We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

Forex Trading: How To Turn $100 Into $1000? It’s Easier Than You Think

Are you looking for a way to make extra money without taking on too much risk? Forex trading, a part of the broader financial markets, may be the answer for you.

If you’re looking to start Forex trading and don’t have much money to invest, that’s alright. Because in this article, you’ll learn the best strategies and tips on how to turn $100 into $1000 in Forex trading.

We will discuss how to identify profitable trading opportunities and minimize your risk. Whether you’re new to currency trading or have some trading skills and experience, there is something here for everyone.

You’ll also learn which mistakes to avoid when trading Forex, so you don’t lose money.

Are you ready to come away from this article knowing how to turn small investments into big cash in Forex? Then, let’s dive right in.

What is Forex and How Does it Work?

Forex, short for Foreign Exchange, is a global market where national currencies are bought and sold. Forex trading involves the exchange of one currency for another. As a result, foreign exchange rates constantly fluctuate due to the dynamics of the market and international markets as well.

Forex trading occurs between two parties: one selling and buying a currency. A currency pair represents the exchange rate for the two currencies, such as EUR/USD and GBP/EUR.

Traders can take advantage of increasing or decreasing values between currencies determined by various socio-political events, economic reports, or natural disasters.

It’s essential to conduct thorough research before getting involved in Forex trading. Various factors like market sentiment, macro forces, and global events can significantly impact currency prices.

Even small fluctuations can result in significant losses or profits depending on how well you make your decisions regarding trades.

There is also a range of online resources available to help Forex trader learn more about the market and become better prepared for the journey ahead.

How to Start Trading Forex With Only $100

You must have thought of a question, can I start Forex with $100? Trading Forex with just $100 may seem daunting, but there are still plenty of ways to get started.

The first step is finding the right broker; you’ll want to look for one that offers low deposit requirements and good leverage to give you more bang for your buck.

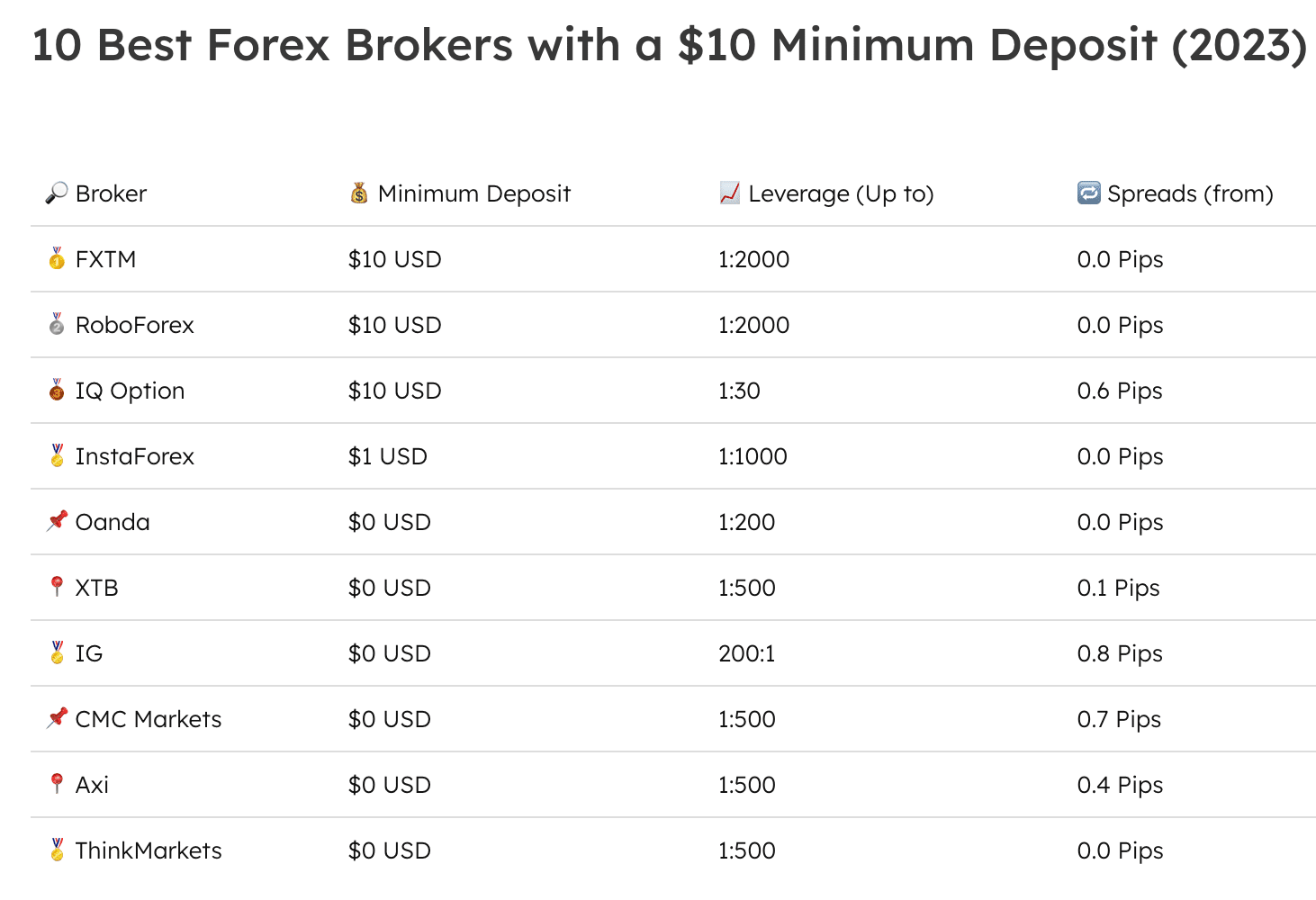

In 2023, many Forex brokers will allow you to open an account with them for less than $10.

Below are a few notable brokers that offer <$10 minimum deposit.

Image Source: ForexSuggest

The second step is familiarizing yourself with the currency markets and setting goals for yourself; this will ensure that you stay focused on what’s important.

Thirdly, it’s time to start trading! By taking it slow and steady, even with only $100 in your trading account, you can gradually grow your profits until your confidence increases, and you can manage greater risk.

Forex traders can start with small amounts and gradually increase their investments as they gain experience.

All it takes is dedication, discipline, a willingness to learn, and just a bit of money!

What Are the Best Currency Pairs to Trade Forex With Just 100 USD?

Trading currency pairs with $100 can be intimidating for first-time traders, but it doesn’t need to be. Major currencies like the U.S. dollar, euro, and Japanese yen account for about 75% of trading in the forex market and are referred to as the majors.

To start, look into the most liquid pairs, such as the EUR/USD, GBP/USD, and USD/CHF.

They tend to move more predictably, so you can better understand trend movements. If you want to diversify your trades, two popular pairs that have a generally stable correlation are USD/JPY and EUR/JPY.

These pairs often remain in ranges and are less impacted by news events. While trading with USD 100 Forex may not yield massive returns, the experience gained is worth more than the amount invested in these trades, making them ideal pairs for beginner traders.

How to Use Leverage and Margin to Increase Your Forex Profits

If you’re looking to increase your Forex profits and don’t want to wait for the markets to move in your favor, taking advantage of leverage and margin is a great way to go.

Leverage or margin allows you to enter trades with more capital than you have available in your account. As long as the trade moves in the direction predicted, this can significantly amplify your gains.

Leverage can magnify gains from movements in forex prices, allowing traders to profit from even small fluctuations in currency exchange rates.

Of course, they also come with risks, so it’s essential to research and understand how they work before diving in. A little extra time spent on learning will go a long way toward helping you maximize Forex profits.

Tips for Risk Management When Trading With a Small Account

Trading with a small account can be daunting due to the associated risks. But by following some simple tips, you can increase your chance of success when using a trading platform on a small account.

- Start with a demo account to get comfortable with the foreign exchange market and learn how to trade.

- Deposit $100 into a live account and use proper risk management to grow your account slowly.

- Use a simple trading strategy you are comfortable with and stick to it.

- Review your trades regularly to see what is working and what is not.

- Always ensure that you have a laid-out plan before any trade is made. This will help ensure that you know the potential risks and rewards.

- Be patient, and don't try to make too many trades - focus on quality over quantity.

- Withdraw your profits regularly, so you don't get caught up in the emotional rollercoaster of trading.

By following these tips, traders should be able to manage their small accounts better and maximize investment returns.

How to Grow Your 100 Dollar Forex Account From $100 to $1000

Growing your financial account from $100 to $1000 may seem daunting, but it is achievable with the right trading strategies and discipline.

Follow the below steps (in the order of their appearance) to achieve success with a small investment.

- Save up and start with at least $100 in your account

- Use a broker that has low fees

- Use leverage effectively

- Consider using a robo-advisor to automate your Forex trades

- Diversify your portfolio by investing in different currency pairs

- Stay disciplined with your money management strategy

- Have patience, and don't expect overnight success

Bottom Line - How to Turn $100 into $1000 in Forex

While there's no guarantee of success, you can follow the tips mentioned in the article to increase your chances of making a profit.

To sum it up, Forex trading is a great way to make a large amount of money and is incredibly accessible to those with small accounts. With only $100, you can start trading Forex and begin to see profits, then very soon, you'll be trading Forex with 1000 dollars and will continue growing your account gradually.

The majors are the best currency pairs to day trade with a small account, which have low spreads and are less volatile. You can also use leverage to increase your potential profits.

Remember to risk-manage your trades, as even a slight loss can deplete your account quickly. By following these strategies, you can turn a 100 USD account into a 1000 USD account in no time.

It may seem daunting, but it is achievable with the right strategies and tools. Implementing the proven methods discussed in this article to trade currencies successfully can maximize your returns. All the best.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: