM GMT), although it's generally less volatile than the London-New York overlap.

Understanding these Forex market sessions and overlaps forms the bedrock of determining the optimal trading times for different currency pairs, including the GBP/USD.

The next section will delve into a detailed analysis of the best times to trade this major Forex pair.

When is GBPUSD Most Volatile

While the London and New York sessions generally offer the best times to trade GBP/USD, various factors can influence the pair's volatility outside these hours.

These factors include economic news releases, political developments, changes in monetary policy, and unexpected events, often referred to as 'black swan' events.

Economic News Releases and Their Impact

Economic news releases can cause significant volatility in the GBP/USD pair outside the prime trading hours. For instance, major economic indicators, like the Non-Farm Payroll (NFP) report in the U.S., are often released outside of the London/New York overlap.

When these indicators significantly deviate from market expectations, they can trigger sizable price movements in the GBP/USD pair. Traders who stay abreast of these releases can seize opportunities during these periods.

Political Developments and Changes in Monetary Policy

Political developments and changes in monetary policy can also lead to volatility in the GBP/USD pair. In the U.K., events like the Brexit referendum led to significant Pound value fluctuations against the dollar, providing trading opportunities outside the usual peak hours.

Similarly, changes in monetary policy from the U.S. Federal Reserve or the Bank of England, such as interest rate adjustments or quantitative easing measures, can heavily influence the GBP/USD pair.

These changes often come as responses to shifts in the economic landscape and are typically announced outside the London/New York overlap.

Unexpected Events (Black Swan Events)

Black swan events — unpredictable occurrences that have severe consequences — can cause substantial volatility in the GBP/USD pair.

Examples include the global financial crisis 2008 and the COVID-19 pandemic, which led to significant exchange rate movements as markets responded to unprecedented circumstances.

These instances highlight the unpredictable nature of Trading Forex and the need for traders to stay informed and adaptable.

While these events are impossible to predict, they underscore the importance of robust strategies incorporating Floating exchange rates and risk management measures. These strategies should focus on the best times to trade Forex and be equipped to handle market volatility during unexpected events.

In conclusion, while the London/New York overlap typically provides the best opportunities for trading GBP/USD due to increased liquidity and volatility, traders should not overlook the potential impacts of economic news releases, political developments, changes in monetary policy, and black swan events.

These factors can cause significant price movements in the GBP/USD pair outside the 'ideal' trading times, providing additional opportunities for prepared and informed traders.

Strategies for GBP Trading

When it comes to trading GBP/USD, there are several strategies that traders can employ. These include day trading, swing trading, and scalping, among others.

Day Trading

This involves entering and exiting trades within a single trading day. This strategy often aligns well with the London/New York overlap when volatility and liquidity are highest. Day traders might focus on short-term price movements influenced by economic news releases or market sentiment.

Swing Trading

This involves holding positions for several days or even weeks. Swing traders look for medium-term trends and patterns in the market. This strategy might be suitable when the GBP/USD pair shows clear directional trends, regardless of the specific trading session.

Scalping

Scalping is a strategy that involves making numerous trades within short time frames to profit from small price changes. Scalpers might find ample opportunities during high volatility periods, like the London/New York overlap, where quick trades can lead to cumulative profits.

Which Is The Best Strategy?

Choosing the best strategy depends on various factors, including trading time, risk tolerance, and the trader's style and preferences. A good understanding of different strategies and continuous market analysis can help traders identify the best approach for their individual needs.

Risks and Considerations in GBP/USD Trading

Trading GBP/USD, like all trading pairs, involves risk. While presenting profit opportunities, the market's high volatility can also lead to significant losses. Therefore, it's crucial to consider risk management strategies and understand the potential downsides.

Volatility

Image Source: https://www.callcentrehelper.com/calculate-forecast-volatility-168418.htm

Firstly, market volatility can lead to rapid price swings, resulting in losses if not managed properly. Implementing stop-loss orders and take-profit levels can help manage this risk by setting predefined exit points for trades.

Leverage

Image Source: https://tradeshala.co.in/is-financial-leverage-an-opportunity-or-risk/

Secondly, leverage, which allows traders to control large positions with a small amount of capital, can magnify profits and losses. It's important to use leverage judiciously and understand its implications.

Market Gaps

Image Source: https://okcredit.in/blog/methods-to-identify-gaps-in-market/

Also, traders should be aware of the risk of market gaps, where the price jumps from one level to another without trading, often due to unexpected news or events. This can be particularly risky for stop orders as the execution price differs significantly from the stop level.

Lastly, it's important to note that past performance does not indicate future results. Trading strategies should be continuously reviewed and adjusted as market conditions change.

Bottom Line

Understanding the best times to trade GBP/USD is crucial for maximizing potential profits in Forex trading. The high levels of volatility and liquidity during the London and New York sessions, particularly their overlap, often present the best opportunities for trading this pair.

However, these ideal times should not be the sole focus for traders. Economic news releases, political developments, changes in monetary policy, and unexpected 'black swan events can also lead to significant price movements, offering trading opportunities outside these peak periods.

Different trading strategies can be applied based on these factors and the specific market conditions at any given time.

Risk management should also be a key consideration for any trader. Given the inherent risks associated with trading, implementing risk management measures like stop-loss orders and the sensible use of leverage can help mitigate potential losses.

In conclusion, successful GBP/USD trading is not solely about knowing the best times to trade. Still, it encompasses a holistic understanding of market dynamics, appropriate strategy application, and efficient risk management.

As the Foreign Exchange market evolves, traders should continually learn and adapt to keep pace. After all, trading is a venture and a journey of learning, adaptation, and continuous growth.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: